Cost concepts for decision making

advertisement

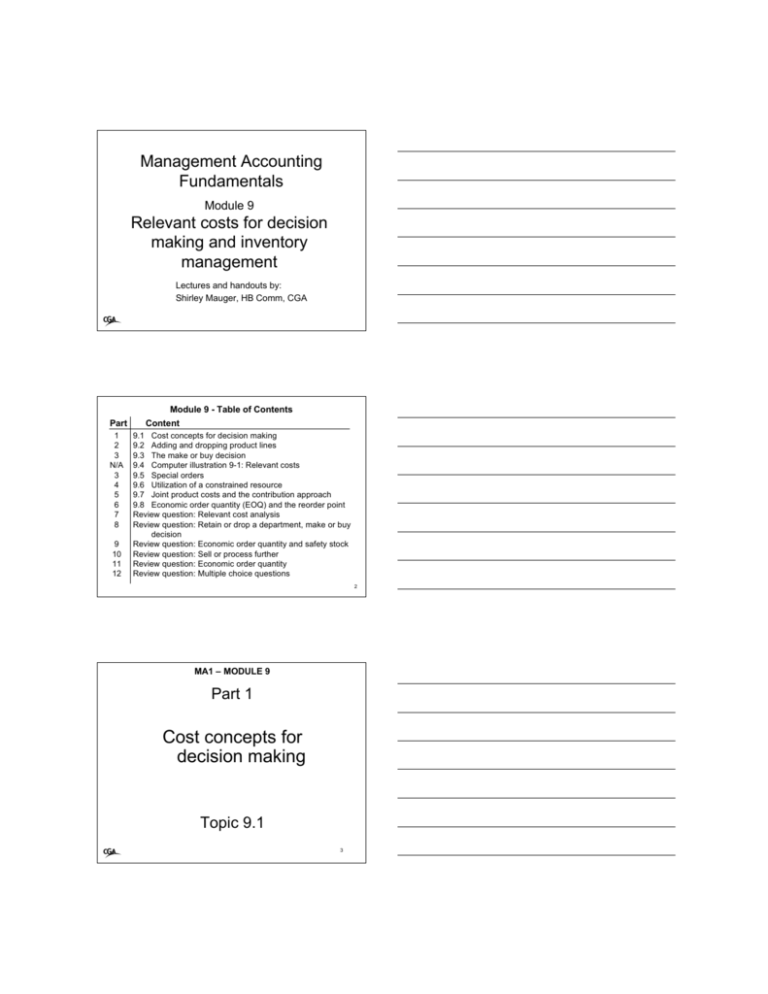

Management Accounting Fundamentals Module 9 Relevant costs for decision making and inventory management Lectures and handouts by: Shirley Mauger, HB Comm, CGA Module 9 - Table of Contents Part 1 2 3 N/A 3 4 5 6 7 8 9 10 11 12 Content 9.1 Cost concepts for decision making 9.2 Adding and dropping product lines 9.3 The make or buy decision 9.4 Computer illustration 9-1: Relevant costs 9.5 Special orders 9.6 Utilization of a constrained resource 9.7 Joint product costs and the contribution approach 9.8 Economic order quantity (EOQ) and the reorder point Review question: Relevant cost analysis Review question: Retain or drop a department, make or buy decision Review question: Economic order quantity and safety stock Review question: Sell or process further Review question: Economic order quantity Review question: Multiple choice questions 2 MA1 – MODULE 9 Part 1 Cost concepts for decision making Topic 9.1 3 Part 1 – Cost concepts for decision making (Topic 9.1) Identify sunk costs and explain why they are not relevant in decision making based on a general rule for distinguishing between relevant and irrelevant costs, including decisions about whether to keep or replace old equipment. (Level 1) Formulating longand short-term plans (Planning) Comparing actual to planned performance (Controlling) Implementing plans (Directing and Motivating) Decision Making Measuring performance (Controlling) Garrison, Noreen, Chesley, Carroll, Managerial Accounting, 6 th Canadian edition, 2004 p. 6 4 Part 1 – Cost concepts for decision making (Topic 9.1) Short term decisions • Adding and dropping product lines or segments • Make or buy • Special orders • Utilization of a constrained resource • Sell or process further 5 Part 1 – Cost concepts for decision making (Topic 9.1) Short term decisions • Adding and dropping product lines or segments • Make or buy • Special orders • Utilization of a constrained resource • Sell or process further Relevant costs A cost that differs between alternatives Irrelevant costs A cost that can be ignored in the analysis 6 Part 1 – Cost concepts for decision making (Topic 9.1) Avoidable/differential cost Relevant Irrelevant Future costs that don’t differ between alternatives Sunk cost Opportunity cost Different costs for different purposes Whether a cost is relevant or irrelevant depends on the circumstances 7 Part 1 – Cost concepts for decision making (Topic 9.1) Avoidable/differential cost Relevant Irrelevant Future costs that don’t differ between alternatives Sunk cost Opportunity cost Can be eliminated in whole or in part by choosing one alternative over another. • Department manager’s salary if the department is eliminated • Savings in direct materials cost because of the purchase of a new machine 8 Part 1 – Cost concepts for decision making (Topic 9.1) Avoidable/differential cost Relevant Irrelevant Future costs that don’t differ between alternatives Sunk cost Opportunity cost Any cost which will continue in the future no matter which alternative is chosen • Lease cost on the building which will continue to be used whether or not you install the new equipment. • Depreciation cost of existing equipment that will be kept whether or not the new product line is manufactured. 9 Part 1 – Cost concepts for decision making (Topic 9.1) Avoidable/differential cost Relevant Irrelevant Future costs that don’t differ between alternatives Sunk cost Opportunity cost Any cost that has already been incurred and cannot be changed • Money that a corporation spent last year to investigate the site for a new office, expensed those funds and now is deciding whether or not to go forward with the project. • Book value of old equipment that cannot be resold 10 Part 1 – Cost concepts for decision making (Topic 9.1) Avoidable/differential cost Relevant Irrelevant Future costs that don’t differ between alternatives Sunk cost Opportunity cost The potential benefit foregone when one alternative is chosen over another • Revenue lost because the retail outlet closes early on the weekends. • Potential loss of investment income due to stockpiling inventory • Seldom recognized on financial reports 11 MA1 – MODULE 9 Part 2 Adding and dropping product lines Topic 9.2 12 Part 2 – Adding and dropping product lines (Topic 9.2) Prepare an analysis showing whether a product line or other organizational segment should be dropped or retained. (Level 1) Adding and dropping product lines Two approaches to the cost analysis: 1. Compare all costs 2. Compare only differential costs (those that differ between alternatives) 13 Part 2 – Adding and dropping product lines (Topic 9.2) Jackson County Senior Services Exercise 13-3, page 646 First classify the costs: Variable costs Depreciation on van Liability insurance Program administrators’ salary General administrative overhead Relevant/ Irrelevant Avoid./diff. R Sunk I Avoid./diff. R Avoid./diff. R Future cost I Stop the audio, turn to exercise 13-3, page 646, and the handout, page 1 then come back to listen to the solution. 14 Part 2 – Adding and dropping product lines (Topic 9.2) Jackson County Senior Services Exercise 13-3, page 646, requirement 1 Compare all costs Revenues Less variable expenses Contribution margin Current House-keeping Total Dropped Difference $900,000 $660,000 $(240,000) 490,000 330,000 160,000 410,000 330,000 (80,000) Variable costs are avoidable 15 Part 2 – Adding and dropping product lines (Topic 9.2) Jackson County Senior Services Exercise 13-3, page 646, requirement 1 Compare all costs Revenues Less variable expenses Contribution margin Less fixed expenses: Depreciation Liability insurance Current House-keeping Total Dropped Difference $900,000 $660,000 $(240,000) 490,000 330,000 160,000 410,000 330,000 (80,000) 68,000 42,000 68,000 27,000 0 15,000 Depreciation is based on the van which is a sunk cost. Liability insurance is an avoidable cost 16 Part 2 – Adding and dropping product lines (Topic 9.2) Jackson County Senior Services Exercise 13-3, page 646, requirement 1 Compare all costs Current House-keeping Total Dropped Difference Cost of administrator’s Revenues $900,000 salary$660,000 $(240,000) Less variable expenses is avoidable 490,000 330,000 160,000 Contribution margin General administrative 410,000 330,000 (80,000) overhead is not unavoidable. Less fixed expenses: Depreciation Liability insurance Program admin. salaries General administrative overhead Total fixed expenses Net operating income/loss 68,000 42,000 115,000 180,000 405,000 $ 5,000 68,000 27,000 78,000 0 15,000 37,000 180,000 0 353,000 52,000 $(23,000) $ (28,000) 17 Part 2 – Adding and dropping product lines (Topic 9.2) the housekeeping service is dropped, Jackson County SeniorIfServices netrequirement income will Exercise 13-3, page 646, 1 be reduced by $28,000 Compare all costs Revenues Less variable expenses Contribution margin Less fixed expenses: Depreciation Liability insurance Program admin. salaries General administrative overhead Total fixed expenses Net operating income/loss Current House-keeping Total Dropped Difference $900,000 $660,000 $(240,000) 490,000 330,000 160,000 410,000 330,000 (80,000) 68,000 42,000 115,000 180,000 405,000 $ 5,000 68,000 27,000 78,000 0 15,000 37,000 180,000 0 353,000 52,000 $(23,000) $ (28,000) 18 Part 2 – Adding and dropping product lines (Topic 9.2) Jackson County Senior Services Compare lost contribution margin Exercise 13-3, page 646, requirement 1 to costs that can be avoided. (Relevant costs) Compare all costs Revenues Less variable expenses Contribution margin Less fixed expenses: Depreciation Liability insurance Program admin. salaries General administrative overhead Total fixed expenses Net operating income/loss Current House-keeping Total Dropped Difference $900,000 $660,000 $(240,000) 490,000 330,000 160,000 410,000 330,000 (80,000) 68,000 42,000 115,000 180,000 405,000 $ 5,000 68,000 27,000 78,000 0 15,000 37,000 180,000 0 353,000 52,000 $(23,000) $ (28,000) 19 Part 2 – Adding and dropping product lines (Topic 9.2) Ignoring the irrelevant costs, Jackson County Senior Services will give the same answer. Exercise 13-3, page 646, requirement 1 Compare differential costs Difference Contribution margin lost if housekeeping is dropped Less fixed costs that can be avoided Liability insurance Program admin. salaries Total traceable fixed expenses Net annual cost increase (80,000) 15,000 37,000 52,000 $ (28,000) 20 Part 2 – Adding and dropping product lines (Topic 9.2) Segment reporting format Sales (Variable costs) = Contribution margin (Traceable fixed costs) = Segment margin Segmented statements – module 8 (Common costs) = Net income Corporate wide income 21 Part 2 – Adding and dropping product lines (Topic 9.2) Jackson County Senior Services Exercise 13-3, page 646, req. 2 Revenues Less variable expenses Contribution margin Home Meals on Total Nursing Wheels $900,000 $260,000 $400,000 490,000 120,000 210,000 410,000 140,000 190,000 Housekeeping $240,000 160,000 80,000 Deduct variable expenses Housekeeping has a 33% contribution margin ($80,000/$240,000) 22 Part 2 – Adding and dropping product lines (Topic 9.2) Jackson County Senior Services Exercise 13-3, page 646, req.2 Home Meals on HouseTotal Nursing Wheels keeping Revenues $900,000 $260,000 $400,000 $240,000 Less variable expenses 490,000 120,000 210,000 160,000 Contribution margin 410,000 140,000 190,000 80,000 Less traceable fixed expenses: Depreciation 68,000 8,000 40,000 20,000 Liability insurance 42,000 20,000 7,000 15,000 Program administrators’ salaries 115,000 40,000 38,000 37,000 Total traceable fixed expenses 225,000 68,000 85,000 72,000 Program segment margins $185,000 $ 72,000 $105,000 $ 8,000 Deduct fixed costs that can be traced to the department 23 Part 2 – Adding and dropping product lines (Topic 9.2) Jackson County Senior Services Exercise 13-3, page 646, req.2 Home Meals on HouseTotal Nursing Wheels keeping Revenues $900,000 $260,000 $400,000 $240,000 Less variable expenses 490,000 120,000 210,000 160,000 Contribution margin 410,000 140,000 190,000 80,000 Less traceable fixed expenses: Depreciation 68,000 8,000 40,000 20,000 Liability insurance 42,000 20,000 7,000 15,000 Program administrators’ salaries 115,000 40,000 38,000 37,000 Total traceable fixed expenses 225,000 68,000 85,000 72,000 Program segment margins 185,000 $ 72,000 $105,000 $ 8,000 General administrative Deduct common overhead 180,000 costs from the Net operating income/loss $ 5,000 corporate wide total. 24 Part 2 – Adding and dropping product lines (Topic 9.2) Qualitative factors to consider: • Is the line necessary to the sale of other products? • Does the line serve as a ‘magnet’ to attract customers? 25 MA1 – MODULE 9 Part 3 The make or buy decision Special orders Topics 9.3 & 9.5 26 Part 3 – The make or buy decision (Topic 9.3) Explain what is meant by a make or buy decision and prepare a well-organized make or buy analysis. (Level 1) • Vertical integration: • When a company is involved in the production of more than one or more steps in the production and distribution of the product. (value chain) • Make or buy decision: • Decision as to whether a product should be made internally or purchased from an outside supplier Common steps in an organization’s value chain R&D Product Design Customer Manufacturing Marketing Distribution Service © M cGraw-Hill Ryerson Limited., 2004 27 Part 3 – The make or buy decision (Topic 9.3) • Advantages of integration: • Less dependence on suppliers • Smoother flow of parts and materials • More control over quality • Disadvantages of integration • Suppliers may be able to benefit from economies of scale resulting in higher quality and lower cost. • Contact with suppliers may be necessary if there is an emergency and parts cannot be produced in-house. Product Design R&D Customer Manufacturing Marketing Distribution Service © M cGraw-Hill Ryerson Limited., 2004 28 Part 3 – The make or buy decision (Topic 9.3) Climate Control Inc. Exercise 13-4, page 647 – requirement 1 First classify the costs: Direct materials Direct labour Variable manufacturing OH Fixed manufacturing OH salaries Fixed manufacturing OH equipment Fixed manufacturing OH common Cost of component from outside supplier Avoid./diff. Avoid./diff. Avoid./diff. Avoid./diff. Sunk Future cost Avoid./diff. Relevant/ Irrelevant R R R R I I R Stop the audio, turn to exercise 13-4, page 647, and the handout, page 2, then come back to listen to the solution. 29 Part 3 – The make or buy decision (Topic 9.3) Climate Control Inc. Exercise 13-4, page 647 – requirement 1 Per unit Total-15,000 units Make Buy Make Buy Direct materials $6 Direct labour 8 1 Variable manufacturing OH 2 Fixed manufacturing salaries -Fixed manufacturing OH equipment -Fixed manufacturing OH common TOTAL $17 Exclude irrelevant costs 30 Part 3 – The make or buy decision (Topic 9.3) Climate Control Inc. Exercise 13-4, page 647 – requirement 1 Per unit Total-15,000 units Make Buy Make Buy Direct materials $6 Direct labour 8 1 Variable manufacturing OH 2 Fixed manufacturing salaries -Fixed manufacturing OH equipment -Fixed manufacturing OH common Purchase price of components $20 TOTAL $17 $20 It will cost $3 per unit more to purchase the thermostats. 31 Part 3 – The make or buy decision (Topic 9.3) Climate Control Inc. Exercise 13-4, page 647 – requirement 1 Per unit Total-15,000 units Make Buy Make Buy $6 $ 90,000 Direct materials 8 120,000 Direct labour Variable manufacturing OH 1 15,000 Fixed manufacturing salaries 2 30,000 -Fixed manufacturing OH equipment -Fixed manufacturing OH common $20 $300,000 Purchase price of components TOTAL $17 $20 $255,000 $300,000 A total difference of $45,000 32 Part 3 – The make or buy decision (Topic 9.3) Climate Control Inc. Exercise 13-4, page 647 – requirement 2 First classify the costs: Direct materials: Direct labour Variable manufacturing OH Fixed manufacturing OH salaries Fixed manufacturing OH equipment Fixed manufacturing OH common Cost of component from outside supplier Opportunity cost: segment margin foregone on a new product line Relevant/ Irrelevant Avoid./diff. Avoid./diff. Avoid./diff. Avoid./diff. Sunk Future cost Avoid./diff. R Opportunity cost R R R R I I R 33 Part 3 – The make or buy decision (Topic 9.3) Climate Control Inc. Exercise 13-4, page 647 – requirement 2 Total-15,000 units Make Buy $ 90,000 Direct materials 120,000 Direct labour Variable manufacturing OH 15,000 Fixed manufacturing salaries 30,000 -Fixed manufacturing OH equipment -Fixed manufacturing OH common $300,000 Purchase price of components Segment margin foregone 65,000 TOTAL $320,000 $300,000 A difference of $20,000 in favor of buying the new thermostat and implementing the new product line. 34 Part 3 – Special orders (Topic 9.5) Prepare an analysis showing whether a special order should be accepted. (Level 1) Special order • One-time order that is not considered part of the company’s normal ongoing business • Only incremental costs are considered • Should not affect normal sales • Idle capacity should be available 35 Part 3 – Special orders (Topic 9.5) Vicario Jewellers Exercise 13-5, page 647 First classify the costs: Materials Direct labour Fixed manufacturing OH Variable manufacturing OH Additional materials (for filigree) Cost of special tool Relevant/ Irrelevant Avoid./diff. Avoid./diff. Future cost Avoid./diff. Avoid./diff. Avoid./diff. R R I R R R Stop the audio, turn to exercise 13-5, page 647, and the handout, page 3 then come back to listen to the solution. 36 Part 3 – Special orders (Topic 9.5) Vicario Jewellers Exercise 13-5, page 647 37 Part 3 – Special orders (Topic 9.5) Vicario Jewellers Exercise 13-5, page 647 Incremental revenue ($389.95 x 10) Incremental cost Variable costs: Materials Direct labour Variable manufacturing OH Additional materials (for filigree) Total variable cost Fixed costs: Per bracelet 10 bracelets $349.95 $3,499.50 143.00 86.00 7.00 6.00 $242.00 1,430,00 860.00 70.00 60.00 $2,420.00 Total incremental cost Incremental operating income 38 Part 3 – Special orders (Topic 9.5) Vicario Jewellers Exercise 13-5, page 647 The special order adds $614,50 to the company’s net operating income and should be accepted. Incremental revenue ($389.95 x 10) Incremental cost Variable costs: Materials Direct labour Variable manufacturing OH Additional materials (for filigree) Total variable cost Fixed costs: Fixed manufacturing OH Cost of special tool Total incremental cost Incremental operating income Per bracelet 10 bracelets $349.95 $3,499.50 143.00 86.00 7.00 6.00 $242.00 1,430,00 860.00 70.00 60.00 $2,420.00 465.00 $2,885.00 $ 614.50 39 MA1 – MODULE 9 Part 4 Utilization of a constrained resource Topic 9.6 40 Part 4 – Utilization of a constrained resource (Topic 9.6) Make appropriate computations to determine the most profitable utilization of scarce resources. (Level 1) Constraint • A limitation under which a company must operate that restricts its ability to satisfy demand • i.e. – a machine already operating 24/7 cannot produce any more units. • When this constraint is narrowly focused it’s called a bottleneck. • How can a company maximize its profits under these conditions? • Focus on maximizing total contribution margin 41 Part 4 – Utilization of a constrained resource (Topic 9.6) Banner Company Exercise 13-6, page 648 – requirement 1 Selling price Less variable costs: Direct materials Direct labour Variable manufacturing OH Total variable cost Contribution margin A $60 Product B $90 C $80 27 12 3 42 $18 14 32 8 54 $36 40 16 4 60 $20 Maximize contribution margin when there is a constraint on direct labour: 3,000 hours at $8 per hour Stop the audio, turn to exercise 13-6, page 648, and the handout, page 4, then come back to listen to the solution. 42 Part 4 – Utilization of a constrained resource (Topic 9.6) Banner Company Exercise 13-6, page 648 – requirement 1 Selling price Less variable costs: Direct materials Direct labour Variable manufacturing OH Total variable cost Contribution margin Amount of direct labour hours required Direct labour cost per unit/$8 Product A: $12/$8=1.5 hours Product B: $32/$8=4.0 hours Product C: $16$/8=2.0 hours A $60 Product B $90 C $80 27 12 3 42 $18 14 32 8 54 $36 40 16 4 60 $20 1.5 4.0 2.0 43 Part 4 – Utilization of a constrained resource (Topic 9.6) Banner Company Exercise 13-6, page 648 – requirement 1 Selling price Less variable costs: Direct materials Direct labour Variable manufacturing OH Total variable cost Contribution margin Amount of direct labour hours required Contribution margin per direct labour hour A $60 Product B $90 C $80 27 12 3 42 $18 14 32 8 54 $36 40 16 4 60 $20 1.5 $12 4.0 $9 2.0 $10 Contribution margin per direct labour hour Product A: $18/1.5= $12/hour Product B: $36/4.0= $9/hour Product C: $20/2.0= $10/hour 44 Part 4 – Utilization of a constrained resource (Topic 9.6) Banner Company Exercise 13-6, page 648 – requirement 2 A $60 Product B $90 C Selling price $80 Less variable costs: Direct materials 27 14 40 Direct labour 12 32 16 Variable manufacturing OH 3 8 4 Total variable cost 42 54 60 Contribution margin $18 $36 $20 Contribution margin ratio 30% 40% 25% Amount of direct labour hours required 1.5 4.0 2.0 Contribution margin per direct labour hour $12 $9 $10 Times 3,000 direct labour hours available 3,000 3,000 3,000 Total contribution margin $36,000 $27,000 $30,000 Focus production on product A 45 Part 4 – Utilization of a constrained resource (Topic 9.6) Utilizing constraints • Focus on the constraint by relaxing (or elevating) it • add more hours by paying overtime • add another machine • subcontract bottleneck processing • move shift workers from a non-bottleneck process • perform business process reengineering or total quality management techniques on the bottleneck process • reduce defective units How much would you be willing to pay to relax a constraint? Not more than the additional contribution margin will generate. 46 Part 4 – Utilization of a constrained resource (Topic 9.6) Banner Company Exercise 13-6, page 648 – requirement 3 Contribution margin Amount of direct labour hours required Contribution margin per direct labour hour Times 3,000 direct labour hours available Total contribution margin A $18 Product B $36 C $20 1.5 4 2 $12 $9 $10 3,000 3,000 3,000 $36,000 $27,000 $30,000 Up to how much should the company be willing to pay per hour in overtime wages if 3,000 additional hours are made available? 47 Part 4 – Utilization of a constrained resource (Topic 9.6) Banner Company Exercise 13-6, page 648 – requirement 3 Contribution margin Amount of direct labour hours required Contribution margin per direct labour hour Times 3,000 direct labour hours available Total contribution margin Contribution margin per direct labour hour Current direct labour rate Maximum overtime rate: A $18 Product B $36 C $20 1.5 4 2 $12 $9 $10 3,000 3,000 3,000 $36,000 $27,000 $30,000 $12 8 $20 They would be willing to pay an additional $12 per hour or $20 in total in overtime pay to produce Product A. 48 Part 4 – Utilization of a constrained resource (Topic 9.6) Banner Company Exercise 13-6, page 648 – requirement 3 A $18 Contribution margin Amount of direct labour hours required Contribution margin per direct labour hour Times 3,000 direct labour hours available Total contribution margin Product B $36 C $20 1.5 4 2 $12 $9 $10 3,000 3,000 3,000 $36,000 $27,000 $30,000 Contribution margin per direct labour hour Current direct labour rate Maximum overtime rate: $12 8 $20 $9 8 $17 $10 8 $18 They would be willing to spend up to $17 in overtime pay for product B and up to $18 in overtime for product C. 49 MA1 – MODULE 9 Part 5 Joint product costs and the contribution approach Topic 9.7 50 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Prepare an analysis showing whether joint products should be sold at the split-off point or processed further. (Level 1) Joint product costs Cream Raw milk Purchasing and separating Split-off point Skim Joint products 51 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Prepare an analysis showing whether joint products should be sold at the split-off point or processed further. (Level 1) Joint product costs Raw Purchasing and milk Sales value Cream $28,000 10,000 litres 1.Based on relative sales value 2.Based on physical measure separating $30,000 Skim $25,000 30,000 Split-off litres point How are the costs of the raw milk and the further processing allocated to cream and liquid milk? Joint products Stop the audio, turn to the handout, page 5, then come back to listen to the solution. 52 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Prepare an analysis showing whether joint products should be sold at the split-off point or processed further. (Level 1) Based on relative sales value Sales value % of total Cream $28,000 56% Skim Total $22,000 $50,000 44% 100% Allocate $30,000 processing costs $16,800 $13,200 $30,000 Contribution margin $11,200 $8,800 $20,000 53 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Prepare an analysis showing whether joint products should be sold at the split-off point or processed further. (Level 1) Based on relative sales value Sales value % of total Cream $28,000 56% Skim Total $22,000 $50,000 44% 100% Allocate $30,000 processing costs $16,800 $13,200 $30,000 Contribution margin $11,200 $8,800 $20,000 Based on physical measure Litres % of total Allocate $30,000 processing costs Contribution margin 10,000 30,000 40,000 25% 75% 100% $7,500 $22,500 $30,000 $20,500 ($500) $20,000 54 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Prepare an analysis showing whether joint products should be sold at the split-off point or processed further. (Level 1) Joint product costs Separate product costs Cream Manufacture ice cream Skim Pasteurize homogenize and bottle Raw milk Purchasing and separating Split-off point Ice cream Packaged skim milk Joint products 55 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Prepare an analysis showing whether joint products should be sold at the split-off point or processed further. (Level 1) Sell or process further decision. Cream Manufacture ice cream Skim Pasteurize homogenize and bottle Raw milk Purchasing and separating Ice cream Packaged skim milk Joint products 56 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Solex Company Exercise 13-7, page 648 Input Stop the audio, turn to exercise 13-8, page 648, and the handout, page 6, then come back to listen to the solution. 57 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Solex Company Exercise 13-7, page 648 Joint product costs X $50,000 Input Processing $100,000 Y $90,000 Z $60,000 Split-off Joint point products 58 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Solex Company Exercise 13-7, page 648 Joint product Separate costs product costs Additional X processing $50,000 $35,000 Input Processing $100,000 New product X $80,000 Y $90,000 Additional processing $40,000 New product Y $150,000 Z $60,000 Additional processing $12,000 New product Z $75,000 Split-off Joint point products 59 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Solex Company Exercise 13-7, page 648 Joint product Separate costs product costs Additional X processing $50,000 $35,000 Input Processing $100,000 New product X $80,000 Y $90,000 Additional processing $40,000 New product Y $150,000 Z $60,000 Additional processing $12,000 New product Z $75,000 Split-off Joint point products 60 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Solex Company Exercise 13-7, page 648 Classify the costs: Relevant/ Irrelevant Joint processing costs Further processing costs Sunk Avoid./diff. I R 61 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Solex Company Exercise 13-7, page 648 Sales value after further processing Sales value at split-off point Incremental revenue Cost of further processing Incremental profit/loss Product X Y Z $80,000 $150,000 $75,000 50,000 90,000 60,000 30,000 60,000 15,000 62 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Solex Company Exercise 13-7, page 648 Sales value after further processing Sales value at split-off point Incremental revenue Cost of further processing Incremental profit/loss Product X Y Z $80,000 $150,000 $75,000 50,000 90,000 60,000 30,000 60,000 15,000 35,000 40,000 12,000 ($5,000) $20,000 $3,000 Sell product X at split-off and process product Y and Z further. 63 Part 5 – Joint product costs and the contribution approach (Topic 9.7) Joint product costs Input Processing W By-products X joint product with a relatively low sales value (wood chips, molasses) Y Z Split-off Joint point products 64 MA1 – MODULE 9 Part 6 Economic order quantity (EOQ) and the reorder point Topic 9.8 65 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Compute the optimum inventory level and order size. (Level 1) • Ordering cost • Clerical costs • Transportation costs • Carrying cost Inventory • Storage space costs • Handling costs Costs • Property taxes • Insurance • Obsolescence losses • Interest on capital invested in inventory • Costs of not carrying sufficient inventory (stock outs) • Customer ill will • Quantity discounts forgone • Erratic production • Inefficiency of production runs • Added transportation charges • Lost sales 66 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Compute the optimum inventory level and order size. (Level 1) Inventory Control • ABC analysis • Break inventory items into three categories based on value. Control is focused on ‘A’ items which have the highest value and are usually the smallest in number. • Economic order quantity • Determining an order size that minimizes costs of ordering and carrying inventory 67 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Economic order quantity Total cost Annual carrying cost: C Annual ordering cost: P Exhib it 13-9, Reading 9-1, CGA lesson notes, module 968 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Economic order quantity EOQ – Total cost is minimized (reading 9-1 page 2) Exhib it 13-8,Reading 9-1, CGA lesson notes, module 9 69 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Economic order quantity formula E = order size in units Q = annual quantity used in units P = cost of placing an order C = annual cost of carrying one unit in stock 70 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Economic order quantity formula E=? Q = 3,000 P = $10 C = $.80 71 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Total annual cost T = P(Q/E)+C(E/2) Order cost Carrying cost E = order size in units Q = annual quantity used in units P = cost of placing an order C = annual cost of carrying one unit in stock 72 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Total annual cost T = P(Q/E)+C(E/2) Order cost Carrying cost T = P(Q/E) +C(E/2) =$10(3,000/274)+$.80*(274/2) = $109 + $110 = $219 73 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Economic order quantity formula for production O O = optimal production lot size Q = annual production quantity P = setup costs for each run C = annual cost of carrying one unit in stock 74 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Bakerview products sells 24,000 units of the Deluxe-2M each year. The inventory control manager is concerned about rising costs and wants to determine the economic order quantity. After doing some research, the manager has determined the following costs: • • Cost to place an order Cost to carry one Deluxe-2M in inventory for 1 year $25 $2 What is the EOQ for the Deluxe-2M? Stop the audio, turn to the handout, page 7, then come back to listen to the solution. 75 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Bakerview products sells 24,000 units of the Deluxe-2M each year. The inventory control manager is concerned about rising costs and wants to determine the economic order quantity. After doing some research, the manager has determined the following costs: • • Cost to place an order Cost to carry one Deluxe-2M in inventory for 1 year $25 $2 What is the EOQ for the Deluxe-2M? = 775 units per order 76 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Bakerview products sells 24,000 units of the Deluxe-2M each year. The inventory control manager is concerned about rising costs and wants to determine the economic order quantity. After doing some research, the manager has determined the following costs: • • Cost to place an order Cost to carry one Deluxe-2M in inventory for 1 year $25 $2 What is the total annual cost for Deluxe-2M? T = P ( Q / E) + C( E / 2) T=25(24,000/775)+2(775/2) T = $1,549 per year 77 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Bakerview products sells 24,000 units of the Deluxe-2M each year. The inventory control manager is concerned about rising costs and wants to determine the economic order quantity. After doing some research, the manager has determined the following costs: • • Cost to place an order Cost to carry one Deluxe-2M in inventory for 1 year $35 $2 What will happen to EOQ if ordering costs increase to $35 per order? = 917 units per order 78 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Bakerview products sells 24,000 units of the Deluxe-2M each year. The inventory control manager is concerned about rising costs and wants to determine the economic order quantity. After doing some research, the manager has determined the following costs: • • Cost to place an order Cost to carry one Deluxe-2M in inventory for 1 year $25 $2.50 What will happen to EOQ if carrying costs increase to $2.50 per unit? = 693 units per order 79 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Original costs $25 Annual carrying cost/unit $2.00 Increased order costs $35 $2.00 917 Increased carrying costs $25 $2.50 693 Summary of requirements Order cost EOQ 775 As order costs increase, EOQ increases. The manager will want to order larger quantities resulting in fewer orders As carrying costs increase, EOQ decreases. The manager will want to order smaller quantities, resulting in less storage and handling. 80 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) JIT focuses on reducing the order cost (P). 81 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Reorder point • Time when an order is placed to replenish stock = (lead time x average demand) + safety stock Lead time • Time between order and receipt of stock Safety stock • Additional units kept on hand to satisfy maximum demand that can be reasonably expected during the lead time 82 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Time (weeks) Average usage EOQ Safety stock Adapted from Exhib it 13-10, Reading 9-2, CGA lesson notes, module 9 83 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Time (weeks) Average usage EOQ Safety stock Maximum expected usage Adapted from Exhib it 13-10, Reading 9-2, CGA lesson notes, module 9 84 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Time (weeks) Average usage EOQ Reorder point Safety stock Lead time Maximum expected usage Adapted from Exhib it 13-10, Reading 9-2, CGA lesson notes, module 9 85 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Aegean distributors sells building materials throughout western Canada. The following information relates to a line of metal doors carried by the company: Economic order quantity Lead time Average weekly usage 650 units 4 weeks 65 units What is the reorder point? (assuming no safety stock) = (lead time x average demand) + safety stock = ( 4 weeks x 65 )+0 = 260 +0 = 260 units Stop the audio, turn to the handout, page 8, then come back to listen to the solution. 86 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Aegean distributors sells building materials throughout western Canada. The following information relates to a line of metal doors carried by the company: Economic order quantity 650 units Lead time 4 weeks Average weekly usage 65 units Maximum weekly usage 78 units What is the reorder point? (with safety stock) Safety stock is additional stock required to satisfy maximum demand during the lead time. Maximum weekly usage 78 units Average weekly usage 65 units Safety stock 13 units Lead time x 4 weeks Safety stock 52 units 87 Part 6 – Economic order quantity (EOQ) and the reorder point (Topic 9.8) Aegean distributors sells building materials throughout western Canada. The following information relates to a line of metal doors carried by the company: Economic order quantity Lead time Average weekly usage Maximum weekly usage 650 units 4 weeks 65 units 78 units What is the reorder point? (with safety stock) = (lead time x average demand) + safety stock = ( 4 weeks x 65 ) + 52 = 260 + 52 = 312 units 88 MA1 – MODULE 9 Part 7 Review question: Relevant cost analysis (download the additional questions handout: ma1_mod9_handout1.pdf) 89 Part 7 – Review question: Relevant cost analysis Problem 13-22 pages 656-657 Handout pages 9 and 10 1. Would the increased fixed expenses be justified? 2. Compute the per unit break-even price on this order 3. What would be the dollar advantage or disadvantage of closing the plant for the threemonth period? 4. What unit cost figure is relevant for setting a minimum selling price? 5. Compute the unit cost figure that is relevant for comparison to the quoted price Stop the audio, read and attempt the question in the textbook then come back to listen to the solution. 90 Part 7 – Review question: Relevant cost analysis Problem 13-22 pages 656-657 Handout pages 9 and 10 1. Would the increased fixed expenses be justified? 2. Compute the per unit break-even price on this order 3. What would be the dollar advantage or disadvantage of closing the plant for the threemonth period? 4. What unit cost figure is relevant for setting a minimum selling price? 5. Compute the unit cost figure that is relevant for comparison to the quoted price 91 Part 7 – Review question: Relevant cost analysis Problem 13-22 pages 656-657 Handout pages 9 and 10 1. Would the increased fixed expenses be justified? 2. Compute the per unit break-even price on this order 3. What would be the dollar advantage or disadvantage of closing the plant for the threemonth period? 4. What unit cost figure is relevant for setting a minimum selling price? 5. Compute the unit cost figure that is relevant for comparison to the quoted price 92 MA1 – MODULE 9 Part 8 Review questions: Retain or drop a department Make or buy decision (download the additional questions handout: ma1_mod9_handout1.pdf) 93 Part 8 – Review question: Retain or drop a department; make or buy decision Question 8 March 2006 Handout page 11 Prepare an analysis to determine whether the shoe department should be dropped, and make a recommendation. Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 94 Part 8 – Review question: Retain or drop a department; make or buy decision Question 7 June 2007 Handout page 12 State whether Green’s should make or buy the game boards from the competitor. Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 95 MA1 – MODULE 9 Part 9 Review question: EOQ and safety stock (download the additional questions handout: ma1_mod9_handout1.pdf) 96 Part 9 – Review question: EOQ and safety stock Handout question Handout pages 13 thru 14 1. Compute the EOQ 2. At 18% risk of a stock out what would be the safety stock? The reorder point? 3. At 6% risk of a stock out what would be the safety stock? The reorder point? Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 97 Part 9 – Review question: EOQ and safety stock Handout question Handout pages 13 thru 14 4. At a 6% stock out risk what would be the total cost of ordering and carrying inventory for one year? 5. a) Using a JIT purchasing policy compute the new EOQ b) How frequently would the company be placing an order? 98 MA1 – MODULE 9 Part 10 Review question: Sell or process further (download the additional questions handout: ma1_mod9_handout1.pdf) 99 Part 10 – Review question: Sell or process further Question 3 December, 2005 exam Handout pages 15 thru 16 a. Compute the profit if all 3 products are sold at the split-off point b. Compute the profit if all 3 products are processed further before being sold c. Compute the profit at the optimum mix of sales either at, or after split-off Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 100 Part 10 – Review question: Sell or process further Question 3 December, 2005 exam Handout pages 15 thru 16 a. Compute the profit if all 3 products are sold at the split-off point b. Compute the profit if all 3 products are processed further before being sold c. Compute the profit at the optimum mix of sales either at, or after split-off 101 Part 10 – Review question: Sell or process further Question 3 December, 2005 exam Handout pages 15 thru 16 a. Compute the profit if all 3 products are sold at the split-off point b. Compute the profit if all 3 products are processed further before being sold c. Compute the profit at the optimum mix of sales either at, or after split-off 102 MA1 – MODULE 9 Part 11 Review question: Economic order quantity (download the additional questions handout: ma1_mod9_handout1.pdf) 103 Part 11 – Review question: Economic order quantity Question 2 June, 1989 exam Handout page 17 a. How many bottles should Quality Produce request in each order? b. If Koala Products offers Quality Produce a 10% discount off the delivered price for minimum orders of 50,000 bottles what should Quality Produce do? Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 104 Part 11 – Review question: Economic order quantity Question 2 June, 1989 exam Handout page 17 a. How many bottles should Quality Produce request in each order? b. If Koala Products offers Quality Produce a 10% discount off the delivered price for minimum orders of 50,000 bottles what should Quality Produce do? 105 Part 11 – Review question: Economic order quantity Question 2 June, 1989 exam Handout page 17 a. How many bottles should Quality Produce request in each order? b. If Koala Products offers Quality Produce a 10% discount off the delivered price for minimum orders of 50,000 bottles what should Quality Produce do? 106 MA1 – MODULE 9 Part 12 Review questions: Multiple Choice Questions (download the additional questions handout: ma1_mod9_handout1.pdf) 107 Part 12 – Review questions: Multiple choice Multiple choice questions Handout pages 18 thru 20 Now working on page 18 Q1 What is the affect of the decision on EOQ? Q2 If the division were discontinued how much would IPM’s income increase? Q3 What is the EOQ for Popcorn Co. Q4 Which would not be relevant to the closure decision? Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 108 Part 12 – Review questions: Multiple choice Multiple choice questions Handout pages 18 thru 20 Now working on page 19 Q5 What type of cost is machine amortization? Q6 Which is not a relevant cost? Q7 Which is the appropriate decision and related cost? 109 Part 12 – Review questions: Multiple choice Multiple choice questions Handout pages 18 thru 20 Now working on page 20 Q8 How many units of the standard and deluxe models should be produced? Q9 What should be considered when deciding whether to accept or reject the order? 110