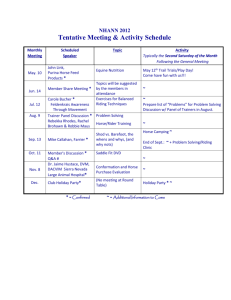

Pricing for Profit:

A Scientific Approach

Mike Pritchard & Dan DeVries

Pricing Is Simple – Isn’t It?

JCP vs. S&P 500

“Pricing is actually a pretty simple and straightforward thing. Customers will not pay literally a

penny more than the true value of the product. “

Ron Johnson, Ex-CEO, J.C. Penney

AP Interview, Jan 30, 2012

Left JCP in April 2013

$1B in losses

Interim CEO left

Board Member/Investor Ackerman Left

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

2

Pricing Drives Profitability

Increase

Price

by 1%

Increase

Profit

by 8.7%

Profit

Profit $12.50

$11.50

Variable Cost,

$68.00

Price, $101.00

Price, $100.00

Fixed Cost

$20.50

S&P Global 1200 average income

statements 2010, trailing 5 years

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

3

… and Loss

Volume

increase to

break even

17.50%

Decrease

Price 5%

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

4

Traps to Avoid

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

5

Trap - Racing to the Bottom

Market share unchanged - Profits down

Typical order $15

Typical order $10

Any Size, Any Topping $10

Any Size, Any Topping $10

Any Size, Any Topping $10

Week 1

Week 2

Any Size, Any Topping $10

Week 3

Week 4

Week 5

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

6

Trap – Basing Price on Cost

Manufacturer is giving away profits

Pricing Framework:

Cost based: 3x the cost

Customer Survey:

Better than competitors

with lower price

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

7

Trap – Features That Aren’t Valued

What’s in your product that customers don’t value

Blue Ocean Strategies – Kim and

Mauborgne

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

8

Value Based Pricing

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

9

Value Based Pricing Framework

Acme Smart Motor

Lowers

Maintenance

Value = $150

Reduces Power

Costs

Value = $150

Skimming

Strategy

$600

$450

Value

Based

Pricing

Zone

$300

Competitors Base

Price $300

(Dumb Motor)

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

Market

Penetration

Strategy

10

Buyers Can Understand Value

But you need to communicate it

$54,760

Maintenance

Energy

Purchase

$18,400

$55,196

$89,884

$103,490

Incandescent

$146,800

LED

From Dec. 9th 2011

Portland Business Journal Wal-Mart

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

11

… For Services As Well

Value based pricing still applies

Price Per Hour

Price Per Repair

“Safe” (for seller)

“Risky” (for seller)

Profits fixed by hourly rate

Can yield higher profits

Profits driven by time taken

Profits driven by value delivered

How could you take advantage of a different

pricing scheme?

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

12

Value Doesn’t Have to be Physical

$0.07 / Pill

$0.02 / Pill

Don’t underestimate the power of a brand

How does your brand influence your pricing?

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

14

Get in Touch with the Market

Chris Shinouskis

“Engineering

Specialist for

Storage” - GM

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

15

Get in Touch with the Market

• Factor in “big-picture”

issues

• Deliver features

customers want

How do you determine what your customers want ?

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

16

Ask People about Price

• Bargain?

• Getting expensive, but would still

consider?

• Too expensive to consider?

• Too cheap?

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

17

Van Westendorp Analysis

100%

Not a Bargain

90%

80%

70%

Cumulative percentages

Too Expensive

60%

50%

40%

30%

20%

Not Expensive

10%

Too Cheap

0%

$1

© 5 Circles Research

$6

$11

$16

$21

$26

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

$31

$36

18

Van Westendorp Analysis

100%

Not a Bargain

90%

80%

Range of acceptable prices

70%

Cumulative percentages

Too Expensive

60%

50%

40%

30%

20%

Not Expensive

10%

Too Cheap

0%

$1

© 5 Circles Research

$6

$11

$16

$21

$26

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

$31

$36

19

Demand and Revenue Modeling

At a price between [bargain] and [getting expensive] how

likely are you to buy … within the next six months?

Would you say you are:

o

o

o

o

o

Very likely

Somewhat likely

Neither likely nor unlikely

Somewhat unlikely

Very unlikely

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

20

Demand and Revenue Modeling

Higher volume isn’t necessarily higher revenue

12%

1.0

0.9

0.8

Revenue indexed against maximum

Percentage likely to purchase

10%

0.7

8%

Model generates

believable results

within range of

acceptable prices

6%

4%

0.6

0.5

0.4

0.3

2%

0.2

Revenue

0.1

0%

0.0

$-

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

21

Communicate the Value

Investors

Customer

Service

Sales

Training

Integrated

Communications

Social

Media

Images from www.emcoutdoor.com

Ads

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

Web

Media

PR

23

•

Pricing Approaches:

–

–

–

–

–

–

•

Differentiation Aided by Price

–

–

–

–

–

–

•

Customer segment pricing (students, Sr. Citizens)

Product form pricing – Single application vs. 6 month supply, subscriptions

Image pricing – same perfume – different bottle

Channel pricing – Coke in restaurant, store, vending

Location pricing – better seats in a theatre

Time pricing – early bird specials, airlines

Other Factors:

–

–

–

–

–

–

–

•

Survival

Maximize Cash Flow

Value Based Pricing

Market Penetration

Market Skimming

Product Quality Leadership

Approval Threshold

Competition

Category Expectations

Psychology

Reference Pricing (online comparison)

Open Source

Freemuim

Sales Channels:

–

–

Commissions and Discounts

Waterfall / Pocket Pricing

by Uwe Kils, Wiska Bodo via Wikimedia Commons

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

24

Getting Started

Research

•

•

•

Industry demand

Product value

Prices customers will pay

+

Strategy

•

•

•

Product positioning

Branding

Communications

Staging Process

1. Evaluate current situation

2. Work on individual components

3. Develop a comprehensive pricing strategy

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

25

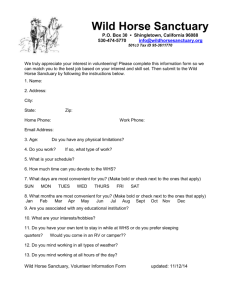

The Pricing Gurus

Dan DeVries is a seasoned executive with a strong

background in marketing, business development,

engineering and new product development. He has a

successful track record at leading organizations such as

Microsoft, AT&T Wireless and Honeywell, and currently

focuses on helping small businesses and start-ups bring

new products to market and achieve profitability and

growth. Dan holds a MS/BS in Electrical Engineering

and an MBA in Marketing. He has taught marketing at

the University of Washington and Keller Graduate

School.

dan@wildhorsestrategies.com, (425) 891-5163

Mike Pritchard’s senior marketing and engineering

positions at Intel, ICL and Sperry Gyroscope include

running a leading industrial computing business. Mike

has consulted for leaders such as Microsoft, Amazon,

Sharp, IBM, Netgear and Hewlett-Packard, as well as

startups. Mike’s worldwide pricing research experience

includes online services, industrial and consumer

products. He holds a BSc in Electronics and an MBA.

Mike’s teaching experience includes Northwest

Entrepreneurs Network and the University of

Washington.

mikep@5circles.com, (425) 968-3883

© 2013, all rights reserved,5 Circles Research and Wild Horse Strategies

26