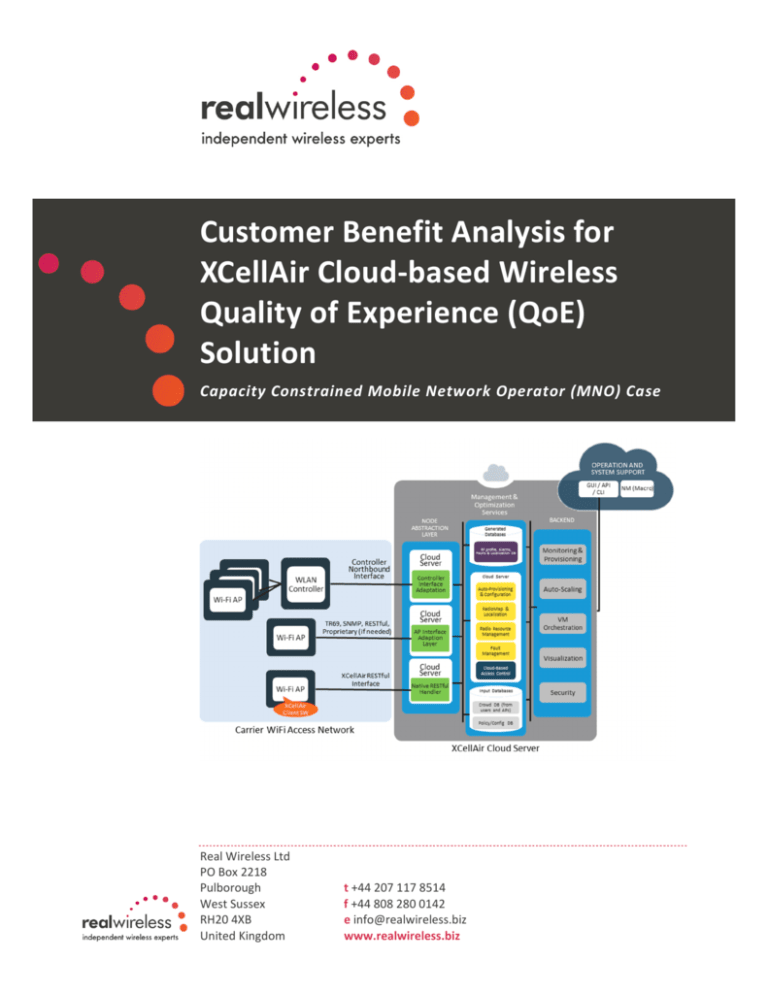

Customer Benefit Analysis for

XCellAir Cloud-based Wireless

Quality of Experience (QoE)

Solution

Capacity Constrained Mobile Network Operator (MNO) Case Real Wireless Ltd PO Box 2218 Pulborough West Sussex RH20 4XB United Kingdom t +44 207 117 8514 f +44 808 280 0142 e info@realwireless.biz www.realwireless.biz Issued to: XCellAir Issue date: July 2015 Version: 5.0 Real Wireless Ltd PO Box 2218 Pulborough West Sussex RH20 4XB United Kingdom t +44 207 117 8514 f +44 808 280 0142 e info@realwireless.biz www.realwireless.biz About Real Wireless Real Wireless is the pre-eminent independent expert advisor in wireless

technology, strategy & regulation worldwide. We bridge the technical and

commercial gap between the wireless industry (operators, vendors and

regulators) and users of wireless (venues, transportation, retail and the public

sector) - indeed any organization which is serious about getting the best from

wireless to the benefit of their business.

We demystify wireless and help our customers get the best from it, by

understanding their business needs and using our deep knowledge of wireless

technology to create an effective wireless strategy, business plan, implementation

plan and management process.

We are experts in radio propagation, international spectrum regulation, wireless

infrastructures, and much more besides. We have experience working at senior

levels in vendors, operators, regulators and academia.

We have specific experience in LTE, LTE-A, 5G, UMTS, HSPA, Wi-Fi, WiMAX, DAB,

DTT, GSM, TETRA, PMR, PMSE, IoT/M2M, Bluetooth, Zigbee, small cells, radio,

core and transport networks – and much more besides.

For details contact us at: info@realwireless.biz

Tap into our news and views at: realwireless.biz/blog

Stay in touch via our tweets at twitter.com/real_wireless

Copyright ©2015 Real Wireless Limited. All rights reserved.

Registered in England & Wales No. 6016945

About XCellAir

Delivering high-quality wireless service is complicated and expensive, but XCellAir’s mission

is simple – to give our customers the ability to manage and optimize their wireless network

to deliver the best Quality of Experience (QoE). Whether you are a Multiple System

Operator (MSO) relying on Wi-Fi to deliver services in the home and on the move, or a

Mobile Network Operator (MNO) leveraging a combination of LTE and Wi-Fi to meet the

growing demand for data centric services – XCellAir accelerates radio network deployment,

simplifies operations and optimizes the network for the delivery of services – Voice, Video

and Data.

In the face of increasing demand for wireless services the limiting factor remains spectrum.

The scarcity and expense of licensed spectrum is driving two key trends. First, the

increasing desire to use all available airwaves – both licensed and unlicensed. Second, the

move towards densification through smaller cells – whether these “cells” are Wi-Fi Access

Points or Cellular Small Cells. However, to date, taking advantage of unlicensed spectrum

while scaling the radio network by an order of magnitude is either an unrealized dream or is

having the opposite effect – dragging down the QoE due to interference and operational

challenges. XCellAir solves these issues at scale with our proprietary and the industry’s first

cloud-based, multi-market, Wi-Fi and LTE QoE solution.

For details e-mail us at: InfoSharing@xcellair.com

Tap into our news and views at: xcellair.com/blog

Stay in touch via our tweets at twitter.com/xcellair

Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015

Version: 5.0

Foreword

The journey of launching a new company certainly has its fair share of highs and lows –

usually from one hour to the next. The dynamism of the environment can easily distract

from the fundamentals of driving a successful enterprise. In our case to help keep our focus

we did the logical thing – sat down and made of list of critical goals and deliverables that

will help set XCellAir up for success. What you are reading here is the outcome of one of

those bullet items.

For any new enterprise it’s easy to get caught up in the “tech” and the story around the

tech. Why not – it’s the reason you’ve decided to take the leap in the first place. However,

tech without a fundamental business benefit is just cool tech and not the foundation of a

thriving enterprise. At the same time it is so easy to fall into a group think mentality on why

or how your customers will put a dollar value to your cool idea. So we decided to outsource

this part of the process.

In steps, Real Wireless – a group of trusted independent wireless experts with specialized

skills that range from policy, economics, technology and standards – was asked to take a

look at our business and come up with a financial benefits case for using our cool tech. Here

in are the results.

As you read further you’ll learn that this is just one of the four case studies analysed by Real

Wireless. Rest assured, we will make available all four as separate papers. Together they

comprise a nearly 80 page feast so we’ve taken upon ourselves to deliver the material in

more easily digestible bites.

Thanks as always for taking part in the XCellAir journey.

Sincerely,

Todd C. Mersch

Co-Founder & EVP Sales & Marketing

Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015

Version: 5.0

Contents

1. General introduction .........................................................................................1 2. Capacity constrained LTE network .....................................................................6 2.1 Operator type and examples ................................................................................... 6 2.2 Strategic objectives .................................................................................................. 7 2.3 Key network requirements ...................................................................................... 9 2.4 Existing capabilities ................................................................................................ 10 2.5 Further customer business needs .......................................................................... 12 2.6 The contribution of the XCellAir solution ............................................................... 13 2.7 Results .................................................................................................................... 16 2.8 Sensitivities ............................................................................................................. 17 2.9 Model assumptions ................................................................................................ 19 References ...................................................................................................................... 21 Tables

Table 1: Summary of the challenges in the four case study scenarios, the available solutions, and the potential contribution of XCellAir .............................................. 3 Table 2: The three broad levels of MNO deployment of Wi‐Fi offload, as a way to ease cellular capacity limitations, with their network requirements and contribution to strategic objectives. ...................................................................... 10 Table 3: Summary of MNOs’ Wi‐Fi offload challenges, the available solutions, and the potential contribution of XCellAir .................................................................... 15 Table 4: Financial results: Capacity constrained LTE operator ............................................ 17 Table 5: Financial results: Constrained MNO – lower offload without XCellAir .................. 18 Table 6: Financial results: Constrained MNO – variation in market share .......................... 18 Table 7: Financial results: Constrained MNO – Bespoke Wi‐Fi integration costs vary compared to base case ........................................................................................... 19 Table 8: Scenario differences: Capacity constrained MNO ................................................. 19 Figures

Figure 1: Sources of additional wireless data capacity for MNOs in 2015 and 2019. ............. 7 Figure 2: Primary, and top three, reasons for consumer churn. Source: Rethink Technology Research survey for InterDigital, March 2015. ..................................... 9 Figure 3: Deployment of new Wi‐Fi hotspots by MNOs (directly or via partner deals and roaming) between 2013 and 2019, by region. (Source Rethink Technology Research survey of 76 MNO groups, January 2015). ............................................. 11 Figure 4: MNOs’ current and planned use of Wi‐Fi to enhance data capacity. Source: Rethink survey of 45 MNOs April 2015. ................................................................. 12 Figure 5: Capacity constrained LTE operator result for 25% mobile market share in New York City ......................................................................................................... 16 Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 1. General introduction

This report takes an independent look at the business case for using XCellAir services that offer cloud based management and integration of small cell / Wi‐Fi resources for high quality mobile services. We complete four case studies which we think have the greatest potential for XCellAir solutions. These cover scenarios where XCellAir services can fulfil a substantive business need for MSOs and/or MNOs (generating substantial benefits) and where the addressable market for XCellAir solutions, in terms of the number of operators that may have these business needs, is likely to be significant. The four case studies are:

Case study 1 ‐ Cable operator offering mobile services via a Wi‐Fi first strategy Case Study 2 – Capacity constrained LTE network Case Study 3 – Using metrocells or Wi‐Fi for coverage and capacity in‐fill for an LTE network without spectrum constraints Case Study 4 – Network as a service with LTE‐U and Wi‐Fi This paper presents Case Study 2 – Capacity constrained LTE network. We estimate the Financial Benefit Case in each case study by modelling two scenarios:

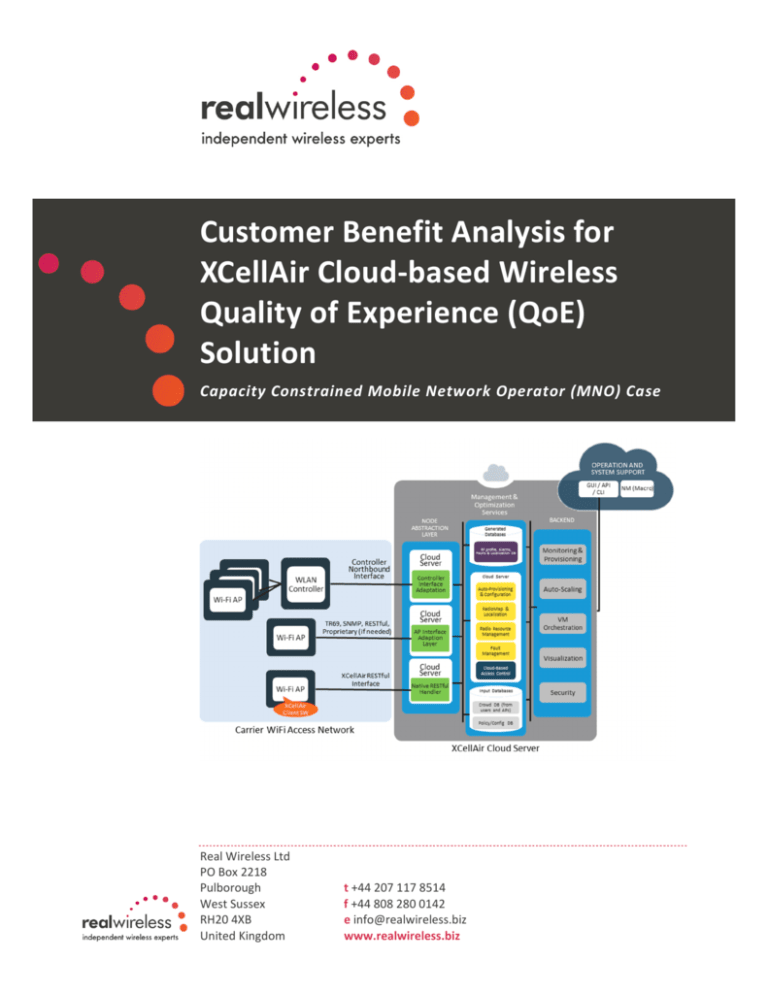

the counterfactual, i.e. the business as usual scenario assuming that XCellAir solutions are not deployed the “factual” scenario describing the changes in network capabilities, architectures, services, costs and revenues that could come about if XCellAir services were used. There are some challenges in common across all the case studies. The operators all need to address the combination of rising data usage and stagnating ARPUs – only a lower cost base and more efficient network will enable them to retain profitability in their conventional mobile broadband services. In addition, they need to expand into new applications, especially in the Internet of Things, which may consume less data and have the potential to deliver higher margins. However, they bring additional challenges such as massive scalability and high levels of security and reliability. In summary, all wireless service providers need to maximise capacity while lowering cost, while improving QoE. This often involves tapping into cheaper sources of capacity such as Wi‐Fi or, in future, LTE‐Unlicensed; and using third party networks as well as the carrier’s own. XCellAir’s solution addresses these overall requirements by helping MSOs and MNOs to manage and optimise Wi‐Fi and cellular as though they were a single network, while supporting other capabilities such as SON (self‐optimising networks) and big data analytics. As a cloud‐based service, it can augment the existing functionality of a WLAN controller, WAG, ACS and EMS system, or replace a vendor specific controller, EMS or ACS. The cloud‐based wireless access layer is agnostic to technology or vendor, and allows customers to deploy, manage and optimise dense networks from a single view. Capabilities Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 1

within the cloud‐based system include QoE solutions encompassing auto provisioning, radio optimization and auto‐healing.

Fully automated and scalable provisioning. Management, monitoring, automated fault recovery and visualization of dense Wi‐Fi networks, and for HetNets including access points in different bands (licensed and unlicensed) and from different vendors. Flexible data capacity management which allocates resources where they are needed, including wholesale capacity. End‐to‐end solution including management, RRM / SON and analytics to optimise network performance and mitigate interference Context‐aware wireless analytics so that operators can understand and improve their networks and service delivery, and enhance monetization. There are also specific challenges and requirements in each of the four case studies, which may be addressed by the XCellAir capabilities outlined above. a) The MSO with a Wi-Fi first strategy.

Fixed‐line service providers such as cable operators are increasingly adding wireless elements to their triple play offerings, initially to allow customers to access services while on the move, but evolving towards a full quad play. Many are adopting a Wi‐Fi first approach, creating wireless coverage and capacity with dense deployments of hotspots and homespots that are integrated with their own OSS/BSS and analytics systems. Subscribers only move onto the cellular network when no good Wi‐Fi connection is in range. This lowers costs (fewer MVNO fees to the MNO partner), and gives the MSO full control of how the customer is monetised and the QoE they receive. The key challenge, then, is to ensure the user stays on Wi‐Fi as much as possible, which requires intelligent connection management across a large number of owned and third party access points (and with seamless transfer to cellular when required) , as well as cellular‐class optimisation and QoE tools for Wi‐Fi. b) The capacity constrained MNO.

Most MNOs use some degree of Wi‐Fi offload, moving certain users or traffic types to Wi‐Fi to reduce cost of data delivery and ease the strain on the cellular network. This has been something of a blunt instrument, but now some MNOs are looking for more sophisticated ways to balance their traffic for an optimal cost/QoE outcome. They may also be able to extend their service area and target price sensitive users more profitably, with options like Wi‐Fi Calling. All this requires a single view of cellular, Wi‐Fi and, in future, LTE‐Unlicensed connections and access points (including third party), and of the activity and status of all users. It is also essential to be able to deliver a consistent QoE across all the connections and to monetise the subscriber, as well as collect data for analytics, wherever they move. c) LTE-centric operator using metrocells for in-fill.

This scenario concerns MNOs which are deploying LTE and plan to use LTE small cells to fill coverage gaps and to augment capacity in specific areas of high usage such as venues or business parks. These operators have sufficient 4G spectrum to rely almost entirely on cellular base stations rather than Wi‐Fi offload. They are likely to be companies whose business model centers on migrating customers rapidly from 2G/3G to LTE, which means it is important to have full coverage and a consistent quality of experience. This will be particularly true if the operator plans to switch off legacy networks in a short timeframe, or is a pure‐play LTE provider. In all these cases, the aim will be to keep users on the LTE network as often as possible, to harness its efficiencies, and minimize the need to hand off Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 2

to the operator’s own legacy networks or those of a partner (or to Wi‐Fi). That will make VoLTE an important element of this scenario, and potentially LTE‐Unlicensed in future. The key requirements here are systems which enable the MNO to scale up flexibly and rapidly, potentially to manage and optimise many thousands of small cells. It will be important to be able to target these cells exactly where they are needed, to maximise cost efficiency, and to add or move access points dynamically as usage patterns change. Capabilities such as SON will be critical for cost efficiency and QoE in the dense LTE‐only network. d) Network as a service (NWaaS) platform. This is a slightly more futuristic scenario, but one which is seen emerging in some markets from 2016 and which plays heavily to XCellAir’s strengths. In this case study, a wholesale‐

only operator supports numerous service providers via a hosted, cloud‐based system. A pool of wholesale capacity (LTE, Wi‐Fi and LTE‐U) is virtualised and can allocate and charge for capacity on an on‐demand basis, across licensed and unlicensed spectrum. The NWaaS operator may be an MNO or a dedicated wholesale provider (partnering with MNO(s) for spectrum). The customers will not have to sign rigid, long‐term MVNO contracts, but instead will use the wireless capacity as they require it, paying for the time and amount they use on a marketplace basis. The platform to manage this will need to support massive scalability, virtualisation (including dedicated capacity for certain providers), big data analytics and large‐scale dynamic connection management in order to enable SLA‐class QoE and cost effectiveness. Table 1: Summary of the challenges in the four case study scenarios, the available

solutions, and the potential contribution of XCellAir

Scenario

Challenge

What is required

Limitations of

current

approach

XCellAir

addresses?

MSO with Wi‐Fi first strategy Keeping customers on Wi‐Fi whenever possible. Carrier‐class Wi‐

Fi network planning. Few cellular tools extend to Wi‐Fi. SON and intelligent load balancing. Limited visibility of third party APs. Cloud‐based management of all hotspots including third party. Automated provisioning. Limitations to seamless hand‐

off standards. Supporting strong QoE in unlicensed spectrum. Cellular integration where required. Scalability at low TCO. Always best connected‐ seamless hand‐

off and authentication. Pay‐as‐you‐grow fees. Cloud‐based SON, RRM and other tools, unified across multivendor kit and across cellular and Wi‐

Fi. Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 3

Scenario

Challenge

What is required

Limitations of

current

approach

XCellAir

addresses?

Capacity constrained MNO Securing Wi‐Fi locations. Carrier‐class network planning for Wi‐

Fi. Few cellular tools extend to Wi‐Fi, Wi‐Fi tools immature. Cloud‐based management of all hotspots including third party. Scaling up offload capacity with low TCO. Common QoS across Wi‐Fi and cellular SON and other Limited visibility automated tools. of third party hotspots. Always best connected Limitations to access seamless hand‐

management off standards. Seamless Intelligent load hand‐off and authentication balancing. LTE MNO using small cells for infill Minimise capex and opex. Scalability at low TCO. Common QoS on all connections including LTE‐

U Flexible resource allocation and well targeted capacity to minimise numbers of cells SON and intelligent load balancing. Always best connected access. Interference management. Most tools still designed for macrocells, small cell tools immature. Small cell SON unproven beyond basic functions. Pay‐as‐you‐grow fees. SON and optimisation of cellular and Wi‐

Fi, in future dynamic provisioning Cloud‐based single view of entire network. Ability to target resources where required at any one time. Cloud‐based SON and RRM. Pay‐as‐you‐grow fees. Connection management. Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 4

Scenario

Challenge

What is required

Limitations of

current

approach

XCellAir

addresses?

NWaaS provider Massive scale with low TCO and opex. Full automation (SON). All the key enablers, including virtualisation and SON, are immature and seen as high risk when deployed inhouse. Cloud‐based SON services. On‐demand provisioning. Maximise spectrum efficiency. Virtualisation including dedicated capacity. Manage many service providers with different traffic patterns. Harness spectrum from multiple MNOs plus unlicensed including LTE‐U. Support big data analytics for customers and network. Ensure SLA‐class QoS and different QoS levels. Many SON and RRM tools tied to one vendor. Fully virtualised platform with self‐contained VMs. Pay‐as‐you‐grow fees. Smart traffic allocation to reduce overall cost of delivery. Unified multivendor RRM and SON across many spectrum bands, integrated with management tools. Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 5

2. Capacity constrained LTE network

2.1

Operator type and examples

This scenario focuses on mobile network operators (MNOs) which are deploying LTE (probably alongside 2G/3G), but are facing current or near term constraints on spectrum and network capacity. They are therefore looking to offload a predictable percentage of traffic to Wi‐Fi (their own WLANs or those of a partner) to reduce strain on their 4G systems, and to balance traffic intelligently between the two types of network to achieve the cost to quality ratio. Their 4G constraints are likely to arise from a combination of factors:

Limited 4G spectrum availability, because of o

o

o

regulatory policy (e.g. small allocations in some Latin American countries1) delayed auctions, (e.g. India) operator failed to win LTE spectrum, or only small amounts, in a competitive market High burden on 4G network, because of o

o

o

particularly high usage of mobile broadband (e.g. South Korea) operator needing to migrate quickly from legacy network (WiMAX, CDMA, iDEN), putting extra strain on the LTE network operating offering network‐intensive propositions (e.g. all‐you‐can‐eat data plans) for competitive reasons These factors may apply to MNOs in any geography where there is significant mobile data usage, especially where combined with limited licensed spectrum availability. The emphasis is on urban and suburban areas. They may apply to a wide range of MNOs, but particularly to tier two and three players, which may have limited financial resources to invest in more spectrum and 4G network capacity. Wi‐Fi offload may come into play in any situation where there is heavy data usage, from residential to enterprise to public access. Examples of MNOs making heavy use of Wi‐Fi offload demonstrate the wide range of relevant players. For example:

KDDI of Japan has an advanced LTE roll‐out but also makes significant use of Wi‐Fi to deliver sufficient coverage and capacity to satisfy its demanding user base. It recently said that it was currently offloading 57% of macro network traffic to Wi‐

Fi, which had reduced its LTE capex bill by a similar percentage. It is targeting 65% during this fiscal year.2 Safaricom in Kenya is deploying Wi‐Fi in its network for the first time, alongside 3G expansion, in order to support rising data usage in urban and enterprise scenarios, before it is able to access LTE spectrum. The Competitive Carriers’ Association, which represents tier two and three US MNOs, has a Wi‐Fi offload program for its members, which includes partnerships Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 6

with hotspot aggregator Boingo Wireless and curated free Wi‐Fi service Devicescape. The CCA believes smaller US carriers will offload about 22% of their cellular data to Wi‐Fi by 2016. 2.2

Strategic objectives

In the context outlined above, there are clear strategic objectives for an MNO to incorporate Wi‐Fi into its overall network capacity alongside LTE, whether this is achieved via simple data offload or by integrating the two technologies more tightly in a heterogeneous network (HetNet).

To increase overall capacity, especially where the level of mobile data usage is anticipated to outrun the operator’s LTE and 3G capabilities, because of limitations on its spectrum, sites, coverage areas, financial resources etc. In a survey of 67 MNOs conducted in January 2015, operators expected, on average, to obtain 23% of their additional wireless data capacity from Wi‐Fi offload in 2015. In 2019, that figure would be reduced, as a percentage, to 17%, but Wi‐Fi would be part of a more integrated HetNet strategy, which would also include cellular small cells, and would account for almost one‐quarter of additional capacity (see Figure 1). % of new wireless data capacity

30

25

28

20

15

25

24

23

21

17

14

13

10

11

9

5

11

4

0

New spectrum

WiFi offload

HetNet (small

cells and WiFi)

2015

LTE upgrades

Intelligent traffic

management

SON

2019

Figure 1: Sources of additional wireless data capacity for MNOs in 2015 and 2019.

MNOs were asked to rate their most important sources of new capacity. They were then asked to assess the contribution of those which emerged as the top six factors. Source: Rethink Technology Research, survey of 67 MNOs, January 2015.

Specifically to improve QoS of the LTE network by reducing congestion and, in some cases, reserving it for higher value services or customers. To reduce the cost of capacity. Even for operators which are not severely constrained in terms of spectrum, sites etc. there is a difficult balance to draw between meeting rising customer demand for mobile data, and the ROI on that Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 7

capacity investment. Especially in segments where ARPUs are stagnant or falling, such as consumer internet access, cost containment is vital. Wi‐Fi reduces the overall cost per Mbps and per gigabyte. If built out by the MNO, it has no spectrum cost and equipment prices are kept low by the broad competitive ecosystem. If secured from a partner, Wi‐Fi leasing and roaming deals generally carry lower fees than similar arrangements on cellular networks, such as MVNOs. In the KDDI example cited above, the Japanese operator says its capex bill for LTE falls roughly in line with the percentage of data it offloads to Wi‐Fi. In countries where many MNOs are regional, Wi‐Fi can be a way to expand coverage into other areas, or support roaming for existing customers, without relying too heavily on expensive agreements with other cellular operators. In countries like the USA and Russia, many smaller MNOs are regional, while in India, none of the major MNOs, as yet, has nationwide 3G or 4G spectrum. The same considerations apply to operators which want to support their customers when abroad, as Wi‐Fi can significantly reduce the user’s and the carrier’s roaming costs. If an MNO can achieve the double objective of greater capacity at lower cost, it has far greater flexibility in terms of its service pricing. A key strategic objective for most MNOs is to be able to respond quickly to the demand for low cost or unlimited data plans, without sacrificing margins to an unacceptable level. The USA and France are two countries where ‘challenger’ MNOs have harnessed more cost‐efficient networks to engage in price wars with the incumbents (e.g. T‐

Mobile USA and Iliad’s Free Mobile in France are both aggressive users of Wi‐Fi). It is important for MNOs to be able to target price‐sensitive customers who will be attracted to MVNOs or to Wi‐Fi‐first and Wi‐Fi‐only services run by new wireless entrants such as MSOs. A persistent strategic objective for any MNO is to reduce churn, since it costs more to recruit a new customer than to service an existing one. The key factors which influence a customer to churn are price, followed by quality of experience (predictable data rates and unbroken calls, especially for voice and video – see Figure 2). Both of these may be improved by adding Wi‐Fi to the network to improve capacity and coverage at affordable cost. In a survey of almost 60 service providers, 19% said that poor network QoE was the number one driver of churn, while 56% placed it in the top three. Cost, coverage gaps and lack of free Wi‐Fi were also factors which can be addressed by an offload strategy.

Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 8

70

% of respondents

60

50

40

30

20

19

19

16

16

14

12

5

10

0

Cost

Poor

network

QoE

Device

choice

Coverage Lack of

Lack of

gaps

free WiFi particular

service

Primary

Other

Top 3

Figure 2: Primary, and top three, reasons for consumer churn. Source: Rethink Technology

Research survey for InterDigital, March 2015.

The home and office are areas where QoE is particularly important as users’ expectations are often higher than when they are outdoors. Wi‐Fi offload is important in these areas of high data usage, and a managed Wi‐Fi experience can enable the MNO to monetise the customer even when they are not on the cellular connection. 2.3

Key network requirements

There are three broad approaches to Wi‐Fi offload, each with its own network requirements. Each entails a different level of cost and commitment, and has a different level of impact on the business case, as summarised in Table 2. Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 9

Table 2: The three broad levels of MNO deployment of Wi-Fi offload, as a way to ease

cellular capacity limitations, with their network requirements and contribution to

strategic objectives. Approach to Wi‐Fi Description Network requirements Address strategic objectives? Simple offload Network‐controlled or user‐selected move from cellular to any available and accessible hotspot or homespot No infrastructure, all Wi‐Fi is third party. Software to detect access point and alert the user or transfer them Reduces cost of data delivery and may improve customer satisfaction, but no QoE control and no ability to track and monetise user. Managed, intelligent offload Always best connected policies applied by network, seamless transfer and authentication, user tracked throughout Investment in Wi‐Fi network or access deals with WLAN operators, to control quality; seamless hand‐

off/authentication; policy‐driven intelligent connection manager; offload control from EPC As well as cost and coverage, operator can define and control QoS levels, keep track of users wherever they are, and monetise their Wi‐Fi usage (eg with targeted advertising) Full integration Wi‐Fi connection and AP managed from mobile core and OSS/BSS in same way as a cellular small cell In addition to the above, enhanced OSS/BSS, SON and PCRF tools which handle Wi‐Fi as well as cellular connections and subscribers In addition to the above, operator has enhanced ability to deliver services which span Wi‐Fi and cellular and to monetise the customers wherever they are 2.4

Existing capabilities

Mobile operators’ current approach to Wi‐Fi depends on their business case and the urgency of their wireless data requirements. A large number use Wi‐Fi offload, at least at the most basic, opportunistic level. About 63% of MNOs worldwide are currently using Wi‐

Fi offload in at least some situations (see Figure 4). Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 10

As outlined above, at the most basic level, this requires limited capabilities beyond software to detect and authenticate an open hotspot and make the connection based on simple rules. For instance, an operator may decide always to default to Wi‐Fi, in an MNO Wi‐Fi‐first approach (e.g. some tariffs offered by T‐Mobile USA under its Uncarrier initiative). Or it may offload packets of a certain size or type. To move towards the more sophisticated business models for MNO Wi‐Fi, far greater control over the network and over the user will be required to ensure QoS and monetisation. The key capabilities to support this are:

Access to, and control over, Wi-Fi hotspots (owned or third party). Existing capabilities vary enormously, between MNOs with access to many thousands of hotspots (e.g. AT&T, China Mobile) to those with only a few. Deployment, direct or indirect, is increasing and will peak in 2015‐2017 – after that many MNOs will either have their Wi‐Fi capacity built out, or will be moving towards more converged Wi‐Fi/cellular architectures and towards ‘5G’ (see Figure 3). 1,600

1,400

No of hotspots

1,200

1,000

800

600

400

200

0

2013

Africa

APAC

2014

CALA

2015

CIS

Europe

2016

2017

Middle East/Turkey

2018

2019

North America

Figure 3: Deployment of new Wi-Fi hotspots by MNOs (directly or via partner deals and

roaming) between 2013 and 2019, by region. (Source Rethink Technology Research survey

of 76 MNO groups, January 2015).

Intelligent access software to support: seamless hand‐off; log‐in and authentication as users move between cellular and Wi‐Fi; LTE‐U in future (LTE running in 5 GHz licence‐exempt spectrum); and to support ‘always best connected’ approaches driven by policy engines or customer preferences. Emerging standards like Passpoint, Next Generation Hotspot and ANDSF are designed to address some of these issues including seamless access, unified authentication and, increasingly, automatic selection of the best available connection, according to criteria set by the operator. However, these are in the early stages of deployment and have yet to achieve all the capabilities which operators may gain from specialised client software or network‐side proprietary approaches. Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 11

Carrier-class Wi-Fi. Operators are starting to move from best effort to carrier‐

grade infrastructure, in order to support higher value services and a user experience comparable to that of cellular. Key enablers are the 802.11ac gigabit Wi‐Fi standard, seamless authentication, and the ability to be managed from an MNO’s core network. This enables offload to become a strategy for additional revenue, since the same services can be delivered wherever the user goes, not just for reduced cost. The aim is to support a comparable user experience on Wi‐

Fi that customers receive on cellular, but at lower cost to the operator. Full integration of Wi-Fi hotspots, owned or third party, into the MNO network, potentially at multiple levels including RAN (e.g. Wi‐Fi SON), evolved packet core (especially PCRF), IMS (especially for Wi‐Fi Calling and Wi‐Fi Multicast), and BSS (customer experience management). Large vendors are enhancing the Wi‐Fi offload and integration support within their OSS/BSS and packet core platforms, but adoption remains at an early stage and these often represent major upgrades and investments for the carriers. The roll‐out of LTE, especially VoLTE, is driving IMS adoption, which can ease Wi‐Fi integration since it is also an IP technology.

This fully integrated HetNet is in its infancy and for the next few years, with a few exceptions, MNOs will be focused on the first two categories. 2.5

Further customer business needs

% of MNOs

Despite the developments outlined above, there are still many capabilities which are missing, or inadequately supported by current technologies. A large number of MNOs aim to move from simple offload to a HetNet strategy, as Figure 4 indicates – in a survey of about 45 MNOs, it was found that almost two‐thirds were engaged in some form of Wi‐Fi offload, but 60% of those had not moved beyond simple offload, as described in Table 1. By 2019, over 80% will be using Wi‐Fi as a strategic capacity tool, and 39% aim to support Wi‐Fi in a full HetNet environment. 45

40

35

30

25

20

15

10

5

0

39

37

22

16

11

6

Simple

offload,

limited

9

7

Simple

offload, over

35% of data

Support

seamless

offload

2014

18

16

14

5

Support Support WiFi

always best in HetNet

connected

No WiFi

offload

2019

Figure 4: MNOs’ current and planned use of Wi-Fi to enhance data capacity. Source:

Rethink survey of 45 MNOs April 2015.

Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 12

To achieve these goals, mobile operators will need additional tools and capabilities. Challenges include:

Difficulty of securing optimal Wi‐Fi locations, either directly or via third parties, and likely rise in costs of accessing third party Wi‐Fi networks as large operators, such as MSOs, recognise their strategic value. Challenges in balancing traffic and data loads between licensed and unlicensed spectrum. Challenges in delivering equivalent QoE on Wi‐Fi as on cellular, in order to increase customer satisfaction and usage of services. Despite significant improvements in the Wi‐Fi platform itself, it will still be necessary to invest in tools or services to ensure security and QoE, and to monetise the users whichever connection they are on. In a survey conducted by RealWireless for Amdocs in August 2014, 48% of MNOs said achieving cellular‐class QoE was a top three challenge in deploying Wi‐Fi.3 Impact on Wi‐Fi QoS of increased congestion, especially in the 2.4 GHz band. Operators have a difficult balance to draw, between coverage (access to maximum number of hotspots) and quality (keeping users off sub‐optimal connections). This will require more intelligent utilization of unlicensed bands including adaptive channel allocation and radio optimization. Increasingly unpredictable usage patterns. New applications are constantly emerging which use the network in new ways (e.g. the signalling load of social updates, the emergence of the internet of things). As services and usage diversify, the metrics that define Quality of Experience (QoE) will continue to shift and static radio resource management based solely on traditional radio signali measurements will not be sufficient. Additionally, the decision of which is the best technology (e.g. Wi‐Fi or cellular) will become increasingly complex and unpredictable, requiring real time and dynamic response – of a kind not supported by current tools. Ability to monetise the user when on Wi‐Fi. This can be done at a basic level once seamless hand‐off (e.g. Passpoint) is implemented, but the challenge will be to deliver high value, revenue generating services even when the user has been ‘offloaded’. Ability to scale up. MNOs are already moving towards far smaller cells and a wide array of elements in their networks, and Wi‐Fi offload and integration – including in homes and enterprises – add to the challenge of managing huge numbers of access points and connections. In addition, these are likely to come from multiple vendors – a key driver for HetNet adoption is the ability to mix and match equipment from many suppliers. Full integration with cellular platforms. Wi‐Fi/IEEE and cellular/3GPP standards have been conceived with very different architectures and the industry is only in the early stages of managing both types of connection in a harmonised way from the RAN and core, with a unified view of all connections.

2.6

The contribution of the XCellAir solution

The previous sections show that MNOs are well down the road of basic offload, usually of heavy‐duty traffic like over‐the‐top video, to nearby Wi‐Fi access points. However, although 69% of MNOs aim to move beyond that by 2019 and support ‘always best connected’ or full Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 13

HetNet integration, the tools to enable that are scarce and immature. That reduces the business impact and ROI of Wi‐Fi for MNOs because they cannot treat the two types of connection as a seamless network, ensuring a comparable QoE across both. XCellAir’s solution addresses many of the challenges of managing and optimising Wi‐Fi and cellular as though they were a single network, and therefore improving capacity, QoE and cost of delivery. The cloud‐based wireless access layer is agnostic to technology or vendor, and allows customers to deploy, manage and optimise dense networks from a single view. Capabilities within the cloud‐based system include:

Management, monitoring and automated fault recovery services for a dense HetNet including access points in different bands (licensed and unlicensed) and from different vendors. SON and radio resource management to optimise network performance and mitigate interference. Flexible data capacity management which allocates resources where they are needed, including wholesale capacity. Context‐aware wireless analytics so that operators can understand and improve their networks and service delivery, and enhance monetization. To address the specific MNO challenges outlined above, the XCellAir solution would offer the following key changes compared to the counter‐factual scenario, and in each case there should be a direct impact on aspects of the business case.

Automated and scalable provisioning, management, SON and predictive optimisation are delivered from the cloud and can be applied to the cellular network and to public or private Wi‐Fi in the same way, allowing a single view of the whole network, and delivering a more unified customer experience. Cloud‐based access control can be linked to MNO’s policy and security engines to make intelligent decisions about the best connection for a user, based on their profile, preferences and the network environment. This improved QoE allows the MNO not just to offload data from the LTE network in order to free up capacity and reduce overall cost, but to do so without compromising user experience and satisfaction. The platform helps to monetise Wi‐Fi in the same way as cellular by applying analytics and contextual awareness across both network types, so that users can be monitored and accurately targeted with promotions and services. The cloud‐based system brings TCO into line with usage/revenues by adopting a pay as you scale model that is aligned with operations vs. traditional upfront capital expenditure. This allows an MNO to scale up in line with demand for Wi‐Fi offload, either coming from consumers or its own network priorities. Most MNOs will rely heavily on third party hotspots and Wi‐Fi wholesale deals and, in future, bandwidth‐on‐demand services, can be accommodated by XCellAir. More details of the specific solutions are included in Table 2 and quantified in the modeling (below). Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 14

Table 3: Summary of MNOs’ Wi-Fi offload challenges, the available solutions, and the

potential contribution of XCellAir

Challenge

What is required

Limitations of current

approach

XCellAir addresses?

Securing Wi‐Fi locations wherever required Many roaming and sharing deals, carrier‐

class network planning for Wi‐Fi Non‐standard bilateral deals, limited visibility of third party APs, few small cell planning tools extend to Wi‐Fi Cloud‐based management of all third party hotspots, access to wholesale capacity, optimisation of cellular and Wi‐Fi, in future dynamic provisioning Scaling up offload capacity while minimising TCO Automation (self‐

These tools are optimising network – immature, especially in SON) to manage Wi‐Fi large numbers of elements. On‐

demand provisioning. Load balancing across licensed and unlicensed spectrum Cloud‐based SON services. Pay‐as‐you‐

grow fees. Smart traffic allocation to reduce overall cost of delivery. Support for multivendor equipment Delivering common QoS and user experience across cellular and Wi‐Fi Seamless hand‐off and authentication, ‘always best connected’ access Standards for seamless access only support lowest common denominator Full ‘always best connected’ capabilities building on top of standards; optimisation across Wi‐Fi and cellular; unified RRM and SON including auto‐healing from network faults. Integration with OSS/BSS and IMS, single network view Immature solutions, many controlled by large OEMS; mobile core integration and IMS carry high costs for T2/T3 MNOs Cloud service supports network, service and QoS management without the need to invest in major in‐house systems Tools to track users on any connection, deliver the same UE and services as on cellular, deliver personalised services and promotions Some tools are available for cellular small cells and for Wi‐Fi, but most are single‐network, and need to be deployed in‐

house Analytics, context awareness etc. all apply across Wi‐Fi and cellular. Cloud model supports pay‐as‐you‐grow Cellular integration Monetising offloaded customers Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 15

The future:

We have seen how rapidly Wi‐Fi offload is evolving towards full cellular/Wi‐Fi HetNet platforms, and further developments will continue to affect MNO’s capacity requirements and their Wi‐Fi strategies. It is clear that the problems of constrained LTE capacity/spectrum will only get worse, in areas of high data usage, and so the reliance on Wi‐Fi is likely to increase all the way to ‘5G’, though from 2016 there may also be the option to incorporate LTE‐Unlicensed in to the mix too. An important way to maximise the usable capacity in LTE and Wi‐Fi networks in future will be increasingly dynamic allocation of bandwidth, across many spectrum bands and technologies, on demand, so that capacity is fully mapped to patterns of usage. That process will increasingly be managed from the cloud and from virtualised platforms, and in that respect XCellAir is already laying strong foundations for the future. 2.7

Results

The chart below shows the net benefits for the spectrum constrained LTE operator case study. It shows the cost savings from deploying XCellAir services to manage Wi‐Fi homespots and public hotspots compared to a more bespoke solution giving limited integration and management. It also presents our estimates of the potential increase in revenues from attracting price sensitive customers and providing carrier Wi‐Fi services net of traffic transport costs. Capacity constrained LTE MNO: Net Benefit

160

140

USD millions

120

100

80

60

40

20

0

2015

2016

Cost savings ‐ managed WiFi

2017

2018

2019

Net benefit ‐ price sensitive users

Additional revenue: carrier WiFi

Figure 5: Capacity constrained LTE operator result for 25% mobile market share in New

York City

Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 16

On the one hand, cost savings are higher than in the MSO case study because we assume that the MNO has a much larger market share, 25% compared to 5%. On the other hand, cost savings in the MSO case are increased because the MSO avoids relatively expensive wholes charges for its MVNO operation. The net present value of the benefits to using XCellAir compared to the counterfactual – cost savings and net profits from additional customers – is shown in the table below. It also reports the present value of the costs of using XCellAir in this scenario and the ratio of the benefits to the cost of using XCellAir. This last measure allows a clearer comparison of the relative benefits of using XCellAir across the case studies. The discount rate used is 10% as before. Table 4: Financial results: Capacity constrained LTE operator

USD millions NPV Total Benefits PV Cost savings PV New services PV XCellAir Costs Benefit:Cost ratio 374 71 303 21 17.5 Cost savings are relatively significant and largely arise from reductions in the total cost of core network transport due to the greater offload that XCellAir services facilitate. However there is clearly a substantial opportunity for MNOs to target additional users too. In this particular case study, XCellAir’s services allow the MNO to use Wi‐Fi offload to get around their capacity constraint, maintain QoE and bring down the incremental cost of capacity. This enables an MNO to target price sensitive users, who for example might otherwise be targeted by MVNOs or upstart new entrants. We estimate that this segment represents 15% of the market with an ARPU 75% that of standard cellular ARPU. The scale of the opportunity depends on what proportion of these consumers the MNO can capture and our forecasts assume that the MNO’s share of this segment rises from 5‐20% from 2015‐19. 2.8

Sensitivities

Offload in the counterfactual is 75% of the base scenario

In the base case we assume that the capacity constrained MNO can still offload a significant proportion of is traffic in the counterfactual where it can only partially integrate Wi‐Fi with the cellular network (rising from 12%‐30% over the model period) This is an important assumption, and we find that the financial benefits are quite sensitive to it. The table below shows the impact if offload in the counterfactual is 75% of that assumed in the base case. The present value of the cost savings increases by 22% in response. Hence if MNOs are slow or reluctant to deploy and integrate Wi‐Fi into their cellular networks, the potential cost savings from using XCellAir solutions are even greater. Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 17

Table 5: Financial results: Constrained MNO – lower offload without XCellAir

USD millions

NPV Total Benefits PV Cost savings PV New services PV XCellAir Costs Benefit:Cost ratio Base case 75% offload

counterfactual

Change

374 71 303 21 17.5 389 86 303 21 18.3 +4.2% +22.2% 0% 0% n/a Lower MNO market share

In the table below we show how the business case changes as the market share of the MNO varies. The results indicate two things. First, they show that the XCellAir solution benefits smaller players as well as larger players. The benefit:cost ratio for an MNO with a 5% market share, while lower than that of a larger MNO, is still large. Second they illustrate the scalability of the XCellAir solution. A 5‐fold increase in market share from 5% to 25% sees nearly a 10‐fold increase in cost savings. In fact scalability benefits may be more significant because we have taken a conservative view of (i.e. at the low end of the scale) the potential costs of Wi‐Fi integration solutions in the counterfactual. The net benefits from new services are also affected since we assume that MNO’s ability to capture additional price sensitive customers will be related to its market size. This leads to a proportionate change in revenue Table 6: Financial results: Constrained MNO – variation in market share

USD millions

NPV Total Benefits PV Cost savings PV New services PV XCellAir Costs Benefit:Cost ratio Base case:

25% share

Market

share 10%

% change

Market

share 5%

% change

374 71 303 21 17.5 154 15 139 9 16.8 ‐58.8% ‐79.1% ‐54.0% ‐56.8% n/a 81 7 74 5 15.7 ‐78.4% ‐89.8% ‐75.7% ‐75.8% n/a Bespoke Wi-Fi integration costs vary

There is a considerable uncertainty over the costs of Wi‐Fi integration solutions. Costs vary considerably now and it is difficult to forecast how they may change in the future as they become able to better integrate Wi‐Fi with cellular networks. Hence we model the impact of higher and lower values for this particular cost. If the cost is double, i.e. 200% that of the base case, the impact on the overall cost saving is significant, at nearly 12%, but limited. This is because other cost savings are also important, notably from the higher offload that XCellAir services allow. We note that the sensitivity of the total benefit is limited to this factor. This is because the opportunity to target additional services represents a large part of the total benefits in this Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 18

case study and because the costs of bespoke Wi‐Fi integration systems are only a fraction of the wider cost savings from using the XCellAir solution. Table 7: Financial results: Constrained MNO – Bespoke Wi-Fi integration costs vary

compared to base case

USD millions

NPV Total Benefits PV Cost savings PV New services PV XCellAir Costs Benefit:Cost ratio Base case

200% of

base case

% change

50% of

base case

% change

374 71 303 21 17.5 382 79 303 21 17.9 +2.2% +11.8% 0% 0% 370 67 303 21 17.4 ‐1.1% ‐5.9% 0% 0% 2.9

Model assumptions

This case study models an MNO with a 25% market share and is operating in New York City, i.e. the same metro area as in the MSO case study. The MNO operates an LTE network and suffers capacity constraints due to a shortage of spectrum. It could deploy macrocells to increase capacity, but the cost effectiveness of this would be limited. In the counterfactual, we assume that the MNO uses specialised software and tools to integrate Wi‐Fi connectivity with its LTE network and provide seamless connectivity. However, a much more significant and costly upgrade of OSS/BSS and packet core platforms would be needed to deliver full integration, hence we assume that the degree of offload is limited, as detailed in the table below. With XCellAir services, the MNO is able to fully integrate public and private Wi‐Fi APs with its cellular network, substantially increasing the amount of data it can offload. This significantly eases the capacity constraint. It also brings down the MNO’s cost of capacity and allows it to target price sensitive users it had not been able to target previously. Table 8: Scenario differences: Capacity constrained MNO

Counterfactual

Factual

Wi-Fi homespots: We assume that Wi‐Fi Same as counterfactual homespots with public SSIDs need to be seeded in user base – fast uptake from 40% to 90% in three years Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 19

Counterfactual

Public Wi-Fi hotspots: MNO concludes agreements with hotspot operators for access to hotspots. Increase from 25% to 90% over 5 years (in‐line with observed market developments). Factual

Same deployment of public hotspots as in counterfactual. We assume offload is significantly higher due to XCellAir services and reaches 46% in 2019, much closer to MNOs such as Japan’s KDDI which are leading the way in offload. The degree of offload is limited due to the challenging nature of managing interference/ No access controllers are needed with XCellAir quality control with existing tools. It does not rise above the 22% level which MNOs expect to services achieve in the short term. We assume, based on our information knowledge, that 1 access controller is needed for every 400 public hotspots.

Wi-Fi integration: Specialised OEM solution which provides partial integration and management with high fixed costs and ongoing engineering support costs

Full integration of Wi‐Fi and cellular networks is achieved with XCellAir services. Charges are based on scalable annual charges per access point Macrocell and backhaul costs – number of sites based on Nokia site density planning factors in urban and suburban areas

Same as counterfactual Core network transport costs: These costs cover the cost of traffic in the core network as opposed to the access network. We adjust the traffic volumes to take account of traffic offloaded onto Wi‐Fi

Core network transport costs are reduced relative to the counterfactual because more traffic is offloaded. Additional core network transport costs since MNO can target additional, price sensitive users because its cost of capacity is lower (see below) Additional revenues: price sensitive users. We assume that the proportion of price sensitive users is roughly equal to the proportion of MVNO customers at 15% and that their mobile ARPU is 75% of a typical mobile user. The operator is assumed to attract an increasing proportion of these users rising from 5% in 2015 to 20% in 2019. Additional revenues: Wi-Fi calling outside of the MNOs service area. We assume that initially 10% of customers rising to 25% would be willing to pay extra for this service. According to the CTIA, ARPU in the US was USD49 in 2013 4. We assume that users are willing to pay an extra 6% or USD3 per month for the Wi‐Fi calling service Constrained data demand: We assume that data demand is 10% lower than our standard estimates to reflect capacity constraints. Voice traffic is not affected as it is less likely to be affected by the constraint. As a result, both offload and demand are higher in the factual scenario. Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 20

References

References

1 GSMA, ‘Towards a sustainable approach for 4G deployment in Latin America’, May 2015, https://gsmaintelligence.com/research/2015/05/towards‐a‐sustainable‐approach‐for‐4g‐

deployment‐in‐latin‐america/505/ 2 Fumio Watanabe, chairman of KDDI R&D Laboratories, address to Broadband Asia, May 2015 3 Amdocs/RealWireless, ‘The leap to carrier‐grade Wi‐Fi and its monetization potential’, http://solutions.amdocs.com/rs/amdocs1/images/Carrier‐grade%20Wi‐

Fi%20Whitepaper.pdf?aliId=975479 4 Annual Wireless Industry Survey, CTIA, 2014 ‐ http://www.ctia.org/docs/default‐

source/Facts‐Stats/ctia_survey_ye_2013_graphics‐final.pdf?sfvrsn=2 Customer Benefit Analysis for XCellAir Cloud-based Wireless Quality of Experience (QoE)

Solution

Issue date: July 2015 Version: 5.0 21

Copyright ©2015 Real Wireless Limited. All rights reserved.

Real Wireless Ltd PO Box 2218 Pulborough West Sussex RH20 4XB United Kingdom t +44 207 117 8514 f +44 808 280 0142 e info@realwireless.biz www.realwireless.biz