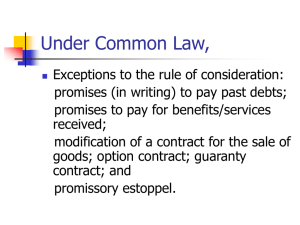

COMMERCIAL TRANSACTIONS UNDER THE

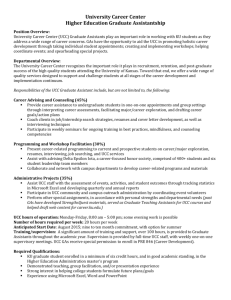

advertisement