HSC Economics 2010

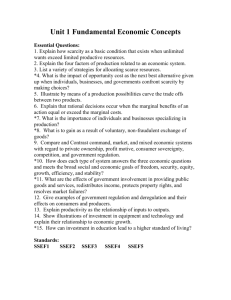

advertisement