SCRA- Death knoll on Put and Call options?

advertisement

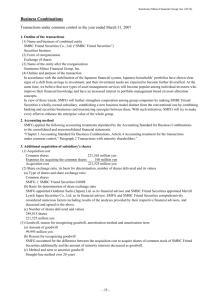

UNIVERSAL LEGAL Attorneys At Law Bangalore ▪ Chennai ▪ New Delhi ▪ Mumbai ▪ Chandigarh SCRA- Death knoll on Put and Call options? Edition: June, 2011 Authors: Bhavana Alexander Kavitha Vijay www.chugh.com Affiliated to The Chugh Firm, USA 1 The Securities and Exchange Board of India (“SEBI”) issued a recent directive in the matter of the proposed acquisition of Cairn India Limited by Twin Star Energy Holdings Limited and Vedanta Resources Plc with respect to the put and call option and right of refusal arrangements entered into by the acquirers and the selling shareholders of Cairn on the ground that the said arrangements were in violation of notification no. SO 184(E) dated March 1, 2000 issued by SEBI. It was also communicated that such arrangements not being a “spot delivery contract” under the Securities Contracts (Regulation) Act, 1956 (“SCRA”), are void. The controversy on the validity of options in securities has been in the air for over a decade now and the arguments continue to grow unabated and with vehemence. The debate has largely centered on the following areas of concern: •Options in securities, being a restriction on the transferability of shares, is in direct conflict with the nature of a public company as embodied in Sections 3 and 111A of the Companies Act, 1956 (“Companies Act”) •Options in securities, not being a „spot delivery contract‟, is in violation of the SCRA The author seeks to discuss the issues, both proponent and opponent, that relate to the validity of options under the Companies Act and under the SCRA. For the purposes of this article, the author has restrained her discussions to public companies as the law relating to private companies has been clear in that, options in securities do not contravene any law and are legally valid and enforceable. Do options amount to a restriction on the free transferability of shares under the Companies Act? In the prominent decision in the matter of V.B. Rangaraj(1), the apex court held the shares of a company were freely transferable unless otherwise stated in the articles of association of the company. The argument is rather straightforward in the case of private companies due to the very nature of private companies which make it necessary to have restrictions on transfer of shares. However the debate on public companies engaged much more discussion. Much of the debate was centred on Section 111A of the Companies Act which expressly stated that shares in a public company were freely transferable. The debate was very clearly elucidated in the case of Mafatlal Industries(2) which related to the exercise of pre-emptive rights between the shareholders of a public company. It was argued by the defendant(3) that it was settled law that vide sections 82 and 111A of the Companies Act, shares are freely transferable and that there cannot be any restriction on transferability of shares except any restriction in the articles of association. However, the opposite counsel argued that such an understanding of the concept of free transferability of shares was too restrictive. A restriction placed by a shareholder was argued to be within the bound of his right of free transferability. Some of the arguments were as follows: •Free transferability of shares refers to absence of restrictions which may be imposed by third parties, but it cannot exclude the right of a shareholder to impose restrictions on himself in the matter of transfer of shares to another person. •Such an application of the V.B. Rangaraj decision would cause a serious draw back in cases where the promoters of private or a public limited companies borrowing loans from banks and/or financial institutions have to pledge their shares with the lending institutions/banks within agreement not to transfer the shares without prior written consent of the lending institutions/banks. Practice areas Corporate , M&A, Real Estate, Employment, Intellectual Property, Family Law, Litigation, Taxation, Immigration, Technology Law, Transaction Law & Regulatory Compliances 2 •It also renders difficulties in cases where shareholders (as is often in the case of companies like Reliance Industries Ltd., or TISCO) settle their shares on trust for the benefit of certain minor beneficiaries with a stipulation that the shares shall not be sold before the beneficiaries attain the age of 21 years. Much of the concerns raised were pure commercial concerns voicing the layman‟s perspective. The court, however, concurred with the argument of the defendant and subsequently did not permit the right of preemption as the same was not incorporated in the articles of the company. The case of Western Maharashtra Development Corporation(4) emerged as a powerful contender of the argument that options or pre- emptive rights were a violation of section 111A of the Companies Act and were void. Subsequently, the Bombay High Court in a recent judgment in the case of Messer Holdings Limited(5), the High Court declined to accept the reasoning in Western Maharashtra Development Corporation and held that options and right of first refusal and offer were not in violation of section 111A of the Companies Act. For the purposes of deciding the ambit of Section 111A of the Companies Act, the court paused to visit the legislative history of the said section. Prior to introduction of Section 111A, Section 111 of the Companies Act provided for remedy of appeal to a transferor or transferee seeking relief in respect of a transfer/transmission of shares in public or private company. They could apply for rectification of register of members under Section 155 of the Companies Act. However, with the insertion of Section 22A into the SCRA on January 17, 1986, which section reads as laid out below, the provisions of Section 111 of the Companies Act needed to be re-examined: "Notwithstanding anything contained in its articles or in Section 82 or Section 111 of the Companies Act, 1956 (1 of 1956), but subject to the other provisions of this section, a company may refuse to register the transfer of any of its securities in the name of the transferee on any one or more of the following grounds and on no other ground, namely: (a) that the instrument of transfer is not proper or has not been duly stamped and executed or that the certificate relating to the security has not been delivered to the company or that any other requirement under the law relating to registration of such transfer has not been complied with: (b) that the transfer of the security is in contravention of any law: (c) that the transfer of the security is likely to result in such change in the composition of the Board of Directors as would be prejudicial to the interests of the company or to the public interest: (d) that the transfer of the security is prohibited by any order or any Court, Tribunal, or other authority under any law, for the time being in force". It was held that the said section 22A of the SCRA was inserted in order to provide for free transfer of shares and on the other hand, provided a leeway for free transfer by curbing the exercise of arbitrary powers by the board of directors by limiting the grounds for refusal of registration for transfer of shares. Section 22A of the SCRA was subsequently deleted by the introduction of the Depositories Act, 1996, simultaneous with the insertion of section 111A into the Companies Act which was very similar to the erstwhile section 22A of the SCRA. Section 111A of the Companies Act therefore shared a common legislative intent with the section 22A of the SCRA in that its goal was not to curb restriction on transfer of shares but to prevent the board of directors from arbitrarily refusing the registration of transfer of shares. To construe it as a restriction on the right of shareholders to deal with their shares or to enter into consensual arrangement/arrangement regarding their shares (by way of pledge, preemption, sale or otherwise), was held to lead to a misinterpretation of legislation. Practice areas Corporate , M&A, Real Estate, Employment, Intellectual Property, Family Law, Litigation, Taxation, Immigration, Technology Law, Transaction Law & Regulatory Compliances 3 This judgment has been one of the latest in the series of judgments on restriction on transferability of shares in a public company. Though the view of the judiciary is yet a hazy mixture of proponents and opponents, the reader can sufficiently come to a conclusion that there has emerged a very strong contention for the validity of put and call options between contracting parties as not infringing the right to transfer shares of such contracting parties. The argument hinges on the enforcement of a contract entered into by the free will of parties. However, such a right remains questionable in the light of the rights of the other shareholders in case of public companies- who were not a party to such a consensual arrangement? Further, in view of judgments which have decreed that such agreements are enforceable, it was limited only to the extent they are permitted in the articles of the company(6). Are options in securities a violation of the SCRA? Section 20 of the SCRA, as it originally stood, read as follows: Notwithstanding anything contained in this Act or any other law for the time being in force, all options in securities entered into after the commencement of this Act shall be illegal. Any option in securities which has been entered into before such commencement and which remains to be performed, whether wholly or in part, after such commencement, shall to that extent become void. In order to understand the full intent of Section 20 of the SCRA, we would first need to examine the meaning of the terms contained therein as defined under the SCRA. The term “options in securities” is defined in section 2(d) of the SCRA to mean: a contract for the purchase or sale of a right to buy or sell, or a right to buy and sell, securities in future, and includes a teji, a mandi, a teji mandi, a galli, a put, a call or a put and call in securities The term „securities‟ has been defined in section 2(h) of the SCRA to include: Shares, scrips, stocks, bonds, debentures, debenture stock, or other marketable securities of a like nature in or of any incorporated company or other body corporate; Although the term “marketable securities” has not been defined in the SCRA, it has been largely understood to mean, those securities which enjoy a high degree of liquidity and can be freely bought and sold in the open market(7). The ambit of the term “securities‟ has therefore been held to extend to securities issued by all public companies- listed and unlisted. The language of Section 20 of the SCRA is unambiguous in its language with respect to the validity of options in securities post the commencement of the SCRA. Section 20 of the SCRA prohibits all options in securities which would extend to right of first refusal, right of first offer, put option, call option and all other similar rights that are commonplace in investment transaction documents and declares such arrangements to be void. Practice areas Corporate , M&A, Real Estate, Employment, Intellectual Property, Family Law, Litigation, Taxation, Immigration, Technology Law, Transaction Law & Regulatory Compliances 4 Further, the Central Government, vide notification no. S.O. 2561 dated June 27, 1969 extended the restrictions on options in securities by prohibiting all contracts for sale of purchase of securities other than spot delivery contracts: In exercise of the powers conferred by sub-section (1) of section 16 of the Securities Contract (Regulation) Act 1956 (42 of 1956) the Central Government being of opinion that it is necessary to prevent undesirable speculation in securities in the whole of India, hereby declares that no person in the territory to which the said Act extends shall save with the permission of the Central Government enter into any contract for the sale or purchase of securities other than such spot delivery contract or contract for cash or hand delivery or special delivery in any securities as is permissible under the said act and the rules, bye laws and regulations of a recognized Stock Exchange. The term “spot delivery contract” as defined in Section 2(i) of the SCRA reads as follows: means a contract which provides for: (a) actual delivery of securities and the payment of a price therefore either on the same day as the date of the contract or on the next day, the actual period taken for the dispatch of the securities or the remittance of money therefore through the post being excluded from the computation of the period aforesaid if the parties to the contract do not reside in the same town or locality; (b) transfer of the securities by the depository from the account of a beneficial owner when such securities are dealt with by a depository; Therefore, any contract with an option to buy or sell “securities”, being a contract that provided for a sale and purchase in future, could be struck off or rendered nugatory. In 1995, vide Securities Laws (Amendment) Act, 1995, the said Section 20 of the SCRA was deleted and in 2000, the 1969 Central Government notification was also rescinded. However, at the same time, SEBI, vide notification No SO 184(E) dated 1st March 2000 brought a similar notification into force as laid out below. No person shall, save with the permission of SEBI, enter into any contract for the sale or purchase of securities other than such spot delivery contract or contract for cash or hand delivery or special delivery or contract in derivatives as is permissible under the said Act. On a combined reading of section 2(d) of the SCRA by virtue of which put, call and other options in securities fall clearly outside the scope of spot delivery contracts and the said SEBI Notification as laid down above, it appears that status quo remains in as much as any contract of sale or purchase of securities which is meant to occur in the future, has no effect unless specifically approved by the SEBI. This was affirmed in the matter of Niskalp Investments and Trading Co. Ltd.vs. Hinduja TMT Ltd(8) wherein the court held that options on securities are void as they are in violation of the SCRA. From a reading of Section 111A (3) of the Companies Act, it is evident that the Company may refuse to register a transfer of shares if it is contrary to the provisions of “any other law for the time being in force”- thereby including the SCRA. Practice areas Corporate , M&A, Real Estate, Employment, Intellectual Property, Family Law, Litigation, Taxation, Immigration, Technology Law, Transaction Law & Regulatory Compliances 5 Conclusion: It is evident therefore that the argument of restriction on transferability in relation to put and call options and ROFRs is beginning to wear away and will, in little time, be rendered redundant. However, the concerns voiced by SEBI on the issue of Cairn continue to subsist and the prohibition by the SCRA on all contracts other than spot contracts, pose a constant nagging concern for all investment managers. The repercussions of the interpretation of the notification in Cairn are far ranging and prone to strike down almost every commercial practice prevalent in the market. It is also crucial to determine if a contract that stipulates a put and a call would fall within the definition of a “contract for sale and purchase”, as referred to in the 2000 notification. This is owing to the simple reason that an agreement that merely captures an option of sale and purchase could be construed to fall into the category of an “agreement to enter into an agreement”. It being well settled law that an agreement to enter into an agreement is not an enforceable agreement, such an agreement would, in such interpretation, not fall within the definitive term of a contract of sale and purchase of securities. This reasoning was followed in the case of Jethalal Thakkar wherein the court made a distinction between a contract where there is a present obligation and the performance is postponed to a later date, and a contract where there is no present obligation at all and the obligation arises by reason of some condition being complied with or some contingency occurring. The court held that a contract which was contingent in its nature, was no contract at all at the time the contract was made. Put and call options being contingent by their very nature (as in, being one of the options the promoter or the investor would want to follow), the execution of a contract which gives the right to exercise such an option does not thereby become a contract for the sale and purchase of shares. Yet the court did not extend the logic of a contingent contract in its subsequent decision in the matter of Niskalp Investments. In the said case where the investor either had the right to sell his shares at a pre- determined price or opt for an initial public offering in order to exit, the court held that the contract was a contract for future performance and therefore, not being a spot delivery contract ,was invalid under law. It is pertinent to note the maturity of the regulations in most developed countries (such as the USA and UK) which permits the accommodation of options in the securities market. Share purchase agreements that are commercial contracts and not speculative in nature must be allowed to have put and call options and the lawmakers should take necessary steps to amend its stand in the Indian scenario. References: 1. 2. 3. 4. 5. 6. 7. 8. V.B. Rangaraj versus V.B. Gopalkrishnan and others: AIR1992SC453 Mafatlal Industries Ltd versus Gujarat Gas Co. Ltd and Ors: [1999]97CompCas301(Guj) Relied on Gujarat Bottling Co. Ltd v Coca Cola Co. AIR1995SC2372 Western Maharashtra Development Corpn. Ltd. versus. Bajaj Auto Limited: [2010]154CompCas593(Bom) Messer Holdings Limited versus Shyam Madanmohan Ruia and Ors. [2010]159CompCas29(Bom) V.B. Rangaraj (Ibid 1) and Messer Holding (Ibid 11) Dahiben Umedbhai Patel and others vs. Norman James Hamilton and others; Northern Projects Ltd. Vs. Blue Coast Hotels and Resorts Ltd: [2008]88SCL74(Bom) [2007]79SCL368(Bom) Locations: #9/5 II Street Padmanabha Nagar Adyar Chennai 600020 #302, Regency Enclave, 4, Magrath Road, Bangalore 560025 #312, Turf Estate, Shakti Mill Lane, Mahalaxmi, Mumbai 400 011 #A-2, East of Kailash, New Delhi 110065 #SCO 170-172, IV Floor, Sector 17-C, Chandigarh 160 017 Ph: +91 44 42187856 Ph: +91 80 4123 3140 Ph: +91 22 400 46647 Ph: +91 11 4658 1691 Ph: +91 0172 3042032 6