Broadband Provider Report For

advertisement

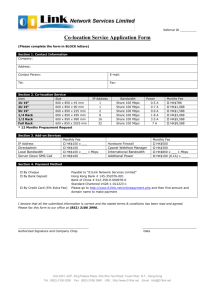

Broadband Provider Report for Prepared by August 7, 2012 1 Table of Contents Description of CVII and Broadband Connectivity 3 Federal and State Broadband Objectives 8 What is the CVII Opportunity? 11 CVII Existing Infrastructure Overview 12 Provider Overviews CenturyLink 19 Frontier 21 Arrowhead 24 Cooperative Light and Power 25 North East Services Cooperative 28 Lake County 30 Air Fiber 32 AT&T Wireless 34 Verizon Wireless 36 Excede/Wildblue 38 Hughesnet 40 Provider Comparison Charts Bandwidth and Price 42 Data Cap 43 Latency 44 Technology Platforms 46 Conclusions and Recommendations 48 U-reka Broadband Overview 51 2 Description of CVII and Broadband Connectivity CVII Overview The following is the Cloquet Valley Internet Initiative overview of itself, sometimes it is best to let the customer speak for themselves. The townships of the Cloquet Valley Region of St Louis County, MN – Alden, Ault, Fairbanks, Gnesen, Normanna, North Star, Pequaywan and two “unorganized townships (53-15 and 54-13) - are working collaboratively on an initiative to improve internet access in our communities. Major broadband internet projects, funding by the USDA’s RUS, are being initiated to the east and west, with no plans to include our directly adjacent townships. Other internet providers have some presence in some townships but thus far have not indicated commitment for expansion or upgrade to true broadband. The townships have come together formally as the Cloquet Valley Internet Initiative (CVII) Steering Committee to pursue a strategy of attracting one or more providers of true broadband internet service for our citizens and businesses. We realize that, thus far, rural townships have had less presence in the area of broadband funding. The CVII is largely a citizen-based initiative that has gained solid backing from township governments. The following are our goals for implementation of broadband in our region: Ubiquity: Our goal is that all residents and businesses and public offices (such as town offices and fire halls) have access to high speed broadband. We believe it will be cost effective to leverage advances in technology as they occur, which will achieve this goal in stages Competition, Affordable, Neutrality and Interoperability: These goals are interdependent. Competition will be advanced if the feasibility study assembles data that can be used by more than one potential provider to consider upgrading broadband internet in the townships. The CVII townships are vendor-neutral, since there is some presence of multiple vendors in the area who may be convinced, by the results of the study and the internet incentive landscape, to upgrade or advance new service in the CVII townships. We expect that any market analysis would address affordable services. We are seeking affordable rates, comparable to broadband rates in the region, for high-speed broadband, and we are seeking a network that is interoperable so that new and future internet tools and services can be available to our citizens. Collaboration: The CVII townships recognize that partnerships are the only way that broadband internet will be implemented in rural areas. Our townships continue to collaborate on the strategy to enhance internet; we know that, alone, none of us has sufficient population to attract enhanced broadband services. We are in the process of establishing a Steering 3 Committee, comprised on one town supervisor and one or two interested citizens from each township, to develop partnerships, joint power agreements, and advance the market analysis. We have successfully brokered financial partnerships for this study with St. Louis and Lake Counties, both with interests in promoting rural broadband. Given the limited administrative capacity of rural townships, we must move forward with capable partnerships in the proposed study and eventually in implementing a broadband network. We are also interested in promoting or participating in some form of private – public partnership. World Class Service: The CVII Team aspires to attract state of the art broadband services, not just incremental improvements. We recognize that our citizens are currently underserved, and any incremental improvement is welcome. However, we seek to attract broadband service that will make future internet opportunities and capabilities available, not just services available today. The State of Minnesota strategy for internet access indicates that 10 Mbps download / 5 Mbps upload is a capacity that will provide citizens with access to tools of the near future. We seek to promote speeds that will truly make the future of internet available to our citizens, businesses, governments and other organizations. Options: At the present time, there are no broadband providers with active plans to build systems across our townships. This preliminary feasibility study is an effort to identify the capabilities and real opportunities for various technologies and providers to expand into our townships. Because there are no real plans, our townships need to know the cost, level of broadband speed, and advantages and challenges of various types of internet technologies at the level identified by Minnesota’s state goals (or better). Today’s Broadband Landscape: At present there is very little connectivity throughout the CVII service area; and even those services could be debated do not provide the bandwidth required for businesses and residences to access the Internet content required to participate in the Internet economy. At even the lowest level of connectivity there are still large areas of the CVII service area that have access to no landline or cellular data connectivity and must rely on either dial-up services or satellite-based Internet services. The map provided by Connect Minnesota gives an overview of what services are available today, it should be remembered that this data is provided by the carriers and should always be validated by community residents to validate that the carriers are providing accurate data. The map does show where DSL, Cellular Internet and Unserved areas are in the CVII service area. 4 Connect Minnesota Broadband Availability Map (768K Upstream and 256K Downstream) with CVII Service Area Lavender-DSL Blue-Wireless Yellow-Unserved 5 Existing Providers and the Doughnut Hole Issue-the largest issue for the CVII service area is what is called the Doughnut Hole Issue. For rural townships they are often the furthest away from a telephone company central office therefore making it more difficult to receive DSL services. These rural areas have low customer densities that make it difficult for landline providers to spend the capital required to achieve a return-on-investment that would allow it to sell the upgrade to its corporate offices. In the CVII area the issue is exacerbated by the fact that there are three different providers and four different exchange areas that serve the area and the CVII area is often at the outer edge of those exchanges. This means in most cases that the copper network infrastructure is not able to support the bandwidth requirements of nextgeneration broadband services without a significant capital investment in fiber optics for backhaul and the installation of Digital Subscriber Line Access Multiplexers (DSLAM). Also finding which provider serves which township can be difficult because telephone exchange boundaries don’t align to community boundaries. In the CVII service area telephone providers include (a map of the exchange boundaries is available on the next page): Local Carrier CenturyLink Exchange Duluth Frontier Frontier Two Harbors Brimson Arrowhead Communications Cotton CVII Townships Served Gnesen, Normanna, Northstar, Alden Alden Fairbanks, Ault, Pequaywan, 54-13 Gnesen, 53-15 These doughnut hole areas also have such low customer densities that cable television providers would not even consider extending its services which are historically only located in the most dense areas of a rural community leaving the responsibility for these services to the telecommunications provider in the area. In the CVII service territory there are no cable television providers providing internet services today. 6 CVII Overlay of Minnesota Telephone Exchange Map (courtesy of Minnesota PUC) 7 Federal and State Broadband Objectives The Federal Government has a long history of providing financial backing and mechanisms for the provisioning of landline telephone services to ensure that rural areas would be on an equal basis with their more urban counterparts. At this point the Federal Communications Commission (FCC) www.fcc.gov has focused on transferring the benefit of these dollars to provision broadband services to rural areas; this is part of a larger nationwide movement to create a globally competitive broadband infrastructure. Of particular interest to rural customers are: The establishment of 4 Mbps download and 1 Mbps Upload as the standard for rural broadband-the FCC has created two different goals for its citizens. Urban areas are looking to achieve 100 Mbps service (through the FCC “100 Squared “initiative which would bring 100 Mbps service to 100 million households by 2020) while rural areas are to be satisfied with a much lesser service. The Connect America Fund-taking the dollars today used for landline telephone support the FCC has created the Connect America Fund to incent carriers to improve rural services to the 4 Mbps/1 Mbps threshold. Currently two of the telecommunications providers in the CVII area (CenturyLink and Frontier) have committed to these phase one dollars at $775.00 per unserved customer to improve its DSL services. The Rural Utility Service (RUS) continues to provide low-cost loans to rural providers through the farm bill program to assist in developing next-generation broadband services to the most rural areas. These dollars most frequently go to incumbent rural telephone companies and cooperatives. The development of Broadband Stimulus projects funded by federal dollars that will establish next generation fiber infrastructures for Cook County, Lake County, portions of St. Louis County, and the Northeast Services Cooperative. While these networks do not serve the CVII area they will show the need for next-generation broadband in rural areas. Mobility Fund Phase 1 Auctions (http://wireless.fcc.gov/auctions/default.htm?job=auction_summary&id=901) -there are significant portions of the CVII area that are eligible for these FCC funds. The auction will offer up to $300 million in one-time support to carriers that commit to provide advanced mobile voice and broadband services in areas where those services are not available. The carrier must provide 3G services within two years and 4G services within three years of the award. A map of the eligible areas is provided on the next page: 8 FCC Mobility Fund Phase 1 Auction Areas (in black) CVII area in red box The State of Minnesota has also made significant progress in the development of broadband awareness through the Minnesota State Broadband Taskforce (http://mn.gov/commerce/topics/Broadband/Governors-Broadband-Task-Force.jsp). The three most important activities that CVII should focus on are: 1. The creation of broadband goals for state of Minnesota residents-the first calls for ubiquitous service, broadband for all Minnesotans, and the second, that sufficient broadband speed was a minimum of 10 to 20 Mbps downstream and 5 to 10 Mbps upstream. These targets are to be met by 2015. The map on the next page shows that there are no areas of the CVII area that meet the state broadband goals 2. The launch of the Connect Minnesota website-Connect Minnesota was created through Broadband Stimulus funds. It provides an excellent source of information for broadband usage and availability. The Connect Minnesota Website can be found at www.connectmn.org. 9 3. The 2012 Taskforce Report-The Task Force will develop legislation for the 2013 legislative session and beyond, where needed, on policy and finance incentives. Identify, evaluate and suggest the funding resources necessary in order to reach the broadband goals and methods for generating that funding including tax incentives for broadband infrastructure; tax deduction equity for fiber, equalization of Minnesota depreciation to federal levels; tax forgiveness to build out in areas without access and/or low population. (State Taskforce Report Outline available at http://mn.gov/commerce/images/BroadbandPlanOutline.pdf). This legislation may assist in providing incentives to build services in the CVII area. Connect Minnesota Broadband Availability (10 Mbps Upstream and 6 Mbps Downstream) with CVII Service Area Orange-Underserved Yellow-Unserved Blue-Wireless 10 What is the CVII Opportunity? The townships are sparsely populated in the north, but there are significantly denser numbers in North Star, Normanna and Gnesen that will help the CVII group appeal to the provider community with their household counts between 46 to 77 per census block. This raises the area’s appeal and there may be upcoming opportunities with changes to federal subsidies since the basis for their administration appears to be centered on census blocks. Another set of positive indicators appears to be the age and income median levels-the Cloquet Valley population is both younger and higher earning than what providers normally assume a rural area to be. CVII is representing almost 1500 households with an additional 600+ seasonal cabins that are looking more attractive because of the data that has been collected and the energy of the people working on this project. CVII citizens developed and deployed a questionnaire to determine the potential market for enhanced internet service. They collected over 500 household responses. Looking at the summarized survey results in addition to the demographics creates an even more compelling picture to potential providers as just over 65% of respondents are now getting their Internet from either a cell connection or a satellite, both considered to be lacking in some respects and 85% of the respondents would be “very likely” to subscribe to 10 Megabit service if they could get it. It appears that CVII has done the right things to position their constituents in the best light for future recruiting efforts in pursuing high speed broadband for the area. They have been effective at proving there is a market here, staying organized, and courting providers with actual customers. And all along they’ve taken every opportunity to educate citizens on current broadband opportunities. As CVII continues to attract providers there are additional marketing activities it should continue to gain the interest of providers: Continue to gather information on the interest of local residents of committing to switch to a new service provider and their current dissatisfaction with existing providers Quantify the interest of the seasonal residents of CVII; what are their interests in receiving service Tout the unique aspects of the area including higher income, age of the population and willingness to commit to a service provider willing to bring enhanced services to the area 11 CVII Existing Infrastructure Overview County Road 44 cuts through the heart of the CVII service area and is an important corridor for the provisioning of broadband services in the area. A drive from Gnesen Township to Fairbanks Township along County Road 44 provided some high-level insight to the existing telecommunications infrastructure in the area. Some of the important highlights of the drive include: 1. Existing Fiber Optics-looking for telltale signs of fiber connectivity (handholes and fiber markers) there were no signs of a fiber infrastructure until we reached the Brimson Central Office (Frontier). This will continue to be an issue for the area as fiber optics utilized as middle-mile infrastructure can dramatically increase the speed to last-mile customers. 2. T1 Backhaul-it was evident that any existing DSLAMS were being served by T1/Copper infrastructure to provide the Internet backhaul to CVII wired Internet customers. 3. Cellular/Wireless Infrastructure-except for an AT&T tower positioned close to the North Star Township Hall there is very little wireless infrastructure in the CVII service area. At least on that tower there was significant space left for a second wireless carrier to collocate on that tower. The issue around the Cellular infrastructure is that without a fiber infrastructure even a deployed 3G/4G infrastructure would suffer from a lack of backhaul. 4. Antiquated Technologies-looking at the existing Digital Loop Carrier infrastructure, most of the area has not been upgraded in quite some time. It did look though that CenturyLink has placed some new DSLAM infrastructure but lacks backhaul to make it efficient. Some of the important infrastructure locations during the drive include: 1. CenturyLink Island Lake Office-Corner of Abbott Road and Rice Lake Road 12 This office is part of the Duluth exchange and does not seem to have fiber connectivity to it. The Common Language Location Identifier (CLLI) Code is ISLKMNIL. It looks like all of the remaining CenturyLink serving areas within the CVII study area are homed back to this office. There were no signs that the building was fiber fed except for some Qwest fiber markers on County Road 4 located approximately one mile away. 2. CenturyLink DSLAM-Corner of Rice Lake Road and Normanna Road This DSLAM is fed by the Island Lake Office. It is relatively new (within the last five years). It does not look to be fed by fiber. 3. CenturyLink DSLAM-corner of County Road 44 and Schultz Lake Road This DSLAM is fed by the Island Lake Office. The DSLAM looks relatively new (within the last five years); it does not look to be fed by fiber. The DSLAM (on the very left) was placed next to an existing Digital Loop Carrier (Center) to support voice services for the area. 13 4. CenturyLink Digital Loop Carrier-corner of County Road 44 and Barrs Lake Road. This DSLAM is fed by the Gnesen Office. The DSLAM looks relatively new (within the last five years) but does not look to be fiber-fed. The DSLAM (on the very left) was placed next to an existing Digital Loop Carrier to support voice services for the area. 5. CenturyLink Digital Loop Carrier Site Alden Lake-at County Road 44 and Little Alden Lake Road This site looks like it has no or limited DSL capabilities. It is fed from the Gnesen Central Office and serves the Pequayan and Alden Lake area. 14 6. Frontier Octal ADSL Cards at County Road 44 and White Lake Road It looks like this was placed to serve the Internet requirements of customers living on White Lake Road. It is hard to determine if the units are actually in service. This product is part of the Conklin Flex Access 9000 platform; the 9300 unit is used to extend ADSL service to areas that have small customer counts and is fed by a copper pairs for transport back to the Central Office terminal in this case located in the Brimson Central Office. 7. Brimson Central Office-located at Hwy 44 and Two Harbors Brimson Road This office is part of the Brimson exchange and does have fiber connectivity to it. The Common Language Location Identifier (CLLI) Code is BRSNMNXB. 15 8. AT&T Wireless Tower-located at Hwy 44 and St. Louis County Road 998 This tower provides a majority of all wireless connectivity within the CVII service area. The tower is fed by a microwave feed –there is no copper connectivity to this tower. The AT&T tower number is MPLSMN5049. It looks like there is additional room for another wireless provider. 16 9. New Wireless Tower Island Lake North-located at 7397 Thompson Lake Road (north of the corner of Rice Lake Road and Thompson Lake Road. This 300’ tower is owned by American Tower (www.amerciantower.com) and the tower number is MN-311204. From a site visit it looks like the carriers are just beginning to turn up services on this tower. One of the carriers on the tower is T-Mobile according to the site information; the other provider is AT&T. The tower is fed by copper T1’s and one of the providers has placed a microwave link to the tower. 17 10. ATT tower Normanna Township on Pioneer Road This tower is owned by American Tower (www.amerciantower.com) and the tower number is MN-273105. Currently only AT&T is providing service to this tower but it looks like an additional two wireless carriers could co-locate. The tower is fed by copper T1’s. 18 Provider Overviews CenturyLink Contacts: Troy Mack 218-491-4653 troy.mack@centurylink.com Kirstin Beach 612-663-7911 kirstin.beach@centurylink.com Andrew Schriner 612-663-6930 andrew.schriner@centurylink.com Website: www.centurylink.com CenturyLink Opportunity: Our encounters with CenturyLink were unproductive. The information we are including in this report comes from our research of online archives, trade press and onsite observation. When asked for their pricing we were told to go to the website. The website requires a customer address to access any pricing information. When using an address of a current subscriber with a Duluth address, the website says there is no service offered there besides dial-up. When tested with a metro address, the author’s own with current CenturyLink service, the website seized up so we were relegated to outside sources to determine both pricing and availability. All information is offered with that caveat; it does not come from the company. Apparently, CenturyLink offers download speeds of 1.5Mbps for as little as $19.95 a month, but “where offered” will also sell 7Mbps service for $19.95 with the purchase of Unlimited Phone at an additional $45. The price is guaranteed for 5 years. Pricing appears to vary widely according to your custom bundle makeup. DSL service can be ordered without phone service and it appears the price for that is similar to other providers, averaging between $45 and $55 dollars per month depending on the speed available. The company announced on July 24, 2012, that they have accepted some funding, $35 million of the almost $90 million they were allocated, from the FCC under the Connect America Fund for the purpose of taking broadband service into areas that are currently unserved. The company announced they would use close to a third of that funding, $11 million of the CAF money, in the state of Minnesota. We are still awaiting an update on just where the 14 regional areas are that they are targeting. If the company is granted the waiver they seek to use the money to deploy in areas now served by wireless Internet providers, that dollar amount may increase nationally and perhaps here in the state. The company has sought such a waiver for several areas in northern Minnesota served by WISPs that they claim do not offer sufficient speed and are too high priced. As of this reports publication date, there is no decision on the request from the FCC. 19 The Department of Commerce of Minnesota sent a letter of support for the company’s effort to gain the waiver and it remains to be seen whether that will result in more service for the state or not. It is possible that the issue will remain open until the waiver question is settled. In any case, watching the press – both commercial and trade – seems to be the only reliable source of information. Existing Connection Speeds: One CVII resident who has access to CenturyLink Internet services tested their connection at (this customer resides approximately 2 miles from the DSLAM): Download Speed Upload Speed 0.84 Mbps 0.74 Mbps 1.05 Mbps 0.74 Mbps 1.06 Mbps 0.70 Mbps *see page 43 for explanation of latency Latency* 91 ms 93 ms 92 ms 20 Frontier Contacts: Scott Behn 952-891-7712 scott.behn@ftr.com Kirk Lehman 612-816-0916 kirk.lehman@fr.com Website: www.frontiernet.net Frontier Opportunity: Frontier territory covers the northern most part of the Cloquet Valley target area in Ault, Fairbanks, and Pequaywan townships. Frontier offers DSL service to its exchange area and several residents are subscribers. The service is advertised at 3Mbps downstream speeds and 384Kbps upstream, which is relatively slow but still a useable speed for most home applications. We have speed tests results from users that indicate that their service is far slower than the 3Mbps service that it’s advertised to be however. The pricing for Frontier is hard to come by unless you’re adept at maneuvering through their website or willing to talk to a service rep. The plethora of packages also complicates the matter but is generally the best pricing, as bundles give at least a minimal discount on services. As best we could determine, the base price for High Speed Internet without a package would be $49.99 with a phone line added or $54.99 without. A modem rental fee is $6.30 per month. There are multiple add-ons that they offer including free access to ESPN3 for sports fans and Hulu Plus for $7.99 per month. They even offer a second DSL line for $13.50 per month for households with multiple users. Unless waived there is an installation charge but Frontier does a thorough install that includes checking computers for viruses to ensure the service will work properly when they’re done. The pricing included in this report was gathered from multiple queries to the websites of both Frontier and authorized agents. Pricing was requested twice from company representatives but never received. It’s quite likely that the actual uses of the service have pricing that differs from the base prices we are using. Reasons for slower than advertised service from Frontier would include several factors such as distance from the Central Office (CO) in Brimson or even the condition of the copper wiring to your premise, which may be many years old. Copper becomes brittle with exposure to oxygen so if the sheath is worn it could affect both your Internet speed and voice line quality. In many cases if you suspect interference like that, a call for service may result in a replacement line installed at the company’s expense. Customers should be sure to discuss that if they do call for possible repairs. Frontier was the first eligible company to accept FCC Connect America Funding (CAF) from Phase One that offered the company close to $72 million to deploy DSL in their unserved exchange areas. The fund offered $775 for each new install, which in Frontier’s case amounts to 92,876 new installs in about half of Frontier’s 27 states. 21 Unfortunately, we have since learned that Minnesota will not be one of those states. Frontier has already committed that by the end of the year they would be upping the download speeds of their broadband service to you to 6Mbps from the 3Mbps now offered. Without CAF interruptions to the Minnesota engineering plan, that upgrade is most likely going to stay on schedule. Another announcement by Frontier on July 24 is that they have signed an agreement to offer HughesNet satellite service to their customers. As detailed in the satellite services section of this report, HughesNet’s owner, Echostar, has launched a new satellite with Jupiter technology that is expected to be able to deliver download speeds of up to 20Mbps as early as this October. Frontier has had a longstanding partnership agreement with Echostar by virtue of their resale of the DISH video product. We also expect that the satellite pricing from the new HughesNet product will closely align with the current Exede pricing, which will be a welcome adjustment to what we judge to be their current high priced offer for a very low speed connection. Frontier staff, Scott Behn, the statewide manager, and Kirk Lehman, the area general manager, were both very forthcoming with their information and generous with their time. We also appreciated their willingness to discuss solutions that most industry providers consider to be out of the box. They have begun their formal arrangement with NESC for increased middle mile capacity and were willing to talk about potential for serving customers outside of Frontiers service area. Those discussions may be continued after this report by the steering committee with the Frontier folks, although their corporate structure may preclude anything happening quickly. A strong relationship is possible with this provider. Existing Connection Speeds: One CVII resident who has access to Frontier Internet services in Pequaywan Township tested their connection at (this customer resides approximately 1.2 miles from the DSLAM): Download Speed Upload Speed Latency* 0.71 Mbps 0.05 Mbps 87 ms 0.70 Mbps 0.15 Mbps 348 ms 0.76 Mbps 0.05 Mbps 80 ms 0.70 Mbps 0.07 Mbps 85 ms Another CVII resident provided these test results from Pequaywan Township 0.97 Mbps 0.15 Mbps 107 ms 0.97 Mbps 0.15 Mbps 86 ms 0.23 Mbps 0.14 Mbps 126 ms 0.67 Mbps 0.14 Mbps 85 ms 0.67 Mbps 0.14 Mbps 87 ms 0.43 Mbps 0.11 Mbps 290 ms 22 0.96 Mbps 0.15 Mbps 1.14 Mbps 0.16 Mbps 1.10 Mbps 0.16 Mbps 1.11 Mbps 0.11 Mbps 0.23 Mbps 0.15 Mbps 1.14 Mbps 0.16 Mbps 0.98 Mbps 0.13 Mbps *see page 43 for explanation of latency 377 ms 88 ms 85 ms 87 ms 103 ms 85 ms 87 ms 23 Arrowhead Contacts: Bob Weiss –General Manager bobw@sleepyeyetel.net (507) 381-1359 Website: www.arrowheadtel.net Arrowhead Opportunity: Arrowhead is owned by Hector Communications; a partnership between New Ulm Telecom, Arvig Communications and Bevcomm. Today Arrowhead provides limited services in the most western area of the CVII service area including the Cloquet Valley State Forrest and the most northern section of the Boulder Lake through its Cotton Exchange. According to the Arrowhead website it provides up to 10 Mbps DSL services for a price of $69.95 bundled with a telephone line and $109.95 without a telephone line (known as naked DSL in the business). Currently Arrowhead has no plans for improvements to their infrastructure for the area and no interest in expanding their footprint further into the CVII area. 24 Cooperative Light and Power Contacts: Steve Wattnem-General Manager swmngr@clpower.com (218) 834-2226 Kevin Olson-Mgr. Technology kolson@clpower.com (218) 834-2226 Website: www.clpower.com Cooperative Light and Power Opportunity: Cooperative Light and Power (CLP) is the electrical provider for most of the CVII service area. Cooperative Light and Power Electrical Service area. 25 CLP has been providing Internet services to portions of its service territory for many years. Currently CLP is upgrading its Internet infrastructure to not only provide Internet services to its customers but also to leverage it for both SCADA (Supervisory Control and Data Acquisition) and Meter Reading for its Electrical services. In discussions with management of CLP there was definite interest to expand its services to cover the entire CVII service territory if the build-out is financially feasible. The main concern is the ability to create enough customer requirements in the most northern area of CVII; due to this CLP would like to work with CVII to understand maps of potential customers to finalize financials for the service territory. The new technology being deployed by CLP is a MIMO (Multiple-Input and Multiple-Output) technology, this technology increases data throughput by spreading the total transmit power over several antennas. The three non-licensed spectrums being used by CLP are 900 MHz and 2.4 GHz for customer access and 5.8 GHz for backhaul. Currently CLP is developing a backhaul network capable of 200-300 Mbps of transport that allows it to dramatically increase the endservice bandwidth to its customers. CLP is deploying the Ubiquity wireless platform, the key to Ubiquity’s success is MIMO spatial multiplexing. A high rate signal is split into multiple lower rate streams and each stream is transmitted from a different transmit antenna in the same frequency channel. If these signals arrive at the receiver antenna array with sufficiently different spatial signatures, the receiver can separate these streams into (almost) parallel channels. MIMO technology uses the 802.16e standard. In other words line of sight is less important because signal can travel in separate orthogonal channels and be assembled at the antennae. CVII committee member Mark Anderson was a beta customer of this new service and provided excellent test data and impressions of the service. Mark’s experience included: HTTPS (Hypertext Transfer Protocol Secure) has worked well over the network. Having a secure Internet connection is very important for those CVII residents who will want to telework from the area. Downloads worked well, Mark frequently downloaded files in excess of 100 Mbps without problems. Remote Desktop and Skype Services worked well over the network. Mark was able to support online students remotely without any problems Streaming Video worked very well over the network. Mark was able to stream Best Quality-non-HD and often could stream the Best Quality HD setting Humidity did affect the wireless service but did not affect the customer experience Average Downloads were in the 5 Mbps range and average latency was around 35 milliseconds 26 To complete the network, towers would need to be built every 3-5 miles at a cost of $10,000$15,000 a site. The towers would be at a height between 70’ and 90’ and a blanket easement by the CVII townships would assist CLP in completing the network. In addition in the Island Lake area there is an existing wireless operator that delivers a less than quality service that causes interference with the CLP system, assistance in limiting this carrier would also be a positive in the eyes of CLP. Final engineering will determine the total number of towers and capital costs to serve the CVII area. Today CLP is planning to have two packages over its new network (customers on existing equipment are more limited to their services) : 1) a 3 Mbps symmetrical package with 1.5 Mbps guaranteed for $49.95 and 2) a 7 Mbps symmetrical package with 1.5 Mbps guaranteed for $59.95. Additional costs will include an install cost of $250.00. CLP is planning to offer a wireless service that will raise the bar in the area for wireless speeds and be very competitive against the wireline services available in the area. Existing Connection Speeds: One CVII resident who has been testing CLP Internet services in Normanna Township tested their connection at: Download Speed Upload Speed 12.9 Mbps 4.55 Mbps 9.66 Mbps 5.31 Mbps 7.0 Mbps 5.8 Mbps 5.0 Mbps 5.5 Mbps 9.0 Mbps 5.6 Mbps 7.7 Mbps 6.0 Mbps 4.3 Mbps 6.2 Mbps 6.2 Mbps 6.2 Mbps 7.9 Mbps 6.3 Mbps 6.5 Mbps 3.0 Mbps 5.0 Mbps 7.7 Mbps 9.8 Mbps 5.5 Mbps 7.6 Mbps 3.8 Mbps 4.9 Mbps 4.5 Mbps 6.6 Mbps 5.9 Mbps *see page 43 for explanation of latency Latency* 45 ms 35 ms 36 ms 35 ms 26 ms 35 ms 35 ms 27 ms 35 ms 35 ms 26 ms 37 ms 42 ms 35 ms 35 ms 27 North East Services Cooperative Contacts: Paul Brinkman-Executive Director paulb@nesc.k12.mn.us (218) 748-7603 Lyle MacVey-Dir. Information Technology lmacvey@nesc.k12.mn.us (218) 748-7623 Website: www.nesc.k12.mn.us North East Service Cooperative Opportunity: The Northeast Service Cooperative (NESC) was awarded a Broadband Stimulus Award for a $43.5 million loan-grant combination to provide over 915 of miles of fiber to eight counties including St. Louis and Lake Counties. The funding will provide middle-mile, dark fiber, wavelength services to private sector providers in rural areas of northeast Minnesota. In November of 2011 NESC announced an agreement with Frontier Communications to provide 450 miles of dark fiber to Frontier to improve broadband access in the Frontier service area. Frontier will light the fiber network and this new network will allow them to have full redundancy for both voice and data routes and broadband speeds up to 10 Gbps. It is this partnership that could be of benefit to the CVII service area. There have been discussions between Frontier and NESC about how they might be able to leverage this middle mile transport to provide improved services to those service areas that CenturyLink provides to in the CVII service area (by leasing copper loops from CenturyLink). This would take significant work at a corporate level at Frontier to decide to move into the CenturyLink area. Besides Frontier, since NESC provides a carrier-neutral network it could provide other competitive carriers access to its middle-mile network to serve the needs of other competitive carriers interested in providing residential broadband services along its network. It is advised to keep the lines of communication open with NESC to better understand what carriers and alternative providers it might be in discussions with. One of the largest issues for any provider who would want to leverage the NESC middle-mile network will need to build either fiber optic or wireless backhaul to reach the NESC network. Below is an NESC map showing the middle-mile route and give readers a perspective of the fiber routing needed to reach the CVII service area. It seems that the route along Hwy 61 from Duluth to Two Harbors might be the most cost-effective to reach the CVII service area. 28 Network Map of NESC Middle-mile Network 29 Lake County-Lake Connections Contacts: Jeff Roiland-Project Manager jroiland@lakeconnections.com (218) 834-8320 Matt Huddleston-County Administrator matthew.huddleston@co.lake.mn.us (218) 834-8320 Website: www.lakeconnections.com Lake County Opportunity: In 2010 Lake County was awarded a $10 million grant and $56.5 million loan to construct a fiber optic network to every home and business in Lake County and sections of St. Louis County (see Lake County Area Service Map below), the network will not serve the CVII service area but will surround the CVII area to the north and to the east. Lake County Service Area Map from Lake County website 30 In June of 2012 Lake County began construction of the network in Two Harbors in partnership with Lake Connections. It is expected it will take at least three years to complete the entire network build and the network build is broken into three phases (a map of the phases can be found at www.lakeconnectins.com/map: 1. Phase 1-the towns of Two Harbors, Silver Bay and Winton (target completion August 2012) 2. Phase 2-all towns and rural areas along the fiber interconnect route (target completion December 2012) 3. Phase 3-the remainder of all the rural areas (target completion September 2013), includes some fiber through the CVII area only to serve Lake County needs Lake Connections has not yet released services and pricing but has committed to providing: Internet Speeds up to 100 Mbps to homes and 1 Gbps to businesses Digital Video, including high-definition service and digital video recording Traditional telephone or voice over Internet service While there are no plans to serve CVII if additional funds separate from the initial project were available Lake Connections may be interested in providing services to the area. During Phase 3 Lake County will build network fiber through a portion of the CVII service area (it is noted as a dotted line on the Lake County website) it is not intended at this point in time to provide lastmile access to CVII residents. It could be leveraged though as a potential middle-mile connection to allow alternative carriers to reach the CVII area. It is suggested that the CVII group keep in contact with Lake County to understand the final routing of the fiber network through the CVII service area. 31 Air Fiber Contact: Tiegen Fryberger-Dir. Community Wireless Broadband Development Tiegen@myairfiber.com 218 349-9967 Website: www.myairfiber.com Air Fiber Opportunity: Air Fiber is a company based in Superior, WI focusing on the needs of rural communities while also providing services in portions of Duluth and Superior. Currently Air Fiber is working with Hermantown and Balkan Township to deliver wireless broadband services to those underserved communities. Air Fiber utilizes unlicensed spectrum at the 5.8 GHz (for backhaul) and 2.4 GHz and 900 MHz for customer access utilizing the Ubiquity platform as described in the Cooperative Light and Power network. This technology allows them the ability to penetrate the tree cover expected in the CVII service territory. Today Air Fiber provides the following bandwidth speeds and would expect to provide the same speeds and pricing in a CVII network: Service Plans Monthly Rate Installation Cost 10 Mbps $49.95/Month Always FREE Installation 7 Mbps $44.95/Month Always FREE Installation 5 Mbps $39.95/Month Always FREE Installation 3 Mbps $32.95/Month Always FREE Installation 2 Mbps $29.95/Month Always FREE Installation *All customers require an AirFiber Wireless Modem to obtain quality internet and speeds. The casual surfer plan is a 2 Mbps plan perfect for the casual internet user for online gaming, social apps, email, and casual surfing. 32 Additional Equipment Monthly Rate Purchase Cost Wireless Modem $5.95/Month $89.95/1x Purchase Wireless Router N/A $49.95/1x Purchase Existing AirFiber Pricing and Packages Based on back of the envelope engineering it would require eighty towers (100’) to serve the entire CVII service area. Backhaul connections would be brought in from the west from Highway 53 and from the east from Two Harbors. A budgetary number for the network is approximately $500,000.00. The AirFiber model is that the community would provide the funds to install the network and then AirFiber would provide a revenue share back to CVII. It would also be expected that CVII would assist in marketing activities to place customers on the network. 33 AT&T Wireless Contacts: Bob Bass, MN President Robert.bass@att.com 952-656-9163 Website: www.att.com AT&T Wireless Opportunity: Bob Bass was responsive to our request for information and took a look at the map of the CVII area provided to us by the steering committee. His information regarding the townships quoted here says: “If it is voice, it is covered well, however the border area near Lake County is difficult. As far as data, on the bottom 40% of the area we cover it with 4G with the speeds being better in the left side of your area moving towards 53 which has good 4G coverage from Duluth up through Virginia, Hibbing, and Mountain Iron.” Bob also stated that the ongoing issue with the 450’ tower in the Ely area, if ever settled in the company’s favor, could have a positive effect on the service levels over the entire northeast quadrant of the state. AT&T has recently won an appeal decision that would allow the construction but will face at least one more court challenge. Data plan pricing for wireless carriers is changing to shared plans, data capped plans, and by the device. A typical plan for AT&T right now would be priced at $30.00 per month for a DataConnect 4G Tablet plan capped at 3 Gigabits per month and would charge $10 per gigabit for data use over the cap. There are options for a 3G/4G wireless customer to extend their service to computers within their home. Some wireless handsets allow a customer to create a wireless hotspot from the phone to share through a WiFi connection with computers within the home. Some customers who want to share service can also purchase a separate device called a mobile hotspot to share internet services without it being tethered to the phone. AT&T does offer these devices. We also remind the reader that 4G is a relative term that means 4th generation. While initially intended to be a wireless standard that would provide 100Mbps download speeds, it now refers to any substantial improvement over 3G, which typically delivered speeds of 768kbps or less. This applies to all wireless labeling. It will be interesting to see if AT&T will bid on the FCC Phase 1 Mobility Auction to deploy 3G and 4G services in September of 2012. Wireless coverage areas are located on the map below; according to AT&T’s website there is only 2G wireless services available in the CVII area. According to some residents close to AT&T towers there is some 4G capability in the CVII area, speed tests would show that there are some 4G services available. 34 AT&T Coverage Area from Website 07/22/2012 Download Speed Upload Speed 4.39 Mbps 1.42 Mbps 2.50 Mbps 1.10 Mbps 3.39 Mbps 1.49 Mbps 1.56 Mbps 0.92 Mbps 1.58 Mbps 0.83 Mbps 1.33 Mbps 0.87 Mbps 0.80 Mbps 1.02 Mbps 1.61 Mbps 1.05 Mbps 1.00 Mbps 1.20 Mbps 1.34 Mbps 1.30 Mbps 2.50 Mbps 1.55 Mbps 1.01 Mbps 1.39 Mbps 1.96 Mbps 1.36 Mbps 3.02 Mbps 1.28 Mbps 2.03 Mbps 1.29 Mbps 1.62 Mbps 1.37 Mbps 3.23 Mbps 1.43 Mbps 1.66 Mbps 1.24 Mbps *See page 43 for definition of latency Latency* 165 ms 89 ms 180 ms 198 ms 213 ms 214 ms 198 ms 198 ms 214 ms 213 ms 198 ms 182 ms 198 ms 229 ms 198 ms 182 ms 182 ms 1.24 ms 35 Verizon Wireless Contacts: Contact: Mike McDermott 847-706-2648 michael.mcdermott@verizonwireless.com Karen Smith Karen.smith@verizonwireless.com Website: www.verizonwireless.com Verizon Wireless did not reply to inquiries from us but they too have recently changed their pricing to the data cap model. There are options for a 3G/4G wireless customer to extend their service to computers within their home. Some wireless handsets allow a customer to create wireless hotspot from the phone to share through a WiFi connection with computers within the home. Some customers who want to share service can also purchase a separate device called a mobile hotspot to share internet services without it being tethered to the phone. Verizon does offer these devices. It will be interesting to see if Verizon will bid on the FCC Phase 1 Mobility Auction to deploy 3G and 4G services in September of 2012. Verizon also has a new product, HomeFusion, that may hold some potential in the future but it would require 4G capabilities which Verizon does not have in the CVII area. It’s described like this on their website: HomeFusion Broadband Plans HomeFusion Broadband delivers our lightning-fast wireless service straight to your home and internet-capable devices. 1. Verizon 4G LTE service is received through the HomeFusion Broadband Antenna. 2. The HomeFusion Broadband Router takes the signal from the antenna and broadcasts it through your home via Wi-Fi or wired Ethernet. Monthly Data Allowance 10 Gig 20 Gig 30 Gig Monthly Access $60.00 $90.00 $120.00 36 Verizon Coverage Area 7/22/2012 Download Speed Upload Speed 1.14 Mbps 0.55 Mbps *See page 43 for definition of latency Latency* 165 ms 37 Excede/Wildblue Contact: Exede and Wildblue 888-746-8960 Northland Connect Website: www.exede.com 888-567-1919 www.northlc.com Excede Opportunity: This improved ViaSat-1 service satellite was launched on October 19, 2011, and has quickly expanded its service area to include Minnesota, although we are on the eastern edge of the western satellite coverage area. It appears to have succeeded the Wildblue service offering with EXEDE, a much faster service. Note: The original Wildblue service still has a small amount of the stimulus money granted to it that could pay for installation to anyone who is currently unserved by any broadband service provider and which then carries a $39.95 life time price for 1 Mbps down, 200 Kbps up service. HughesNet also was awarded stimulus funding under similar restrictions. ViaSat-1, at 140 Gigabits, is the world’s highest capacity satellite, more than double the capacity of all other existing satellites combined that serve North America. The capacity means they are capable of carrying the traffic of over 1 million customers. This alleviates the problem Wildblue encountered as it ran out of satellite ‘space’ and had to turn away customers in several states over the last few years. Exede is advertised as a one speed service priced by data capacity. The speed offered is 12 Mbps down and 3 Mbps up. The data caps and their monthly pricing are: 7.5 Gigabits 15 Gigabits $ 49.99 $79.99 *Northland Connect offers 10 Gigabits for $49.99 25 Gigabits $129.99 Installation charges were lowered for an introductory period from May 29 thru June 30, cutting the normal $149.99 to $100.00. We believe that offer has been extended until July 31 and may be extended again. New customers may be able to negotiate either this lower rate or even free installation. The service also charges users an additional $10 per month equipment rental fee and requires a 24-month commitment. To determine which service level a customer should choose the site provides a handy calculator depending on the usage patterns of a customer. The site can be found at http://www.northlc.com/plan-selector.htm. While the service can be directly purchased through Excede current CVII customers have found that purchasing the service through Northland Connect, a consortium of four electrical cooperatives that is based in Grand Rapids. Comparing the install and rental pricing between Northland and the Excede site there are install savings and a local number to call for customer support. 38 Inherent in satellite service however is the latency issue since the signals travel 26,000 miles up and back. There will be a half second minimum latency (delay) with the service with local users reporting up to 700 milliseconds latency in local installations. This precludes using satellite for Virtual Private Networking (commonly used for telecommuting), VOIP (voice over Internet service), high definition streaming video without buffering, quick response gaming or real time stock trading for example, but still is perhaps a stopgap solution for several users in the seven township area as we wait for wireline services to appear. It definitely outperforms the previous satellite service from Wildblue and resident tests of Skype services shows it supports that technology. Existing Connection Speeds: CVII residents who have access to Excede and Wildblue Internet services in Northstar Township tested their connection (there is some debate as to the latency): Download Speed Upload Speed 8.83 Mbps 2.28 Mbps 11.93 Mbps 2.00 Mbps 28.03 Mbps 2.37 Mbps 7.70 Mbps 2.14 Mbps 4.95 Mbps 1.34 Mbps 10.59 Mbps 2.16 Mbps 7.84 Mbps 1.86 Mbps 7.72 Mbps 1.91 Mbps 7.39 Mbps 1.77 Mbps 3.9 Mbps 1.12 Mbps 8.23 Mbps 2.06 Mbps 8.38 Mbps 2.19 Mbps 8.67 Mbps 2.11 Mbps 11.06 Mbps 1.86 Mbps 3.73 Mbps 1.17 Mbps Wildblue services were also tested Download Speed Upload Speed 1.52 Mbps 0.07 Mbps 1.59 Mbps 0.10 Mbps 4.46 Mbps 1.51 Mbps 6.15 Mbps 1.96 Mbps 4.24 Mbps 1.69 Mbps 3.62 Mbps 1.54 Mbps 3.21 Mbps 1.06 Mbps 3.21 Mbps 0.68 Mbps 1.99 Mbps 0.82 Mbps 2.43 Mbps 0.58 Mbps 1.60 Mbps 0.78 Mbps *see page 43 for explanation of latency Latency* 725 ms 14 ms 15 ms 758 ms 721 ms 14 ms 15 ms 805 ms 818 ms 12 ms 16 ms 722 ms 14 ms 14 ms 14 ms Latency* 887 ms 1486 ms 812 ms 760 ms 745 ms 760 ms 51 ms 51 ms 955 ms 49 ms 981 ms 39 Hughesnet Contact: Hughesnet 877-275-9818 Website: www.hughesnet.com Hughesnet Opportunity: Initially we found that Exede would be the only satellite service we would recommend for those seeking an immediate broadband solution in unserved areas, but on July 6, 2012, Echostar, who owns Hughesnet, announced they also have launched a new satellite that will greatly enhance their service offering. It uses a different transport technology than the ViaSat-1 and is expected to be able to offer up to 20 Mbps service downstream. No customers will be acquired before October of this year however, so we can’t find any testimony or test cases online to report further information at this point. This quote is from their press release: “Extensive tests will be completed after the spacecraft is maneuvered into a circular orbit 22,300 miles above the equator at 107.1° West longitude. Hughes expects to begin commercial operations this fall. The Ka-band EchoStar XVII with JUPITER high-throughput technology will enable HughesNet Gen4—Hughes’ fourth-generation satellite Internet service. HughesNet Gen4 will dramatically increase Internet browsing performance and support highbandwidth applications such as video and music. HughesNet Gen4 customers will be able to experience faster speeds and the industry’s greatest download capacity so they can experience Internet connectivity at its fullest. “ We suggest watching the trade magazines for announcements and articles as the next few months to see if this satellite will also offer service that would be acceptable to CVII’s unserved population this fall. Watch for the range of the service area and the speeds advertised on their website also. We anticipate pricing will be similar to the Exede range, with tiers divided by the usage rather than the speed of transmission. For all satellite systems, the long distance that data must travel will result in some latency, but both major systems described here also try to cache (retain on a server) those sites you visit often or repeatedly in a session to allow you to retrieve them much more quickly and will enhance your experience. The current pricing scheme for HughesNet may give some clue as to their probable tiers of data caps for the future offering. For right now, this is the best you can get from this provider. We would hope that the company greatly expands its data caps for the newer faster service to something that will approach a more practical cap that moves into the gigabit range as other providers have done. 40 Current Hughesnet Satellite Internet Services 41 Provider Comparison Charts Bandwidth and Price There are several service provider options within the CVII area, the only providers who service the entire area are the Satellite Providers (Excede, Hughesnet and Wildblue). All other carriers have limited service areas, and AT&T and Verizon Wireless have limited service areas depending on their tower coverage. The service levels are advertised, there are actual speeds in the report. Service Provider and Pricing (Existing Providers in CVII Area) Provider Speed Down/Up Data Cap Price Install AT&T 5-12 Mbps/2-5 Mbps for 4G services 0.7-1.7 Mbps/0.5-1.2 Mbps for 3G services 5 Gig 1.5 Mbps Down 150 Gig CLP CLP Excede Excede Excede Frontier 3 Mbps/1.5 Mbps 7 Mbps/1.5 Mbps 12 Mbps/3 Mbps 12 Mbps/3 Mbps 12 Mbps/3 Mbps 1 Mbps/ 256Kbps None None 10 Gig 15 Gig 25 Gig In Trial 49.95 59.95 49.99 79.99 129.99 34.99 250.00 250.00 149.99 149.99 149.99 yes 0.00 0.00 9.99 9.99 9.99 6.30 Frontier 3 Mbps/ 1 Mbps In Trial 49.99 yes 6.30 Hughesnet 1 Mbps/250 Kbps 250 Meg 49.99 199.99 9.99 Hughesnet Hughesnet Wildblue 1.5 Mbps/250 Kbps 2 Mbps/300 Kbps 1 Mbps/200 Kbps 350 Meg 450 Meg 10.3 Gig 79.99 109.99 39.95 199.99 199.99 Free 9.99 9.99 9.99 3 Mbps/300 Kbps 8 Mbps/2 Mbps 5-12Mbps/2-5 Mbps for 4G services 0.6-1.4 Mbps/0.5-0.8 Mbps for 3G services 27 Gig 60 Gig 4 Gig 69.95 129.95 30.00 Free Free 19.9979.99 9.99 9.99 N/A Century Link Wildblue Wildblue Verizon 42 50.00 19.9999.99 Lease N/A According to CenturyLink Website HSD not available. Some CVII customers do have service though Notes: Limited Service Area within CVII (2G); Additional 1 Gig for $10.00/month Advertised Speeds are not achievable in tests Under New Platform Priced by Data Cap; Speeds are the same Advertised Speeds are not achievable in tests Free InstallStimulus Pkg Free InstallStimulus Pkg Limited Service Area within CVII; $10.00 per 1 Gig for additional data Data Caps Many Internet providers, including all satellite and most cellular companies, have classes of service based more on data caps than speeds. This change in pricing and availability has been due to the quick growth of data carried by systems which, as carriers pay to have that traffic transported, becomes the highest element of the cost of service. Also, carriers are investing billions in network upgrades to carry traffic while companies like Netflix, Google, and Amazon use those networks for free, leaving the customer as the only one who pays. So while we understand the reasons why carriers put the caps in place, the customers hate the idea of limiting what has always been an unlimited resource to them: access to the Internet. Actual access is not terminated except for egregious cases of abuse, but the connection of a user going over the limit will be slowed appreciably. Data caps are common now on all services except cable and DSL usually, although Comcast has instituted a 300 Gbs cap on their service and Frontier has experimented with caps that will likely become permanent at some point in the future ( http://www.frontier.com/networkmanagement/), but both services are still priced by speed. Satellite services, with brackets of service at Exede ranging from 7.5 Gbs to 25 Gbs per month priced by cap, Wildblue has a cap of 60 Gbs on its highest level service under the stimulus offering and Hughesnet tops out with a comparatively measly 450 Mbs on its highest plan. Cooperative Light and Power is currently not planning on instituting a data cap on its service. Lake County is also not planning on providing data caps on its Internet services. As CVII continues to negotiate with carriers to bring new services to the area this will be a consideration in discussions. For those interested in learning what not to do avoid reaching your data cap on a cellular data network this PC World article provides some good recommendations: http://www.pcworld.com/article/237345/phone_data_caps_five_things_you_shouldnt_do_too _often.html . These same rules and including the same rules for video can help in reducing running into your data cap. A comparison of data caps can be found under the Bandwidth and Pricing comparison table located on page 41 of this report. 43 Latency Latency is defined as the amount of delay, measured in milliseconds, that occurs in a round-trip data transmission. Latency is unavoidable in any Internet connection and it can only be minimized using a better managed network. Not directly related to speed, latency can be an issue with all networks. Because latency can depend on factors out of the control of the lastmile service provider, a direct comparison of technologies can be difficult. It is important to understand though that latency is not matter of speed of your connection. Latency most affects satellite connections; satellites used for two-way Internet service are located approximately 23,000 miles above the equator. This means that a round-trip transmission travels 23,000 miles to the satellite, 23,000 miles from the satellite to the remote site, and then as the TCP/IP acknowledgment is returned. Each time a data packet ‘hops’ (i.e. handled by a device along the path) several milliseconds of latency are introduced. The physics involved account for approximately 550 milliseconds of latency, a limitation shared by all satellite providers. (Source: http://www.vsatsystems.com/satellite-internet-explained/latency.html). It is common to see satellite latency of 700 milliseconds. Latency is also affected by how quickly you are sharing network with others and competing for bandwidth with other subscribers. This happens at some point in all networks as oversubscription is a necessary requirement of service providers to keep internet services prices reasonable. Comparing Wireline technologies there can be significant differences between fiber based technologies; a good rule of thumb is the deeper the fiber, the less the latency. In the FCC Measuring Broadband America (http://www.fcc.gov/measuring-broadband-america) report thirteen of the largest wireline providers (including the former Qwest, Frontier and CenturyLink) were tested by thousands of tests carried out by citizens across the United States. Based on this testing the average millisecond latency by technology was: DSL-44 milliseconds Cable-27 milliseconds (note: there are no cable services in the CVII service area) Fiber-17 milliseconds Because 3G and 4G services are relatively non-existent in the CVII area it is difficult to provide latency comparisons. It is important that these technologies have fiber-optic or microwave backhaul to provide the speeds promised by the providers. In metro areas where these technologies have been deployed, wireless carriers are seeing latency in the range of 125-225 milliseconds (http://www.phonearena.com/news/4G-speed-test-results-are-in-Verizons-LTE-is44 fastest-but-T-Mobile-holds-the-fort-in-smartphone-speeds_id17405); it can be expected that if deployed in the CVII area, latencies for these technologies would not be better than the metro latency ranges. Current latency tests done by residents of CVII show what current CVII subscribers are experiencing. This test is not scientific; all testers utilized www.speedtest.net. Provider CenturyLink CLP Excede Frontier Hughesnet Verizon Wildblue Latency (in milliseconds) 92 ms 26-45 ms 700-800 ms 80-100 ms 700-800 ms 165 ms 800-1400 ms The following table gives an estimate of the services that are acceptable over each technology; this table is not a guarantee but an approximation of the technologies ability to deliver the service. Application VOIP Video Conferencing Gaming Skype Connect Netflix DSL Yes Yes Fixed Wireless Yes Yes Mobile Wireless Yes No No No Fiber to the Premise Yes Yes Yes Yes Yes Yes No Yes No No Yes Yes Yes Yes Yes Yes Yes 45 Satellite Technology Platforms This chart provides a description of the different broadband technologies that service providers utilize to provide last-mile services. The chart is arranged by current technologies available; potential opportunities to improve broadband (3G and 4G are included in this section as they have limited access today in the CVII service area) in the CVII service area and then other technologies that show promise. Technology Description Current Provider Technologies DSL A solution that utilizes the existing copper cables owned by incumbent telephone companies. Additional speed can be achieved by shortening the length of the copper loop or bonding the copper pairs together. DSL comes in a variety of flavors including ADSL, ADSL 2+ and VDSL. Typical DSL deployments will not exceed 18,000’ of copper cable route connected to backhaul at the DSLAM Satellite A solution that utilizes telecommunications satellites in earth orbit to provide services. The long delays between the satellite and ground stations cause latency that can affect real-time applications such as voice and virtual private networks (VPN). Fixed Wireless A solution that utilizes either licensed or non-licensed spectrum to deliver internet services. Fixed Wireless can be provided as a Line of Sight or Near Line of Sight technology. Depending on the spectrum also affects the ability to penetrate trees and other obstacles. Common spectrum for Fixed Wireless include 5.8 Ghz, 3.65 Ghz, 2.4 Ghz and 900 MHz Potential Provider Technologies Fiber-to-the-Premise A solution that utilizes a fiber optic cable directly to the premise. There are several variations of FTTP services including Passive Optical Networks, Active Ethernet and RFOG. FTTP technologies are considered future-proof as the fiber does not need to be replaced, only the electronics to increase speeds. Fiber-to-the-Node A solution that utilizes fiber optic cable to a node where then either twisted-pair copper or coaxial cable is used to reach the end customer. 3G/4G Wireless A solution that utilizes cellular spectrum to provide internet service. It is important that fiber backhaul be combined with the technology to provide the bandwidth required to meet the requirements of today’s mobile user. Technologies That Show Promise Whitespace or SuperWifi A solution that utilizes the “white space” between commercial UHF and VHF television channels to provide internet services. 46 Given the spectrum qualities of these channels, the signal is able to penetrate obstacles that typical WiFi technologies cannot. Some vendors are working on unlicensed spectrum solutions for this technology. This technology is just at the start of development and today there are no providers in the Minnesota market working to deploy the technology. 47 Conclusions and Recommendations There is tremendous opportunity for CVII to work with existing and new providers to bring better broadband services to the area. It is obvious that today’s technology options will not allow CVII residents the opportunity to fully participate in the current Internet economy. In conclusion there are four topics to cover: What are the best options today, who should CVII be talking to today? Who is making progress where, what should CVII watch? What should CVII do next from a marketing perspective? How does CVII update the information going forward? What are the best options today, who should CVII be talking to today? Today for CVII residents who are looking for a service that will allow them to perform the most common Internet-based tasks (e-mail, web-surfing and social networking) it seems that the Excede satellite provides the best option for the overall CVII area. There are issues around the latency around the service for more advanced real-time applications like VPN and remote office but as a basic service it has the best bandwidth speeds. The other caution is the data cap surrounding the Excede service. As far as opportunities to gain additional providers into the CVII area there are two providers that CVII should be engaging with: 1. Cooperative Light and Power-CLP has a vested interest in the area being the existing power provider for most of the CVII area. In addition CLP has been improving its wireless platform and in testing with CVII residents is providing bandwidth in range of the CVII goals. CVII should engage with CLP to quantify a business model that would be acceptable to CLP and also leverage the CLP network to provide SCADA and Smart Grid technologies. This will require CVII to share additional information about the survey responses and also require CVII to assist in sales and marketing activities 2. Air Fiber-Air Fiber is interested in serving the requirements of rural areas and given it is using the same platform as CLP it is expected that its bandwidth will at least equal the CLP experience. The same types of business development and market development activities will be required. It is the opinion of Air Fiber that CLP is a first choice given their ties to the area. 48 Who is making progress where, what should CVII watch? There are additional activities that CVII should be monitoring that can improve the broadband options of CVII residents: 1. The Frontier commitment to bring 6 Mbps/1 Mbps to its serving areas-this network enhancement will improve broadband connectivity for the northern portion of the CVII area 2. The possibility that CenturyLink will be granted a waiver to utilize Connect America Funds in Minnesota-this network enhancement would improve broadband connectivity for the CenturyLink served areas of CVII 3. The participation of AT&T and Verizon in the FCC Mobility Fund Phase 1 Auction-CVII is eligible for these funds. CVII should prepare documentation given its support of AT&T and Verizon applying for funds and present those to the carriers. Since AT&T provides more service in the area a letter to the state president encouraging them to apply for the Phase 1 mobility dollars to complete services in the CVII area. 4. The Lake County fiber build through portions of CVII-while not an immediate opportunity this fiber could be leveraged in the future to interconnect to a new provider using Lake County as the last-mile solution or as a possible jumping off point for a future Lake County fiber-to-the-home expansion 5. The launch of the Hughesnet satellite that will bring an additional high-speed satellite player to the marketplace in competition with Excede 6. Blandin Broadband Opportunities-as Blandin launches its MIRC 2.0 program this can be an opportunity for CVII to raise additional funds for broadband improvement What should CVII do next from a marketing perspective? It is important that CVII continue to develop its own marketing story to share with existing and potential providers. The activities surrounding this should include: 1. Creation of a marketing package including the benefits of serving the area and the attractive demographics of CVII. 2. Work with St. Louis County and member townships to determine potential wireless tower sites to assist both fixed and mobile wireless operators. 3. Additional customer commitments to share with potential broadband providers-taking the next step of commitment will allow providers to quantify the business opportunity. At some point this will require CVII to share where these committed customers are located. 4. A willingness to create co-marketing opportunities with existing and potential broadband providers, as existing and new providers bring services to the area CVII should engage in opportunities to make them know to CVII residents. This includes newsletters, e-mail blasts and community events. 49 5. Getting the CVII story out to the rest of the world-press releases and participating in Broadband forums will assist in keeping the CVII story fresh How does CVII update the information going forward? This report is a snapshot in time and presents the foreseeable opportunities for CVII to improve broadband services to its communities. To keep this information fresh, CVII will need to continue to communicate with providers and validate any improvements that providers bring to the area. 1. Quarterly communication with the providers-constant pressure on the providers can help in moving up a project. It is true, “the squeaky wheel gets the grease”. 2. Validate speeds of new and existing providers-by utilizing the Connect Minnesota speed-test and validating actual coverage areas CVII can assist in shaping the actual broadband mapping in area. This report is just the next step in CVII taking control of its broadband future. By following the recommendations presented we believe CVII can continue to improve the broadband future of its residents. 50 U-reka Broadband Ventures is a team of telecommunications experts that have united to provide the experience, expertise and services necessary to succeed in today’s dynamic communications environment. With offices in Stillwater, MN, and talent recruited from the upper Midwest, you can be assured that the best talent and advice is available to meet your requirements. U-reka has not only knowledge of how the pieces go together but can put the pieces together for you. We utilize our over 50 years of experience in the industry to provide an “eco-system” of qualified contractors and vendors to meet your needs regardless if your network is fiberoptic, wireless or a network that combines both of these architectures. We work with providers, local governments, economic developers and community groups to find workable solutions and positive partnerships. Services we offer include, but are not limited to, Feasibility Assessments, Partnership and Fiber Business Models, Fiber Network Design, Fiber Network Builds, Project Management, Installation & Testing and Grant Writing. CVII’s U-reka Broadband Team John Schultz John Schultz is a 25 year veteran of the telecommunications industry and has spent his career concentrating on bringing next-generation architectures to business and residential customers. John's passion is fiber connectivity and the possibilities that it brings to his customers. John has been involved in deep fiber architectures including VDSL, HFC and FTTP networks. In addition John has been actively involved in the development of fiber connectivity across the region including long-haul routes for both Incumbent and Competitive Local Exchange Carriers. John has also been retained by the investment community to provide industry expertise for merger and acquisition activity. During his time with U-reka Broadband John has been instrumental in developing fiber optic networks for Service Providers, Municipalities and Private Businesses. John has a common sense approach to the business given his background in construction and engineering. John has received a Bachelor's and Master’s Degree in Telecommunications from St. Mary's University. 51 JoAnne C. Johnson Twelve years in government relations and community development, the last ten years with Frontier Communications, have helped create the knowledge base that drives her work in the communications industry and was also a defining factor in her being named Chair by Governor Pawlenty of the MN Broadband Advisory Task Force, created in 2010’s legislative session. The task force explored the state of broadband in MN and assisted the Commissioner of Commerce with creating a yearly report on the state of broadband in MN. She also served on the original highly acclaimed Ultra High Speed Broadband Task Force in 2009-2010. In addition to JoAnne’s broadband activism, her background in both state and federal level regulatory and legislative activities is a valuable asset to our clients. Prior to her work in the private sector, JoAnne was an Economic Development Officer for Congressman Collin Peterson in the rural 7th District, giving her ample experience in outstate MN and background in rural issues. Her work there involved technology and telecommunications and she organized the Congressman’s three Rural Telecommunications Conferences in partnership with MN Rural Partners and St. Cloud State University. Contact Us Anytime John jschultz@u-rekabroadband.com JoAnne jjohnson@u-rekabroadband.com 52