What do the reforms mean for the Customer – Provider Relationship

Community Forum - Securing Our Place in the Future

What do the reforms mean for the Customer –

Provider Relationship? How can providers meet customer expectations?

Jane Mussared, Chief Executive, COTA SA

10 November 2015

Who and what is COTA?

#reframingageing

2

Aged care will grow a lot….

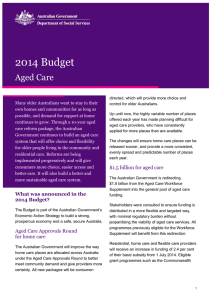

2014

Aged over 65 Percentage aged over

3 million

65 2010

14%

Percentage aged over 65

2050

25%

People with dementia

340,000

2050 8 million 25% 36.5% 900,000

3

Growing workforce

• Largest employing industry in Australia, employing more than 1.4m people (12.3% of the total workforce)

• Increased by 458,500 (or 48%) over the 10 years to May 2014 - largest growth industry in

Australia over this period

• Average annual growth rate of 4% - double the growth of 2% in all industries

4

The Aged Care Market

5

“get out of the way; let consumers decide what they want and allow the market to supply what is needed.”

Former Aged Care Minister Mitch Fifield, Nov 2014

So what might that mean?

• What do the reforms mean for the

Customer – Provider Relationship?

• How can providers meet customer expectations?

• Nobody knows exactly what it will mean

• But there are some questions that might help…

7

From – Provider with Government

Customer

Government

Service

Provider

8

To - Provider with Customer

Customer

Government

Service

Provider

9

And its no longer exclusive…..

Brokers

Information

Move & declutter

Ironing, home maintenance etc

Customer (& their network)

Health

Housing

Financial Advice

Service Provider

10

New measures of quality

Government Customer and their network

Passing Accreditation

95% survey satisfaction

Focus on benchmarking

Financial accountability to government

Focus on ACAR & passing accreditation

Exceeding expectations

Deep conversations with new insights

Focus on point of difference

Explaining price to customer

Focus on each part of the value chain

11

Quality Systems and Better

Practice

12

The Theory of Markets

• if the price isn’t right, don’t buy

• if the service is sub-par, go elsewhere

• if what you want isn’t available, try someone else

• if advice and extra care matters, pay more

13

Wow! - Kano Model

14

Surveys v Conversations

15

Benchmarking v Point of

Difference

16

Pricing

17

Value Chain

Exit

General promise – market pitch

Individual promise – personal pitch

Delivery

Agreement

&

Expectations

18

Battle of the brands?

Misao Okawa

19

The re-emergence of craft beer

20

Foodland takes it up to

Woolworths and Coles

21

Market Limitations

1. Ageism

2. Power Imbalance

3. Immature Market

4. Low expectations of selves

5. Thin or non-existent markets

6. Artificial cap on what and how much

7. Exclusion and marginalisation

22

Cultural Diversity

23

Wealth Diversity

• Low Super

• Home ownership in free fall

• No jobs

24

It will thus be a highly segmented market, not only for aged housing and aged care, but for all the goods and services older people use.

Professor Graeme Hugo, 2014

25

So then, how can providers best identify and meet the expectations of consumers?

26

Reframe ageing…

“Things have been shaken up enough that truly there's this opportunity on the horizon for reinventing the idea of what it means to age.”

Sloan Center for Work and Aging

27

Dementia Friendly

No one wants to spend time with me now that I have a diagnosis. It is like they think I no longer count and I am not a person anymore.

Man with dementia, Alzheimer ’s Australia 2014

28

New Language

Customer or

Consumer or

Citizen

Or

?

29

Strong Communities

30

Co-Design

31

Complaints, Rights and Advocacy

32

Information and Language

Services

33

Uncap Supply

Is this the right amount and type?

• 78 residential care places

• 2 “reablement” places

• 45 home care places

34

Technology and equipment

35

Ian Day

Chief Executive

COTA NSW www.cotansw.org.au iday@cotansw.org.au

36