CHAPTER 6 PRICE TAKING: THE PURELY COMPETITIVE FIRM

advertisement

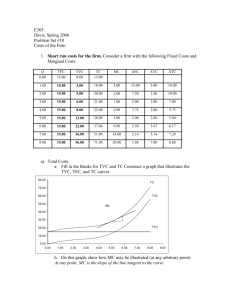

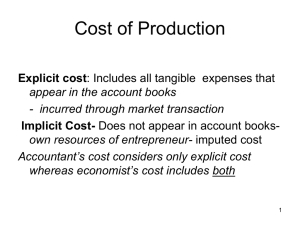

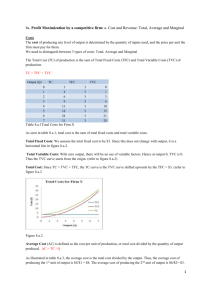

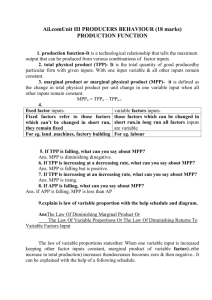

CHAPTER 6 PRICE TAKING: THE PURELY COMPETITIVE FIRM Firm It is the basic producing unit of a market economy Industry It is a group of firms which produce a well-defined product or a closely related set of products Four theoretical market structures: 1. Perfect competition 2. Monopoly 3. Monopolistic competition 4. Oligopoly Assumptions of Perfect Competition 1. All firms in the industry sell a homogeneous product 2. Each firm is a price taker I.e. there are a large number of sellers, and each firm has no power the influence the market 3. Customers have perfect information (about the nature of the product and the prices charged by each firm) and are indifferent about which firm they buy from 4. The industry is characterized by freedom of entry and exit Profit Maximization of Price Takers Recall that all firms are assumed to be profit maximizes and that • Profit = TR – TC • TR = P x Q • TC = TFC + TVC • TFC (overhead or sunk costs) = rent, property taxes, salaries, etc. **must be paid even if firm produces no output (i.e. Q = 0) • TVC = costs for raw materials, wages of production workers, electric bills, shipping costs, etc. **when Q = 0, TVC = 0 Recall that there are differences between how economists define terms and how accountants define terms (e.g. capital) Accountants do not charge for risk taking when computing costs, but economists do: • Normal profits: used by economists to refer to the opportunity costs of capital and risk taking E.g. you quit your job to become a trapeze artist • Economic profits: Difference between TR and TVC+ TFC+ Opportunity costs of inputs economic profits (economists) are less than net profits (accountants) **A situation where revenues equal costs (economic profits of zero) are satisfactory because all factors (visible and hidden) are being rewarded at least as well as they would in their next best alternative. Short-run Profit Maximization • The purely competitive firm is a price taker • Its output’s price is determined by the market (not influenced by firm) • It can only vary level of output to increase profits • Can only vary output in short-run within capacity of current capital (in the long-run, the firm can increase capital to expand output further) • Shape of MC curve • MR = additional revenue for producing one more unit of output • Firms which are price takers have MR = P = Demand • As long as MR > MC the firm will produce an additional unit • As long as MR < MC the firm will reduce output • The firm will produce an output where MR = MC • The competitive firm operates along the MC curve, supplying the output dictated by its intersection with the price • That makes the firms’ MC curve* equal to its supply curve **where MC > AVC, b/c if P < AVC the firm will produce no output So in the Short-Run: D (firm) = MR = P S (firm) = MC** Short-run costs Average Fixed Cost: AFC = TFC • FC is the same at every level of output, so the more output, the lower AFC (i.e. you are “spreading your overhead”) • AFC decline as output increases • Graphically: AFC is a decreasing curve • Marginal Cost: the cost of producing one more unit of output • Graphically: MC first decreases, then increases • First decreases due to specialization of labor • Then decreases due to over-utilization of resources (Capital, labor, space) Recall the relationship between marginal and average (Pete Rose) Average Variable Cost: AVC = TVC • Only the variable cost (TVC) varies from one unit of output to another, fixed cost (TFC) is the same for every unit of output, so the MC only takes into account the variable costs of production • If the marginal value (MC) is higher than the average value (AVC), then it will bring up the average (AVC) • Graphically: when the MC curve is below the AVC curve, then AVC is decreasing • If the marginal value (MC) is lower than the average value (AVC), then it will bring down the average (AVC) • Graphically: when the MC curve is above the AVC curve, then AVC is increasing • When MC=AVC, AVC will remain the same • MC curve will cut the AVC curve at its lowest point Average Total Cost: ATC = TC = TFC + TVC • ATC is the aggregate of the AFC and AVC curves, so it will initially decline (as both AFC and AVC do) and then increase (but at an output level after AVC) The comp. firm’s profit, loss and breaking even TR = P x Q = MR x Q TC = ATC x Q Now, determine profit, loss, breakeven point by comparing TR and TC at the short-run equilibrium • In all cases the competitive firm will produce where MR = MC (I.e. D = S)