CHAPTER CHAPTER

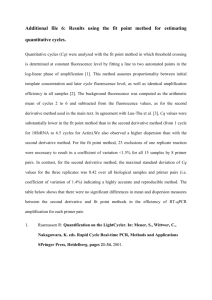

advertisement