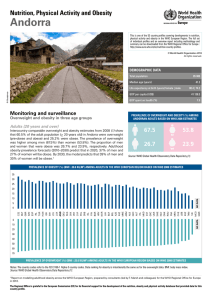

andorra en xifres 2009 - Departament d'Estadística

advertisement