Handbook F66-D - Investment Policies and Procedures

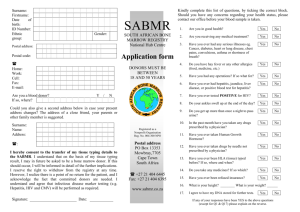

advertisement