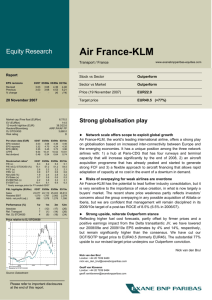

PDF, 8.12 MB - Air France KLM

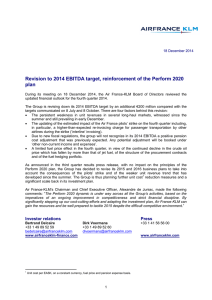

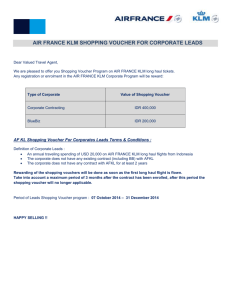

advertisement