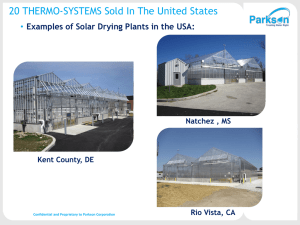

parkson retail asia limited

advertisement