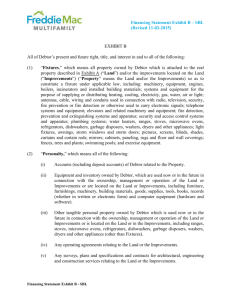

Report on Article 9 of the Uniform Commercial Code

advertisement