40-100-4 PAYROLL AND RELATED LIABILITIES

40-100-4

PAYROLL AND RELATED LIABILITIES (PROCEDURE)

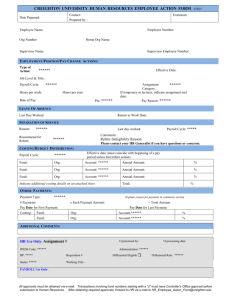

Personnel, employment, and rate authorizations: a. Requests for new personnel shall be originated only by department heads or other responsible employees. b. Personnel shall require an investigation of and employment application from new employees. (Investigation shall include checking employee's background, former employers, and references). c. The personnel director shall periodically review classes of positions and pay rates for compliance with the provisions of the personnel practices or other documents designating rate of pay of employees. d. All employees shall be notified in writing of the organization's personnel policies and performance reviews. e. Personnel files shall be maintained. They shall contain information on employment application and new employee investigation, date employed, pay rates, changes in pay rates and position, authorizations for payroll deductions, earning records, W-4 forms, immigration documentation, specimen signatures, and termination data where appropriate. f. Written termination notices shall be required that properly document reasons for termination and require approval of an appropriate person. g. Physical control shall exist over personnel records that prevent their loss or use by unauthorized personnel (e.g. maintenance in locked files accessible only to authorized persons). h. Changes in personnel data shall be reported promptly to the payroll accounting function.

Payroll preparation and timekeeping: a. Persons preparing the payroll shall be independent of other payroll duties (e.g. timekeeping, distributing of checks), and have no access to other payroll data or cash. b. Payroll shall perform the following functions in preparing the payroll:

1. Check attendance records for computations of payroll period hours.

2. Review records for specific overtime approval and approvals of department heads, etc.

3. Check overtime hours, rates, and computations.

4. Verify pay rates. c. The payroll (paychecks and direct deposit slips) shall be subject to pre approval before payment by a responsible official (e.g. the Presidents Assistant) who is independent of payroll preparation. d. Payroll checks shall be drawn on a separate account in compliance with requirements. e. Payroll checks shall be pre-numbered, blank stock controlled, numerical sequence.

Numerical sequencing will be accounted for and reconciled to the payroll check register. f. All voided/spoiled checks shall be properly mutilated (removal of signature portion) and retained. g. Checks shall contain detail of gross pay and deductions. h. An adequate system shall exist for distributing payroll costs to the proper accounts, programs, and other functions. i. Reconciliations shall be prepared of gross and net pay amounts as shown on tax returns to total payroll on the payroll register and general ledger. j. Paychecks shall be distributed by someone independent of timekeeping or preparing payroll, checks, or envelopes.

Unclaimed paychecks: a. Checks shall be returned to an employee who is not associated with the payroll function. b. Checks shall be released only on presentation of proper identification by the employee. c. A continuing record shall be maintained of all unclaimed wages.

Year-end preparation of W-2 forms: a. The total of W-2 wages for the year shall be reconciled to the general ledger and payroll register wages paid and the 941. b. W-2 forms that have been returned or unclaimed shall be received by payroll and held until requested for a maximum of three years.

Employee time records shall be maintained in sufficient detail to allow for allocation of payroll costs:

a. To specific grants, contracts, or cost-reimbursement agreements. b. By function (i.e. by program, management, and fund-raising). c. Between unrelated business income activities and activities related to the organization's purpose.

Actual and budgeted payroll will be conducted by a responsible person and all significant variances investigated and documented.

Detailed records shall be maintained of the liability for compensated absences and regularly reconciled to the control account.

There will be no salary advance under ANY circumstances.