Gillette: The Best Anyone Can Get

advertisement

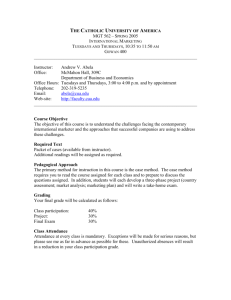

Gillette: The Best Anyone Can Get Team 2 Marketing 8030 07-20-2014 Summer 2014 Gillette: The Best Anyone Can Get Executive Summary Gillette is a multi-billion dollar company focused on personal grooming products founded by King Gillette in 1901. Now part of the Procter and Gamble family, Gillette has consistently innovated its products to maintain its place as the leader in its market segment. Gillette is most identified with the slogan “Gillette: the best a man can get.” Gillette currently faces the struggle of how to maintain competitive advantage in a mature market without creating trivial and easily duplicated innovations. An examination of Porter’s Five Forces and a rigorous SWOT analysis has revealed that for Gillette to continue to experience success in its market segment, the best approach is to continue with its innovative efforts, and to broaden its marketing strategies to women in an effort to become known as “Gillette: the best anyone can get.” 07-20-2014 1 Gillette: The Best Anyone Can Get Contents Executive Summary......................................................... 1 Contents .......................................................................... 2 Company Overview ......................................................... 3 Situation Analysis ............................................................ 4 Problem Statement ......................................................... 5 Assumptions.................................................................... 6 SWOT Analysis ................................................................ 6 Porter’s 5 Forces in The Personal Grooming Market...... 7 Marketing Alternatives Considered ................................ 8 Decision Criteria ............................................................ 10 Decision Analysis MATRIX ............................................. 10 Recommendations ........................................................ 12 07-20-2014 2 Gillette: The Best Anyone Can Get Company Overview King Camp Gillette was born in Fond du Lac, Wisconsin in 1855. When he was 16, his family’s home was destroyed in the Chicago fire of 1871. This single event galvanized King Gillette to lead a life of selfsufficiency, innovation, and invention. Gillette’s work as a travelling salesman led him to a colleague who firmly implanted in his mind the paradigm that “the most successful invention is one that can be purchased over Figure 1: A Gillette Safety Razor and over again by satisfied customers.” His initial razor invention was the “safety razor” (Figure 1) that had a reusable handle grip functioning as a blade mount and disposable blade as an accessory. This was a significant and considerably safer improvement over the straight razor, which was essentially a sharp knife (Figure 2). The Gillette Safety Razor Company was established in 1901 with the successful implementation of the mass produced “Safety Razor” and disposable blades. Gillette did not have direct competitors in the disposable razor market for 61 years until 1962 when Wilkinson Sword introduced its stainless steel Figure 2: Typical Straight Razor disposable razor blades. Today, Gillette still maintains dominant market share in the U.S. and across the globe under the ownership of Proctor & Gamble. Gillette only has one serious competitor, Schick, for its wet shaving products. There are other private brand competitors but they hold negligible market shares. Up to the 1980’s, Gillette held 70% of the global market share for wet shaving with roughly 5% decline through the end of this case study in 2009. 07-20-2014 3 Gillette: The Best Anyone Can Get 4 Situation Analysis Gillette is competing in a very mature wet shaving market segment that is characterized by low innovation and very few competitors. The company only has one direct competitor, the Schick Company, who has an estimated 17% global market share. It is estimated that 25% of people that are of shaving age do not shave for reasons including cultural, religious, discomfort, or personal preferences. 94% of women who shave prefer to shave with a disposable razor, and they shave an average of 11 times a month. 84% of men who shave prefer to shave with a disposable razor, and they shave an average of 22 times a month. While Gillette has had some cannibalization of its product lines with the advent of new products, they have been able to continuously milk the cash cows even as new entrants come to market. Trivial innovation has been described by industry analysts as adding a 6th or 7th blade to the existing design. In the past, Gillette has demonstrated solid strength to combat competitive threats with innovative designs for the disposable razor. However, most analysts now believe that the wet shaving market has reached its peak ability to create meaningful innovations. Examples of trivial innovations have been described by industry analysts as ‘adding a 6th or 7th blade to the existing design’. While Gillette is best known for its “Gillette, The best a man can get” tag line, the company has been very adept at marketing and reaching a broad audience. Gillette does market to both men and women but has a marketing emphasis in male dominated sports and activities. 07-20-2014 Gillette: The Best Anyone Can Get Gillette’s wet shaving products are in a classic mature market and have an enviable position in that market. However enviable, Gillette will have to take market share from Schick to grow profits and maintain a competitive advantage. Problem Statement Gillette’s problem is defined as follows: How can Gillette maintain competitive advantage in a mature market without creating trivial innovations? It is important to understand that competitive advantage is equated with increased market share. Although this is quite a mature market (Gillette did not have competitors in disposable wet shaving for 60 years and since then) its market share has only vacillated approximately 10 percent. Therefore, this market is still susceptible to rapid changes based on significant innovation. While Gillette has cannibalized its own sales recently through trivial innovation, there is opportunity for large market share gains with meaningful innovations. Analysts regard their move to a five bladed Fusion system from the three bladed Mach-3 system as virtually trivial and even mocked Gillette with their own tag line “I thought this was the best a man can get?” Most analysts firmly agree that adding blades to the existing design would be a trivial and inconsequential innovation. 07-20-2014 5 Gillette: The Best Anyone Can Get Assumptions An important assumption made in the analysis of this case is that Gillette cannot modify the prices of its products without significantly impacting unit sales. If prices are raised, the company runs the risk of alienating consumers and reducing profitability. If prices are lowered, new consumers that are attracted by the decreased price cannot offset the reduced profitability. We believe that Gillette has put a great deal of thought into their current pricing structure that should not be altered. The original case study was written during the recession in 2009. The analysis was made with the assumption that the economy is in recovery in certain sectors including the wet shaving market. Furthermore, analysis was made without additional research per instruction. Identification of problems, alternatives, and recommendations were derived from the case alone. SWOT Analysis The case demonstrates that Gillette’s strengths to date were their ability to innovate, capture and hold dominant market share, very strong branding via successful marketing, the financial backing of Proctor and Gamble, as well as their diversification into complimentary personal grooming products. The documented weaknesses in the case include their recent inability to create substantial technological improvements that are difficult to copy. Most of 07-20-2014 6 Gillette: The Best Anyone Can Get their primary product lines are also in the very mature stage of their life cycles. Gillette has higher price points with a narrow segment focus since they market primarily to men. Gillette has significant opportunities stemming from a rise in global demand for personal grooming products, emerging global markets, the female market segment, and underserved minor market segments. Significant threats facing Gillette include direct competition from The Schick Company who holds approximately 15 to 17% of the wet shaving market at the time of the case. Significant innovation from Schick could propel a rapid market share gain. Other smaller threats are bad press from critics and consumer publications like Consumer Reports, the depressed economy, the competitions’ pricing strategy, and consumer safety groups and regulations. Porter’s 5 Forces in The Personal Grooming Market 07-20-2014 7 Gillette: The Best Anyone Can Get Modern business case analysis is no longer complete without an examination of Michael Porter’s Five Forces Model that some consider more complete than a standard, SWOT analysis. In Gillette’s case, disregarding disruptive technologies such as 3-D printed shavers that do not represent a revenue for any company, the barriers to entering into direct competition with Gillette are very high as the potential competitor would have to invest heavily in manufacturing facilities, supply and distribution chains, as well as significant marketing costs and relationships with large scale distribution outlets. Gillette does enjoy significant power as a very large global procurer of steel and chemicals for plastics extrusion for their shaving devices. This gives them the power to negotiate from a place of strength with the suppliers. The weakness lies in the ease for customers to substitute Gillette’s products with their competitor’s. Furthermore, large volume buyers such as Wal-Mart have significant negotiating power. However, Gillette’s large sales volumes earn them preferential perks and preferred placement in stores with large retailers such as Wal-Mart. While there is significant rivalry in the wet shaving market, the competition is really between only two main competitors of which Gillette has roughly seventy percent of the market share. This gives Gillette a significant advantage in the rivalry. Marketing Alternatives Considered 07-20-2014 8 Gillette: The Best Anyone Can Get Given the SWOT analysis, Five Porter’s Forces, assumptions, situational analysis, and company history, the best alternatives to the problem statement are listed in Figure 3. The first alternative is the production of a serious, patentable and not easy to Figure 3: Solution alternatives to the problem statement duplicate innovation that has been dubbed the “Lazer Razor”. The case demonstrates that significant innovative breakthroughs attract purchasers. Subscription service additions to deliver personal care products directly to the home on a frequent basis will raise the bar of difficulty for customers to choose alternative personal care products. Marketing to new target segments, particularly to women, is something that is recommended. In most women’s sports, with few exceptions, ladies generally are bare legged and frequently showing their armpits. This represents a significant opportunity for wet shaving products to advertise at these venues. An alternative that should also be considered is partnership with ventures in the travel industry such as cruise ships and hotels. Hotels provide personal grooming items in most rooms and having entire chains provide Gillette products will get the products into the hands of customers who may not choose Gillette products normally. Furthermore, these products would be associated with hopefully a positive experience. Another alternative worth consideration is the continued expansion of other related personal grooming product lines that complement the wet shaving market such as lotions, creams, and body washes. 07-20-2014 9 Gillette: The Best Anyone Can Get Decision Criteria The selected relevant decision criteria are outlined in Figure 4. Increased US market share and increased global expansion are weighted most heavily as they represent the paths to capture a larger market share. Brand equity is very important, and the Gillette brand is already well established. The alternative solutions are weighted on their ability to further increase Gillette’s brand equity and make it a bigger household name that it already is. One of Gillette’s greatest strengths from the case study is its ability to cleverly market products to consumers, and to do this successfully, they must be able to leverage their brand name. Low investment cost and low competitive threat are not weighted as heavily. The wetshaving market segment already has very low competitive threats due to the high barriers to entrance for Figure 4: Decision Criteria Matrix incoming competitors. The strong financial support that Gillette enjoys as a member of the Procter & Gamble family can allow them to embark on a moderate to high cost venture to garner fresh market share. Decision Analysis Matrix 07-20-2014 10 Gillette: The Best Anyone Can Get Figure 5 represents the results from the Decision Matrix. Under the “Increase U.S. market share” criteria, it would appear from the significant ability of new innovation to swing consumers that the Razor innovation is scored with a four assuming that the innovation is not trivial. Gillette, as mentioned before is a marketing machine, earning a five in the market to new segments category, as it is a core competency of the company. Expansion of personal grooming products in related product lines of wet shaving also earned a four, as there seems to be a significant market here, particularly to women. A subscription program and partnerships with travel sites would gather only moderate gains. The trend follows suit with only slightly lower scores when examined in the global expansion category. All Figure 5: Decision Analysis Matrix alternatives scored well in increasing brand equity; however, the standout was the “marketing to new target segments” alternative. This stood out as the idea of marketing to the female segment would gain great increases here. A subscription service rated poorest in this category, as it likely would have only a moderate effect on brand equity. Low investment cost scores were low as none of these are particularly low cost efforts. The Razor innovation is the alternative category that stood out when considering low competitive threat as all the other alternatives could be easier to duplicate. Patent protections 07-20-2014 11 Gillette: The Best Anyone Can Get and complexity in design would make it more difficult for Schick to copy and infringe on a truly innovative product. Recommendations Based on a thorough analysis of the case and the decision matrix, the recommended solution alternative is for Gillette to broaden its marketing strategies and market to new under-explored segments. To implement this recommendation, we suggest the following three steps. First, Gillette should initiate a study to determine the most profitable market segments that can be tapped successfully to increase market share. Second, Gillette should assemble a cross functional marketing team (Customer Marketing, Marketing Communications, and Ad Agency) to define the strategy to reach the target audience. Lastly, Gillette should Implement the strategy and measure the results. This plays to the inherent strengths of Gillette to market very effectively but expands beyond their core cash cow base of men without neglecting them. A potential change in their household tag line from “Gillette, the best a man can get” to “Gillette, the best anyone can get” would broaden the customer base by making Gillette a more inclusive brand. Because innovation is intrinsic to Gillette, to maintain long term competitive advantage, it is also recommended that Gillette continues with its research and development efforts to create groundbreaking innovations in the wet-shaving market. 07-20-2014 12