Predatory Incentives and Mergers in Network Industries: Evidence

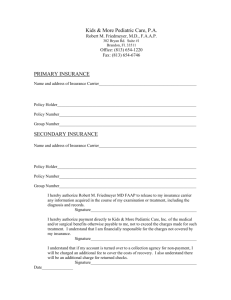

advertisement