TiVo Inc. Case

advertisement

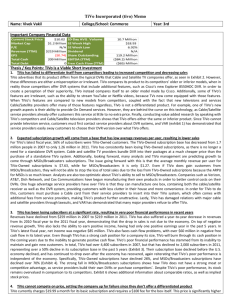

TiVo Inc. Case By Mitch Casselman & John Nadeau October 29, 2002 Carleton University Ph.D. Program - Dr. Tom Koplyay Note: Analysis is based entirely on information from public sources 1 1 Presentation Outline n n n n n Company Background Market Discussion Competitive Picture Situational Analysis Strategic Direction 2 2 Company Background Product, Technology, Partners, Investors, Government, Lawyers and Customers 3 3 Company Background Product n n n n n TiVo Service Subscriptions - monthly $4.99 (recently reduced from $9.95) or lifetime $249 Licensing arrangements for Personal Video Recorders (PVR’s) Sponsored content Audience measurement research Platform for electronic commerce 4 The TiVo Service represents what’s been billed as the Personal Television Industry. Watch what you want, when you want! PVR’s are designed and developed by Tivo, licensed for manufacture and sold in retail channels as a consumer electronic device. Seasonality – anticipate large growth of annual new subscribers during the holiday shopping season. Sponsored content delivers charter advertising and sponsorship revenue. However, revenue by this source has been relatively insignificant. Examples: Short films, Counting Crows Debut of Album 4 Company Background: Technology/R&D n Pause and instant replay n Planned R&D focus n On-staff engineers n Technology Risk 5 Pause and instant replay of live TV by storing information on a hard drive Continued investment in the improvement and addition of features and functionality of current products as well as design of new platforms On-staff engineers in R&D now (previously contract based) Technology Risk – can be devised in home on a PC with a large hard drive and video card or a competitive technology solution. Overall, many competing solutions 5 Company Background Partners n Manufacturing Partners n n n n n Hughes Network Systems Sony Quantum Phillips Thomson Multimedia 6 MANUFACTURING PARTNERS Hughes Network Systems Manufacture, marketing and distribution of personal video recorders that enable TiVo Service in the United States Sony Manufacture, marketing and distribution of personal video recorders that enable TiVo Service in North America 7 year deal to pay royalties on Sony video recorders incorporating TiVo’s technology (part when shipped and another part when activated) Given the right to sublicense mfg. in Japan Quantum Supply agreement for hard disks Revenue sharing of subscription fees for devices with their hard disks Philips Manufacture, marketing and distribution of personal video recorders that enable TiVo Service in North America Awarded a subsidy by TiVo for each unit sold (part when shipped and another part when activated) Ceases mfg. TiVo recorders Jan 31, 2002 Thomson Multimedia SA Manufacture, marketing and distribution of personal video recorders that enable TiVo Service in the United Kingdom Subsidy on a monthly basis for each unit sold 6 Company Background Partners n Service Partners n n n n n n n AOL investment ($200 Million) Discovery Communications and NBC DirecTV AT&T Broadband BSkyB Best Buy Creative Arts Agency 7 SERVICE PARTNERS AOL investment ($200 Million) 3 year agreement to allow AOL TV subscribers access to TiVo services AOL was issued equity for their investment Discovery Communications and NBC $8.1 Million in the form of advertising and promotional services Additional $5 M paid to NBC for promotions DIRECTV Market, sell, and support the TiVo Service To collaborate on R&D and utilize a portion of DIRECTV’s satellite network Issued 3M shares for marketing services Revenue sharing of DIRECTV/TiVo subscriptions Comprises a “healthy” portion of TiVo subscribers AT&T Broadband Market, sell, and support the TiVo Service in Boston, Denver and Silicon Valley areas Revenue sharing of subscription fees and advertising BSkyB Market, sell, and support the TiVo Service in the United Kingdom Best Buy exclusivity agreement to sell only TiVo branded Series2 digital video recorders (expires February 2003) Creative Artists Agency Marketing and promotional support of the personal video recorder Given 67,122 shares of preferred stock as compensation 7 Company Background Partners n Research Partners n n Lieberman Research Worldwide Nielson Media Research 8 Research Partners Lieberman Research Worldwide Nielson Media Research Develop ways of improving and measuring promotions and viewer behaviour First ever DVR-based panel established in August 2002 with Lieberman 8 Company Background Suppliers n Single supplier dependency for key components and services n n n n CPU’s MPEG2 encoder/decoder secure microcontroller semiconductor device program guide data 9 Risk – should strive to develop a relationship for secondary suppliers in these areas (possible for 10-20% of demand?) 9 Company Background Investors n Acqua Wellington North American Equities Fund n n n n $13.8 million purchase of common stocks Option to sell up to $19 million more shares to raise cash (Feb 2002) Crosslink Capital and New Enterprise Associates are buying $25 million of stock (October 2002) Previous partners also major investors 10 10 Company Background Customers n Consumers n n n n 464,000 subscribers (October 2002) TiVo community Forum where customers can engage each other and the company online Hacker community is utilizing TiVo’s proprietary software code to design a web interface Advertisers n n Relatively small portion of revenues Experimenting with various ideas for sponsored content (e.g. concerts for CD releases) 11 Customers Community development is good for loyalty and insight to help feature development Hacker community may be beneficial (as de facto imitators) to he lp promote TiVo as a platform 11 Company Background: Sales & Gross Margin Growth Total Sales 40.0 30.0 $US Millions 20.0 10.0 - Beginning exponential growth? Oct 2001 Jan 2002 Apr Jul 2002 2002 Quarter Gross Margin 12 What we’ve seen so far: -Multiple products -R&D focus on developing features for the core product -Many partners, many are large players (AOL most significant, some hold equity) -Single source risk for some core components (Risk) -Customer base is growing and showing signs of active involvement -Advertising constitute a small amount of revenue -Sales growth is high and margins are okay 12 Market Discussion Market Dynamics, Market Growth, Government, Legal Situation 13 13 TiVo’s Market is at the point of Convergence Broadcasting & TV Software & Programming TiVO Electronic Instruments Communications Equipment 14 Personal Television Market is located at the convergence of these 4 established industries. Broadcasting & TV – Content Communications Equipment – Pipeline equipment Software – run on equipment Electronic Instruments – consumer products 14 High Segment Growth Projected Digital Television Penetration 350 Households 300 250 200 150 100 CAGR 29% 50 0 2001 2002 2003 2004 2005 2006 Source: Strategy Analytics 2002 15 Digital growth is a proxy to show growth in new TV technology 15 High Segment Growth Projected Interactive Television Penetration 240 220 Households 200 180 160 140 120 100 80 60 CAGR 40% 40 20 0 2001 2002 2003 2004 2005 Source: Strategy Analytics 2001 16 Interactive growth is a proxy to show growth in new TV technology 16 Government Influence n Legislative environment is not stable and could change n n Copyright laws FCC could alter regulations that affect TiVo indirectly through partners 17 There is a real threat that the gov’t will alter the copyright legislation and create a barrier for TiVo. Consortium of broadcasters are lobbying for these changes. 17 Legal Situation n TiVo Intellectual Property n Standards n Consumer Class Action n n Competitors n Replay TV 18 Intellectual Property Seven patents for pausing live television Five lawsuits (StarSight, Pause Technology, SONICblue - x2, Command Audio) Standards Consortium of broadcast and cable companies threaten to require personal television operators to obtain copyright or other licenses (e.g. Time Warner & Fox Television Consumer Class Action TiVo faces Class Action lawsuits stemming from IPO practices and potentially misleading advertising Replay TV (Competitor) is being sued for harming the potential market and value of copyrighted material. Replay TV allows users to skip commercials while TiVo only allows fastforward. 18 Competitive Picture 19 What we’ve seen in the market: -TiVo sits between 4 large established segments -High projected penetration of new TV technology (Positive) -Legislation risk (copyright) -Legal battle zone – Personal TV is potentially a disruptive technology 19 Competition Looms Large Broadcasting & TV (EchoStar, DirecTV, BSkyB, Cox, Liberty, MDU, Walt Disney, AOL, Newscorp) Communications Equipment Electronic Instruments (NDS, Nagra Vision, TiVO (SONICblue, Sony, Canal+, GIC-Motorola, -Atlanta, Phillips, Panasonic, Scientific Microsoft) Viaccess-France Telecom) Software & Programming (OpenTV, Microsoft, Liberate Technologies, Canal+ Group, NDS) 20 lMany big players with vested interest in the traditional business model lIncestuous – for example, OpenTV is owned by Liberty and has EchoStar, DirecTV and BSkyB as customers lDirect – Microsoft (UltimateTV), OpenTV, NDS, EchoStar Communications, Cache Vision, Keen Personal Media, Sony, Moxi Digital (supported by AOL) and SONICblue (ReplayTV) lIndirect – satellite television, video on demand services, digital video disc players, laser disc players, cable TV, Internet lAdvertisers – competing against traditional media (print, radio, and television) lEchostar has around 600,000 of its subscribers with DVR capabilities and does not charge for the service. lSony PlayStation 2 game console will have TiVo- like features using BroadQ software to connect the PS2 to a PC and Snapstream personal video software for the PC 20 Competitors and Size TiVo is a very small player, even compared to SONICblue (a recent entrant). 12,000 10,000 8,000 6,000 4,000 2,000 TiV o SO NI Cb lue Op en TV ND S 0 Ec ho sta r Number of Employess Firm Size of Some Competitors Competitor 21 Glimpse of TiVo’s relative size to competitors 21 Strategic Analysis SWOT, Product Life Cycle, Porter, SPACE, Value Chain Analysis, Vulnerability, Product Matrix, Technology Check, Financial Ratios, Advantage Matrix 22 Competition Summary - Incumbents are big and there’s potential for a fierce fight since personal TV strikes at the core of the incumbents’ business model. 22 Strengths • Partnered with many large established players for quick entry and development in the US and UK •High customer growth rates •Still able to attract fresh capital (I.e. Oct 2002) •Multiple potential revenue streams Opportunities •High market growth •Sponsored content •Market research data •Electronic commerce •Replay is drawing most legal attention Weaknesses • Single suppliers for key product components •Over reliance on partners •Separated from customers by partners •Partners squeezing pressure on value chain •Cannot make financial obligations without further injection of cash Threats •Established players in traditional markets are entrenched and will implement defensive strategies to protect their market share (eroding traditional strategic segment barriers) •Legal challenges •Legislative agenda could restrict opportunities •Low barriers to entry (technology is easy to replicate) •Many competitors – many are heavy weights 23 General summary of what we discussed 23 TiVo Lifecycle Tivo has entered the growth phase of the PLC Introduction Growth Maturity Decline Sales are increasing at high rate, many new entrants, not yet profitable, low barriers to enter, recent price reduction for subscriptions 24 24 Porter Analysis Pay TV/Set-top Boxes (OpenTV, NNDS) Pure PVR Co.’s (SonicBlue) Broadband Internet Multimedia Giants Traditional Broadcast TV Electronic Manufacturers Personal Television Industry Microsoft, Western Digital, Seagate, Scientific-Atlanta, Digeo (Paul Allen) Satellite Consumer Cable 25 Although typical for pressure to be coming from vertical areas, the market dynamic is coming from all sides on the Personal Television Industry. Not only is there pressure from all sides but these players are directly getting into the Personal Television market or indirectly through ownership of another player. This is a market in transition. 25 SPACE Analysis Company’s Financial Strength High Low High Company’s Competitive Advantage Defensive Environmental Stability Industry Strength Low 26 Environmental Stability is low -rapid technological change -Price range of competition is relatively high (Echostar free service) -Barriers to entry are low (functionality can be set up on a computer, a number of different patents to do the same thing) -Many substitute products Industry Strength is moderate -High growth potential -Technological know-how -Overall, the industries are quite strong, but the ranking becomes tempered when looking specifically at the Personal Television market. Company’s financial picture is weak Tivo is currently engaging an aggressive strategy that is not a good fit. The company is trying to aggressively sign on subscribers, generate content, and conduct market research. TiVo is situated in an attractive industry but lacks the financial and competitive strength to pursue a competitive strategy. The SPACE analysis indicates that TiVo should consider a more defensive strategy than the one they currently use. 26 Value Chain Analysis Traditional Value Chain Research Feedback Broadcasting Delivery Software Equipment Customer TiVo Value Chain (vertical Integration) Research Feedback Broadcasting Delivery Software Equipment Customer 27 These are the four primary areas of the market where TiVo participates – Broadcasting & TV, Communications Equipment, Software and Programming, and Electronic Instruments. TiVo is striving to influence the whole value chain rather than focus on their component where they excel. They are essentially trying to implement a convergence model at the intersection of these industries. -Broadcasting with sponsored content -Although not trying to replace the Delivery channel, they are branded the TiVo service to the end consumer -The software to receive signals, record, and adapt to viewer preferences -Equipment by designing and outsourcing the manufacturing of the “box” that houses the software and large storage device. -They are also getting into the feedback loop by conducting viewer panels and collecting viewing statistics. 27 TiVo Vulnerability Analysis High Impact of Threat Defenseless Endangered Financially reliant on AOL and others. Rely on others for manufacturing. Vulnerable Relatively little control over customer base. Prepared Major partner has just acquired a competitor. Low Low High Ability to React or Retaliate Source: Rowe et al. 28 28 BCG Product Matrix Question Mark Industry Growth Rate High Dogs High growth rate demonstrated in TiVo’s rate of customer acquisition and projected technology penetration. Stars Maturity Low Low High Relative Market Share TiVo is not the market leader. 29 Although products in the growth phase are typically classified as Stars, TiVo has not yet accomplished significant market share. There are other players with a larger subscriber base. For instance, EchoStar has grown a larger base by offering the service for free to subscribers (they just have to buy the equipment). 29 Technology Check Technology Success Potential High Outsource or acquire capability Technological opportunity is present. Grow/Protect The company’s technological ability is differentiated by features. Fair Outsource Maintain Low Low Average Company Technology Ability High Source: Rowe et al. 30 Differentiated feature example - adapting to viewer preferences – “TiVo’s Suggestions” option 30 Financial Ratio Profile Profitability Losing Money Very Low Average Very High Liquidity On the brink Very Tight About Right Too Much Slack Leverage Negative Equity Too much debt Balanced Too Much Equity Activity High Sales Growth Too slow About Right Too Fast 31 Current Ratio = 0.80 Quick Ratio = 0.75 They are not able to meet current obligations $27M in cash Shareholders Equity = -51M Market Capitalization = $199.6M Liquidity – w/o new investment in October of $25 Million, they were essentially bankrupt. This injection represents their “burn rate” for a quarter. Leverage – they have used up investors money and then some! Activity is good since sales are ramping up. This is good. 31 Number of Approaches to Achieving Advantage BCG Advantage Matrix Many Fragmented Business Stalemated Business Specialized Business Volume Business Few Small Large Potential Size of Advantage 32 # of Approaches to Achieving Advantage There are many ways that a firm could deliver Personal Television to their advantage -traditional TV with pay-per- view -PVR -PC’s (connect to TV or stand alone) -Video Game console (X-Box and Sony Playstation) It can be pursued from any of the four established industries, but each advantage is relatively small. It is difficult to see at this point. Eventually, if Personal Television is adopted, the position should migrate to another spot on the matrix (volume business). 32 Analysis Summary n n n n n Growth Phase of Product Life Cycle SPACE Analysis suggests defensive approach TiVo’s model is based on industry convergence but the market’s not ready yet TiVo is currently vulnerable financially Proprietary technology represents a key opportunity 33 33 Strategic Direction 34 34 Key Success Factors n n n n Market Share Which Standard/Business Model Survives Ability to Survive Avoid Entrenched Players Wrath 35 Market Share – must create a presence in the market to ultimately cross the chasm Which Standard/Business Model Survives – the technology to win the battle over competing solutions will contribute to survival Ability to Survive – financial resources and cash flow Avoid Entrenched Players Wrath – big players already here that can fight hard 35 Strategic Options for TiVo 1. Status Quo (Vertical Integration via Joint Ventures) 2. 3. 4. Horizontal Integration Concentration Divestiture 36 Status Quo (Vertical Integration) Continue to grow the convergence business model Work on developing advertisement and sponsored content revenue to evolve differently than direct competitors (essentially becoming a broadcaster) Trying to capture value from across the value chain with such big players could come back to bite TiVo - TiVo really doesn’t have the financial resources for this course of action. Horizontal Integration Purchase competitors to gain market leadership - Again, finances restrict this course of action Concentration - Focus on Technology Core Expansion with product differentiation Strive for platform leadership Divestiture – Leave the market, dissolve the company or sell. 36 Recommended Strategy n Focus on one thing and do it well n n n n A defensive stance from current approach Focus on technology development and licensing revenue business model Aggressive on promoting this position to establish platform leadership Anticipate a Merger n n Once made attractive to an established player TiVo will need help to Cross the Chasm at the end of the growth phase 37 37 NPD Strategies & the Life Cycle Introduction Growth Maturity Decline Pioneer Strategy First Mover Advantage N/A N/A N/A Imitator Strategy Strong Benefit Decreasing Benefit Only Useful if Cost Advantages Only Useful if Cost Advantages Rapid Innovation First Mover Advantage Steal Competitors Growth Extend Life Cycle Limited Benefit Disruptive Technology Introduction Create New Market – First Mover Advantage Strong Benefit Terminate Incumbents N/A Pre-Announcement Strategies Financing Strategy Perceptual Barriers Standard Setting Switching Costs Strategic Communication Competitive Games Strategic Communication Competitive Games Partnering Strong Benefit – Absorptive Capacity Strong Benefit – Growth & Learning Limited Benefit – Cost Only Limited Benefit – Cost Only Standard Setting Cooperate until technology legitimation Standard Set;Market Segmentation & Cost Competitive Phase Erect Entry Barriers Competitive Phase Use of Platforms Limited Applicability Strong Aid to Growth Critical Component Of Survival Weakens but some Lasting Benefits38 Relatedness to TiVo Imitator Strategy – TiVo was a fast second to the Personal Television market after ReplayTV Rapid Innovation – Competitors are coming into the market from all sides to try and steal away growth Disruptive Tech – Personal Television may be disruptive, however, the incumbents have identified this potential threat and are positioning themselves accordingly. Therefore, tough to terminate them! Pre-announcement – TiVo actually pre-announced their product when Replay TV came out first Partnering – key aspect of the TiVo strategy since they are too small to carry out the convergence strategy on their own. Standard Setting – A Consortium of broadcasters (incumbents) are trying to force a standard on the new technology (re: copyright) to reduce disruption to their existing business model Use of Platforms – Becomes important in the growth phase. This is where TiVo should be focused on becoming the platform leader. 38 TiVo Inc. Case Australia Team Mitch Casselman/John Nadeau Note: Analysis is based entirely on information from public sources 39 39 Porter Competitive Analysis Managerial Capability Industry Rate of Innovation Technological Sophistication Supplier Bargaining Power Buyer Bargaining Power Dependency on Inputs Product Substitutability Intensity of Competition Ease of Entry Industry Rate of Growth 0 2 4 6 8 40 40 Company Capability Managerial 0% Weak Strong 100% Managerial Factors 1. Corporate Image, Social Responsibility 2. Use of Strategic Plans and Strategic Analysis 3. Environmental Assessment and Forecasting 4. Speed of Response to Changing Conditions 5. Flexibility of Organizational Structure 6. Management Communication and Control 7. Entrepreneurial Orientation 8. Ability to Attract Highly Creative People 9. Ability to Meet Changing Technology 10. Ability to Handle Inflation 11. Aggressiveness in meeting competition 12. Other 41 41 Company Capability Competitive Factors 1. Product Strength, Quality, Uniqueness 2. Customer Loyalty and Satisfaction 3. Market Share 4. Low Selling and Distribution Costs 5. Use of Experience Curve for Pricing 6. Use of Life Cycle of Products and Replacement Cycle 7. Investment in New-Product Development by R&D 8. High Barriers to Entry into Company’s markets 9. Advantage Taken of Market Growth Potential 10. Supplier Strength and material availability 11. Customer Concentration 12. Other 42 42 Company Capability Financial Factors 1. Access to Capital When Required 2. Degree of Capacity Utilization 3. Ease of Exit from the market 4. Profitability, Return on Investment 5. Liquidity, Available Internal Funds 6. Degree of Leverage, Financial Stability 7. Ability to compete on prices 8. Capital Investment, Capacity to Meet Demand 9. Stability of Costs 10. Ability to Sustain Effort in Cyclic Demand 11. Price Elasticity of Demand 12. Other 43 43 Potential for Leveraging Customer Value Corporate Development Matrix High 1. Watch and Wait 4. Losers Low Low 2. Winners 3. Unstable Cash Bonanza High Achievable Competitive Cost Advantage 44 44 Z-Factor n n n n Formula developed by Edward Altman in 1968 to predict the company survival for manufacturing companies Z = .012 A + .014 B + .033 C + .006 D + .999 E Z = .765 Less than 1.81 therefore significant risk of bankruptcy 45 Z = .012 A + .014 B + .033 C + .006 D + .999 E, where A = working capital/total assets (%) B = Total retained earnings/total assets (%) C = Earnings before interest and taxes/total assets (%) D = Market value of equity/book value of total debt (%) E = Sales/Total Assets In some cases the z-factor can be approximated with the equation sales/total assets. Companies with a z- factor less than 1.81 have a significant risk of bankruptcy Companies with a z- factor of 1.81 to 2.99 are in a zone of ignorance Companies with a z- factor greater than 2.99 have minimal chance of bankruptcy. 45