Q&As about the publication of the Solvency II relevant risk

advertisement

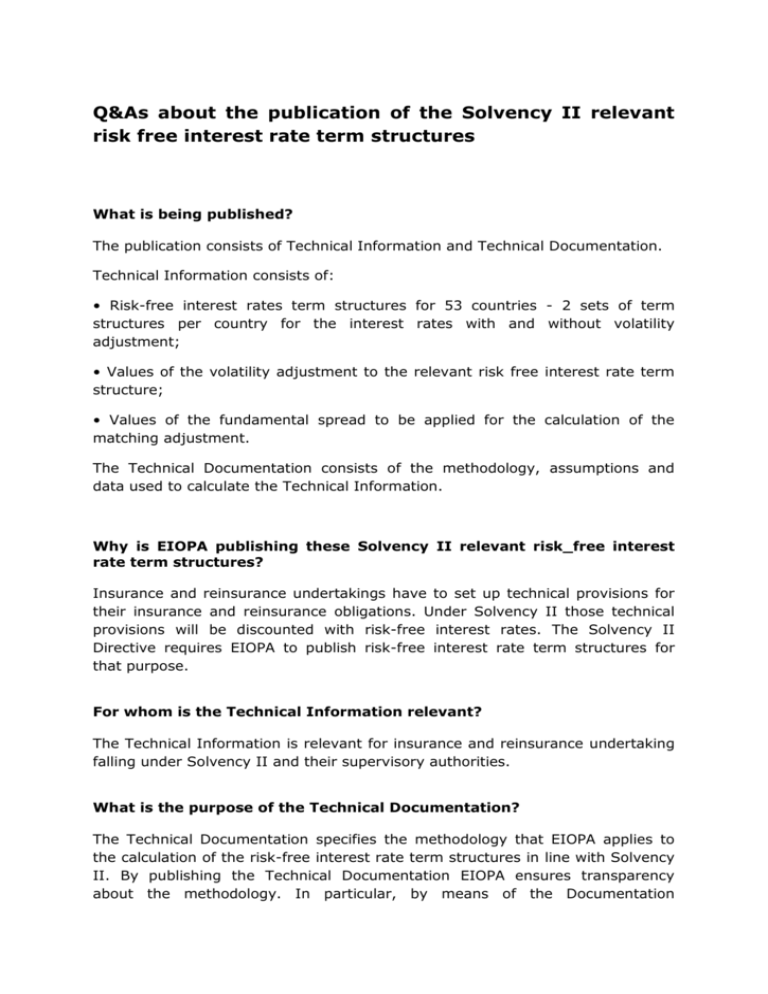

Q&As about the publication of the Solvency II relevant risk free interest rate term structures What is being published? The publication consists of Technical Information and Technical Documentation. Technical Information consists of: • Risk-free interest rates term structures for 53 countries - 2 sets of term structures per country for the interest rates with and without volatility adjustment; • Values of the volatility adjustment to the relevant risk free interest rate term structure; • Values of the fundamental spread to be applied for the calculation of the matching adjustment. The Technical Documentation consists of the methodology, assumptions and data used to calculate the Technical Information. Why is EIOPA publishing these Solvency II relevant risk_free interest rate term structures? Insurance and reinsurance undertakings have to set up technical provisions for their insurance and reinsurance obligations. Under Solvency II those technical provisions will be discounted with risk-free interest rates. The Solvency II Directive requires EIOPA to publish risk-free interest rate term structures for that purpose. For whom is the Technical Information relevant? The Technical Information is relevant for insurance and reinsurance undertaking falling under Solvency II and their supervisory authorities. What is the purpose of the Technical Documentation? The Technical Documentation specifies the methodology that EIOPA applies to the calculation of the risk-free interest rate term structures in line with Solvency II. By publishing the Technical Documentation EIOPA ensures transparency about the methodology. In particular, by means of the Documentation stakeholders can understand how the term structures will change when the market inputs of the calculation change. Solvency II starts in 2016. Why does EIOPA publish Technical Information already now? Insurance and reinsurance undertakings need to prepare for the introduction of Solvency II. The availability of the Technical Information at this stage will facilitate that preparation. Moreover, some approval procedures for Solvency II start already in April 2015, for example for the use of internal models to calculate capital requirements. Knowing how the risk-free interest rate term structures are calculated will help the undertakings in specifying their applications. What will happen from 2016? From January 2016 insurance and reinsurance undertakings will have to use the updated term structures for the calculations of the technical provisions under Solvency II. What will be the impact of calculating technical provisions with the published term structures? The risk-free interest rate term structures will change over time, depending on market parameters, in particular the level of market interest rates. Therefore, the amount of technical provisions will usually increase when market interest rates decrease and vice versa. This will allow undertakings and supervisors to better assess the risks that changes in market interest rates will pose to insurance and reinsurance undertakings. Better risk management will ultimately be of benefit for consumers. Why did EIOPA change parts of its model to calculate the technical information? EIOPA has calculated and published the technical information during 2015 in order to allow the insurance industry and other stakeholders to prepare for Solvency II. EIOPA used the preparatory phase to increase the robustness of the calculations. Changes to the EIOPA model come from different sources: - EIOPA reviewed parts of the methodology used to derive the technical information; EIOPA published on its website the source code used to calculate the technical information and asked stakeholders for feedback; - An external review was conducted during November 2015 and led to several improvements; Finally, the internal validation process continued during 2015 to ensure a consistent implementation of the technical information. When will be those changes implemented? EIOPA decided to finalise the implementation of the changes decided by its Board of Supervisor for the November 2015 production. This will allow stakeholders to familiarise themselves with the results and EIOPA’s final model. What are the changes and what is their impact? The below table summarises all the changes made that have an impact on the results. After these last changes, will the new RFR source code be re-published? The new RFR source code will be re-published before 18 December. Changes on the basic risk-free rates Where does it Description of the change Impact of the change come from? EIOPA (BoS A new DLT assessment has been The impact is limited to that decision) carried out and implemented in currency. October. The calculations for the Turkish lira have been aligned to the DLT assessment. External review Implementation of the credit risk The impact is nil for all currencies and adjustment calculations have but the Hong Kong dollar and the STAKEHOLDERS been aligned with the technical Thai baht. For those two documentation for those currencies, the impact is medium. currencies where the third situation (as described in section 5.C of the technical documentation) should be applied: - Detection of when the third situation should be applied; - Calculation of the ratio, used in the third situation, now takes the rates that are both DLT and available. Clarification of the technical The impact is medium for those documentation as regards the currencies where there is missing situation where there is not data. This situation is exceptional. enough data to calculate a riskfree curve. Cf. section 7.A and paragraph 120. Changes on the long-term average spread (LTAS) Where does it Description of the change Impact of the change come from? EIOPA Correction of erroneous For those currencies/countries that corporate bond rates that had have a high percentage of nonbeen provided to EIOPA. On 13th financial bonds of credit quality and 14th April 2006, the rates of step 5 and 6, the impact on the the non-financial bonds of credit volatility adjustment (VA) is high. quality step 5 and 6 are not Those countries are Croatia, representative of the market Denmark, Greece and the United situation at that time (outlying Kingdom. The change leads to an yield of 100 000%). Those rates increase of the VA. were deleted and are not taken into account in the LTAS calculation. EIOPA Replacement of the corporate Small impact on the LTAS. bond yields: yields-to-worst had been provided to EIOPA, where those should have been usual yields. EIOPA (BoS Change on the methodology to The impact is limited to the LTAS decision) derive the LTAS on government for the pound sterling. and corporate bonds for the pound sterling. Adjustment factors have been introduced (cf. annex 14.H of the technical documentation). External review Alignment of the LTAS The impact is medium for the and EIOPA calculation for the Danish krone Danish krone VA. with the technical documentation with regards to the duration to be used and the comparison of the yields with the krone basic risk-free interest rates and not the euro basic risk-free rate. External review Alignment of calculations of the Impact is small on the LTAS and LTAS on corporate bonds with not visible in the VA. the technical documentation: - Correct application of the K factor formula for pound sterling and US dollar bonds of credit quality step 4 and 5; - Correct calculation of the number of dates without data; - Correct application of the rule that the 1 year LTAS is equal to the 2 year LTAS for bonds of credit quality step 0. Changes on the probability of default and cost of downgrading Where does it Description of the change Impact of the change come from? EIOPA (BoS Change on the methodology to Medium impact on the fundamental decision) derive the cost of downgrading. spread and small impact on the VA. Cf. annex 14.I of the technical documentation. Changes on the volatility adjustment Where does it Description of the change Impact of the change come from? STAKEHOLDERS Alignment of the weights to be Medium impact on the VA of and external used in the national part of the Greece and Hungary. review VA with the technical documentation. EIOPA (BoS Calculation of a VA for the High impact for the Icelandic króna decision) Icelandic króna (cf. section 9.D as no VA was calculated before. paragraph 231 of the technical External review documentation). The calculation of the euro VA Small impact for the euro VAs. on government bonds for exposures to non-euro area governments was changed to be based on the government bond indices of those governments instead of the ECB curve.