SA Experience Rating and Retro-Paid Loss - March 2011

advertisement

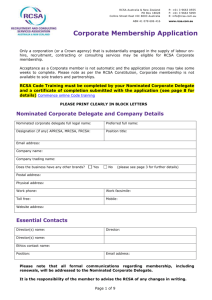

Stakeholder Consultation on the Introduction of Experience Rating and Retro-Paid Loss WorkCover SA Submission of The Recruitment and Consulting Services Association (RCSA) March 2011 Recruitment & Consulting Services Association Ltd RCSA Head Office PO Box 18028 Collins St. East Melbourne Victoria 8003 RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss 1 The Recruitment and Consulting Services Association The RCSA is the peak body for the recruitment and on-hire workers services industries throughout Australia and New Zealand. It is a not-for-profit Association that is managed by a Board of Directors. The principal focus of the RCSA is “to represent and serve the interests of Members for the increased profile and professionalism of the industry”. The RCSA has more than 3200 Members in Australia and New Zealand comprising multi-national companies, single consultancies, and individual practitioners operating within a recruitment consultancy. The Association is instrumental in setting the professional standards, educating and developing Member skills, monitoring industry participant performance and working with legislators to formulate the future. Members are kept up-to-date on information regarding best practice techniques, resources and technological innovation, along with legislative changes impacting on employment. The RCSA also acts as a lobbying voice, representing its Members on issues that impact upon the industry. It has a strong relationship with the public and private sector. Members of the RCSA provide an extensive range of employment services including on-hire employee services (‘labour hire employees’), contracting services (“including labour hire independent contractors’), recruitment services (agency/placement only), Job Services Australia services and consulting services. Every year the industry places millions of individuals in on hired employment and on-hire independent contracting in an increasingly broad range of sectors from building, construction and engineering to secretarial placements, call centres and accounting. The method of engagement may vary within occupational type and industry, with the majority of on-hire independent contracting amongst the RCSA Membership occurring within professional, scientific and technical occupations. The RCSA is instrumental in setting standards in the on-hire worker services industry. Furthermore, maintaining and raising standards in work safety, workplace relations and work law are at the top of the Association’s agenda. RCSA Code for Professional Practice RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss 2 The RCSA has a Code for Professional Practice, authorised by the ACCC, which can be viewed at http://www.rcsa.com.au/imis15/RCSA/RCSA_Code/Introduction_to_the_Code/RCSA/wcRCSACode/Introduction_to_Code.aspx. In conjunction with the RCSA Constitution and By Laws, the Code sets the standards for relationships between Members, best practice with clients and candidates and general good order with respect to business management, including compliance. Acceptance of, and adherence to, the Code is a pre-requisite of Membership. The Code is supported by a comprehensive resource and education program and the process is overseen by the Professional Practice Council, appointed by the RCSA Board. The Ethics Registrar manages the complaint process and procedures with the support of a volunteer Ethics panel mentored by RCSA's Professional Practice barrister. RCSA’s objective is to promote the utilisation of the Code to achieve self-regulation of the on-hire worker services sector, wherever possible and effective, rather than see the introduction of additional legislative regulation. RCSA Member Service Categories and Terminology RCSA believe that the absence of precise terminology is contributing to the confusion and lack accountability amongst any non-compliant element of the industry. RCSA has been instrumental in developing and promoting the following categories of service and terminology, with a view to identifying the various forms of third party employment and contracting services. Put simply, the term ‘labour hire’ is now used to describe most a-typical forms of employment and is no longer descriptive of genuine on-hire employee services, which results in misinformation, misrepresentation and ultimately harbours both intended and unintended non-compliance. See attached diagram for RCSA definitions and service categories along with additional information, which provides some context around on-hire worker services. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss 3 RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss 4 On-Hired Work in Context The on-hired employment industry is a significant contributor to the Australian economy Research completed by the Australian Bureau of Statistics in 2002 indicated that the on-hire services industry contributes $10 billion to the Australian economy, more than that of accounting services and more than that of legal services. The annual revenue of the industry is $16 billion, according to both Recruitment Super and RCSA Member Research. Most on-hired employees employed by RCSA Members are either skilled or professional workers RMIT University research1 found the 61% of RCSA on-hired employees are skilled or professional workers with the remaining 39% being semi-skilled or unskilled. Many on-hired employees are employed on a permanent basis RMIT University research found that 16% of on-hired employees are now employed on a permanent basis. Where on-hired employees are employed on a casual basis they have improved opportunities for ongoing work as they are supplied to alternative workplaces RMIT University research found that half of all on-hired casual employees employed by RCSA Members are immediately placed in another assignment following the completion of their initial assignment that is, they enjoy ‘back to back’ assignments without having to search for new work like those engaged in direct hire casual employment. An overwhelming majority of people choose to work as an on-hired employee and the reasons for this choice are not what you may expect RMIT University research found that 67% of on-hired employees chose to work as an on-hired employee and 34% prefer this form of work over permanent employment. The most important reasons for choosing on-hired employment are diversity of work, to screen potential employers, recognition of contribution and the payment of overtime worked. 1 Brennan, L. Valos, M. and Hindle, K. (2003) On-hired Workers in Australia: Motivations and Outcomes RMIT Occasional Research Report. School of Applied Communication, RMIT University, Design and Social Context Portfolio Melbourne Australia RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 5 Business uses on-hired employees to help with recruitment and urgent labour requirements, not to reduce cost or pay. RMIT University research found that the main reason that organisations use on-hired employee services is to resource extra staff (30%), cover in-house employee absences (17%), reduce the administrative burden of employment (17%) and overcome skills shortage issues (9%). Only 2% of organisations surveyed indicated that the primary reason for using on-hired employees was related to pay. Business is more productive and competitive because of the use of on-hired workers RMIT University research found that 76% of organisations using on-hired workers were more productive and competitive as a result. On-hired employment creates jobs and doesn’t necessarily replace direct hire employment opportunities RMIT University research found that 51% of organisations using on-hired employees would not necessarily employ an equivalent number of employees directly if they were unable to use on-hired employees. In fact 19% of organisations said they would rarely do so. Furthermore, 19% of RCSA Member on-hired employees eventually become permanent employees of the host organisation they are assigned to work for, according to RMIT University research. Submission General Submission As the peak industry body for the on-hire worker services and recruitment industries within South Australia, the RCSA wishes to record its interest in being kept abreast of developments in relation to this review. Ongoing contact should be made with RCSA Policy Manager, Charles Cameron Email ccameron@stratecom.com.au or call 0414 734 329 RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 6 Specific Submissions ABOUT YOU Contact details: Name: Charles Cameron Position title: Policy Manager Organisation: Recruitment and Consulting Services Association Ltd Email: bsc@rcsa.com.au or ccameron@stratecom.com.au Please check the box that best describes the views you represent: Employer association RCSA RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 7 GUIDING PRINCIPLES OF AN EXPERIENCE RATING SYSTEM Do you support the guiding principles? Refer to page 8 (of the discussion paper) X Yes No Prefer not to respond If you would like to make a comment about the principles, please do so below. Experience rating has provided the incentive for employers to prevent injuries as well as manage claims to reduce claims costs. Furthermore Experience Rating means that premiums reflect the employer’s performance rather than the industry generally. Multi SAWIC employers need to have the claims costs for each SAWIC partitioned so that each risk profile in their business is measured accurately. QUESTION 1 Should a combination of remuneration and premium be used to determine the threshold for entry into the Experience Rating System? Refer to page 12 x Yes, a combination of remuneration and premium should be used No, only the amount of remuneration should be used No, only the base premium amount should be used I do not think there should be an entry threshold Prefer not to respond Do you have any other comments? QUESTION 2 Modelling of these options would need to be provided to allow an informed debate on the respective thresholds. Would you support a move from ‘levy’ to ‘premium’? Refer to page 14 x Yes No Prefer not to respond Should we issue employers with insurance-based documentation? Refer to page 14 x Yes No Prefer not to respond Do you have any comments to add or would you like to explain your answer? Worker’s Compensation is an employer insurance against the cost of workplace injury. The lack of acceptance of this in South Australia is fundamental to the failure of the system. The employer is the premium payer who funds the scheme. Levies are taxes. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 8 QUESTION 3 Do you support a location-based or employer-based approach to the calculation of premiums? Refer to page 16 X Location-based Employer-based Prefer not to respond Do you have any comments about these approaches? Location based premium calculations allows employers to more accurately capture costs of worker’s compensation for each discrete area across their business. Employers can still apportion costs across their business if they so desire. QUESTION 4 Should we use manual claims estimates in the experience rating premium calculation? Refer to page 17 X Yes, I support the use of manual claims estimates No, I do not support the use of manual claims estimates Prefer not to respond Do you have any comments about claims estimates? Manual claims estimates are preferred over Statistical Claim Estimates (SCE’s). Experience in Victoria has shown that SCE’s are not transparent, bear no resemblance to reality (low cost claims with high SCE’s) and employers are unable to influence the SCE regardless of claims management efforts. Typically agents are unable to interpret SCE movements either. Manual claims estimates must have robust guidelines and a dispute mechanism for employers to be able to request a review of the estimate. The ability to keep claim costs down is largely in the hands of the claims manager not the employer, so the concern of this happening at the expense of the injured worker is not valid. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 9 QUESTION 5 Should we extend the claims excess waiver notification period from two business days to five calendar days? Refer to page 19 Prefer not to respond Do you have any comments about the notification period? QUESTION 6 Should we move to contributory negligence for third parties, or keep the current arrangements? Refer to page 20 Keep the current arrangements, where a third party wrongdoer is liable for 100% of the damages X Change to contributory negligence, where the amount of compensation recovered from a third party is proportionate to their degree of fault Prefer not to respond Do you have any other comments to add about contributory negligence? Contributory negligence is consistent with case law in all other jurisdictions. Third parties should not be required to pay for the negligence of another party (employer). Workers’ rights are limited if their employer is wholly negligent, so why should this change (and they receive full common law benefits) if their employer is partly negligent and a third party is partly negligent. The scheme underwrites employer negligence so it should do so in all cases. The S54 provisions are stifling business opportunities in South Australia. QUESTION 7 This is broken into three questions, so please respond in the boxes provided below Should the definition of injury in the Act be changed to ‘injury’ from ‘disability’? Refer to page 22 X Yes, change all references to ‘injury’ from ‘disability’ No, don’t change Prefer not to respond Please add any comments below This is consistent with harmonisation of workers’ compensation across Australia. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 10 Would you support a change to the definition connecting secondary injuries to employment? Refer to page 22 X Yes, change the definition to ‘significant contributing factor’ (or similar definition) No, do not change the definition Prefer not to respond Please explain your answer or add your comments below Consistent with other jurisdictions Should secondary and unrepresentative injuries be included in the premium calculation for an experience rated employer? Refer to page 22 X Yes, if the definition connecting secondary injuries to employment changes Yes, even if we maintain the current definition No Prefer not to respond Please explain your answer or add your comments below The major factor determining employers’ view of each category of claim is the impact on their premium, and this is driven by claims agent effectiveness in managing claims. If claims that were previously non premium related were to be included, then more pressure will be applied to claims agent efficiency and effectiveness. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 11 QUESTION 8 This is broken into two questions, so please respond in the boxes provided below Would you like more payment options? Refer to page 25 X Yes, I support more payment options I support some of the options (please explain below) No, I do not support more payment options Prefer not to respond Please explain your answer or add your comments below Funding difficulties for business in recent years makes this highly desirable. Many insurance companies provide these options. What do you think about a discount for employers who pay their full premium upfront? Refer to page 25 X Yes, I support a discount being offered No, I do not support a discount being offered Prefer not to respond Please explain your answer or add your comments below RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 12 QUESTION 9 Which approach would you support for new employers entering the Experience Rating System? Refer to page 26 I support Option 1 (Experience Rating System applied after two years of registration with the Scheme) x I support Option 2 (a phased approach to introducing the Experience Rating System) I do not support either option (please explain below) Prefer not to respond Please explain your answer or add your comments below QUESTION 10 Should ‘related’ employers be grouped together? Refer to page 28 X Yes No Prefer not to respond Do you have any other comments? This is supported in principle, however there should be scope for flexibility if management control of entities in the same group of companies is not common in Australia. If two entities share the same management structure at a global level but nowhere else in the world, then they can hardly be regarded as part of the same group for OHS and W/C purposes. QUESTION 11 Should claims experience be transferred with a business? Refer to page 30 X Yes No Prefer not to respond Please add your comments below QUESTION 12 Should costs associated with fraudulent claims be taken out of an employer’s claims experience? Refer to page 31 X Yes No Prefer not to respond RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 13 Please add your comments below Fraudulent claims are not something the employer has any control over, so these costs should be shared across the scheme. QUESTION 13 What do you think of these options to change the industry rate cap? Refer to page 32 Keep at 7.5% X Increase the cap X Remove cap altogether Prefer not to respond Please add your comments or suggestions below Support removal of the cap, or at least increasing it. For those employers who suffer significant impacts, the changes can be phased in over 3 years. This will reduce the cross subsidisation by the rest of the scheme and make high risk industries accountable. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 14 QUESTION 14 Should there be a cap on the costs of a single claim when calculating an employer’s premium? Refer to page 33 X Yes No Prefer not to respond Please indicate the cap amount you support and/or add your comments below Range of $175,000 to $200,000 QUESTION 15 Do you support a cap on premium movement? Refer to page 34 X Yes No Prefer not to respond Please add your comments below Sometimes premium movement may not occur because of the employer’s claims experience, so there should be a cap. QUESTION 16 Do you support a cap on the amount premiums can increase as part of moving to an Experience Rating System? Refer to page 35 X Yes No Prefer not to respond Please add your comments below This prevents undue volatility caused by the move. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 15 QUESTION 17 This is broken into three questions, so please respond in the boxes provided below What are your thoughts on harsher fines and/or penalties for employers who fail to register, or who provide a false statement to the principal contractor? Refer to page 36 Fines should be appropriate to the benefit the employer expected to gain by failing to register. The fines should be in keeping with other jurisdictions. What are your thoughts on principal contractors holding responsibility to ensure sub-contractors are registered? Refer to page 36 Principal contractors often use sub-contractors to reduce their own risks, so the onus should be on them to establish the subcontractor is registered. What are your thoughts on issuing a certificate of currency to registered employers to help principal employers in confirming a sub-contractor’s registration? Refer to page 36 This works well in other States, and will further reinforce the concept of insurance. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 16 If you have any further comments on the consultation paper or any suggestions, please complete the box below Thank you for your feedback. Please note: If you would like more room for your comments please attach another sheet, or provide a separate submission outlining your feedback. End of feedback form RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 17 GUIDING PRINCIPLES OF A RETRO-PAID LOSS SYSTEM Do you support the guiding principles? Refer to page 7 (of the discussion paper) X Yes No Prefer not to respond If you would like to make a comment about the principles, please do so below. QUESTION 1 An entry threshold will be set for the Retro-Paid Loss System. What are your views? Refer to page 11 Please provide your answer below QUESTION 2 Agree with an entry threshold. This will limit access to the scheme to those employers with the resources to manage the risk of the scheme. This question has two parts We will ask for a written commitment from an employer’s CEO or Board to participate in the Retro-Paid Loss System. What are your views? Refer to page 12 X I agree with all of the ways that commitment will be required I agree with some of the ways that commitment will be required (please explain) I do not agree with these measures Prefer not to respond Please explain your answer Should employers in the Retro-Paid Loss System be required to participate in quarterly networking sessions facilitated by WorkCover? Refer to page 12 RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 18 X Yes No Prefer not to respond If you would like to make a comment, please do so below QUESTION 3 This will facilitate sharing of experience between participants and also provide a forum for discussion between WorkCover and employers. Employers will be required to provide a financial guarantee to participate in the Retro-Paid Loss System. What are your views? Refer to page 14 Please provide your answer below QUESTION 4 Agreement in principle with a financial guarantee. However it is the level of the guarantee that is more relevant. Rolling guarantees that in total exceed the exposure to the scheme are inappropriate. This question has two parts Should employers be able to choose between two different large claims cap amounts? Refer to page 15 X Yes No Prefer not to respond Should there be a cap for a single event with multiple claims? Refer to page 15 X Yes No Prefer not to respond Please use the space below if you would like to explain your answers QUESTION 5 The cap on single events operates on the same principle as the cap on EBR schemes. The amount may be higher but needs to be reasonable. A Retro-Paid Loss System requires a minimum, deposit and maximum premium to be set. What are your views? Refer to page 16 Please provide your answer below Support the concept of minimum, deposit and maximum premiums. However modelling needs to be presented to establish what each premium should be. The maximum premium in NSW is generally considered high relative to the tariff premium. It would be very unlikely that a participant in the scheme would have claims costs of 2.5 times tariff premium. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 19 QUESTION 6 In the Retro-Paid Loss System adjustment factors will apply to an employer’s claims costs. What are your views? Refer to page 18 Please provide your answer below Agree that adjustment factors should exist. Comparison with similar schemes operating in the private sector should be conducted to evaluate what the factors should be. A premium of $1.67 per $1 of claims cost is not a very strong incentive to entice an employer away from self-insurance. QUESTION 7 A run-off period and periodic premium adjustments would be part of a Retro-Paid Loss System. What are your views? Refer to page 20 X I support all elements of the policy run-off system outlined I support some but not all elements of the policy run-off system (please explain) I do not agree with this system (please explain) Prefer not to respond Please use the space below to explain your answer QUESTION 8 What are your views on the two conditions for employers leaving the Retro-Paid Loss System? Refer to page 22 X I agree with both conditions I agree with only one of the conditions (please explain) I do not agree with the conditions (please explain) Prefer not to respond Please use the space below to explain your answer If you have any further comments on the consultation paper or any suggestions, please complete the box below RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 20 Thank you for your feedback. Please note: If you would like more room for your comments please attach another sheet, or provide a separate submission outlining your feedback. RCSA Submission WorkCover SA – Experience Rating and Retro-Paid Loss Consultation 21