ifrs and aspe summaries - Mr. Goldkind's Grade 11 Accounting Wiki

advertisement

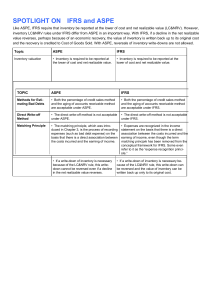

IFRS AND ASPE SUMMARIES High School Accounting Supplement IFRS and ASPE Summaries High School Accounting Supplement Zach Witte, BCom Research Assistant Joseph L. Rotman School of Management University of Toronto Toronto, ON Lisa Harvey, BBA, MAcc, CPA, CA Lecturer in Accounting Joseph L. Rotman School of Management University of Toronto Toronto, ON © 2014 This summary was funded by the CPA/Rotman Centre for Innovation in Accounting Education Introduction & Review All companies are complex organizations with differing objectives, processes, resources, people etc. Financial statements are a way to organize this complex information into a format that is understandable for users who have a reasonable background in business and accounting. This is done by following what is referred to as a financial reporting framework. Financial Reporting Frameworks A financial reporting framework is a set of standards under which financial statements should be prepared and presented so that it the financial statements are standardized and comparable. Since there are many users with differing degrees of financial information required, several different financial reporting frameworks exist. Types of Users In general there are two main types of users: internal users and external users. Internal Users Financial statements help make decisions for many internal functions such as: Management – What is a reasonable bonus to be paid to employees and the senior leadership team based on current year results? Human Resources – What workforce size is needed to meet production forecasts? Finance – How much debt will we need to finance our expansion? Marketing and Operations – At what price will our new product turn a profit while remaining competitive in the market place? Internal users generally have direct access to those who prepare the financial information and are therefore able to request additional or more detailed information if needed. External Users Financial statements help make decisions for many external users such as: Creditors – Does the company have enough cash flow to repay its debt? Owners and Investors – Will the company continue to be profitable in the future? Customers – Will the company have to reduce product and/or service offerings due to cash flow or profit concerns? Government – What is the amount of taxes owed? External users generally only have access to financial information given to them by the business. This information typically includes financial statements. As such, the information requested and/or required by the users of a business determines the type and amount of an entity’s financial statements. 3 Changes in the Accounting World In Canada, formal accounting standards have been issued via financial statement frameworks since 1968 using what is now referred to as the Chartered Professional Accountants of Canada Handbook (CPA Canada Handbook). A financial statement framework is a set of standards under which financial statements should be prepared and presented so that it is standardized and comparable. This first set of bulletins and guidelines organized as a framework were referred to as Canadian Generally Accepted Accounting Principles (CGAAP). Users’ needs are the primary motivation for the development of financial statement frameworks. This is because providing useful information for the various users is one of the main reasons why financial statements and financial information are created and presented in the first place. Therefore, as business, politics, and technology changed, so did CGAAP. Users began to require more information and financial statement frameworks had to adopt new ways of presenting increasingly complex information. From 1968 onward, new standards were added, old standards were updated and obsolete standards were removed. One of the biggest changes to the Canadian financial reporting frameworks occurred in 2006 when the Canadian Accounting Standards Board (AcSB) announced its intention to replace CGAAP with International Financial Reporting Standards (IFRS). Since IFRS generally contained far more detailed requirements than CGAAP, the move to IFRS was met with some resistance by users who required less information to make informed decisions. As such, the AcSB decided that IFRS would only be required for publicly accountable companies (generally companies whose stocks are traded on a stock exchange) and optional for all others. The AcSB then developed additional standards to meet the needs of the other types of users. 4 Types of Financial Reporting Frameworks In Canada, there are currently five distinct financial reporting frameworks. The first four are included in the CPA Canada Handbook: 1. International Financial Reporting Standards (IFRS) is the framework required of all publicly accountable companies. The most common publicly accountable companies are those that trade their shares or bonds on a stock exchange. IFRS is the most detailed financial reporting framework. 2. Accounting Standards for Private Enterprises (ASPE) is most commonly used by private companies. ASPE is generally less detailed because private company users generally have the ability to request additional and/or more detailed information from the company itself. 3. Accounting Standards for Not-for-Profit Organizations (ASNFPO) are used by charities and other entities that are not profit driven such as hospitals and universities. These are generally the least detailed financial statements because Not-for-Profit Organizations (NPOs) often do not have the capacity to provide overly detailed financial information. They tend to focus their resources on meeting their missions instead. ASNFPO is mentioned here to provide a complete list. Note that this financial reporting framework is outside the scope of this resource. 4. Accounting Standards for Pension Plans (ASPP) are used by companies when they are reporting their pension plans separately from the overall entity. ASPP is mentioned here to provide a complete list. Note that this financial reporting framework is also outside the scope of this resource. The fifth financial reporting framework in Canada is included in the CPA Canada Public Sector Accounting Handbook: 5. Public Sector Accounting Standards (PSAB) PSAB are used by companies in the public sector such as local, provincial or federal governments. However, certain public sector companies can choose to use IFRS. PSAB is mentioned here to provide a complete list. Note that similar to ASNFPO and ASPP, this financial reporting framework is outside the scope of this resource. 5 IFRS and ASPE: The “Big 2” Financial Reporting Frameworks The two most common financial statement frameworks are ASPE and IFRS. IFRS requires detailed disclosures that generally require considerable financial and staffing resources to prepare. IFRS has more required disclosures because it is used by a much larger group of users than that of a private company. For instance, Bell Canada, a public company, has millions of shareholders whereas a private company can have as little as one shareholder. Furthermore, when users of a private company require additional information, it is generally much easier for them to get access to that information due to their close ties to the company. For example, an owner of a private company could request more detailed information than what is presented in the ASPE statements. In contrast, shareholders of Bell Canada would be hard pressed to obtain more information they need because of their very small ownership percentages in the company. Thus, IFRS attempts to provide most of the information a user could need while balancing the cost of providing that information. Both IFRS and ASPE are referred to as principles-based frameworks. In essence this means that instead of being a series of rules that must be applied, both frameworks are made up of a series of ideas and guidelines that must be applied. In plain English, this means that under both frameworks, transactions should be presented in a way that reflects the true economic impact of the transactions (i.e. they should show what actually happened). Whereas with a rules-based framework (as they have in the U.S.), transactions that meet certain criteria must be presented a certain way. This can sometimes lead to misleading financial statements and/or financial information. Some key advantages and disadvantages to IFSRS and ASPE are presented below. Advantages IFRS Comparable to other companies in other countries because IFRS is used by the majority of the world to prepare financial statements with the biggest exception being the U.S. More information is presented and thus the financial statements are useful to more users IFRS is generally supported by finance executives across Canada and the world as it provides more useful information IFRS supports going public in the future (as it’s required for publicly accountable entities) and is generally the preferred framework for lenders ASPE Aligned with the Canadian environment where there are a significant amount of private companies Based mostly on using historical cost which reduces fluctuations in the balance sheet as compared to fair value Less disclosure requirements which saves time and money Most simple framework which is similar to previous Canadian accounting standards 6 Disadvantages IFRS Much more education and training of staff required IFRS has fewer rules and clear requirements which can add a significant layer of judgement which increases the time and cost of preparing financial reports ASPE If the makeup of a company’s financial statement users changes, ASPE may not provide sufficient information for all users If a company plans to expand globally, ASPE does not provide a comparable framework for global suppliers, customers, or competitors 7 Accounting under IFRS and ASPE To better understand the more detailed requirements under IFRS when compared to ASPE, this resource will outline major accounts in financial statements and detail how they are accounted for under IFRS and ASPE. Inventory Inventory is one of the best examples of where IFRS and ASPE have almost completely converged. Under both frameworks, inventory is valued at the lower of cost and net realizable value. Cost: The cost paid to purchase the inventory from an outside vendor or the costs related to purchasing raw materials and converting them into finished goods. Net Realizable Value: This is the idea of the amount of money expected to be received (realized) as a result of the sale of the inventory (i.e. it is the selling price of the inventory less the costs to sell it). For example, if you purchased inventory for $50 and are only going to be able to sell it for $25 presenting it on the balance sheet at a value of $50 is misleading to users. Accounting for Investments and Subsidiaries Under both ASPE and IFRS there are 3 main accounting treatments for accounting for investments and subsidiaries. They are consolidation, equity method and fair value. Consolidation: This method requires that the financial statements of both companies be combined together line by line on the financial statements of the parent. For example, if the parent had $1,000 in cash and the subsidiary had $500 the total balance of cash on the parent’s consolidated balance sheet would be $1500. Equity Method: The investment is originally recorded at the cost of purchase on the parent’s balance sheet and then is adjusted by its ownership percentage of the subsidiary’s net income. For example, a 40% share of a subsidiary purchased for $1 million would initially be recorded by the parent at $1 million. If in the next year the subsidiary earned income of $100,000, the value of the subsidiary on the parent’s balance sheet would increase by $40,000 ($100,000 x 40%). The ending value would be $1,040,000 on the parent’s books. Fair value method: This method requires the investment to be initially reported at the cost to purchase and then adjusted to its fair market value at each balance sheet date. 8 Both ASPE and IFRS have all 3 accounting treatments, but they differ significantly in their application. As discussed, users of ASPE financial statements generally have access to more detailed information when needed. Therefore, ASPE allows a choice in accounting treatments. Under ASPE there is a choice between 3 accounting treatments for subsidiaries/investments. They can be held at fair value, recorded as an equity investment, or consolidated. Accounting for subsidiaries under IFRS is quite different. The required treatments are determined by the influence or control the parent company has. In general, a company has significant influence if it has between 20% to 50% ownership of its investment and control if the parent company has an ownership of greater than 50%. If there is no significant influence, the investment should be carried at fair value. If there is significant influence but not control, the investment (referred to as an associate) is required to be accounted for using the equity method. Finally, if the parent controls the company it has invested in (referred to as a subsidiary), consolidation is required. Property, Plant and Equipment (PP&E) ASPE requires PP&E to be measured at cost at recognition and then at cost less depreciation subsequently. Cost is a much simpler method to prepare than fair value and thus the reason for use in ASPE. If there is a significant decline in the value of the PP&E (i.e. it breaks, become technologically outdated, etc) ASPE requires the value of the PP&E to be written down to the fair value in this case. If the value subsequently rebounded, under ASPE you are not allowed to reverse the write down. IFRS generally does not allow for choice in accounting policies. However, PP&E is an area where choice exists. PP&E must be measured at cost upon recognition and subsequently there is the choice to measure using cost less accumulated depreciation or at fair value less depreciation. PP&E has generally been measured at cost less accumulated depreciation in most countries before IFRS. However, IFRS favours the use of fair value generally as it shows the clearest picture of the entity at that point in time. This is one of the main reasons for the choice between cost and fair value under IFRS. If there is a significant decline in value of PP&E in IFRS, it too must be written down to fair value, however, unlike ASPE, the write down can be reversed in the future if the conditions that caused the value to drop also reverse. For example, if a piece of PP&E was no longer useful because a technological process changed the PP&E would be written off in value. However, if a new use for the equipment was found, the PP&E could be written back up to the value before the write off. This follows the idea under IFRS that fair value is the most representationally faithful presentation. . 9 Revenue Under ASPE, revenue is recorded at the time of performance assuming ultimate collection is assured. This means that to record revenues, you need to have performed the action required to earn revenue and you have reasonable assurance that you will collect from the customer. In plain English this would mean the following for the sale of a boat: 1) Performance – When the boat has been constructed and transferred from the seller to the buyer, performance has been met. 2) Collection – if the deal was paid for upfront then collection is assured once the payment is received by the seller. Accounting for revenues under IFRS follows the same basic principal – performance and collection, but is organized into 5 requirements. The chart below will show which IFRS criteria can be mapped to the two ASPE criteria of performance and collection. IFRS Criteria ASPE Criteria the entity has transferred to the buyer the significant risks and rewards of ownership of the goods; Performance the entity retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold; the amount of revenue can be measured reliably; Collection it is probable that the economic benefits associated with the transaction will flow to the entity; and the costs incurred or to be incurred in respect of the transaction can be measured reliably. As you can see the recognition criteria for revenue is in essence very similar under both IFRS and ASPE, however they are explained using slightly different terminology. Income Taxes Accounting for income taxes is another area where there is a significant difference between IFRS and ASPE. ASPE again allows preparers of financial statements a choice. Income taxes can either be presented using the income taxes payable method or the future income taxes method. The income taxes payable method is the most simple. At year end a company is required to accrue the amount of taxes required to be paid to the government for the current year’s operations. The future income taxes method requires the recognition of income tax 10 assets and liabilities relating taxes due in the current year and in future years that relate to current operations. For example, when you are getting a loan you can deduct the legal costs associated with obtaining the loan under both ASPE and IFRS in the year paid. However for tax purposes you can only deduct one fifth of the costs each year, over 5 years. Thus there is a difference in accounting income and tax income that would have a future income tax effect. IFRS requires the use of the future income taxes method (referred to as deferred tax method under IFRS) as it shows a more accurate and faithful picture of all the taxes incurred or that will be incurred related to current operations. Disclosures An area of significant difference between IFRS and ASPE is in disclosure. Disclosure means additional information required to support the financial statements. This is generally in the form of notes to the financial statements. As discussed earlier, ASPE is the closest Canadian financial reporting framework to the old CGAAP. In 2011, the transition from CGAAP to either IFRS or ASPE was undertaken. Updating financial statements from CGAAP to ASPE required very little additional disclosure. However, the transition from CGAAP to IFRS required abundant additional disclosure. This is because IFRS requires additional disclosure in almost every section. Disclosures encompass one of the starkest differences between IFRS and ASPE. Since users of ASPE statements generally have more access to information, they tend to require less information in the financial statement disclosures. IFRS users generally have less access to information and thus require much more information to be presented in the financial statements in order to make informed decisions. 11