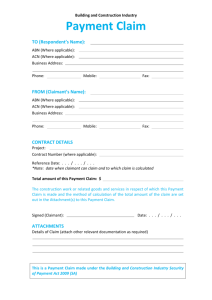

Building and Construction Industry Payments Act 2004

advertisement