(Chapters 2-15) by Garrison

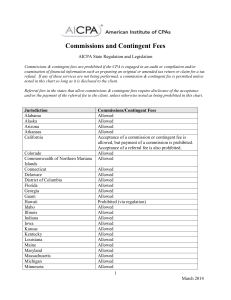

advertisement