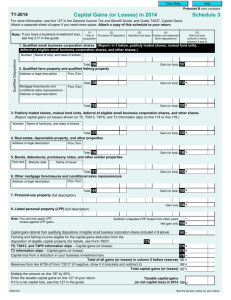

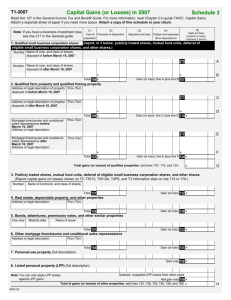

Personal investors guide to capital gains tax 2013

advertisement