View PDF

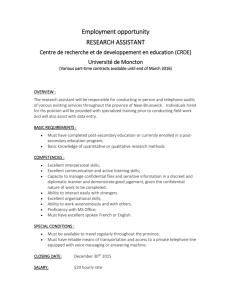

advertisement

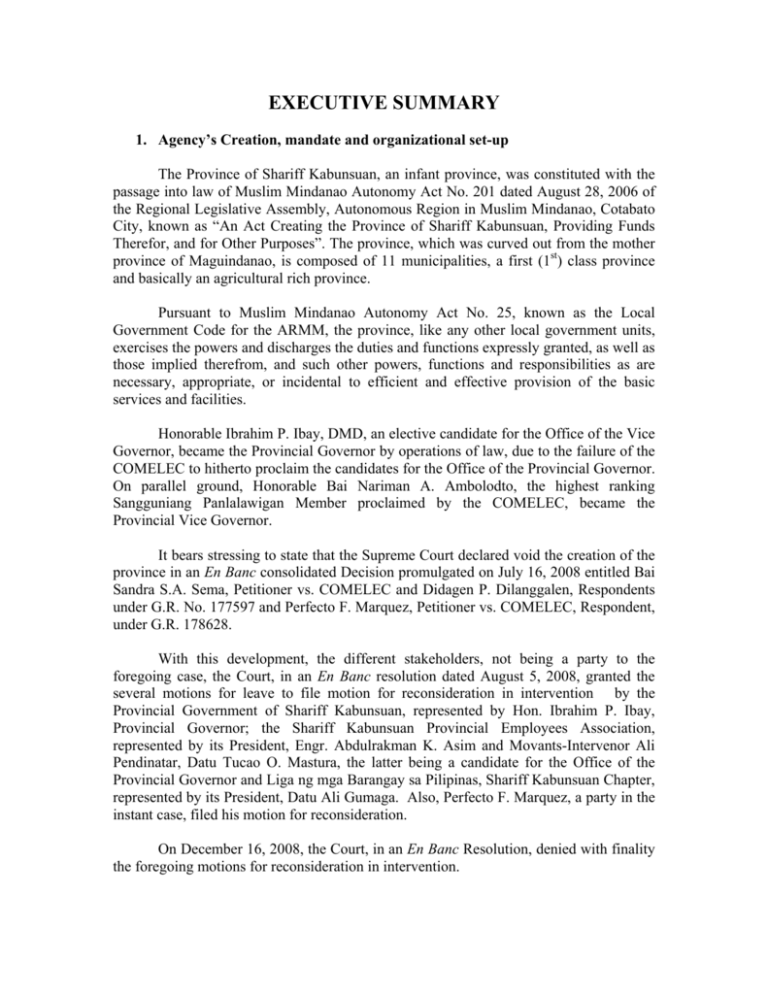

EXECUTIVE SUMMARY 1. Agency’s Creation, mandate and organizational set-up The Province of Shariff Kabunsuan, an infant province, was constituted with the passage into law of Muslim Mindanao Autonomy Act No. 201 dated August 28, 2006 of the Regional Legislative Assembly, Autonomous Region in Muslim Mindanao, Cotabato City, known as “An Act Creating the Province of Shariff Kabunsuan, Providing Funds Therefor, and for Other Purposes”. The province, which was curved out from the mother province of Maguindanao, is composed of 11 municipalities, a first (1st) class province and basically an agricultural rich province. Pursuant to Muslim Mindanao Autonomy Act No. 25, known as the Local Government Code for the ARMM, the province, like any other local government units, exercises the powers and discharges the duties and functions expressly granted, as well as those implied therefrom, and such other powers, functions and responsibilities as are necessary, appropriate, or incidental to efficient and effective provision of the basic services and facilities. Honorable Ibrahim P. Ibay, DMD, an elective candidate for the Office of the Vice Governor, became the Provincial Governor by operations of law, due to the failure of the COMELEC to hitherto proclaim the candidates for the Office of the Provincial Governor. On parallel ground, Honorable Bai Nariman A. Ambolodto, the highest ranking Sangguniang Panlalawigan Member proclaimed by the COMELEC, became the Provincial Vice Governor. It bears stressing to state that the Supreme Court declared void the creation of the province in an En Banc consolidated Decision promulgated on July 16, 2008 entitled Bai Sandra S.A. Sema, Petitioner vs. COMELEC and Didagen P. Dilanggalen, Respondents under G.R. No. 177597 and Perfecto F. Marquez, Petitioner vs. COMELEC, Respondent, under G.R. 178628. With this development, the different stakeholders, not being a party to the foregoing case, the Court, in an En Banc resolution dated August 5, 2008, granted the several motions for leave to file motion for reconsideration in intervention by the Provincial Government of Shariff Kabunsuan, represented by Hon. Ibrahim P. Ibay, Provincial Governor; the Shariff Kabunsuan Provincial Employees Association, represented by its President, Engr. Abdulrakman K. Asim and Movants-Intervenor Ali Pendinatar, Datu Tucao O. Mastura, the latter being a candidate for the Office of the Provincial Governor and Liga ng mga Barangay sa Pilipinas, Shariff Kabunsuan Chapter, represented by its President, Datu Ali Gumaga. Also, Perfecto F. Marquez, a party in the instant case, filed his motion for reconsideration. On December 16, 2008, the Court, in an En Banc Resolution, denied with finality the foregoing motions for reconsideration in intervention. 2. Highlights of Financial Operations Its assets, liabilities and government equity comparatively are as follows: CY 2007 Assets Liabilities Government Equity General Fund P 158,855,860.43 98,839,490.17 60,016,370.26 Trust Fund P 4,190,469.74 4,190,469.74 Consolidated P 163,046,330.17 103,029,959.91 60,016,370.26 CY 2008 Assets Liabilities Government Equity P 156,799,856.50 82,789,296.45 74,010,560.05 P 29,179,145.61 10,000.00 29,169,145.61 P 185,979,002.11 82,799,296.45 103,179,705.66 For calendar year 2008, the collections representing its share from the internal revenue allotment totaled to P447,901,818.12 and the real property tax and other income in the total amount of P204,530.43. It expended P434,112,158.76 out of the current year’s appropriations amounting to P435,734,159.00 for various functions, programs, projects and activities. 3. Scope of Audit A Financial and Compliance Audit as well as Value for Money Audit were conducted on the accounts and operations of the Province of Shariff Kabunsuan for calendar year ended December 31, 2008. The audit included the verification of the accounts in the financial statements based on the generally accepted auditing standards and evaluation of compliance with government accounting and auditing laws, rules and regulations. An evaluation as to whether efficiency, economy and effectiveness in its operation was also observed. 4. Auditor’s Opinion on the Financial Statements In our opinion, except for the effects of adjustments of the Cash in Bank-Local Currency Current Account and Construction and Heavy Equipment, the financial statements present fairly, in all material respects, the financial position of the Provincial Government of Shariff Kabunsuan as of December 31, 2008 and the results of its operations and its cash flows for the year then ended in conformity with applicable generally accepted accounting principles. 5. Significant Findings and Recommendations 9 The existence, accuracy and validity of the Cash in Bank-LCCA in the total amount of P2,993,078.91 could not be ascertained due to the failure to submit the bank reconciliation statements. Likewise, there were delays in the submission of financial statements, disbursement vouchers and payrolls, report of disbursements and other financial reports. We recommend that a particular personnel in the Office of the Provincial Accountant be assigned to prepare the monthly bank reconciliation statement for submission to the Office of the Auditor. Additional personnel be likewise assigned to meet the deadlines in the submission of the financial reports. Management commented that the bank reconciliation statements was prepared but not yet submitted to the Office of the Auditor. The same will be submitted as soon as possible per account. 9 The accuracy of the Construction and Heavy Equipment in the amount of P40,014,340.00 could not be ascertained due to the failure to regularly conduct inventories of said construction and heavy equipments. The conduct of inventory is a management duty which shall be undertaken at least once every year in the presence of the representative of the Office of the Auditor. Each construction and heavy equipment shall be recorded in the Property Card being maintained by the accounting department for each class of equipment/property to determine its acquisition, description, custody, estimated life, depreciation, disposal and other information about the equipment/property based on the source documents of the transactions. Management commented that the conduct of physical inventory of construction and heavy equipment is still in progress. The Office of the Provincial Accountant is still reconciling with the records as appearing the General Services Office. The latter, on the other hand, find it difficult to reconcile due to incomplete records transferred to this newly created province and the fact that there were three (3) changes of administration. 9 The accuracy of the income account out of the proceeds on real property tax in the total amount of P192,390.43 could not be ascertained due to the failure of the province to segregate the proceeds of one percent (1%) basic real property tax as against the additional collection of one percent (1%) tax on Special Education Fund. We recommend that the province shall establish and maintain the Special Education Fund to record collections pertaining to the additional one percent (1%) tax on real property pursuant to Section 309, par. a of RA 7160, otherwise known as the Local Government Code of 1991. This shall be appropriated by the Sangguniang Panlalawigan to meet the needs for the operation and maintenance of public schools based on the annual school board budget as determined by the Provincial School Board. Management commented that the Provincial Revenue Code was enacted on June 5, 2008 and took effect only sometime on the later part of the 3rd quarter of the year after its complete publication in a newspaper of general circulation, hence, the failure to establish and segregate the Special Education Fund. 9 Again, the value of the money as to efficiency, economy and effectiveness of the operation of the province pertaining to the development projects funded from its share in the internal revenue allotment could not until now be determined due to the failure of the province to segregate from the General Fund the disbursements made under the 20% Economic Development Fund. We reiterate our recommendation to open and maintain a special account under the General Fund, pursuant to Section 313 par. c of RA 7160, known as the Local Government Code of 1991. Management commented that, indeed, it was not segregated but the disbursements were duly accounted for. They had already made representations with the Sangguniang Panlalawigan but the authorization to open an account was obtained after a couple of months since it has more pressing matters to attend to, like the decision of the Supreme Court declaring the creation of the province void. 6. Status of Implementation of Prior Year’s Audit Recommendations Of the five (5) recommended remedial measures, One (1) was implemented, Three (3) were partially implemented and One (1) not implemented. 7. Subsequent Event After series of consultations between the officials and employees of the mother province of Maguindanao and the province of Shariff Kabunsuan and pending the entry of judgment and consequent writ of execution of the foregoing case, the latter agreed to withdraw their motion for reconsideration in intervention filed with the Supreme Court, in view of the appointment made by the Regional Governor-ARMM on January 26, 2009 of the following to the reconstituted Province of Maguindanao, to comprise the 1st district of Maguindanao (formerly the Shariff Kabunsuan Province) and the 2nd district of Maguindanao (Mother Province of Maguindanao), viz: 1. Hon. Datu Sajid Islam Uy Ampatuan – OIC Provincial Governor; 2. Hon. Datu Akmad M. Ampatuan, Sr., OIC-Provincial Vice Governor The OIC-Sangguniang Panlalawigan Members are as follows: First District: 1. 2. 3. 4. 5. Hon. Datu Russman Q. Sinsuat Hon. Asnawi S. Limbona Hon. Nashrullah A. Imam Hon. Nariman A. Ambolodto Hon. Talib M. Abo, Jr. Second District: 1. 2. 3. 4. 5. Hon. Datu Sarip K. Ampatuan Hon. Datu Puti M. Ampatuan Hon. Datu Nuali S. Ampatuan Hon. Borgiva Tasmi G. Datumanong Hon. Sultan Abbas A. Pendatun, Jr.