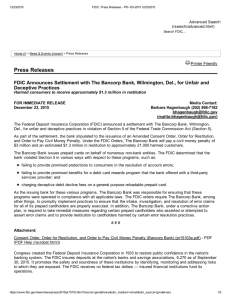

Home Builders Hammer FDIC - WSJ.com

11/30/08 11:23 AM

Dow Jones Reprints: This copy is for your personal, non -commercial use only. To order presentation-ready copies for distribution

to your colleagues, clients or customers, use the Order Reprints tool at the bottom of any article or visit www.djreprints.com

See a sample reprint in PDF format.

REAL ESTATE

Order a reprint of this article now

NOVEMBER 26, 2008

Home Builders Hammer FDIC

Agency Is Accused of Curbing Credit From Seized Banks

By M I C H A E L C O R K E R Y

Home builders from Florida to Texas are railing against the Federal Deposit

Insurance Corp., saying the agency is cutting off construction financing from

seized banks and demanding early repayment of current loans.

The FDIC, which has become a leading advocate for modifying mortgages of

financially strapped homeowners, isn't extending that same tolerance to the

housing industry, the builders said.

"They can do anything they want," said Earl Snyder, president of Snyder

Construction Co. in Englewood, Fla., whose construction lender, Freedom Bank,

was taken over by the FDIC on Halloween.

Four days later, Mr. Snyder met with FDIC officials, and was told that he had 60

days to pay off his $2 million construction loan and he couldn't draw additional

cash to finish 10 houses that he is building in southwest Florida. "I felt like a

criminal and I had done something wrong," said Mr. Snyder. An FDIC

spokesman said that construction loans tend to be "problematic" and the "FDIC

must take into consideration what is in the best interest of the creditors of the

failed banks."

The FDIC and state regulators have been sorting through the wreckage of

souring construction loans that have been weighing on the balance sheets of the

nation's small- and medium-size banks. The nation's largest home builder by

number of houses built, D.R. Horton Inc., reported an $800 million loss for its

fourth quarter on Tuesday and said that it expects 2009 would be a more

challenging year.

In the third quarter, 15.2% of single-family-home construction loans were

delinquent, up from 12.5% in the previous quarter, according to Foresight

Analytics, an Oakland, Calif., research firm. About 20.5% of condo construction

loans were delinquent, up from 16.5%.

Meantime, the amount of outstanding single-family-home construction loans

fell 8% in the third quarter and has contracted 33% since the peak in the third

quarter of 2006, Foresight Analytics said. Analysts said the credit squeeze is a

painful, but necessary process in curtailing building and controlling the glut of

http://online.wsj.com/article/SB122765327405657891.html#printMode

Page 1 of 2

Home Builders Hammer FDIC - WSJ.com

11/30/08 11:23 AM

painful, but necessary process in curtailing building and controlling the glut of

homes.

However, some home builders said the FDIC is exacerbating difficult market

conditions by crimping credit to companies that still are able to sell homes and

make interest payments to lenders.

Brian Binash, a partner of Wilshire Homes of Houston, said he has been unable

to draw money from his $10 million credit line since lender Franklin Bank was

put into FDIC receivership Nov. 7. The FDIC has taken over 22 banks this year,

and the agency said Tuesday that its problem list increased to 171 banks at the

end of the third quarter from 117 at the end of the second quarter. "We have

performing loans that are not in trouble and we can't get money to continue to

do the business we need to do," said Mr. Binash.

He said the FDIC's actions are preventing some Houston builders with loans

from Franklin from making payroll and finishing houses under construction.

The lending squeeze is hitting the nation's smallest home builders the hardest.

For months, banks have been requiring builders to cough up more cash because

the value of the underlying collateral on loans -- land and unsold homes -- has

plummeted.

The builders are taking their complaints to Washington. In a letter that will be

sent to Treasury Secretary Henry Paulson, Sen. Ron Wyden (D., Ore.) said banks

that are participating in the financial-rescue plan should allow builders more

"leeway."

"We are concerned that this situation is creating an unnecessary deteriorating

strain on our economy," Sen. Wyden wrote.

Write to Michael Corkery at michael.corkery@wsj.com

Copyright 2008 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our

Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones

Reprints at 1-800-843-0008 or visit

www.djreprints.com

http://online.wsj.com/article/SB122765327405657891.html#printMode

Page 2 of 2