2014 salary guide - Kelly Services Australia

advertisement

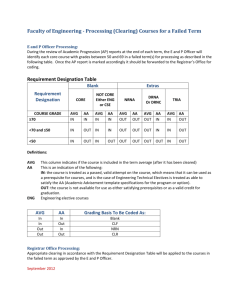

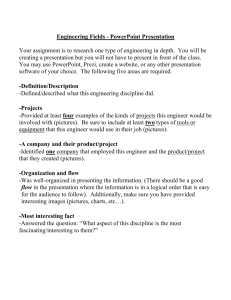

Kelly Services australiA and New Zealand 2014 salary guide april 2014 About the Kelly Services Salary Guide Å The Kelly Services 2014 Salary Guide is designed to provide both employers and job seekers with salary information on a wide range of roles, providing the ability to benchmark a role or an individual against other areas of expertise or against the same role in another area of the country. The Kelly Services 2014 Salary Guide covers both qualified and non-qualified roles across the Industrial, Accounting and Finance, Banking and Financial Services, Scientific, Engineering, Office Support, Professional Support, Call Centre and Information Technology (IT) industries. The guide also provides a location by location overview of the diverse Australian and New Zealand markets. ABOUT KELLY SERVICES Kelly Services is a recognised provider of world-class workforce solutions, offering an array of outsourcing and consulting services as well as staffing on a temporary, contract and permanent placement basis. Kelly Services has been leading the recruitment industry for over 60 years, setting the industry benchmark with unique and innovative recruitment and retention strategies. Headquartered in Troy, Michigan, US, Kelly serves clients in all major markets throughout the world, including more than 90% of the Fortune 500®. In Australia and New Zealand, Kelly Services is a formidable player in the local recruitment markets. An in-depth understanding of local talent issues and business needs, allows Kelly Services to tailor workforce solutions in accordance with client requirements. 2 Contents 4INTRODUCTION 5AUSTRALIA – NATIONAL OVERVIEW 6 Australian Capital Territory 7 New South Wales 8 Queensland 9 South Australia 27 Kelly Engineering Overview 28 Civil/Water/Rail/Power 10 Victoria 11 Western Australia 22 KELLY FINANCIAL RESOURCES 23 Kelly Financial Resources Overview 24 Accounting & Finance 25 Banking & Financial Services 26 KELLY ENGINEERING 29 Construction 30 Manufacturing/Process 12NEW ZEALAND 30 Mechanical 13 Auckland 30 Electrical 14 Christchurch 31 Mining, Resources 15 Wellington 32 KELLY IT RESOURCES SALARIES 33 Kelly IT Resources Overview 34 Information Technology 16COMMERCIAL 35 KELLY SCIENTIFIC RESOURCES 17 Office Support 36 Kelly Scienctific Resources Overview 18 Professional Support 37 Scientific 37 Regulatory Affairs 19 Call Centre 20 Industrial / Operations 37 Clinical Research Industrial / Trades 38 Sales and Marketing 38 Environment 21 39 Contact Details – Australia 40 Contact Details – New Zealand Methodology: Salary figures included in the 2014 Kelly Services Salary Guide are derived by combining the expert market knowledge of senior recruitment professionals within the Kelly Australia and New Zealand network with input from clients and the latest job placement data recorded on the Kelly Services database. 3 introduction Å The Australian economy is going through and a rebound in building and construction I am very confident that it will provide an a period of transition as it shifts from its activity in the wake of the devastating and essential resource for organisations of all types reliance on mining investment which has tragic 2011 earthquake in Christchurch. as they navigate this business landscape. In many ways, the pattern of the The guide provides a detailed look at salary two economies – so often in tandem levels across a range of occupations and – is somewhat divergent. roles in key sectors of the economy, as well been the driver of growth and prosperity for the last decade. This unprecedented spike in resources activity has dominated the country’s recent economic landscape and helped to cushion the nation at a time when the rest of the world was undergoing a severe downturn. As we enter a new phase of the economic Australia certainly enters 2014 with its strong record of economic achievement intact, but at a crossroads in some key areas. cycle, Australia faces some challenging For New Zealand, the year ahead will be issues. The country’s manufacturing sector buoyed by the resurgence in confidence that is experiencing the fallout from the mining is evident among consumers and business. as an analysis of the major trends that will influence employment and hiring activity. I trust that you will gain useful insights to help guide your activities over the coming year. boom as the huge increase in our terms of trade and the currency appreciation I am delighted to be able to present the weaken international competitiveness. 2014 Australia and New Zealand Salary Guide to help firms understand and Karen Colfer Across the Tasman, the New Zealand economy manage the trends that will shape our VP & Managing Director, is flourishing on the back of strong exports two countries over the period ahead. Kelly Services Australia and New Zealand 4 AUSTRALIA –national overview Australia’s recent stellar economic performance has had some of the gloss removed as it heads into 2014. Softer economic conditions and a rapidly changing business landscape are expected, on the back of declining resources investment and a challenging manufacturing outlook. Å Australia’s remarkable run of extraction and processing commence, but from the recent high value of the Australian recorded their lowest growth in economic growth is set to continue in with fewer jobs and no area of the non- dollar, competition from China, and 20 years at the start of 2014, a pattern that 2014 but at a more subdued pace and mining economy able to fill the gap. Australia’s relatively high cost base. is likely to prevail for the year ahead. employment and business activity. A sequence of shocks to the manufacturing The government has signalled an end Hiring intentions are firm, but full time sector has greeted the new federal to the era of industry assistance, and jobs have steadied with most of the Economic growth is tipped to slow government under Prime Minister Tony foreshadowed plans for large national growth in part time work. There are to slightly less than 3 per cent, with Abbott. In quick succession, Ford, Holden infrastructure investment and removal of also likely to be ongoing shifts, from unemployment to rise to 6.25 per cent.1 and Toyota each announced plans to business red tape, designed to promote manufacturing to services, and from mining cease manufacturing in Australia by private sector activity. These measures are construction to mining operations, as well The slower pace of activity stems from 2016-17, effectively marking the end likely to boost employment in construction as to the growing oil and gas sector. the end of the investment phase of the of local motor vehicle production. in major centres, while a pick up in dwelling against a backdrop of major shifts in commencements is also helping the While the country’s run of economic success expenditure in mining operations and a Added to that the national carrier, housing sector. Retail sales have recorded is set to continue, the latest chapter marks jobs stampede in the resource-rich states QANTAS announced significant job very strong growth at the start of 2014, the start of a period of transition to a new of Western Australia and Queensland. losses, while prolonged drought in NSW pointing to rising consumer confidence. phase of economic and business activity. resources boom which saw record capital and Queensland is impacting agricultural This boom in construction activity will production and rural employment. With inflation at less than 3 per cent there is now give way to the operations phase as Manufacturing is under sustained pressure no urgency for a rise in official rates. Wages 1 Mid-Year Economic and Fiscal Outlook. 5 AUSTRALIAN CAPITAL TERRITORY The prospect of significant cuts to the Canberra public service and the flow-on effects to business, consumers and the housing sector are likely to mean a weaker economic outlook and jobs market for 2014. Å Canberra’s cyclical dependence on the Housing and construction has already been fortunes of changing federal governments impacted. A surge over recent years in means that the next few years will likely residential building work has dropped off see it lose much of its recent economic and housing prices have fallen as demand buoyancy. Over recent years the ACT has weakened. Construction activity is also economy has grown faster than the weaker and there is likely to be less demand national average, sustained by the for rental space with several government country’s highest per capita income. agencies being amalgamated or closed. But the new federal government’s plans for The ACT’s relatively small workforce of big cuts to the public service mean that a some 200,000 has experienced weak disproportionate burden will fall on the ACT. recent employment growth, while job vacancies are low. Surprisingly its population It has been estimated that of the 14,000 jobs growth has surged, only slightly less than to be cut from the federal public service, as in Western Australia which has been a many as 6000 could come from Canberra.2 magnet for thousands of mine workers. The impact of public service pruning has One bright spot centres on the first a major impact on consumer sentiment, stage of a new light rail project to housing activity and even the private sector, commence in 2016 which will lift demand where a significant proportion is reliant for engineering and construction on transactions with government and professionals and which is expected to government agencies. Retail turnover has take up to three years to complete. noticeably dipped over the last 12 months. 2 Deloitte Access Economics. 6 NEW SOUTH WALES The NSW economy is being propelled by a rebound in business investment and a series of major infrastructure projects that are driving demand for a broad range of professional and skilled occupations. Å There has been a resurgence of activity in the construction, tourism and confidence and a return of economic commercial and residential sectors. activity in the NSW economy, and a marked improvement in demand for jobs across a range of occupations. Employment growth is forecast to be around trend and the unemployment rate is expected to remain Demand is strong for a wide range of occupations encompassing building and construction, civil engineering, architecture, design, consultancy and project relatively low, at around 5.5 per cent. management services. Stronger dwelling The more upbeat outlook is being felt demand for building and trades skills. across a number of important sectors, namely building and construction, IT and banking and financial services. Interestingly, NSW is also seeing a surge in activity in the high tech component (medical, biotech, commencements are also seeing increased The State’s strong presence in the banking and financial services is being aided by a more upbeat share market performance and increased demand for a range of aerospace) manufacturing space. financial planners, analysts and advisers. The biggest boost is coming from a series of IT services are also in strong demand and government funded infrastructure projects encompassing new rail connections, road upgrades, a light rail project in Sydney CBD and the refurbishment of the city’s entertainment and convention precinct. The $6 billion Barangaroo project on the western harbour foreshore, one of the largest ever undertaken in there are pockets of shortage across some of the high-end enterprise services needed for business restructuring and financial analysis. In the resources sector, planned coal expansion and the growing onshore gas sector are seeing demand for environmental and resource analysts, project managers and plant operators. Australia, will be a major generator of 7 QUEENSLAND Queensland has been a beneficiary of Australia’s two-speed economy with exceptional growth driven by investment in major projects centring on resources, but with a sharp fall off in construction investment, Queensland will need other sources of growth to fill the void. Å Queensland has reaped the rewards taken a toll on industries such as tourism, of sustained investment in resources and agriculture and manufacturing. major projects, but the tide is turning and the economy is facing a period of Economic growth is expected to dip during rebalancing away from resources. 2014 before the massive exports associated Investment in major projects work is forecast on stream over the next year and beyond. to decline by nearly 50 per cent to a trough of $9.5 billion in 2015-16.3 The fall will be led with recent coal developments and LNG come With the state government focussed on by mining and heavy industry construction. restoring the budget and with major flood The completion of major LNG facilities there is little public sector investment on the on Curtis Island and in the Surat Basin horizon, and a weak public sector jobs market. and the passing of the peak of the coal boom are expected to see about 8000 jobs disappear from these sectors. LNG operations and the onshore gas industry are generating demand for plant operators, project managers and technicians, as recovery reconstruction nearing completion, On the positive side, there is strong population growth and healthy home building activity which is lifting demand for a range of trades. The lower value of the dollar will be good for tourism, recreation well as environmental specialists. and accommodation which have had a One of the challenges will be in diversifying are on the rise following a series of reforms away from resources. The high Australian to the state’s tertiary education system. tough few years, while education exports dollar, cyclone and drought have all 3 Construction Skills Queensland and the Queensland Major Contractors Association. 8 SOUTH AUSTRALIA The loss of a manufacturing icon from South Australia and a relatively flat local economy have hit the South Australian economy, while government is under pressure to source projects to get the state moving. Å Economic activity in South Australia has unemployment rate rising from 5.7 to recently been soft and below the long term 6.6 per cent over the past 12 months. average. Both residential and non-residential Some regional areas face real difficulties building activity has been weak and public with chronic unemployment. sector investment has been cut back in line with the state government’s efforts to rein in a There is some optimism surrounding structural budget deficit. industrial construction which largely reflects The manufacturing sector has received a than new projects. blow with Holden’s announcement that it will stop manufacturing from 2017, resulting in a loss of about 6000 jobs. Only months earlier, BHP Billiton decided against the $30 billion open-pit expansion of the Olympic Dam a continuation of work in the pipeline, rather The state will also benefit from ongoing activity in the defence industry, including the construction of three air-warfare destroyers and maintenance of the Collins class copper mine. submarines. A decision on the next generation The South Australian Treasury expects intensely sought in South Australia. growth of 2.5 per cent in 2013/14 with some rise in housing market activity and of submarines is not too far off and is being Ironically, the loss of the venerable Holden household spending. plant could place South Australia in the Employment growth is predicted at only submarine contract if the federal government around 0.5 per cent. Overall the jobs decides to buy an Australian rather than a market remains relatively weak, with the foreign vessel. box seat to win the lion’s share of the new 9 VICTORIA Victoria has experienced a soft economy and a fair share of the downside from the latest shake-out in manufacturing, but the fundamentals are sound and the state should rebound as economic recovery gathers pace. Å Losing big manufacturing businesses is The first stage of the EastWest link is expected a rough way to start the year and Victoria to commence late in 2014 connecting the suffered a double blow with the planned Eastern Freeway and Western Ring Road is closure of Toyota’s car plant at Altona and worth an estimated $6-8 billion. the shutting down of the Alcoa aluminum smelter at Geelong. Also on the drawing board is the Metro Rail With about 30 per cent of the country’s inner core of Melbourne’s rail network. manufacturing in Victoria, the state is experiencing the downside from a high Australian dollar, weak commodity prices and competition from China. Economic growth in Victoria has been weak, advancing only 1.6 per cent over the previous year and not expected to improve much for the rest of 2014. A soft labour market has seen a gradual rise in the rate of unemployment to above 6 per cent. Capacity Project which will help untangle the Also on the positive side, strong population growth, a buoyant housing market and healthy retail sales all seem to defy the gloom that has shrouded the state’s immediate manufacturing prospects. The likelihood of continued low interest rates and some recent signs of an upturn in hiring activity should mean that the state is wellplaced to prosper once the broader economy moves more firmly into recovery. Business investment has also been subdued but a number of government infrastructure projects are helping to boost activity and jobs. 10 WESTERN AUSTRALIA The once-in-a-generation resources juggernaut has propelled Western Australia’s economy and generated enormous prosperity. That boom is now entering a new phase and while activity will be curtailed, there is still much to be confident about. Å The state that dominated the resources 20,000 extra workers, with projected skills boom is now in a period of transition as shortages across a range of engineering the construction phase gives way to mining and plant operations. operations, with less demand for jobs and a changed skills profile. Even with the shift in focus, the West Australian economy is forecast to remain Western Australia remains the country’s best buoyant and indeed the best performing performing economy, but growth will slip back across Australia over the next few years. In as the state confronts the “construction cliff”. particular, housing construction is growing It is estimated that some 75,000 workers will strongly following 2013 which saw the highest be displaced from the construction phase of number of new private housing approvals the mining over 2014–2018, most of them since 2006. from Western Australia and Queensland. This will impact mainly trade skills – electricians, Surging net migration, strong wages growth, plumbers, carpenters and joiners. high levels of consumer sentiment, a lift in In their place, will be demand for mine underpinning the West’s economic strength. workers, plant operators and drivers but this phase is less labour intensive and will need approximately 17,000 additional workers Australia wide. home purchases and robust retail sales are all Other sectors which are forecast to do well and help fill the mining void are agriculture, tourism and international education. Fortunately, the LNG sector is taking off at the right time and will need more than 11 new zealand – national overview New Zealand’s economy is experiencing a remarkable turnaround as a flourishing agricultural sector and a major reconstruction program see the country emerge from a protracted downturn. Å New Zealand has emerged from a this has been bolstered by a significant highs. This confidence is being deep recession with its economy roaring rise in commodity prices which is lifting attributed, in part, to a series of structural out of the blocks in 2014 with a powerful the terms of trade and hence the value reforms including tax reform, free trade rebound in business investment, primary of the New Zealand dollar. Retail sales agreements, sale of public assets and production and consumer spending. are up about 4 per cent over the year. reduction in the size of government. After a recession that started in 2008, Construction activity has advanced strongly New Zealand jumped five places to 18th the economy is set to grow by 3 per cent on the back of the building and reconstruction spot on the World Economic Forum’s Global in 2014, although some private sector work taking place in Canterbury in the wake of Competitiveness Index for 2014, overtaking economists are predicting a figure of around the 2011 Christchurch earthquake. The rebuild Australia which slipped one place to 21st. 4 per cent. The upturn began in earnest is forecast to contribute fully one-third of GDP in the second half of 2013, driven by a lift in 2014. Improving house prices are bolstering All the signs point to a stronger year for in agricultural production and exports in consumer confidence and retail sales. employment and hiring activity, after several years where the private sector the wake of the previous year’s drought. The pace and strength of New Zealand’s has marked time. This could also see Output in the critical agriculture, forestry turnaround is reflected in business some upward pressure on salaries. and fisheries category has surged, and confidence levels which are at historic 12 Auckland New Zealand’s biggest city is reaping the benefits of the resurgence in the broader economy and is seeing a marked turnaround in business activity as well as an influx of people returning to share the prosperity. Å Auckland will be the centre of much of Wages are growing in line with inflation the heightened business activity and but the population influx will help to employment growth that is anticipated keep a lid on excessive wages growth. over the coming year. Like all major financial and business centres, Auckland’s dominant position in the national there is steady demand for professionals economy and the broad based recovery across banking and financial services, IT and that is underway means that there will be property services. In particular high skilled demand for positions across wholesale and people in Science, Technology, Engineering retail trade, transport and storage, housing and Mathematics (STEM) disciplines are and construction and business services. in demand and command a premium. The city is experiencing strong net Manufacturing activity is also strengthening migration as the population swells to take in the Auckland area and will be advantage of the improved circumstances. likely to lead to increased hiring. That will be positive for employment participation, retail sales and housing. The coming year should be a buoyant one for Already there is a shortage of housing when it comes to increasing headcount, stock in the city, which has helped to simply because businesses have been in such push up prices and, in turn, spurred on a risk averse mindset for such a long time. increased dwelling construction. Non- the city. The take-off may be somewhat muted residential construction is also strong. However, once confidence gathers The population growth in the city means tone for the rest of the country, and that skills shortages are likely to be lessened. so far all the signs are positive. steam, Auckland is likely to set the 13 Christchurch The massive reconstruction exercise associated with the Christchurch earthquake is rebuilding the local community as well as underpinning the national economy. Å Christchurch endured enormous human The spike in activity is fuelling demand for and financial loss in the 2010 and 2011 a wide range of tradespeople including earthquakes and is now at the centre of builders, plumbers, electricians, plasterers and a rebuilding program that is powering a tilers as well as for construction managers, nationwide economic revival. planners, designers, drivers, engineers and telecommunications specialists. The construction effort in the Canterbury region of the South Island has a revised price tag of $40 billion – equal to about 20 per cent of annual GDP. Growth in Canterbury of more than 6 per cent annually outstrips every other region and is the dominant item in national economic data as well as the main driver of skills and jobs. The effects are spilling over to a wide range of firms in the South Island where hiring intentions are stronger than they have been for some years. There is a surge in the number of workers attracted to the region. There are skills shortages in some of these occupations resulting in skills being sourced from Australia, the UK and elsewhere. There is also pressure on wages across a range of these roles. The region will be the focus on national efforts for several years meaning that opportunities for re-skilling, up skilling or training should provide job pathways for those wanting to enter the trades. For professionals in construction, property and engineering it is likely to be a period of steady activity. It is generating strong growth in housing For the region more generally, the rebuild approvals, commercial building approvals, is underwriting a robust commercial retail sales and new car sales. The shortage of environment for materials suppliers, housing stock is also pushing up home prices. manufacturers and retailers. 14 Wellington The national capital is sharing in the country’s economic recovery even though a decline in the public sector means that government jobs and programs are being placed on the backburner. Å Wellington has joined the rest of New forecast for the broader economy over the Zealand in reaping the spoils of the economic next few years. Positions in government- recovery which hatched in the second half of related fields will become more in demand 2013. While the capital’s prospective growth including specialist managers, HR, legal may be a little more subdued than elsewhere, professionals, IT and administrative staff. the momentum is gathering. Telecommunications is also forecast to grow more strongly over the next few years as It has been a difficult few years in the city demand for services expands. under the weight of government cutbacks that have seen jobs disappear. This has flowed Professional, scientific and technical services through to weak retail spending and subdued make up a relatively large contribution to employment activity across the board. the city’s workforce. There is also a push to attract more creative and knowledge-based Housing price rises have also been more businesses as part of a strategy to diversify the tempered than elsewhere in the country. economic base. However population movements and work associated with the Christchurch quake After several years of stagnant conditions repairs are giving a lift to the non-residential in Wellington, the coming year will deliver building sector. more robust economic activity. The September election will add its own fervour The city is expected to grow a little more to the economic fabric, but will not alter the slowly than the 3-4 per cent annual rate momentum that is now underway. 15 Kelly Services: Salaries office support professional support call centre industrial 16 office support ACT LOW HIGH NSW AVG LOW HIGH QLD AVG LOW HIGH SA AVG LOW high VIC AVG LOW HIGH WA AVG LOW HIGH AUK AVG LOW HIGH CHCH AVG LOW HIGH WEL AVG LOW HIGH AVG ADMINISTRATION Administration Assistant 44 60 48 40 65 50 38 50 45 40 50 45 37 60 45 45 60 53 40 60 45 36 48 42 38 50 Data Entry Operator 38 50 42 35 50 40 35 48 40 38 45 40 35 45 40 40 50 45 35 50 40 36 41 39 38 45 41.5 44 Executive Assistant (EA) 50 85 65 60 120 70 55 75 60 65 90 77 65 110 70 60 95 80 50 100 70 50 80 65 50 90 55 Human Resources Assistant 45 65 55 50 65 55 45 55 50 46 55 50 52 67 55 45 55 53 50 60 55 50 60 55 50 65 55 Human Resources Co-ordinator 50 70 60 48 55 50 48 65 55 60 75 70 55 65 60 60 70 52 50 75 62 50 60 55 50 60 55 Marketing Assistant 45 60 54 45 60 50 45 55 50 45 55 50 45 65 58 40 55 48 45 60 50 40 50 48 50 60 55 Marketing Coordinator 50 68 56 40 55 45 48 65 60 50 65 57 48 68 58 45 65 55 45 70 52 35 45 40 40 65 55 Office Manager 50 75 60 45 75 65 50 75 65 60 75 65 57 83 70 60 80 70 50 80 60 45 60 53 50 75 60 Personal Assistant (PA) 50 80 60 50 85 65 55 65 60 50 70 60 55 80 65 55 85 70 45 75 60 50 60 55 50 70 57.5 Project Administration 43 65 52 50 80 55 48 65 55 48 65 55 50 80 70 60 85 78 45 65 55 40 55 48 50 65 57.5 Project Coordinator 43 72 55 47 65 48 50 90 70 52 80 66 60 90 80 70 90 80 45 70 55 45 55 50 50 65 57.5 Receptionist 42 55 48 35 65 47 35 48 42 38 55 48 40 58 50 40 60 50 37 60 45 30 40 35 40 50 Secretary - General 48 63 53 50 65 52 45 60 55 50 60 55 45 65 54 50 65 60 45 60 50 45 55 50 50 65 57.5 45 Secretary - Senior 60 85 70 55 75 58 45 60 55 55 70 62 55 82 67 60 72 68 50 70 57 48 60 54 55 70 62.5 Switchboard Operator 38 45 40 35 50 40 38 48 40 40 50 45 40 57 50 50 56 52 37 50 42 35 40 38 45 60 52.5 Team Coordinator 44 60 48 45 60 48 45 55 50 48 60 54 45 65 58 60 70 65 40 55 48 40 55 48 40 55 47.5 WP Operator 38 55 42 35 50 40 40 50 45 43 53 48 40 53 45 42 52 45 40 55 45 40 50 45 45 60 52.5 17 All salaries are $‘000s. Figures are base salary not including superannuation. professional support ACT LOW HIGH NSW AVG LOW HIGH QLD AVG LOW HIGH SA AVG LOW high VIC AVG LOW HIGH WA AVG LOW HIGH AUK AVG LOW HIGH CHCH AVG LOW HIGH WEL AVG LOW HIGH AVG ACCOUNTING AND FINANCIAL Accountant (Non Qualified) 50 70 60 45 65 65 50 70 65 50 70 58 51 81 65 55 75 65 50 75 60 60 70 65 60 75 67.5 Accounts Clerk 45 60 48 38 55 50 42 55 50 44 50 47 39 56 50 45 60 53 40 47.5 45 40 50 45 45 60 52.5 Accounts Payable (0-2 yrs) 45 55 47 45 55 50 42 48 45 40 45 43 41 61 48 43 55 48 40 52 47.5 40 50 45 45 57.5 52 57 Accounts Payable (3-6+ yrs) 50 65 58 48 60 52 45 55 50 45 55 50 51 66 55 50 65 57 44 55 50 45 55 50 48 60 Accounts Receivable (0-2 yrs) 45 53 47 45 55 50 42 48 45 40 45 43 41 56 52 45 60 52 40 52 47.5 40 50 45 45 58 57.5 Accounts Receivable (3-6+ yrs) 50 58 53 48 65 55 45 55 50 45 55 50 51 71 60 50 65 55 45 55 50 45 50 48 53 60 Accounts Supervisor 50 76 62 55 75 70 48 70 60 55 75 60 66 86 75 60 70 65 50 70 62 50 70 65 60 75 67.5 58 Assistant Accountant 50 70 60 45 70 65 50 65 60 50 70 60 41 71 60 58 70 65 50 70 60 50 65 58 65 72.5 70 Bookkeeper 45 70 58 50 70 55 48 65 55 50 65 55 51 76 65 60 80 70 50 75 62 60 70 65 50 75 72.5 Collections Officer 45 58 46 46 65 52 42 60 55 44 55 50 46 66 55 50 65 57.5 40 60 45 40 50 45 50 65 57.5 Credit Controller 50 70 55 50 70 62 48 60 55 55 65 55 51 71 60 48 60 50 80 57.5 45 55 53 50 75 57.5 56 Credit Manager 60 85 70 65 80 75 55 65 60 70 100 80 61 96 75 70 90 80 60 90 67.5 60 70 65 60 65 57.5 Credit Officer 45 55 50 45 65 50 45 55 50 44 55 50 46 66 55 55 65 60 45 60 50 45 55 50 50 65 57.5 Credit Supervisor 52 72 62 55 70 65 50 60 55 55 65 60 66 86 70 60 70 65 50 65 57.5 50 60 55 50 65 57.5 Data Entry Clerk 45 48 46 35 50 42 35 48 45 38 45 42 39 56 47 40 60 50 35 50 40 30 40 35 38 45 41.5 Payroll Manager 65 85 70 60 150 80 60 80 70 65 100 75 76 112 85 70 90 80 55 80 70 50 70 60 55 80 70 Payroll Officer 50 63 56 45 50 50 65 58 50 60 51 60 55 70 63 45 75 60 40 55 48 50 70 55 65 65 76 Payroll Supervisor 55 70 60 55 85 65 55 70 65 60 70 65 66 91 75 65 75 70 50 85 65 50 65 58 52 85 58.5 Procurement/Purchasing Officer 50 65 55 46 75 56 48 65 55 50 80 60 56 81 65 60 90 75 60 80 75 60 75 67 60 80 70 Reconciliations Officer 45 60 56 45 65 55 42 55 50 50 70 60 46 61 55 50 60 55 45 60 55 40 48 44 45 58 52 18 All salaries are $‘000s. Figures are base salary not including superannuation. call centre ACT LOW HIGH Call Centre Manager 50 90 NSW QLD SA AVG LOW HIGH AVG LOW HIGH AVG 65 60 120 75 60 100 75 LOW high 60 90 VIC AVG 75 LOW HIGH WA AUK CHCH WEL AVG LOW HIGH AVG LOW HIGH AVG LOW HIGH AVG LOW HIGH AVG 75 155 105 70 100 85 70 120 90 70 100 85 70 120 90 Customer Service Rep – inbound 35 46 40 40 55 45 35 48 43 40 47 43 40 50 45 45 55 50 33 44 38 32 40 36 33 44 38 Customer Service Rep – outbound 35 50 40 40 60 48 38 48 43 40 50 45 40 60 47 50 60 55 35 50 41 34 42 38 35 50 41 Helpdesk Level 1 42 53 43 34 60 45 40 48 45 45 55 50 45 68 55 52 60 56 38 52 42 35 45 40 38 52 42 Team Leader/Manager 50 65 60 55 85 60 48 60 55 55 75 65 60 77 65 60 75 67.5 Workforce Analyst 53 85 65 50 85 65 50 70 60 60 75 70 50 77 64 70 90 82 Workforce Planner 50 100 70 50 100 70 50 80 65 58 80 66 52 96 70 70 90 80 50 65 60 50 70 60 50 65 60 47.5 80 65 45 55 50 47.5 80 65 50 100 70 50 70 60 50 100 70 19 All salaries are $‘000s. Figures are base salary not including superannuation. industrial / operations ACT LOW HIGH Dispatch/Receiving Supervisor Inventory Controller NSW AVG 46 58 52 50 65 55 LOW HIGH QLD AVG 55 65 60 55 75 LOW HIGH 40 65 SA AVG 50 LOW HIGH VIC AVG 50 75 62.5 65 57.5 LOW HIGH WA AVG 55 70 65 55 70 60 LOW HIGH AUK AVG 45 55 50 50 60 55 LOW HIGH 45 60 40 CHCH AVG 55 LOW HIGH 45 60 WEL AVG 55 LOW HIGH 45 60 AVG 55 65 40 65 50 50 60 50 40 60 50 40 60 50 90 130 110 50 95 72 70 110 90 90 130 100 75 150 105 65 150 90 65 150 90 65 150 90 85 100 130 110 70 90 80 70 120 95 100 130 110 75 150 105 65 150 95 65 150 95 65 150 95 Manufacturing Manager 80 130 100 80 120 100 65 100 80 75 130 102.5 90 130 110 70 140 100 65 140 85 65 140 85 65 140 85 Operations Manager 90 150 120 90 130 110 65 120 90 75 130 102.5 90 130 100 65 135 70 135 80 70 135 80 70 135 80 Logistics Manager Maintenance Manager Procurement Manager Production Manager Production Supervisor 85 120 103 75 120 90 85 150 110 80 150 100 65 90 80 70 110 90 90 150 120 80 160 120 80 200 100 70 150 100 80 200 100 70 100 80 80 120 100 65 100 80 70 110 90 80 120 90 75 140 100 80 140 85 65 120 85 80 140 85 55 65 60 48 62 55 60 80 55 50 65 50 60 50 65 75 80 70 75 80 67.5 90 82 72 75 70 75 Quality Assurance Manager 55 85 65 65 80 65 50 80 65 80 100 90 70 110 80 60 90 75 50 105 70 50 105 70 50 105 70 Quality Assurance Representative 45 63 48 45 65 50 48 65 55 60 80 70 55 70 60 56 63 59 40 65 50 40 65 50 40 65 50 Storeperson 38 50 43 40 55 45 38 55 45 42 55 48.5 40 60 50 40 52 46 35 50 40 35 50 40 35 50 40 Transport Allocator 55 66 60 55 75 65 45 64 55 50 60 50 110 60 42 60 52 40 60 45 40 60 45 40 60 45 Transport Manager 73 102 87 85 120 100 55 95 70 65 100 82.5 85 130 100 70 100 85 70 100 80 70 100 80 70 100 80 Warehouse Manager 60 93 75 70 100 85 50 90 70 60 100 70 110 90 65 85 75 65 130 95 65 100 82 65 130 95 Warehouse Supervisor 48 67 58 55 65 48 78 65 50 65 75 55 70 63 55 60 55 60 55 60 70 55 80 75 62.5 90 75 75 75 20 All salaries are $‘000s. Figures are base salary not including superannuation. industrial / trades ACT LOW HIGH Boiler Maker 53 72 NSW AVG 63 LOW HIGH 55 70 QLD AVG 65 LOW HIGH 50 90 SA AVG 80 LOW HIGH 55 VIC AVG 80 67.5 LOW HIGH 60 85 WA AUK AVG LOW HIGH AVG 70 55 105 70 LOW HIGH 50 95 CHCH AVG 65 LOW HIGH 50 95 WEL AVG 65 LOW HIGH 50 95 AVG 65 Diesel Plant Fitter 65 85 70 65 75 70 50 90 80 55 90 72.5 65 90 75 63 120 75 60 100 70 60 100 70 60 100 70 Electrical Fitter 65 95 73 65 85 70 55 90 80 55 90 72.5 70 85 75 65 92 75 60 85 75 60 85 75 60 85 75 Electrician 'A' Class 65 95 73 65 80 75 50 90 80 55 90 72.5 75 110 85 70 120 90 60 110 75 60 110 75 60 110 75 Electrician Special Class 65 95 75 75 100 85 80 120 90 60 90 HVAC Refrigeration Technician 60 72 62 60 75 65 55 68 65 90 77.5 75 75 80 120 100 75 120 95 65 120 85 65 120 85 65 120 85 70 55 70 50 60 50 60 50 60 95 75 95 95 95 95 Maintenance/Mechanical Fitter 55 83 67 60 75 70 50 100 80 50 80 65 70 90 80 58 100 72 50 100 70 60 100 80 45 100 70 Service Manager 55 75 67 75 100 85 55 90 70 60 90 75 70 85 75 63 96 72 55 95 75 55 95 75 55 95 75 Service/Field Technician 58 76 67 60 75 48 85 60 60 85 72.5 60 80 70 50 90 70 45 80 65 45 80 65 45 80 65 80 Trades Assistant 40 60 45 48 55 50 40 70 45 45 55 50 50 70 60 45 80 58 35 55 40 35 55 45 35 55 40 (Second Class) Welder/Fabricator 45 53 48 50 60 55 50 85 60 50 80 65 55 75 65 52 86 65 45 60 50 45 60 50 45 60 50 21 All salaries are $‘000s. Figures are base salary not including superannuation. Kelly Financial Resources: Salaries accounting & finance banking & financial services 22 Kelly financial Resources overview Accounting and Finance Banking & Financial Services An influx of international students graduating The intense battle for the consumer savings In the mortgage space there has been signs in accounting has swelled the ranks of the dollar has played out in a dramatic way over of a significant rebound over the past 6-12 accounting profession and provided abundant the planned watering down of the former months with interest rates remaining low. choice to employers. Hiring activity is likely Labor government’s FOFA (Future of Financial New market entrants such as Yellow Brick to remain steady throughout 2014, with Advice) reforms. The proposed lifting of some Road, Bank of Tokyo funding AMP and even little advance in salary levels. While supply of the proposed restrictions on financial advice Macquarie Bank are driving demand for will meet needs in the major capital cities, is likely to be positive for hiring. Bankers exceptional lenders and BDM’s in the sector. shortages are common in some rural and and financial planners with strong customer As a result salary levels for BDM’s in particular regional areas. focussed skills are likely to be in demand remain healthy. although salaries will only grow modestly. At the upper level, there is ongoing demand The business, corporate and institutional for professionals with knowledge and There are signs of increased financial planning banking sector has seen renewed hiring experience in business critical areas including mergers and acquisitions stimulated by the activity, based on cautious, yet increasing project management, cost control, financial measures. Across all areas, bankers and business confidence across corporate analysis and commercial finance. There is planners with experience, good contact lists Australia. Areas such as project and likely to be strong demand for those with and sales skills will be highly sought. corporate finance are also starting to direct experience in property, construction and hire again with anticipated increases in infrastructure as a number of major projects infrastructure investment. come on line. 23 accounting & finance Australia only figures LOW HIGH Accountant 60 90 Australia only figures AVG 75 LOW HIGH AVG Audit Manager 100 140 120 85 Accounting Manager 80 120 100 Auditor 70 100 Accounts Administrator 45 60 52.5 Business Analyst 80 110 95 Accounts Payable Manager 65 85 75 Chief Financial Officer 160 220+ 200 Accounts Payable Officer 35 45 40 Entry Level/ Graduate Accountant 45 65 55 Accounts Payable Supervisor 55 70 62.5 Finance Director 140 200 170 Accounts Rec./Credit Manager 70 100 85 Financial Accountant 80 120 100 Accounts Rec./Credit Supervisor 60 85 72.5 Financial Analyst 85 130 107.5 Accounts Recivable Officer 40 60 50 Financial Controller 140 180 160 Assistant Accountant 45 65 55 24 All salaries are $‘000s. Figures are base salary not including superannuation. banking & financial services Australia only figures LOW HIGH Australia only figures AVG Branch Staff LOW HIGH AVG Risk and Compliance Bank Teller 37 60 45 Credit Analyst 75 110 90 Branch Manager 75 120 90 Senior Credit Analyst 85 120 105 Customer Service Consultant 35 60 45 Credit/Risk Manager 110 150 130 Senior Credit/Risk Manager 130 180 160 Loan Administration Manager 80 110 90 Compliance Analyst 75 90 85 Retail Banking Loans Officer 45 70 60 Compliance Manager 90 140 115 Mobile Banker 65 95 80 Senior Compliance Manager 130 170 150 Business Development Manager 120 160 135 Insurance Personal Banker 60 85 70 Claims Assessor 45 70 60 Document Prep/ Settlements 45 65 55 Claims Manager 70 120 85 Senior Claims Manager 85 135 110 Business & Corporate Banking Assistant Manager 70 95 85 Insurance Clerk 40 60 50 Relationship Manager/Banker 90 130 115 Insurance Underwriter 50 85 70 Senior Relationship Manager 130 180 155 Senior Insurance Underwriter 65 100 85 Business Development Manager 140 180 155 Underwriting Manager 90 140 120 Regional Manager 170 230 190 Wealth Management State Manager/GM 230 300 260 Para Planner 50 80 65 Financial Planner 75 125 100 Analyst 80 110 95 Senior Financial Planner/CFP 85 140 120 Associate 90 130 110 Practice Manager 120 170 145 Senior Associate 110 140 125 Dealership Manager 130 210 180 Manager 120 160 140 Private Banking - Relationship Manager 85 125 110 Associate Director 160 230 180 Operations Director 230 320 275 Officer 40 60 50 Managing Director 300 400+ 350 Team Leader 60 80 70 Operations Manager 75 100 85 Officer 40 60 50 Senior Manager 85 140 120 Team Leader 60 80 70 Manager 80 110 90 Senior Manager 110 150 130 Corporate Finance/Advisory Financial Markets (FX/MM/Derivs/Fixed Income) 25 All salaries are $‘000s. Figures are base salary not including superannuation. Kelly Engineering: Salaries Civil Engineering and Infrastructure Construction Architecture Mechanical and Electrical 26 Kelly engineering overview Construction Architecture Mechanical and Electrical The fall in mining related construction activity The outlook for architectural engineering relies The outlook for the mechanical and electrical Civil and infrastructure activity is likely to be from its recent peak will dominate activity predominately on the commercial construction sector is fairly subdued as a result of overall patchy over the year ahead, with significant in engineering construction and result in market, which is forecast to remain relatively weakness in Australia’s manufacturing industry. falls in planned private capital expenditure some excess capacity. Queensland and stable over the coming year but with some offset by some hotspots of activity around Western Australia will bear the brunt of the marked variation across the states. Despite Some opportunity exists thanks to a range particular projects. Private sector investment resources sector tapering but the next phase the tough retail market, there is a fair degree of commercial, retail and residential projects spending is projected to fall 17 per cent to of resources investment in LNG is about of retail refurbishment, while investment in and in the small pockets of manufacturing $125 billion in 2014-15. to accelerate. Activity in commercial and wholesale and distribution continues. that are seeing growth, such as aerospace and Civil Engineering and Infrastructure 5 precision engineering. residential construction is reasonably strong A number of government infrastructure in several of the capital cities. Even with the Investment in offices is being led by Sydney’s projects, particularly in terminal and weaker project pipeline, the industry is still Barangaroo South but elsewhere activity is The end of the construction phase of mining, facilities are soon to commence and the predicting relatively strong employment leaner due to consolidation and a shift to and the imminent end of car making in Commonwealth government has signalled demand due to a few large-scale projects and smaller space and shorter leases. Australia means that demand will continue to a new round of infrastructure investment. continued skill shortages in some areas.6 soften for mechanical and electrical engineers, Engineering work in the telecommunications Health and aged care is a bright spot with a however utilities and waste services operations sector is forecast to remain reasonably strong, large number of hospital projects underway. are expected to deliver reasonably strong even with the scaled back NBN plans. Industrial construction is predicted to hold firm activity levels and drive demand over the at current levels ahead of a resurgence over coming year. the next few years. 5 6 ABS, Private New Capital Expenditure and Expected Expenditure, Australia, Dec 2013. Australian Industry Group/Australian Constructors Association Construction Outlook Survey. 27 engineering Australia only figures LOW HIGH Australia only figures AVG ENGINEERING – CIVIL/WATER/RAIL/POWER LOW HIGH AVG Estimator 75 130 120 Cadet / Engineer 40 60 50 Snr Estimaor 120 175 135 Site Engineer (2-5 years) 65 80 70 Chief Estimator 160 230 175 Site Engineer (5+ years) 80 95 85 Leading Hand 55 88 70 Project Engineer 80 120 100 Supervisor 75 95 80 Snr Project Engineer 120 145 130 Foreman 85 125 100 Junior Project Manager 75 100 85 General Foreman 120 150 130 Project Manager 130 170 145 HSE Advisor 75 90 80 Snr Project Manager 160 200 170 HSE Manager 90 160 120 Construction Manager 170 250 200 Procurement Manager 75 130 110 Cadet / Contracts Administrator 40 60 50 Plant Manager 90 130 105 Contracts Administrator (2-5 years) 60 80 70 Quality Manager 85 125 100 Contracts Administrator (5+) 90 130 110 Quantity Surveyor 75 130 100 Snr Contracts Administrator 120 150 130 Environmental Engineer 75 130 100 Commercial Manager 150 230 180 Environmental Manager 140 180 150 Design Manager 125 180 145 Planner 135 220 150 Cadet / Estimator 35 60 45 28 All salaries are $‘000s. Figures are base salary not including superannuation. engineering continued Australia only figures LOW HIGH Australia only figures AVG ENGINEERING – CONSTRUCTION LOW HIGH AVG Contracts Manager 120 175 135 Architect (0-2 years) 43 50 45 Commercial Manager 150 220 165 Architect (2-5 years) 45 65 60 Operations Manager 170 260 200 Architect (5-10 years) 60 110 100 Design Manager 125 180 145 Architectural (10+ years) 100 160 130 Cadet / Estimator 35 60 45 Architectural Designer 60 100 85 Estimator 75 130 110 Architectural Drafter 45 70 65 Snr Estimaor 120 175 135 Building Surveyor 75 110 80 Chief Estimator 150 220 165 Cadet / Engineer 35 60 45 Leading Hand 55 88 70 Site Engineer (2-5 years) 65 90 75 Foreman 90 130 110 Site Engineer (5+ years) 90 130 110 Site Manager 120 150 130 Project Engineer 100 165 120 Facilities Manager 75 110 90 Snr Project Engineer 140 200 165 HSE Advisor 75 90 80 Junior Project Manager 75 100 85 HSE Manager 130 200 150 Project Manager 90 160 130 Procurement Manager 75 130 110 45 Snr Project Manager 125 200 150 Structural Engineer (0-2 years) 40 50 Construction Manager 170 250 200 Structural Engineer (2-5 years) 60 75 70 Cadet / Contracts Administrator 35 60 45 Structural Engineer (5-10 years) 80 120 100 Contracts Administrator (2-5 years) 75 110 90 Structural Engineer (10+ years) 100 150 130 Contracts Administrator (5+) 90 130 110 Surveyor 75 135 95 Snr Contracts Administrator 115 150 130 29 All salaries are $‘000s. Figures are base salary not including superannuation. engineering continued Australia only figures LOW HIGH Australia only figures AVG ENGINEERING – MANUFACTURING/PROCESS LOW HIGH AVG ENGINEERING – MECHANICAL Instrumentation & Electrical Engineer (0-2 years) 50 60 55 Electrical Engineer (0-2 years) 40 50 Instrumentation & Electrical Engineer (2-5 years) 65 75 70 Electrical Engineer (2-5 years) 60 75 45 70 Instrumentation & Electrical Engineer (5-10 years) 90 110 100 Electrical Engineer (5-10 years) 80 120 100 Instrumentation & Electrical Engineer (10+ years) 120 150 130 Electrical Engineer (10+ years) 100 150 130 Manufacturing Engineer (0-2 years) 50 60 55 Electronics Designer 65 90 75 Manufacturing Engineer (2-5 years) 65 70 65 Electronics Drafter 50 90 75 Manufacturing Engineer (5-10 years) 85 110 95 Mechanical Designer 65 90 75 Manufacturing Engineer (10+ years) 100 120 111 Mechanical Drafter 50 90 75 Plant Engineer (0-2 years) 55 65 60 Mechanical Engineer (0-2 years) 40 50 45 Plant Engineer (2-5 years) 65 70 67 Mechanical Engineer (2-5 years) 60 75 70 Plant Engineer (5-10 years) 80 100 90 Mechanical Engineer (5-10 years) 80 120 100 100 150 130 55 50 Plant Engineer (10+ years) 100 130 120 Mechanical Engineer (10+ years) Production Engineer (0-2 years) 50 60 55 ENGINEERING – ELECTRICAL Production Engineer (2-5 years) 65 75 70 Electrical Engineer (0-2 years) 45 Production Engineer (5-10 years) 75 100 95 Electrical Engineer (2-5 years) 60 75 70 Production Engineer (10+ years) 100 130 120 Electrical Engineer (5-10 years) 80 150 100 Electrical Engineer (10+ years) 100 180 150 30 All salaries are $‘000s. Figures are base salary not including superannuation. engineering continued Australia only figures LOW HIGH Australia only figures AVG ENGINEERING – MINING, RESOURCES LOW HIGH AVG Environmental Officer 90 155 140 Graduate Engineer 55 85 60 Environmental Manager / Superintendent 145 200 170 Mining Engineer 110 150 120 Maintenance Planner 90 135 120 Drill & Blast Engineer 105 130 115 Maintenance Superintendent 140 180 150 Surveyor 90 135 110 Maintenance Manager 170 220 190 Project Manager 120 200 180 Electrical Engineer 90 160 130 CHPP Manager 170 230 195 Mechanical Engineer 90 155 130 Mine Manager 180 250 220 Engineering Manager 150 210 180 Mine Planning Engineer 95 165 125 Workshop Supervisor 120 150 130 Technical Services Manager 160 210 185 Open Cut Supervisor 115 165 135 Deputy 110 150 130 Underground Supervisor 120 175 145 Undermanager 140 180 160 Contracts Administrator 100 160 135 Open Cut Examiner 135 180 150 Contracts Manager 150 240 190 Production Superintendant 140 180 160 Planner 120 145 125 OH&S Manager 120 160 140 Senior Planner 145 200 165 OH&S Coordinator 90 130 120 Estimator 115 150 135 Mine Geologist 90 145 115 Senior Estimator 150 210 170 Senior Geologist 130 170 155 Construction Manager 150 225 190 31 All salaries are $‘000s. Figures are base salary not including superannuation. Kelly IT Resources: Salaries information technology 32 Kelly IT Resources overview information technology There is a quiet expectation of an improved cloud applications, mobility, digital outlook for the IT sector in 2014 after what marketing and data analytics are likely was a flat 2013, impacted by corporate to see strong demand. cost cutting, project postponement and outsourcing. For enterprise architects and major Market confidence is likely to be stronger in which will drive an influx of offshore 2014 with a fair degree of pent up demand talent. For new recruits, social media, and good prospects for those with in-demand mobile apps and digital will be the strong skills and experience. The latest IT trends – area of focus. projects there is a notable skills shortage 33 information technology Australia only figures LOW HIGH Australia only figures AVG IT MANAGEMENT LOW HIGH AVG Unix Systems Administration 85 145 110 Applications Development Manager 120 180 150 Operations Manager 120 145 130 CIO/IT Director 160 350 200 ERP Technical Consultant 85 165 135 Computer Operations Manager 120 140 130 ERP Functional Consultant 75 120 85 Help Desk Manager 90 130 110 Trainers 45 95 65 I.T. Manager 120 170 135 Web Content Manager/Web Master 75 115 100 Infrastructure Manager 110 160 125 APPLICATION DEVELOPMENT & TESTING C++ Software Developer 60 110 80 Help Desk Support 50 75 60 Java (J2EE) Developer 60 120 85 Desktop/PC Support 60 80 70 .Net Developer (C#/VB.Net/ASP.Net) 55 110 85 Incident Manager 75 95 80 Analyst/Programmer - Oracle 60 100 85 Operator 48 65 58 Mainframe Developer (Cobol, CICS, DB2) 55 110 75 Operations Analyst 55 80 65 ETL Developer 90 110 95 Problem Manager 80 115 100 BI Architect 90 170 120 Wintel Server Engineer 75 115 85 Applications Architect 85 160 115 Network Administrator 75 115 85 Team Leader - (.Net or J2EE) 90 125 110 WAN Engineer 80 115 100 Tester 60 80 65 Data Communications Engineer 75 120 100 Senior Tester 75 95 85 INFRASTRUCTURE & IT SUPPORT Change Manager 100 130 120 Test Team Leader 85 120 95 Network Designer (WAN) 90 130 115 Test Manager 100 130 120 Infrastructure Architect 120 155 140 PROJECT MANAGEMENT & BUSINESS ANALYSIS DBA - DB2 80 120 110 Business Analyst 70 95 80 DBA - Oracle 75 125 110 Senior Business Analyst 85 110 95 DBA - SQL Server 75 110 100 Systems Analyst 65 90 80 DBA - Sybase 75 110 100 Project Administrator 50 70 60 Security Administrator 80 135 100 Project Coordinator 65 85 75 Security Architect 120 160 130 Project Manager 110 140 115 Security Engineer 65 95 85 Project Director 125 180 150 Service Delivery Manager 110 150 135 34 All salaries are $‘000s. Figures are base salary not including superannuation. Kelly scientific resources: Salaries FMCG pharmaceutical sales and marketing environment 35 Kelly scientific resources overview FMCG Pharmaceutical Sales and Marketing Environment The retail and packaged goods sector Growth in the $17 billion pharmaceutical There is increased confidence across the The growing priority on environmental has thrown off some of the caution that industry has tapered off under sustained price broad spectrum of scientific and technical compliance and input is translating into characterised 2013, with a lift in consumer pressure being placed on its largest segment, sales and marketing, encompassing strong growth in demand for environmental sentiment that has translated to an upturn in the $13 billion prescription medicines sector. pharmaceuticals and medical devices. The scientists, planners and consultants across a sales early in 2014. Low interest rates and a This pressure has been applied primarily sector is seeing a period of steady growth period of strength in the Australian dollar have through reforms to rein in the cost of the across both the prescription and non- been good for business and this is likely to Pharmaceutical Benefits Scheme. prescription sector, while medical devices are continue through the year. The smaller $4 billion over-the-counter (OTC) In the food sector, enhanced information medicines sector is doing a little better but on nutrition, diet and storage is becoming growth there has also slipped amid shifts in available through bar code scanning. In industry structure. pharmaceuticals, similar technology on ailments and treatments, combined with new labeling and packaging rules will require a range of regulatory and scientific specialists. The increasing market share of supermarkets over traditional pharmacy outlets is placing pressure on margins, as is the deep growing in line with technological advances and an ageing population. The regulatory environment plays a large part in the pace of activity in this space. Australia’s Therapeutic Goods Administration is going through a period of review that aims to free up the medicines scheduling framework. broad range of industries. Over recent years the mining and resource sector has been a major driver of demand for environmental services. That is forecast to continue, but it is supplemented by growing demand in property, construction, and infrastructure. Both public and private sector demand is strong. Corporate R&D budgets are likely to aid this trend. Australia’s move away from carbon trading in favour of direct incentives for carbon reduction should result in a shift The planned merger of the Australian and in focus rather than a downturn. Active New Zealand regulators in 2016 will aim to areas include waste management, building harmonise regulatory arrangements. In the and construction project compliance, and For the first time, vitamin and mineral meantime intense competition among brands pollution monitoring. supplements overtook analgesics as the is contributing to healthy demand for sales largest OTC category.7 This reflects a and marketing executives and regulatory growing trend to preventative health that is specialists. discounting from the expanding discount pharmacy chains. impacting the pharmacy business as well as the product mix. 7 Nielsen 2014 36 scientific / regulatory affairs / clinical research Australia only figures LOW HIGH Australia only figures AVG SCIENTIFIC LOW HIGH AVG Environmental Scientist 64 112 89 70 Laboratory Assistant 39 46 43 QA Supervisor 61 86 Research Assistant 51 64 55 Laboratory Supervisor 61 76 65 New Graduate 39 51 45 Laboratory Manager 81 132 100 Laboratory Technician 41 53 43 QA Manager 81 132 100 Technical Officer 51 66 55 Project Manager - Development 86 132 120 Scientific Officer 66 79 69 Formulation/R&D Manager 86 152 125 Instrument Technician 51 76 60 Technical Manager 81 183 132 QA/QC Analyst 49 66 58 REGULATORY AFFAIRS Analytical Chemist 56 81 60 QA Associate 56 85 70 Industrial Chemist 56 81 60 Compliance Associate 51 66 60 Formulations Chemist 61 96 85 Reg Affairs Associate 61 81 75 Chief Chemist 76 102 95 Senior Reg Affairs Associate 86 107 90 Senior Chemist 69 81 79 Compliance Manager 86 142 120 Research Chemist 63 81 72 Reg Affairs Manager 81 152 135 Senior Research Scientist 70 91 80 Reg Affairs Director 147 203 180 Senor Food Technologist 76 102 90 Regional Reg Affairs Director 178 254 230 Food Technologist 51 83 63 CLINICAL RESEARCH Sensory Analyst 51 81 61 Clinical Trial Administer CTA 41 61 50 Microbiologist 39 66 50 Clinical Research Associate CRA 56 81 70 Biomedical Scientist 56 82 61 Senior CRA 76 102 88 Molecular Biologist 56 82 64 Senior Clinical Data Associate 66 86 72 37 All salaries are $‘000s. Figures are base salary not including superannuation. sales & marketing / environment Australia only figures LOW Clinical Data Manager HIGH Australia only figures AVG LOW 61 71 66 Sales Director 173 HIGH AVG 223 220 Clinical Project Manager 91 132 110 Marketing Assistant 56 66 60 Clinical Operations Manager 112 142 120 Marketing Analyst 81 112 90 Clinical Business Manager 102 152 125 Product Specialist 76 96 80 Clinical Statistician 81 132 92 Brand Manager 81 127 100 Clinical Statistician Manager 102 152 120 Product Manager 96 127 105 Drug Safety Associate/Sn Associate 56 112 65 Business Development Manager 91 152 123 Drug Safety Manager 112 152 130 Marketing Manager 122 152 138 Medical Writer 66 107 89 National Marketing Manager 132 167 142 152 203 180 Medical Affairs Associate 71 112 85 Marketing Director Medical Science Liaison Manager 102 152 130 ENVIRONMENT Medical Affairs Manager 91 132 110 Environmental Consultant CBD Based 71 91 80 Medical Director 183 254 225 Environmental Principle Consultant CBD 102 132 115 Health Economist 76 132 94 Environmental Superintendent 152 193 180 Environmental Advisor FIFO 117 152 130 112 SALES AND MARKETING GP Representative 56 76 60 Metallurgist FIFO 91 127 Hospital Representative 76 96 80 Laboratory Technician FIFO 61 81 70 Medical Devices Representative 76 102 85 Mine Geologist 91 157 124 Scientific Sales Representative 71 102 88 Exploration Geologist 81 132 95 Account Manager 76 96 80 HSE Manager FIFO 152 183 160 Regional Sales Manager 91 147 110 HSE Officer 76 112 83 National Sales Manager 132 188 150 38 All salaries are $‘000s. Figures are base salary not including superannuation. HEAD OFFICE Ground Floor, 15 Castlereagh Street Sydney, NSW, 2000 Phone: 61 2 9246 6000 Fax: 61 2 9246 6793 E-Mail: au_sydney@kellyservices.com ACT CANBERRA 7 Mort Street Canberra, ACT, 2600 Phone: 61 2 6209 1060 Fax: 61 2 6230 0237 E-Mail: canberra@kellyservices.com QUEENSLAND BRISBANE Level 6, 100 Edward Street Brisbane, Qld, 4000 Phone: 61 7 3405 3333 Fax: 61 7 3405 3300 E-mail: brisbane@kellyservices.com VICTORIA MELBOURNE Level 20, 459 Collins Street Melbourne, VIC, 3000 Phone: 61 3 9204 4242 Fax: 61 3 9204 4200 E-Mail: melbourne@kellyservices.com NSW PARRAMATTA Suite 2, Level 2, 60 Phillip Street Parramatta, NSW, 2150 Phone: 61 2 9865 8383 Fax: 61 2 9865 8393 E-Mail: parramatta@kellyservices.com GOLD COAST Level 3, 12-14 Marine Parade Southport, Qld, 4215 Phone: 61 7 5558 5777 Fax: 61 7 5564 0684 E-Mail: goldcoast@kellyservices.com mulgrave Suite 11, Level 2, 799 Springvale Road, Mulgrave VIC 3170 Tel: 61 3 8549 7670 Fax: 61 3 8549 7680 Email: mulgrave@kellyservices.comm WESTERN AUSTRALIA PERTH Level 1, Quayside, 2 Mill Street Perth, WA, 6000 Phone: 61 8 9229 1800 Fax: 61 8 9229 1899 E-Mail: perth@kellyservices.com SYDNEY Ground Floor, 15 Castlereagh Street Sydney, NSW, 2001 Ph: 61 2 9246 6000 Fax: 61 2 9246 6080 E-Mail: au_sydney@kellyservices.com WESTERN SYDNEY Unit 8, 55 Newton Road Wetherill Park, NSW, 2164 Phone: 61 2 9827 0900 Fax: 61 2 9827 0999 E-Mail: wslid@kellyservices.com TOWNSVILLE Level 4, 370 Flinders Street Townsville, Qld, 4810 Phone: 61 7 4760 1022 Fax: 61 7 4760 1039 E-Mail: townsville@kellyservices.com SOUTH AUSTRALIA NORTH ADELAIDE 192 Melbourne Street North Adelaide, SA, 5006 Phone: 61 8 8367 4180 Fax: 61 8 8367 4188 E-Mail: adelaide@kellyservices.com 39 New Zealand North Shore North Shore premises manned by appointment Ground Floor, Building B, 104 Rosedale Road Albany, Auckland 0632 Phone: 64 9 475 0100 Email: nz_northshore@kellyservices.com Auckland Level 9, Chorus House, 66 Wyndham Street Auckland 1001 Phone: 64 9 303 3122 Fax: 64 9 366 7097 Email: nz_auckland@kellyservices.com South Auckland Unit 1, 23 Springs Road, East Tamaki Auckland 1701 Phone: 64 9 273 5577 Fax: 64 9 273 5560 Email: nz_southauckland@kellyservices.com Hamilton 919 Victoria Street Hamilton Phone: 64 7 838 3108 Fax: 64 7 838 3586 Email: nz_hamilton@kellyservices.com Gisborne Phone: 64 6 868 9435 Fax: 64 6 867 9415 Email: nz_gisborne@kellyservices.com Hawkes Bay 70 Ford Road Onekawa Phone: 64 6 843 1740 Fax: 64 6 843 1749 Email: nz_hawkesbay@kellyservices.com Lower Hutt Level 1, Bloomfield House, 46-50 Bloomfield Terrace Lower Hutt 5010 Phone: 64 4 569 5200 Fax: 64 4 569 2899 Email: nz_lowerhutt@kellyservices.com Wellington Level 10, Dimension Data House, 99 – 105 Customhouse Quay Wellington 6001 Phone: 64 4 499 2825 Fax: 64 4 499 2821 Email: nz_wellington@kellyservices.com Christchurch 35b, Leslie Hills Drive Riccarton Christchurch 8011 Phone: 64 3 379 2963 Fax: 64 3 379 2964 Email: nz_christchurch@kellyservices.com 40 Banking & Financial Services Executive & Management Outsourcing & Consulting Information Technology Accounting & Finance Professional Support Office Support Engineering Call Centre Industrial Scientific kellyservices.com.au kellyservices.co.nz