chapter 11 - NavigatingAccounting.com

advertisement

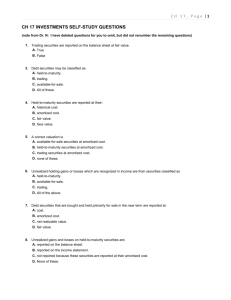

Chapter 11: Valuation Adjustments 1 Chapter 11 Valuation Adjustments TABLE OF CONTENTS Overview 3 Relating Accounting for Marketable Securities to Other Balance-Sheet Items 3 Classifying Marketable Securities 4 Classification Consequences for Financial Statements 4 Available-for-sale Securities 4 Trading Securities 5 Held-to-maturity Securities 5 Tax Consequences A Closer Look at the Key Concepts Example 5 6 6 Assumptions 6 Recording the Purchase 7 Recording Valuation Adjustments 7 Intel’s Related Activity Realized Gains and Losses 8 10 Example 10 Intel’s Comprehensive Income Footnote 11 Exercise 11.01 12 Exercise 11.02 13 Exercise 11.03 14 Exercise 11.04 16 © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 2 Navigating Accounting ® Exercise 11.05 17 Exercise 11.06 18 Exercise 11.07 19 Exercise 11.08 20 Exercise 11.09 21 Exercise 11.10 22 Exercise 11.11 23 © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 3 OVERVIEW This chapter examines how investments (also called marketable securities) affect financial statements and footnote disclosures under US GAAP. This chapter has two sections: (1) this overview, which summarizes the key concepts and links them to those you learned in other chapters, and (2) “A Closer look at the Key Concepts,” which uses an example and Intel disclosures to develop and illustrate the concepts in the overview. Skim the overview the first time through the chapter and then reread it more carefully after you have read “A Closer Look at The Key Concepts.” One of the learning objectives is to help you better understand the difference between realized and unrealized gains and losses. Realized gains and losses arise from selling investments or other assets. Unrealized gains and losses arise from revaluing unsold investments or other assets to their fair value at the end of the reporting period. If you purchase shares of stock in Intel and the value of your shares increases, you have an unrealized gain. If you sell the shares, you have a realized gain. Determining unrealized gains and losses on marketable securities is relatively straightforward. You simply check the price of recent trades versus the price you paid for your shares. However, determining the fair values of other assets not traded regularly are more difficult to assess. Thus, estimating their unrealized gains and losses reliably is more problematic. Relating Accounting for Marketable Securities to Other Balance-Sheet Items Keep in mind, most balance sheet assets and liabilities have unrealized gains and losses; their fair values differ from their financial reporting values. What distinguishes marketable securities from other balancesheet items under US GAAP is marketable securities’s unrealized gains and losses are recognized in balance sheets; the securities are stated at their fair market values. The exception is debt securities classified as securities intended to be held to maturity, meaning the company intends to hold them until the principal is repaid by the issuer. These securities are reported at historical cost, with some minor historical-cost based adjustments not depending on changes in the securities’ values. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 4 Navigating Accounting ® Classifying Marketable Securities Marketable securities are classified in one of three ways. The three classifications depend on what management intends to do with the securities, not on characteristics of the securities themselves: • Available-for-sale securities: Management has purchased these securities for liquidity and thus plans to sell them when and if the company needs cash. Most companies classify most of their securities as available-for-sale. • Trading securities: Management has purchased these securities with a speculative intent. They expect the value of the shares to appreciate quickly. Companies actively buying and selling shares frequently often have trading desks where traders speculate on very short-term opportunities (they buy and sell the same security within a very short time interval, perhaps a few hours or less). The portfolio of shares traded by these individuals is typically classified as trading securities. Some of Intel’s securities are classified this way, but generally only banks and other financial institutions use this classification. • Held-to-maturity securities: These are debt maturities management intends to hold until maturity: until the principal is repaid by the issuer. These securities are reported at historical cost, with some minor historical-cost based adjustments not dependent on changes in the securities’ values. Classification Consequences for Financial Statements The classification decisions can have dramatic financial-statement consequences, yet the accounting differences are pretty easy to comprehend if you focus on the big picture and, in particular, on what happens to both sides of the balance sheet when the securities’ values change: Available-for-sale Securities Available-for-sale securities are recognized at their fair values. Valuation adjustments are recorded at the end of the period, ensuring the securities are stated at their fair values. Here is how these adjustments affect the balance sheet equation: Assets • The securities’ values increase (decrease) by the adjustment needed to state them at their fair values. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 5 Equities • If the adjustment increases (decreases) the value of the securities, a deferred tax liability (asset) is recognized to reflect the tax consequences that would occur if the securities were sold at their current values in the future. • If the adjustment increases (decreases) the value of the securities, other comprehensive income (OCI) reflects the after-tax gain (loss) that would accrue to owners if the securities were sold at their current values. OCI is closed to accumulated OCI at the end of the reporting period. Trading Securities The accounting for trading securities is similar to available-for-sale securities except the after-tax effects of valuation adjustments effect net income rather than OCI. Thus, unrealized gains and losses associated with trading securities are recognized in income. Held-to-maturity Securities Held-to-maturity securities are not adjusted for increases in fair value but, like all other assets, are adjusted for impairments (significant declines) based on the “lower of cost or market” principle. Tax Consequences Realized gains and losses affect the current provisions of tax expenses, just as they do for PP&E disposals. Thus, these tax effects are included in the entry recording the tax expense. Unrealized gains and losses also have tax effects that depend on the way the investments are classified. As indicated earlier, unrealized gains and losses of investments classified as trading assets are recognized in financial reporting income. Generally, these unrealized gains and losses are not recognized for tax reporting until they are realized. Thus, unrealized gains and losses on trading assets recognized in financial reporting income generally affect the deferred tax provision. Unrealized gains and losses on available-for-sale investments are not recognized in financial reporting income, but they are recognized in owners’ equity. Intel mentions the tax consequences of these unrealized gains and losses in the Investments section of the Accounting Policies footnote (underline added for emphasis): Investments designated as available-for-sale are recorded at fair value, with unrealized gains and losses, net of tax, recorded in accumulated other comprehensive income. Page 54, Intel’s 2006 Annual Report © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 6 Navigating Accounting ® A CLOSER LOOK AT THE KEY CONCEPTS Accounting for realized investment security gains and losses is similar to accounting for PP&E disposals. PP&E disposals have the following consequences: • cash (or other proceeds) increases from selling PP&E, • the historical cost of the PP&E is removed from the books, • the accumulated depreciation associated with the disposal is removed from the books, and • a gain or loss is recorded, depending on whether the cash received exceeds, or is less than, the PP&E’s book value (historical cost less accumulated depreciation). The realized gains (losses) are determined essentially the same way for marketable securities as for PP&E, but several accounts related to unrealized gains and losses must be removed when securities are sold. To this end, you must first learn how unrealized gains and losses are recorded. The realized gain (loss) from selling or otherwise disposing of an asset is the fair value of the proceeds received (e.g., cash) less the cost-based value of the disposed asset. The cost-based value is (1) the historical cost of the asset, less (2) a contra account such as accumulated depreciation or amortization (if one exists), plus (3) accrued interest income that has not been collected. In studying marketable securities and other balance-sheet items reported at fair value, you must be careful to distinguish cost-based values from market-based values (fair values), which continually change with stock or debt prices. As indicated earlier, unrealized gains and losses differ from realized ones in that the related asset has not been sold. Otherwise, the definition is essentially the same: the unrealized gain (loss, if negative) of an asset is its fair value less its cost-based value. Realized and unrealized gains and losses are defined similarly for liabilities. Example Assumptions • XYZ Company buys a share of another company’s stock for $1 at the start of XYZ’s first year of operations. • XYZ classifies the stock as available-for-sale. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 7 • The market value of the share is $4 at the end of the first year. • XYZ sells the stock for $5 one month into its second year. Recording the Purchase When the security is purchased, XYZ records: • a $1 cash decrease, and • a $1 increase to a cost-based marketable security asset account classified as available-for-sale. As is true for gross PP&E, the amount in this cost-based account remains unchanged so long as XYZ owns the security. Recording Valuation Adjustments On the asset side of the balance sheet, valuation adjustments are recorded in adjunct or contra accounts. An adjunct account is the opposite of a contra account; a companion account increasing the value of an asset, liability, or owners’ equity item above its cost. In contrast to PP&E, many of these adjunct and contra accounts are not disclosed separately in financial reports. Rather, as we shall see for Intel, they are used to accumulate data needed to meet GAAP disclosures. On the equity side of the balance sheet, valuation adjustments are recorded as [unrealized] gains/losses in other comprehensive income. These are closed into accumulated other comprehensive income at the end of the reporting period. Under GAAP, XYZ reports a $4 asset for this marketable security on its end-of-year-one balance sheet. Stated alternatively, the recognized “book value” is the market-based or fair value of $4. The cost-based value is still $1, but there is an unrealized gain of $3: the market-based value of $4 less the cost-based value of $1. Unrealized gains and losses change daily with stock prices, but typically they are only updated in accounting systems at the end of accounting periods. There are exceptions; some financial institutions and other companies with large investment holdings update these accounts daily to facilitate internal investment decisions. How is the $3 unrealized gain recorded? Assuming a $40% future tax rate, the entry to record the gain is: • increase the marketable security asset adjunct account by $3 (the pretax unrealized gain), • increase other comprehensive income by $1.80 (the after tax unrealized gain), and • increase the deferred tax liability by $1.20 (the tax that will be paid in the future, if the share is sold for $4, which equals 40% of the $3 gain). © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 8 Navigating Accounting ® • Other comprehensive income is closed into Accumulated other comprehensive income at the end of the period. Intuitively, the government and owners of XYZ both benefit from the gain, but neither will receive cash until the gain is realized (assuming the stock price does not drop). In the MMS model, we split this event into two parts: (1) record the $3 pretax unrealized gain (event MMS51), and (2) record the $1.20 related tax consequences (event MMS56). Thus, first increase the equity adjunct account by the pretax gain of $3 and then decrease it by the $1.20 tax consequences. The $3 in the adjunct asset account is added to the $1 in the cost-based marketable security account to get the $4 “fair value” recognized on the balance sheet. The $3 unrealized gain is typically reported in the footnotes. If the share price had dropped from $1 to $0.25, a contra account would be used to record a $0.75 unrealized loss. Intel’s Related Activity Next we will relate the example to Intel. Intel reports $178 year-end unrealized gains and ($1) of unrealized losses for 2006 as summarized below. Thus, Intel recognizes a pretax net unrealized gain of $177 ($178 $1) in its balance sheet for 2006. Intel recognized a pretax net unrealized gain of $159 ($164 - $5) one year earlier. The following table summarizes the pretax unrealized gains and losses on Intel’s available-for-sale securities: Intel's Pretax Available-for-Sale Unrealized Gains/Losses End of 2006 End of 2005 Increase (decrease) Unrealized gains Unrealized losses Net gains $178 $164 $14 ($1) ($5) $4 $177 $159 $18 Page 68, Intel’s 2006 Annual Report These net gains, which pertain to the available-for-sale investments only, are recognized in Intel’s balance sheet, but not recognized in its income statement. The unrealized gains and losses associated with these availablefor-sale securities affect other comprehensive income, rather than net income. In contrast, unrealized gains and losses associated with trading securities are recognized in income. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 9 • Considerable judgment is required to classify securities and managers are not indifferent about the outcome. Intel, would have reported about five billion dollars less pretax income in 2000 if it had been required to recognize unrealized losses on available-for-sale securities. • As a user of financial statements, especially for banks and companies with large securities holdings, you need to understand the consequences of these judgments on net income and know how to assess their appropriateness. Recall from the XYZ example, a deferred tax liability recognizes the income taxes that will be due if unrealized gains are realized, and a deferred tax asset recognizes tax benefits if unrealized losses are realized. For Intel, assuming a 35% tax rate, and multiplying the numbers in the previous table by this rate, yields the deferred tax assets and liabilities associated with Intel’s available-for-sale investments: Intel's Taxes Available-for-Sale Unrealized Gains/Losses End of 2006 End of 2005 Increase (decrease) Deferred tax liability Deferred tax asset $62.30 $57.40 $4.90 ($0.35) ($1.75) $1.40 Net deferred tax liability $61.95 $55.65 $6.30 Subtracting the table above from the earlier one yields the after-tax consequences for accumulated other comprehensive income associated with Intel’s available-for-sale investments: Intel's Net of Taxes Available-for-Sale Unrealized Gains/Losses End of 2006 End of 2005 Increase (decrease) Unrealized gains Unrealized losses $115.70 $106.60 $9.10 ($0.65) ($3.25) $2.60 Accumulated other comprehensive income $115.05 $103.35 $11.70 Above, we estimate Intel recognized $12 of other comprehensive income associated with available-for-sale investments (the change in accumulated other comprehensive income). This estimate is very close. Intel reports a $13 ($113 - $100) change in Accumulated net unrealized holding gain on available-for-sale investments at the bottom of its Comprehensive income footnote (page 71, Intel’s 2006 Annual Report). Importantly, the $13 represents the change in the unrealized gains and losses during 2006, net of taxes, not the year-end balance. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 10 Navigating Accounting ® Note Intel reports a $184 decrease in Total accumulated other comprehensive income (loss) for 2006 (- $57 - $127), including the impact of available-sale investments, derivatives and pension liability. This $184 change is also reported in the bottom panel on Intel’s Statement of stockholders’ equity ($26 - $210) (page 52, Intel’s 2006 Annual Report). The deferred tax table on page 74 of Intel’s 2006 Annual Report shows a $149 net deferred tax liability for Unrealized gains on investments. Thus, our $62.30 deferred tax liability year-end 2006 estimate (in our earlier tax table) is not precise. Similarly, the $57.40 year-end 2005 estimate in the table is imprecise: Intel shows $123 in the footnote. Thus, we must conclude that some other event or circumstance is affecting the year-end balances (perhaps the tax consequences of derivative gains). Later, we will see evidence suggesting deferred taxes were likely affected by unrealized gains and losses associated with financial derivatives. Realized Gains and Losses Example When XYZ sells the security for $5 one month into the second year, the realized gain is $4 = $5 - $1. This is also the unrealized gain immediately before the sale. However, the recognized, unrealized, value is still $4, (the amount recognized at the end of the first year). What is the entry to record this sale? Like recording PP&E disposals, all of the accounts related to this security must be removed from the books and the cash proceeds and gain must be added to the books: • cash increases by $5, • marketable securities at cost decreases by $1, • the asset adjunct account decreases by $3, • accumulated other comprehensive income decreases by $1.80, • deferred taxes decrease by $1.20, and • a $4 realized gain is recorded. • At the end of the year, the tax effect of this entry would be recorded implicitly to the current provision, along with the other items affecting taxable income. Recording realized gains and losses is considerably easier for MMS. Because they are in their first year, no unrealized gains and losses have been recognized when the securities are sold. Suppose, for example, XYZ © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 11 company had sold its marketable security just before the close of the first year, and in particular, before recording unrealized gains and losses. XYZ would have recorded: (a) a $4 increase in cash, (b) a $1 decrease in marketable securities at cost, and (c) a $3 realized gain. Intel’s Comprehensive Income Footnote Intel’s Comprehensive income footnote (Page 71 of its 2006 Annual Report) presents two tables that can be interpreted in light of our earlier estimates. The first table reports two entries associated with unrealized gains netting to $13 of other comprehensive income: • $61 Change in net unrealized holding gain on investments, net of tax of $(33) for 2006 • less: ($48) adjustment for net realized gain or loss on investments included in net income, net of tax of $27 for 2006 The ($48) represents a transfer from Accumulated other comprehensive income to income on the income statement. Because it decreased other comprehensive income, as indicated in the table, the offsetting entry must have increased net income (to keep the balance-sheet equation balanced). Thus, $48 was a net gain recognized in net income. The two tax entries disclosed in the table total ($6), which is ($33) associated with the first row in the table and $27 associated with the second row. Thus, our $6.30 estimate of the change in net deferred tax liabilities associated with available-for-sale investments is fairly precise. The first table in the Comprehensive income footnote reports flows - other comprehensive income. By contrast, the second table reports stocksaccumulated other comprehensive income. Notice the $113 Accumulated net unrealized gain on available-for-sale investments reported in the second table is close to the $115.05 estimate for year-end 2006. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 12 Navigating Accounting R E C O R D K E E P I N G A ssets = iabilities +O wners' liabilities + permanent OE+ E quities temporary OE Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G =L cash +other assets Beg Bal Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue ® Exercise 11.01 Record events MMS 7, 48-51 and 56 and explain how these events affect the three financial statements. How do these events relate to Intel? Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Where would you search for related disclosures in Intel’s 2006 Annual Report? Record Keeping and Reporting Icon This exercise helps you meet the insider record keeping and reporting challenge. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 13 R E C O R D K E E P I N G A ssets = iabilities +O wners' liabilities + permanent OE+ E quities temporary OE Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G =L cash +other assets Beg Bal Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue Net Income Cash change Reconciliations Exercise 11.02 The goals of this exercise are: (1) to give you an opportunity to practice the entries discussed in the text from the perspective of an insider, and (2) introduce a template we will modify slightly in the next exercise to reverse engineer entries from the perspective of an outsider. Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the insiders’ record keeping and reporting challenge. You will need to open the following Excel file to complete this exercise: Ex_11.02.xls. Required Given the assumptions below, complete the entries and year-end balances in the Insiders_Val_Adj_ Template worksheet of Ex_11.02.xls. Assumptions for years 1 and 2 • The tax rate is 35% • All securities are classified as available for sale Year-1 • Purchase $1,000 of securities • Sell securities costing $175 for $200 prior to these securities being written to fair value for the first time at year-end. Thus, there were no previously recognized unrealized gains or losses associated with the sold securities. • At year end, the investment portfolio has $300 of unrealized gains and $100 of unrealized losses. Year-2 • Purchase $1,100 of securities • Sell several securities during the year with a total historical cost of $250 for $400. Some of these securities had a total of $120 unrealized gains, others had a total of $20 of unrealized losses, and the remainder had no previously recorded unrealized gains or losses. • At year-end, management concluded part of the portfolio had a $40 other-than-temporary loss. Management’s policy is to charge other-than-temporary losses directly to the historical cost securities account. • At year end, the investment portfolio has $430 of unrealized gains and $150 of unrealized losses. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 14 Navigating Accounting R E C O R D K E E P I N G A =L = iabilities +O wners' liabilities + permanent OE+ E quities temporary OE Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G ssets cash +other assets Beg Bal Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. ® Exercise 11.03 The goal of this exercise is to introduce a template we will use to reverse engineer available-for-sale-investments’ entries from the perspective of an outsider. You will need to open the following Excel file to complete this exercise: Ex_11.03.xls. Template Modifications As indicated below, the events here are the same as those in Exercise 11.02. However, the outsider template introduced here combines some of the accounts and entries we used in Exercise 11.02. Specifically, the template: • Has 14 unknown items, X1-X14, and contains a general structure for available-for-sale-investments’ valuation adjustments based on the entries in Exercise 11.02. • Records securities sales in one entry rather than three. • Nets the deferred tax assets and liabilities into a single net deferred tax liability account: NetDTL = DTL - DTA. • Nets unrealized gains and losses into a single net unrealized gains account: Neturg = Msurg - Msurl. Assumptions The assumptions are the same as those in Exercise 11.02: Assumptions for years 1 and 2 • The tax rate is 35% • All securities are classified as available for sale Year-1 • Purchase $1,000 of securities • Sell securities costing $175 for $200 prior to these securities being written to fair value for the first time at year-end. Thus, there were no previously recognized unrealized gains or losses associated with the sold securities. • At year end, the investment portfolio has $300 of unrealized gains and $100 of unrealized losses. Year-2 • Purchase $1,100 of securities © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 15 • Sell several securities during the year with a total historical cost of $250 for $400. Some of these securities had a total of $120 unrealized gains, others had a total of $20 of unrealized losses, and the remainder had no previously recorded unrealized gains or losses. • At year-end, management concluded part of the portfolio had a $40 other-than-temporary loss. Management’s policy is to charge other-than-temporary losses directly to the historical cost securities account. • At year end, the investment portfolio has $430 of unrealized gains and $150 of unrealized losses. Required The template in Ex_11.03.xls has 14 variables X1-X14 in cells related to available-for-sale investments entries or balances. An outsiders’ challenge in reverse engineering entries is to locate or estimate as many of these variables as possible. This following questions aim to prepare you for this challenge. (a) Record entries into the template by replacing variables with numbers determined by the above assumptions. (b) Determine the beginning and ending balances by replacing variables with numbers. (c) If you were an outsider who did not know the assumptions behind the entries, what variables or combinations of variables in the template might you expect to find in a company’s annual report and where would you expect to find them? © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 16 Navigating Accounting ® Exercise 11.04 This exercise pertains to investments and valuation adjustment questions on the 2007 final exam, which was based on a supplement from Motorola’s fiscal 2006 annual report. Search Icon This exercise requires you to search for information. R E C O R D K E E P I N G A =L = iabilities Answer final exam 2007 questions 1h, 3e, and 4d. +O wners' liabilities + permanent OE+ Beg Bal E quities temporary OE Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G ssets cash +other assets Required Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. Usage Icon This exercise helps you learn how accounting reports are interpreted and used by outsiders. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 17 Exercise 11.05 This exercise pertains to investments and valuation adjustment questions on the 2006 final exam, which was based on a supplement from HewlettPackard’s (HP’s) fiscal 2005 annual report. HP’s fiscal 2005 year started on November 1, 2004 and ended on October 31, 2005. Search Icon This exercise requires you to search for information. R E C O R D K E E P I N G A ssets cash +other assets = iabilities Answer final exam 2006 questions 3c, 3k, and 4h. +O wners' liabilities + permanent OE+ Beg Bal E quities temporary OE Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G =L Required Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. Usage Icon This exercise helps you learn how accounting reports are interpreted and used by outsiders. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 18 Navigating Accounting ® Exercise 11.06 This exercise pertains to questions involving investments and comprehensive income on the 2005 final exam, which was based on a supplement from Boston Scientific’s fiscal 2004 annual report. Search Icon This exercise requires you to search for information. R E C O R D K E E P I N G A =L = iabilities +O wners' liabilities + permanent OE+ Beg Bal E quities temporary OE Zero E n t r i e s Answer final exam 2005 question 1c, 1d, 1i, 4e, 4h, and 5a. Be sure to read the directions for question 4 on the top of page 8, which specifies how account names should be chosen. Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G ssets cash +other assets Required Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. Usage Icon This exercise helps you learn how accounting reports are interpreted and used by outsiders. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 19 Exercise 11.07 This exercise pertains to questions involving investments and comprehensive income on the 2004 final exam, which was based on a supplement from AMD’s fiscal 2003 annual report. Search Icon This exercise requires you to search for information. R E C O R D K E E P I N G A ssets = iabilities +O wners' liabilities + permanent OE+ Beg Bal E quities temporary OE Answer question final exam 2004 1b, 1d, 4b, and 4g. Be sure to read the directions for question 4 on the top of page 8, which specifies how account names should be chosen. Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G =L cash +other assets Required Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. Usage Icon This exercise helps you learn how accounting reports are interpreted and used by outsiders. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 20 Navigating Accounting ® Exercise 11.08 This exercise pertains to questions involving investments and comprehensive income on the 2003 final exam, which was based on a supplement from Gateway’s fiscal 2002 annual report. Search Icon This exercise requires you to search for information. R E C O R D K E E P I N G A ssets = iabilities +O Answer final exam 2003 questions 1b, 2a and 2i. wners' liabilities + permanent OE+ Beg Bal E quities temporary OE Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G =L cash +other assets Required Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. Usage Icon This exercise helps you learn how accounting reports are interpreted and used by outsiders. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 21 Exercise 11.09 This exercise pertains questions involving investments and comprehensive income on the 2000 final exam, which was based on a supplement from Cisco’s fiscal 2000 annual report. Search Icon This exercise requires you to search for information. R E C O R D K E E P I N G A ssets = iabilities Answer final exam 2000 questions 3i and 5. +O wners' liabilities + permanent OE+ Beg Bal E quities temporary OE Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G =L cash +other assets Required Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. Usage Icon This exercise helps you learn how accounting reports are interpreted and used by outsiders. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson 22 Navigating Accounting ® Exercise 11.10 Search Icon This exercise requires you to search for information. R E C O R D K E E P I N G A ssets = iabilities +O wners' liabilities + permanent OE+ E quities Zero Required Tr Bal Cls IS Cls RE End Bal Zero Balance Sheets Income Statements Operating Assets Revenue Investing Liabilities Expenses Financing You are to search for information in Intel’s 2004 annual report. temporary OE E n t r i e s Direct Cash Flows R E P O R T I N G =L cash +other assets Beg Bal This goal of this exercise is to help you learn how to reverse engineer as many entries and related information about available-for-sale investments as possible from Intel’s 2004 annual report, using the “outsiders” template developed in Exercise 11.03. A copy of this template is included in Ex_11.08.xls, which you will use for this exercise. Owners' Equity Gains & Losses Net Income Cash change Reconciliations Net Income Locate or estimate as many of the 14 unknowns in the outsiders’ valuation adjustment template in Ex_11.08.xls as you can. Replace the template variables with the numbers you estimate or locate. Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. Usage Icon This exercise helps you learn how accounting reports are interpreted and used by outsiders. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson Chapter 11: Valuation Adjustments 23 Exercise 11.11 Search Icon This exercise requires you to search for information. R E C O R D K E E P I N G A ssets = iabilities +O wners' liabilities + permanent OE+ E quities temporary OE Zero E n t r i e s Tr Bal Cls IS Cls RE End Bal Direct Cash Flows R E P O R T I N G =L cash +other assets Beg Bal Zero Balance Sheets Income Statements Operating Assets Investing Liabilities Expenses Financing Owners' Equity Gains & Losses Revenue This goal of this exercise is to help you learn how to reverse engineer as many entries and related information about available-for-sale investments as possible from Cisco’s fiscal 2000 annual report using the “outsiders” template developed in Exercise 11.03. A copy of this template is included in Ex_11.09.xls, which you will use for this exercise. Required Locate or estimate as many of the 14 unknowns in the outsiders’ valuation adjustment template in Ex_11.09.xls as you can. Replace the template variables with the numbers you estimate or locate. Net Income Cash change Reconciliations Net Income Adjustments Operating Cash Record Keeping and Reporting Icon This exercise helps you meet the outsiders’ record keeping and reporting challenge — reverse engineering entries. © 1991–2009 NavAcc LLC, G. Peter & Carolyn R. Wilson