6810_ UBC_DAP_CPA-Course

advertisement

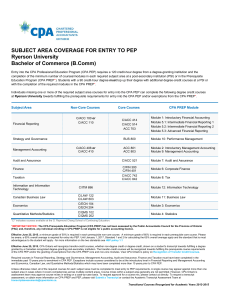

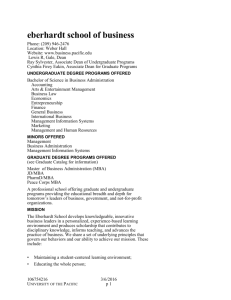

Course Coverage for CPA Programs University of British Columbia (DAP) Students who are missing one or more of the required courses for direct admission into the CPA Professional Education Program (CPA PEP) may consider completing equivalent coursework at the University of British Columbia (DAP), at another recognized postsecondary institution, or through the CPA Prerequisite Education Program (CPA PREP). CPA Professional Education Program (PEP) Pre-requisites University of British Columbia (DAP) students may be exempt from specific CPA PREP modules if they have completed the following courses: For more information on CPA PEP and CPA PREP visit www.gocpabc.ca CPA PREP MODULE SUBJECT AREA REQUIRED COURSES Module 1 Introductory Financial Accounting BUSI 293 Module 2 Introductory Management Accounting BUSI 294 Module 3 Economics ECON 101 and 102 Module 4 Statistics BUSI 291 Module 5.1 Financial Accounting 1 BUSI 353 Module 5.2 Financial Accounting 2 BUSI 450 Module 5.3 Advanced Financial Accounting BUSI 453 Module 6 Corporate Finance BUSI 370 and 470 Module 7 Audit and Assurance BUSI 455 Module 8 Taxation BUSI 355 Module 9 Intermediate and Advanced Management Accounting BUSI 354* Module 10 Strategy and Governance BUSI 493 Module 11 Business Law BUSI 393 Module 12 Information Technology BUSI 335 *Exemption for Module 9 will only be granted to students who have completed this course from September 2013 onwards. Students who completed this course prior to September 2013 will not be granted exemption. *Exemption for Intermediate and Advanced Management Accounting will only be granted to students who have completed the courses from September 2013 onwards. Students who completed this course prior to September 2013 will not be granted exemption. Please note: Legacy Program Courses: •E ffective January 1, 2015 a minimum grade of 50% is required for CPA PREP modules 1—4, 11, and 12. A minimum grade of 60% is required for all other courses. Please be aware, a 65% overall average is required for entry into PEP. Until January 1, 2017, two standards for calculating that 65% overall average apply and the standard that is most advantageous to the student will apply - for more information on the two standards see HEP policy 1.1. Until June 2017, legacy CGA, CMA, and CA courses will be accepted for entry into the CPA PEP. For students who are completing courses required for entry into the CA, CGA, or CMA professional programs, these courses will be accepted for entry into the CPA PEP. Students must meet the prerequisite course requirements of only one of the CMA, CA, or CGA pathways to be accepted for entry into the CPA PEP; students will not be allowed to combine courses from the CGA, CMA, or CA pathways. If a legacy track is applied, the minimum grading requirements for that legacy track will apply. •U nless otherwise noted, all of the required courses for each module must be completed for exemption. •A single course may appear against more than one module in cases where it covers competencies across multiple content areas. Students who have completed either the CA, CGA, or CMA prerequisite courses will be eligible to register for the CPA PEP upon completion of their respective pathway’s Module Zero. Please contact CPA Western School of Business for further information. www.cpasb.ca. This information is subject to change. Last updated March 27, 2015.