Business Focus

advertisement

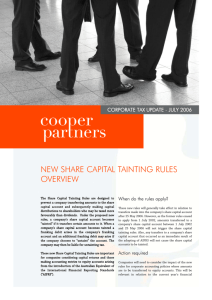

Business Focus Newsletter Issue 1, 2003 Coaching the best results from business people By Anne Gorman Business coaches, like personal trainers, aim to help executives achieve peak performance. Leadership is a lonely place to be these days and there are significant new and constantly changing challenges facing everyone in senior positions in business. These challenges include the fast pace of change, competition in the global market place, and the huge gap between what business leaders are being asked to do and what they have been trained to do. Basically they are supposed to know everything! The leader can’t keep taking problems home to the family and often can’t talk to the board or the people who report directly to them. The essence of business coaching is to help leaders and business owners in the business world, whether they work in large corporations or in small to medium-sized businesses, get unstuck from their dilemmas, within the privacy of a trusted, confidential, one-on-one coaching relationship. One of my clients is the CEO of a small cosmetic company specialising in natural products. He was desperate to talk to someone who might bring a new perspective to his problems and he felt that he could not speak to his board or his senior staff. The company was on a slippery slide. It was losing market share, so profits were falling, the product range and presentation was looking tired and the sales and distribution team were increasingly dispirited. He himself was losing energy around the business, a fatal condition for a CEO. But this was not the real problem. After all, he was a competent businessman and had all the expertise he needed to take action on these fronts. The real problem was that he had not been able to convince his board to invest in change. In his view they could only see, as shareholders, that this would deplete their dividends. They were talking of selling the business. Our CEO embarked on eight coaching sessions over four months and some phone calls in between. These cost the company around $6000. We developed a plan and a way to approach the board that left them with no option but to invest in the future health of the business. The medium-term benefit to the company was an increase in ROI of over 150% and the longer-term benefits look even better. Our CEO’s self-confidence has grown, he’s sleeping better and his energy has returned. Anne Gorman is the co-founder and business director of The Australian Institute of Executive Coaching. Tel 1800 554 040, email agorman@bigpond.net.au Contents 1 Coaching the best results from business people 3 Understanding your customers and their needs 4 Managing conflict within family owned businesses 6 Notice board 7 Succeeding well beyond the comfort zone 8 Tax relief available for de-mergers 10 Protecting yourself from passing off actions 11 Maintaining your relationship while still getting paid 13 Avoiding some of the pitfalls in negotiating contracts 14 Need for caution when allocating franked dividends The information, opinions and advice in this newsletter are of a general nature only and are not intended to be complete or definitive. You should not rely on the contents of this newsletter but should make your own enquiries before taking any action in relation to the matters set out in this newsletter. National Australia Bank Limited ABN 12 004 044 937, its related bodies corporate and all of the authors do not accept any and hereby exclude all liability be it contractual, tortious or otherwise (unless such liability cannot be excluded) for the contents of this newsletter or for any consequences arising from its use or any reliance placed upon it. He has also learned some new skills, new leadership behaviours and some things about himself that will not get in the way of his progress again. As his coach, I did not tell him what to do. What he needed and got was someone who would draw alternative strategies out of him and remove the blockages. Working together The coach is the silent partner with one and only one agenda; the success of their subject. As in competitive sport, coaching involves a collaborative effort between a coach and a player who is willing and able to lift performance. For this process to be a success five things must come into play. The client must have: a reason to change, a desire to change, a commitment to change, a way to change, and support to change. One of the best news coaching stories in the larger corporate world is the public story told by Lion Nathan’s CEO, Gordon Cairns, who attributes much of the company’s recent success to his business coach. One of the key factors in the coaching process, for Cairns, was a shock experience in the form of a feedback report of what his staff thought of his leadership behaviour. The report revealed that what he thought of his leadership and what others thought of it were two very different things. Supported by his coach he set out to make constructive changes such as listening more, and confronting less. As a result, he has achieved a dramatic cultural shift in company culture. Lion Nathan, from being near the bottom of the list, is now the 4th best organisation to work for in Australia, as judged by the 2001 Australian Best Employers to Work for Study. In that study it has been also rated more than 40 per cent ahead in average profit growth compared with that of all other survey participants. 2 Evaluating coaches A coach can cost anything from $3000 for 6-8 fortnightly sessions to $15,000 for a year’s contract. Some top-end coaches charge more than that and, because the results are worth it, clients are willing to pay. One of the things standing in the way of coaching is the idea that coaching is for wimps! One of the burdens many Australian men have had to carry is that to ask for help in any form, is a slur on their manhood. That is why many men find it difficult to approach a counsellor when depressed or running into family problems. But coaching is not counselling and while no one can deny the importance of counselling when these problems arise, coaching is no more like counselling than a sports physio is a football coach. Just as in the sporting arena, not all coaches are created equal. For a start, coaches need to be familiar with the corporate scene and comfortable operating within it. They also need maturity and presence to hold their own among personalities who may bring strong beliefs, preconceptions and resistances to the coaching process. So if you are thinking of using a coach make sure that the coach has received training from a reputable organisation; they are experienced and mature people; that they have a methodology based on sound theory and practice and they present you with a coaching agreement that includes a confidentiality agreement, milestones, progress reviews; and the obligations of both parties. It is important that there is a good fit in terms of the chemistry between you, and that you trust the experience of the coach and have checked out their references (coaches are only as good as the success of their last client). Coaching sessions in the beginning may last for two hours (no more) but after that should never exceed 1.5 hours or even less. If the coach is drawing the process out unduly or if you are having to tell them how to coach you, then you may want to review what is really happening. Conclusion I have seen some remarkable changes occur for people as they move through the challenge of coaching. Men and women open up and start enjoying their jobs, they learn the language of constructive feedback, of positively confronting people when they need to, of ditching the fear factor so they can make a real contribution to the organisation, instead of wasting time with political games. • The Australian Institute of Executive Coaching provides training for people who wish to learn the skills of business or executive coaching. These courses are designed and run by John Matthews who is regarded as one of Australia’s most accomplished master coaches. The Institute has trained over 200 people in Executive/Business Coaching. Understanding your customers and their needs By Andrew Griffiths Good customer service isn’t rocket science, but many businesses fail to meet the expectations of their customers. As customers, we all have certain expectations before we use a business. If you are going to a pizza bar, you expect that the pizza will be served with the toppings you specify, that it will probably take about 15 minutes to prepare, and that it will be packed in a box that will keep it warm until you get home. You will be charged a standard and acceptable price and, in all likelihood, the pizza will taste reasonable. Subconsciously, these are all of the expectations that you have regarding this purchase. If the pizza bar meets them all, you will walk away happy and will probably return. If you have been going to the same pizza bar for some time you may have developed a rapport with the employees, so if they mess up one or two of your expectations, you may forgive them. Perhaps you had to wait longer than usual, or they increased their prices and you were unaware of the change. Whatever the case, the degree of confidence that you subconsciously have in the business will determine how much you will tolerate. If you are using the business for the first time, however, and they fail to meet even one of your expectations, it is very likely that you won’t go back again (unless it is a completely convenience-based decision, such as the pizza bar is across the road from your home). On the other hand, if the business exceeds your expectations – perhaps they gave you free garlic bread – and they delivered on every other expectation, you will go away raving about the business to everyone you know. The two real keys here are identifying what your customers expect, and then meeting and, where possible, exceeding these expectations. Identifying your customers’ expectations requires an open mind and communication with other people – your staff, your customers and your friends. What do your customers expect when they come to your business? Ask a lot of questions and put yourself in your customers’ shoes. Look at your business from a customer’s point of view and try to identify what they expect from you. Think about yourself when you make a purchase. Stop for a few seconds and go through the purchase process and the expectations that you have before you enter a business, and then try to determine if those expectations were met. Author, Andrew Griffiths I know that my wife, my friends and my business associates aren’t stupid either. In fact, it’s highly unlikely that there are a lot of stupid customers out there, yet many companies still treat us as if we are stupid! Treating your customers with respect Treat your customers with the respect that they deserve and your business will benefit enormously. Don’t get caught in the trap of looking at customers simply as numbers on a spreadsheet. This is an area where I feel many larger organisations have started to flounder. The unique needs of every customer are being lost sight of as businesses focus on their balance sheets and profit and loss statements. Customers know this and they have had enough. A flashy advertisement and a few false promises just don’t cut it any more. Customers should always be treated with the utmost respect. Unfortunately, poor customer service generally stems from a real lack of respect for customers. As a consumer, I know that I’m not stupid. Respect is a powerful word. Respect your customers’ intelligence, their time and their decision to make a purchase from your business when they could have purchased the same item from your competitor up the road. With regards to your own business, once you have a very clear understanding of what your customers expect from you, you can begin work on ensuring that you meet these expectations and, hopefully, exceed them. 3 Outstanding customer service This is simple: if you offer really good customer service, your customers will keep coming back to your business. They will tell their friends, who will in turn visit your business, and they will tell their friends. This cycle of recommendations results in a business attracting more and more customers simply by word of mouth. Having people recommend your business isn’t just a very good feeling; it’s very profitable too. Most small business owners and operators take a lot of pride in what they do. There is no better feeling than having a customer walk up to you and compliment you on the great business that you are running. For me, this is the ultimate reward. For that reason, I always take the time to offer congratulations to any business that I feel is offering outstanding service. When a business offers poor service, on the other hand, I not only don’t go back, I advise everyone I know not to go there. So, the benefits to you of offering good customer service are that your business will grow by word-of-mouth (free) advertising, you will make more money, and you and your staff will all walk a little taller because you have positive affirmation that you are good at what you do. Sounds pretty good to me. • This article is an extract from Andrew Griffiths’ new book, 101 Ways to Really Satisfy Your Customers, published by Allen and Unwin RRP $24.95. Managing conflict within family owned businesses By Michael Kulic Emotions bind together family businesses but if not managed carefully, they can also sow the seeds for destruction. In many ways, the family business is like any other business. It produces products or delivers services. It has employees. It generates revenue. It focuses on getting and keeping customers and making profits. It is comprised of individuals with differing objectives, needs, levels of ability and desires. But a critical and fundamental difference between family and nonfamily businesses is that the former is bound together by emotional ties that are both positive and negative. It is orientated inwards toward the security and the nurturing of its members. A family places high value on loyalty and protection. In addition, it operates to minimise change and to keep the equilibrium of the family intact. Problems occur when the system overlap of the family values and priorities are so great as to overwhelm the business values and priorities – or the reverse. 4 Perhaps the most common example of family values prevailing is when children with different abilities work in the business, and the founder decrees that, regardless of their contribution to the business, they are loved equally and thus will be paid equally and own equal amounts of shares. The most successful families are those who find an appropriate balance between family and business values, and have articulated those values. For most, this means running the business according to sound business principles, and providing space for a normal family life away from the business. There is some overlap, but it is under control and within reasonable limits. Handling conflict All families have conflicts; the difference between successful families and the unsuccessful ones is that the successful families learn how to deal with them. For each family member has their own unique values and ethical standards, and there are no common rules that apply to all. Typical issues that are required to be addressed include: • • • • • • who to bring into the business what to pay them how to evaluate performance who to designate as a successor how to transfer power whether and how to share ownership Many people respond to this situation by trying to separate completely the family concerns from the business concerns. This is impossible and undesirable. Attempts to build an artificial wall would deny the reality of family ownership and management. More importantly, it would deprive the business of the unique strengths and contributions that the family can bring in terms of loyalty, trust, and willingness to sacrifice and share in a common enterprise. Sources of conflict Conflicts inevitably occur in all family businesses and several factors contribute to them. Many of the difficulties of the family business begin with a founder who has spent their life nurturing the success of the family business operation. A psychological conflict develops when one or more family members become increasingly involved in the family business. A rivalry may be felt by the ageing founder, particularly with sons/daughters who may do a better job than they have. Particular issues can include: • Equitable compensation of family members. Remuneration of family members may create personal jealousies, especially when there is resentment because one family member is receiving more than another. • Intra-family rivalries. Where more than one family is involved in the business the ‘family’ interest may be different. This may create jealousies among the family members especially as regards senior appointments and positions of power, which increases through the generations of the extended family. • Inter-generational rivalries. Sibling rivalry is well noted as being a major cause of conflict in family businesses. While sibling rivalry is normal, the need is to ensure that such rivalry does not become a destructive force that threatens the survival of the business. • Determination of authority. There is a need for promotions and titles of authority to be defined on an objective basis so as to minimise the impact of family feuding should one family member surpass another. • Working vs. non-working family members. An added complexity is the need to address the family members not engaged in the business every day. These inactive family members may have both the rights, and generally the demands, of ensuring their share of the family business is adequately dealt with. • Separation of business vs. family issues. It is extremely difficult to separate business and family issues. The dilemma is that whatever happens at home is usually carried over into the family business. • Filling the founder’s shoes. The question of succession becomes a daunting task for many siblings working in the family business. More often than not the question of succession has not been identified or dealt with, and if more than one family member works in the family business this too can create conflict, especially when no successor is specifically identified. Resolving these problems Research suggests that family firms that survive over time develop structures that systematically facilitate communication, conflict resolution, accountability and planning. Family meetings and a formal family strategic plan serve as those structures. Effective communication will do much to reduce conflicts confronting business families. While conflict is inherent in the family business scene, ‘healthy’ families do not avoid or suppress conflicts, they simply manage them more effectively. This is a task made more difficult by the family/business overlap. Families that manage conflict effectively recognise that when differences go unresolved conflict normally gets worse. A small disagreement over an issue can create disproportionate animosity if the issue remains unresolved long enough. Such conflicts in a business family are often dangerously suppressed. A common characteristic of successful families is that they communicate well and their values are clearly articulated – everybody knows the ground rules and is willing to abide by them. With successful families they approach the business as a partnership, with family members willing to subordinate their Michael Kulic is a partner with accountants, Howarth, Tel (02) 9372 0777. own personal desires to the best interests of the family and the business. A powerful vehicle for building communication, healing conflict and avoiding feuds in business families is at a ‘retreat’ where family members work together. Clearly, time should be taken and the effort made to find a relaxed setting away from the daily grind where each family member can have the space to reflect, take a good long look at the business, where it is going and what they think the future holds. Then, in an organised fashion they need to come together to share this with the rest of the family. Especially in the beginning, family meetings need to be conducted regularly, at least two times a year and up to four times a year. It is only this way that open dialogue can be created, relationships enhanced and conflicts confronted. The chances of a successful retreat are greatly enhanced by the engagement of a facilitator to run the meeting. 5 Notice board Super review by ATO Review of innovation •••••••••••••••••••••••••••••••••••••••••• •••••••••••••••••••••••••••••••••••••• The Australian Taxation Office is to undertake its first major survey of DIY superannuation funds to determine if there are any compliance issues which need to be addressed. A number of DIY trustees will be interviewed as part of a broader national review of the performance of DIY funds for the 2000-01 year. The field and desk audits will be conducted early in 2003 and the report on compliance is expected to be finalised by midway through the year. Specific areas of review will include super surcharge, deduction claims, and reasonable benefit limits administration and reporting. R&D Start program reactivated ••••••••••••••••••••••••••• The R&D Start program has been reactivated with a call for applications from AusIndustry. New applications for the R&D Start program were suspended in April 2002 and companies which had made applications that were not processed will need to apply again. $170 million will be available for grants and loans under the program during 2003-04. The first round of grants is expected to be announced by mid-February, and further decisions will be announced every six to eight weeks. AusIndustry has amended the general conditions of contract for the program to include a schedule of annual payments, with the aim of avoiding a repetition of the over-expenditure which led to the program being frozen over the past year. For further information contact www.ausindustry. gov.au or the AusIndustry Hotline on 13 28 46. New innovation board •••••••••••••••••••••••••••••••••••••••••••• The Victorian Government has established an Innovation Economy Advisory Board which will advise it on strategies and directions to encourage innovation throughout the Victorian economy. It is being chaired by the Treasurer and Minister for Innovation, John Brumby. 6 The Federal Government has initiated a major study to map Australia’s science and innovation activities across the public and private sectors. The Federal Minister for Education, Science and Training, Dr Brendan Nelson, said the objective of the exercise was to develop a comprehensive overview of the Australian science, technology and innovation system as a whole, including public and private sector players, roles, linkages, resources and priorities. A taskforce has been established within the Department of Education, Science and Training to coordinate the work and will report by the end of 2003. Progress on BITS program •••••••••••••••••••••••••••••••••••••••••••••••• A report of the Commonwealth’s Building on IT Strengths (BITS) program shows that after two years, the 10 incubators supported by the program have assisted 158 early-stage IT and communications companies. These companies were selected by the incubators from a total of 2474 applications over the two-year period. Of the 158 successful applicants, 31 have graduated from the program and 21 have been withdrawn from the program due to failure to meet agreed milestones. The BITS Incubator Program aims to increase the success rates of new businesses in the information, computing and teIecommunications industries. The BITS incubators provide a structured business growth program including access to early-stage finance, management advice, and assistance with channels to market. Incubators can provide up to $450,000 in assistance to individual start-up companies through services, seed funding or a combination of both. The report can be accessed at www.dcita.gov.au. Succeeding well beyond the comfort zone By Peter Stirling Being one of the first in its field to utilise digital technology has catapulted a Sydney company to international success. The world’s first digital video alarm system was not, as might be expected, developed by a multinational information technology and communications company. It was the brainchild of Australian inventor, Bill Nolan, whose determination and entrepreneurialism has built a fast-growing company, Zone Products, at the leading edge of the world security and surveillance markets. It was watching the direct telecast of the first manned moon landing back in 1969 that set Bill, then a young scientist with CSIRO Animal Physiology, to thinking about the remarkable possibilities of sending video images over vast distances. Bill’s career path took a series of surprising twists and turns before he finally followed up his interest in video communications. A factory-sponsored rally driver, Bill left CSIRO to join the car industry, initially testing cars in the toughest Australian conditions for Volvo, and then working his way to senior management levels with Leyland and Toyota. However, he is an incurable inventor by nature, and among other things, developed and patented a heat-pad technology for the treatment of arthritis and muscle pain which he sold to a major US drug company. Another collaborative invention is the world’s smallest drilling rig which can be transported on the back of a truck but can drill as deep as most of the big rigs. But the idea of video surveillance kept resurfacing. In the mid-80s when PCs were still in their infancy and the internet was beyond most people’s imagination, Bill realised that it would be possible to transmit video images down telephone lines. “I worked out that to do this we would need to go digital, but at that time the hardware and compression capability were rudimentary, so you got about one frame through every 15 seconds. I formed a company with family funds and some investors, and after looking at about 140 possible applications of this idea, the one that I picked as the most promising was security. Clearly, if you can be remotely alerted by telephone with a video image of a security breach within 15 seconds, that is a reliable alarm system,” Bill said. By 1990, the company had secured patents in 33 countries and since then has maintained its position at the forefront of digital video security, employing 18 staff in Australia and the United States to design, develop and manufacture digital video transmission, digital CCTV multiplexing and digital video recording products. In 1999, Zone won the ‘Most Innovative Product’ at the Western Sydney Industry Awards, with its latest system, the Zone Raptor, and in 2001 Mr Nolan was named Entrepreneur of the Year. Zone provided non-stop digital video recording of security cameras at the Sydney Olympic Games and in 2000 was awarded ‘the Security Industry’s Finest’ by the US Security Industry Association. Over the next 10 years, Bill continued to develop the technology and slowly build a business that had to overcome the limitations in people’s understanding of the potential of digital communications. 7 In 2002, Zone went global and was re-established as a majority Australianowned US unlisted public company called Zone Products Inc, with its head office in San Diego and a sales office in Washington, DC. Subsidiary companies were set up in Australia and Singapore, and the Centre for Research and Development remains at Castle Hill in Sydney. Since Zone’s first remote video transmission system was released in 1990, systems have been sold in Australia, New Zealand, the USA, Singapore, Malaysia, South Africa and Saudi Arabia. As well as their security applications, Zone’s integrated digital video systems are used for traffic flow monitoring and environmental control. IBM has validated Zone Products’ software as IBM eServer proven, allowing IBM resellers worldwide to sell Zone’s products, and Zone’s Raptor is the only digital video security system approved by IBM for use in their products worldwide. its security technology to the Pentagon and has designed city-wide video surveillance systems for application in the US and other world markets. In conjunction with a major US company, it has made the shortlist for a massive new security contract which the US military wants to implement. A new product is a unique 3-D alarm system which creates a ‘virtual fence’ and can detect intruders at distances of between a centimetre and five kilometres. This product has a wide range of applications from military installations to museums and private business premises. Anti-terrorism is a growth industry, and Zone Products has achieved a growth rate of more than 100 per cent for each of the past three years. In a major new project, prompted by the events of September 11, Zone is now planning to extend its range of products into biotechnology-based sensors which could include chemical/ biological warfare sensors as well as biosensors with medical and commercial applications. The Zone R&D department has set up a sensing division and is currently developing face recognition systems and biosensors for civil and military use. It is also investigating new biosensors and alarm systems for biological weapons. In aiming to list on the US technology stock market, the NASDAQ, it is seeking to raise only a small amount of initial capital, but to also substantially raise its profile among potential US consumers and the investment community. At the moment the intellectual work on R&D is being undertaken in Australia but Bill Nolan says that “the availability of facilities and defence bio-hubs in America as well as government and financial support could cause us to choose to take this activity offshore.” • Zone Products Australia can be contacted on (02) 9894 7025. In alliance with other major suppliers, Zone Products has recently delivered Tax relief available for de-mergers By Mark Northeast New tax provisions to allow businesses to restructure without incurring a tax penalty may help with success planning. Since the introduction of capital gains tax in 1985, businesses have often been prevented from restructuring into separate parts because of the tax cost. The Government has introduced rules that provide for “de-merger” tax relief. These rules improve the flexibility of such restructuring transactions. De-merger relief may allow: • Businesses to be spilt into different entities without an income tax cost; 8 • The potential for segregation of property from business – with some limitations; • Better access to CGT concessions following restructure; • Restructuring for asset protection, estate planning and succession planning purposes; and • the introduction of new equity participants into part of the business following restructuring. Mark Northeast is a partner with Pitcher Partners. Tel (03) 9289 9999. Unlike many recent tax changes, the de-merger tax measures are welcome as they can allow business groups to restructure and "spin-off" businesses at a lower tax cost than was previously the case. in the business property for their retirement. Figure 1. An example of a simple de-merger Before De-merger After De-merger Shareholder A B 50% 50% Shareholder A B 50% 50% Shareholder A B 50% 50% Company Company Company H H S Head Entity Head Entity De-merge Entity 100% Company S De-merge Entity Note: Under the de-merger rules A & B hold equity interest directly in Company S in the same proportions as they hold equity proportions in Company H. Under the de-merger rules there is no immediate tax liability on the above “spin-out” of Company S. What is a de-merger? A de-merger involves the restructure of a corporate or trust group. Typically, a subsidiary entity is “spun-out” from the group, so that the ultimate owners of the group acquire direct interests in the subsidiary entity. An example of a simple de-merger is shown in Figure 1 above. Who can obtain de-merger relief? To obtain relief, there must be a de-merger group that consists of at least a head entity and one or more de-merger entities where the group owns more than 20% of the entity. A company or trust (other than a discretionary trust) can be a head entity of a de-merger group if no other member of the group owns any interest in the company or trust. A de-merger group can consist of companies or trusts (fixed or unit trust) but not discretionary trusts. At least 80% of the de-merger group’s ownership interests in the de-merged entity must be disposed of to the owners of interests in the head entity; What tax relief is available? Tax relief applies to de-mergers that occur from 1 July 2002. Rollover relief is available for de-mergers of shares in companies or units in unit trusts but not in respect of the underlying assets in the company or unit trust. Where certain conditions are satisfied, the outcomes, by reference the above example, are: a) Company H is not subject to capital gains tax on the disposal of shares in Company S b) A & B being the continuing shareholders in Company H and the new shareholders in Company S are not taxable on the receipt of Company S shares. c) The cost base that A & B had in company H’s shares (before the de-merger) is spread over the costs bases of their shares in both Company H and Company S (post de-merger), based on the relative market values of these entities after the de-merger. d) Alternatively, if shares held by A & B in company H were pre-CGT, their shares (after the de-merger) in Company S will also be pre-CGT. Succession planning The following example outlines how the de-merger rules might assist businesses succession plan in a tax effective manner. Mum & Dad own all the shares in a company (H Company), which owns a business, and the premises on which the business is operated. They wish to ultimately hand over the business to their daughter, but retain their interest In these circumstances, S Company, a 100% owned subsidiary of H Company, might be established. Under existing CGT rollover relief the business assets in H Company could be transferred to S Company. The outcome at that point would be that the business property would remain in H Company and the business would be in S Company. S Company could then be de-merged or “spun-out” as shown in the diagram above so that Mum & Dad own direct interests in both H Company and S Company. From there, the required number of shares in S Company could be issued or sold to the daughter so that she obtains an interest in the business company but not the business premises. This procedure might equally be adopted in introducing new equity participants into part of a business only. The relevant part or division of the business would be first “spun-off” into a separate entity as shown above. The de-merger relief rules are a welcome tax reform outcome in that they introduce an opportunity to restructure in the relevant circumstances where previously the income tax cost may have prohibited the restructure. Business Focus Business Focus is distributed to more than 45,000 of the National’s business customers every quarter. It aims to alert readers to business information and trends which will assist them in managing their businesses. We encourage feedback from our readers who are invited to write to the Editor at the address below. Articles in Business Focus are protected by copyright and can be reproduced only with permission. The Editor Business Focus Newsletter National Australia Bank Limited Level 15, 500 Bourke Street Melbourne, Victoria 3000 9 Protecting yourself from passing off actions By Jill Newton Businesses which attempt to hitch themselves to the coat-tails of other successful companies can find themselves at the receiving end of legal action. Any attempt to take advantage of the reputation of another business can be challenged in the Federal Court under section 52 of the Trade Practices Act 1972, in conjunction with a passing off action. The essence of an action for passing off is the protection of goodwill or reputation attaching to a business or commercial venture. Passing off has evolved in Australia to describe situations involving “the deceptive or confusing use of names, descriptive terms or other indicia to persuade purchasers or customers to believe that goods or services have an association, quality or endorsement which belongs or would belong to goods or services of, or associated with, another or others”. There is no requirement that the defendant should be carrying on a business which competes with that of the plaintiff or which would compete with any natural extension of the plaintiff’s business. Further, there is no requirement that there be an actual, subjective intention to mislead. Consumer Protection Section 52 of the Trade Practices Act (TPA) 1974 (and the equivalent provisions in the Fair Trading Acts of the States, which prohibit misleading or deceptive conduct) proscribes a range of unfair practices detrimental to the interests of consumers. Section 52 is the broadest section of Part V of the TPA. ‘Any person’ may seek an injunction under section 80 of the TPA, allowing 10 possible plaintiffs to include as well as consumers, rival traders and the Australian Competition and Consumer Commission. To decide whether conduct is misleading or deceptive involves a consideration of its effect on the consumer. A recent case, Sydneywide Distributors Pty Ltd v Red Bull Australia Pty Ltd [2002] FCAFC 157 (4 June 2002), concerned an appeal to the Full Court from a decision of a primary judge of the Federal Court that the conduct of Sydneywide Distributors Pty Ltd (‘Sydneywide’) in connection with the distribution of cans (not bottles) of an energy drink known as ‘LiveWire’ contravened section 52 of the TPA and constituted passing off. The appeal was dismissed. Red Bull Australia Pty Ltd (‘Red Bull’) has been importing and supplying in Australia an energy drink product under the name Red Bull in 250ml slimline cans. Red Bull’s entry into the Australian market was highly successful due at least in part to the extent of its advertising and promotional campaigns. Sydneywide became a substantial distributor of the Red Bull product in Australia and planned secretly for the manufacture in New Zealand and importation into Australia of its own energy drink under the name ‘LiveWire’ in 250ml cans and 330ml bottles. Despite the Red Bull and LiveWire names being displayed prominently on the cans, the identical shades of blue, silver and red as well as the diagonal Jill Newton works for patent attorneys, Watermark, Tel (03) 9819 1664. thrust, were found to be striking features of each ‘get-up’ with the preferred expert asserting that “the similarities in colouring and design on the two cans are such as to cause confusion”. In arriving at this conclusion the preferred expert focused on what was described as the ‘gestalt’ of the brand, which notion is “the overall identity of a brand as it related to consumers” including “not only the name, colour, physical properties and packaging but also associations with the brand and branding devices used to create associations, including its advertising and the ‘channels’ through which it is sold”. Given a long line of decisions where a defendant, while imitating the get-up of another’s product, has been able to escape liability by including its own trade name on the product, this decision is surprising, particularly as the LiveWire and Red Bull names were displayed prominently on the respective cans. Any argument, however, that the nature and cost of a product will determine whether a label is more closely examined by a prospective customer before committing to purchase would seem at odds with reality in a case such as this, involving prominently labelled but low cost energy drinks. One important basis for the Court concluding that Sydneywide’s conduct was in breach of section 52 of the Act and constituted passing off, was the finding that Sydneywide had deliberately misappropriated aspects of the Red Bull get-up. that consumers may be deceived, as “traders best know their trade”. The ultimate decision was said to be based on a consideration of all of the above matters, namely the Court’s perceptions (as informed by experts) of the similarities and differences between the two get-ups, and the finding of deliberate copying. A finding of deliberate copying or an actual attempt to misappropriate the reputation or goodwill of a rival, should, however, serve to prevent a defendant escaping a section 52 or passing off action merely by displaying its own name on the product. Deliberate copying Summary Section 52 of the TPA is designed to protect consumers. A passing off action, on the other hand, is designed to protect a trader’s goodwill. However, once it was accepted that the Red Bull get-up as pleaded was distinctive of the Red Bull product, the principal issue in the case was whether Sydneywide’s conduct was likely to deceive (for the purpose of the passing off action) or was misleading or deceptive, or likely to mislead or deceive (for the purposes of section 52). The primary judge found that both causes of action were made out and the Full Court saw no basis for upsetting these findings. A long line of Australian cases stand for the proposition that deliberate copying by a rival of the get-up of a competitor is a basis for an inference Maintaining your relationship while still getting paid By Roger Mendelson Getting paid for an overdue account can generally be successfully accomplished; the tricky aspect is not alienating a future customer. Without risk there is no pain, without risk there is no gain. The paradox for the small to medium-sized business lies in the fact that customers are essential to provide fuel for growth but simultaneously have the capacity to starve the hungry beast. The relationship between a business and its customers is always a twin-edged sword. On the one hand, the business wants to maintain the relationship, to ensure further business from the customer and the potential for referrals. On the other hand, a business does not survive on the sweat of its employees alone – cash is king. There comes a time when a customer is no longer a customer but a threat to the business. There can be no doubt of the importance of having invoices paid in a timely manner. Assessing the relationship What is the best way to approach a customer who is 90 days overdue on an account payment? How do you decide whether a customer is no longer worth having? The relationship issue becomes much easier to manage if it is systemised. As a business grows in size, it is crucial that systems are put in place to manage debtor relationships. Rather than relying on ‘gut feel’ over whether a particular customer will pay or is valuable to the business, systems should be set up to manage the process. If a business relies on the gut feel approach and the personal knowledge of staff members then it is vulnerable. The first step in establishing a robust credit management system is the production of a clearly defined credit policy. The policy specifies the credit terms afforded to specific customer categories and covers every type of invoice issued by the business. 11 The second step is the production of credit management procedures. For most businesses, collection procedures will include the following: • completion of a credit application form prior to the granting of credit • detailing of credit terms on all quotes, order forms and invoices • initial telephone contact after a set period, to query the unpaid account • a first written statement, firmly conveying the message that payment is now due • second telephone contact • a final statement incorporating the message ‘Final Notice’ • referral to legal counsel or a collection agency This process, if followed correctly, provides a framework for managing debtor relationships and lessens or negates the impact of interpersonal factors in recovering outstanding invoices. How to respond Most of us are not psychologists and all of us find it hard to express debtor empathy when our businesses seem to be slipping from a tenuous grip due to squeezed cash flow. However, consultation is essential if the money is to be retrieved. Taking a hard line approach when the source of the problem is your invoicing system or quality of product is not going to win customers – establish the reason for non-payment. If there is a genuine problem relating to a product or service, it will need to be remedied. If not, then the recovery process continues. What is the response if a debtor says they cannot afford to pay because they fly overseas in a couple of days? Perhaps you have heard the ‘I’ve just bought a new car’ excuse? ‘I’m a single mother with three kids’ sound familiar? How about the simple yet effective, ‘No, get lost’! All of these responses form a part of daily conversation for the debt collection officer but for many of us the most adequate retort may not be at hand. 12 The theme of any debtor conversation should be ‘firm but understanding’. A business must be firm in its resolve to recover the money but understand that it may take some time to retrieve. Anyone who is employed or has an asset of some worth should be able to pay back a debt over time. The aim is to set up a payment schedule, align it with the debtor’s earnings cycle and assign a periodic payment amount that is proportionate to the debt owed. Mailing the debtor a direct debit form with a document detailing the payment schedule will reaffirm the strength of the agreement. If payment schedules are not agreeable to the debtor, it may be time for the ‘velvet hammer’. If a debtor’s name and details are reported they will be held on file for fifteen years. Fifteen years is a long time for business loans, car loans, home loans, credit cards and rental agreements to be inaccessible to a business or family. It’s certainly food for thought. The final steps When is a debt a ‘bad debt’? If the final notice has been given and the account has not been settled the credit management system categorises the debt as ‘bad’ and the customer should not be retained if the debt is not settled immediately. A customer relationship is a two-way street – if a customer has taken the turn-off and no longer feels any loyalty towards your business, then you must make a decision to write off the debt, contact a debt collection agency or seek legal counsel. The agency will reach a point early in the collection process where it goes one way or the other. If the debtor is responsive and cooperative, it is in the best interests of the agency to develop and maintain that relationship on behalf of the client. However, if the debtor is uncooperative then the agency will apply stronger legal measures. A business must define each debtor relationship with the collection agency; however, if Roger Mendelson is the CEO of Prushka Fast Debt Recovery, Tel 1800 641 617. the agency is unable to get the relationship back on track at the preliminary stage, then it should be regarded as a liability and not worth maintaining. The other recourse is a legal one. If the debt is large enough, the debtor has sufficient assets and the expected legal costs are economic, this is an effective path to debt recovery. Debt collection companies often have large in-house legal teams that will work on a business’s behalf to recover debts on a commission basis as opposed to a fee-for-service agreement. Follow the system, have clear outcomes and your business will minimise the risk to cash-flow resulting from customers who don’t pay up. Avoiding some of the pitfalls in negotiating contracts By Damian Ward Misrepresenting a product, whether deliberately or in innocence, can have legal repercussions. Skill in negotiating contracts is one of the most valuable commercial attributes a person can have. However, what may be seen as good negotiation on a business level may not necessarily be viewed so positively in the eyes of the law. There is often a temptation to exaggerate the capabilities of your business in providing a product or service to a party you are contracting with. While this may clinch a sale or deal, it can create legal problems if the purchaser decides that the ‘how’ or ‘what’ you said you could deliver is not what they got. The law generally states that a company or person cannot engage in misleading and deceptive conduct – the nature of which is pretty broad at law. In general, the following types of representations and omissions may come back to haunt a seller: • not precisely identifying what you will be providing under the contract; • not disclosing all material elements in relation to the deal and remaining silent on the less attractive or potentially disadvantageous elements; • making predictions or statements of opinion about the benefits the buyer will directly or indirectly obtain under the contract without any reasonable basis; • making inaccurate statements about what you can provide in an attempt to persuade the buyer to purchase; • making assurances about ‘after sale’ service or things which you will do during the term of, and after, the contract. These representations or omissions may not be intentional. However, under the law, intent is not necessarily relevant. Silence or not making information available may also be misleading and deceptive. Damage may arise irrespective of whether the seller was consciously dishonest. To balance this otherwise bleak picture, courts do recognise that in negotiating there is some latitude for general assertions. This is quaintly called ‘puffery’. For example calling the product ‘the best in the market’ or ‘the best in the world’. Take, for instance, a manufacturer who produces component engine parts for industrial machinery. A client may order a certain number of parts in a certain timeframe. There may be a stipulation that they must be provided by a precise date. It is likely that your organisation will say that the timetable can be complied with and that the parts will be delivered either on or before the time stipulated. This is a natural reaction in an attempt to expand the business and maintain goodwill with customers. However, if you know at the time you make those representations that you cannot comply with the timetable or you deliver the products later than the stipulated time, you may be accused of saying something that is misleading and deceptive. This is because you did not comply with the request for the products to be delivered by a critical date. Damian Ward is a Senior Associate with Abbott Tout Solicitors This may give the purchaser a right to sue for damages. These damages may be the loss of contracts which the purchaser’s entered into in reliance on your assertions about meeting deadlines. A company may suffer damage arising from a misleading and deceptive representation in many ways, and this is merely one example. There are a number of do’s and don’ts to assist in avoiding liability on this basis. What to do: • Ensure you intimately understand the product you are selling. The precise detail is important. Both the good and bad elements of it are important to your clients and therefore, in this context, important to you. • Take particular care with what you tell clients. To the fullest extent possible make sure you provide them with the entire picture. • Keep a record of the meeting and details about what you said to the client. While lawyers will invariably tell you this, it is not always commercially possible. Nevertheless it is always a useful exercise. A note of what you said will assist in triggering your memory in the event a claim is made and it will boost your creditability before the court. 13 What not to do: • Don’t exaggerate certain elements of the deal that you consider beneficial to the purchaser. It is important to precisely and accurately identify what the purchaser is likely to get. • Do not withhold information that is material to the purchaser’s consideration in buying the product. • Do not attribute qualities to the product that it does not have. • Do not make promises or predictions about the product that cannot be fulfilled or for which you have no reasonable grounds for making. General statements of comfort like ‘this will be a great product for you’ are generally not a problem. Direct assertions about future benefits might be. In particular, a precise representation about when you can deliver the product may be very important. This is particularly so if the statement is in response to the client telling you that it has a genuine need for the product by a certain time. All of these suggestions are in an attempt to help minimise the risk of a claim against you, and in the event one is made, allow you to forcefully respond to it. Regrettably, there is no absolute way of protecting yourself from a claim but these tips will make it much harder for an action to succeed. Need for caution when allocating franked dividends By Gary McDermott Changes to the taxing of dividend imputation require careful planning by companies. The new ‘simplified imputation system’ has been in place since 1 July 2002. But just how simplified is this new system for private companies? While the new system will allow private companies more flexibility in choosing the level to which dividends can be franked, this may come at a cost and taxpayers should remain wary. Under the new system, companies are required to maintain their franking account on a ‘tax paid’ basis and not on a ‘taxed profit’ basis (as was previously the case). By way of example, if a company makes a profit of $100 on which it pays $30 in income tax, the credit in the franking account under the new system is $30. This is in contrast to the previous position where the franking credit was $70. This change simplifies the franking account by effectively aligning the concept of a ‘franking credit’ from both the shareholder and company points of view. 14 The biggest advantage being offered to all companies under the new system is the ability to choose the level of franking to be passed on to shareholders, subject as always to certain limitations. This is done by establishing a benchmark franking percentage. Private companies will be required to set a benchmark franking percentage in each financial year and frank all dividends within that year to the same extent. Under the benchmark rule, if a private company pays a fully franked dividend to its shareholders on day one of the tax year, any subsequent dividends (other than deemed dividends arising from private company loans) in that tax year would be treated as fully franked for the purposes of determining the year-end franking account balance. If a company simply runs out of franking credits, resulting in a debit balance in the franking account at year end, it will be liable to pay franking deficits tax as under the previous regime. Companies will be penalised if the benchmark rules are not adhered to; accordingly special care and planning will be needed when setting the benchmark franking percentage. If the dividend is franked at a lower percentage than the benchmark rate, the company’s franking account will still be debited at the full benchmark rate, thereby wasting franking credits. If the dividend is franked at a higher percentage than the benchmark rate the company will be liable for ‘overfranking tax’ an additional impost which does not result in a credit to the franking account. Franking variation Where the benchmark franking percentage varies significantly between income years there is a requirement to notify the ATO and to provide specified information. The application of the benchmark rule may create practical difficulties. For example, prior to the sale of a company, the company may choose to pay out all its retained profits by paying fully franked dividends to the exiting shareholders. In this case, the new owners will inherit the 100% benchmark franking percentage and any dividends within that year will be required to be franked to the same extent even if there are insufficient franking credits. While a discretion is available to the Commissioner to allow companies to depart from the benchmark rule in extraordinary circumstances, whether the Commissioner will consider such a change in ownership to be sufficient to warrant a departure from the benchmark rule is unclear. Private companies also need to ensure that they have procedures in place to meet the new reporting obligations to both shareholders and the ATO. For each franked dividend made, a ‘distribution statement’ showing prescribed details of the dividend including the franking percentage must be provided to the shareholder. Private companies will be permitted to provide distribution statements to shareholders up to four months after the end of the income year in which the dividends have been paid. This provides some flexibility, by allowing private companies to retrospectively frank dividends (subject to the operation of the benchmark rule which may predetermine the level of franking that needs to be used). The reporting of dividends to the ATO will continue as under the current regime. Anti-avoidance rules On the face of it, the new rules appear to provide some flexibility. However, don’t be fooled. There are specific anti-avoidance rules designed to prevent companies from taking full advantage of the flexibility which is inherent in the new system. These provisions together with the new reporting obligations need to be properly understood by all companies. Private companies paying franked dividends now also have new reporting obligations to the ATO where the benchmark franking percentage in one year varies significantly (ie by more than 20%) from that used in prior years. In particular, private companies must notify the Commissioner in writing where there is excessive variation of the benchmark franking percentage between franking years. In certain cases, this may trigger further enquiry from the ATO. There are also specific anti-avoidance rules (dividend streaming rules) which seek to limit the extent to which dividends can be distributed preferentially to various direct (and indirect) shareholders. A further change introduced under the new system is the new ‘gross-up and credit’ approach for franked dividends received by companies – effectively aligning the treatment to that which currently applies to individuals, trusts and superannuation funds. However, the impact of the gross-up and credit method for companies is that current and past year tax losses will be absorbed faster. To date, we are yet to see the introduction of any amendments to the new imputation system to ensure that companies do not waste current year losses absorbed by franked dividends. Until such time as amended legislation is available, taxpayers should adopt a cautious approach, particularly in view of the ATO’s heightened focus on tax losses. The Government promises the new system will simplify the pre-existing imputation rules, decrease taxpayer compliance costs and ATO administration costs, and increase the flexibility in choosing the level to which dividends can be franked. Gary McDermott is a partner in the Enterprise Growth group in the Melbourne office of PricewaterhouseCoopers, Tel (03) 8603 3736. The rules are more complex and require additional reporting procedures by private companies to both shareholders and the ATO. It is also difficult to see how the application of the new benchmark rules will significantly reduce the administrative burden on the ATO. Further legislation is expected to clarify the wasting of losses through the gross up of dividends and to introduce tougher anti-avoidance rules to prevent trading in franking credits. The absence of these and other components of the proposed legislation leaves us with some uncertainty, even though the new law has already commenced. Finally, it cannot be overstated that the new system has the potential to inadvertently create traps for those private companies and shareholders who fail to properly understand the complexities of the new rules. Careful planning is more important than ever. However, it is hard to see there being any significant savings in compliance costs for companies in the short term. 15