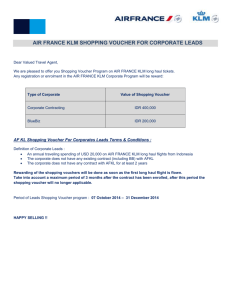

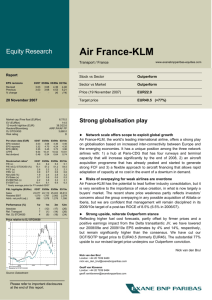

PDF, 8.12 MB - Air France KLM

advertisement