Study Guide

advertisement

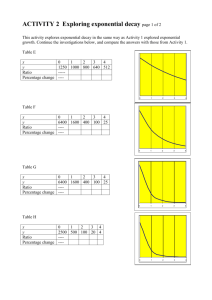

∗ Linear: the average rate of change is constant on any size interval. Each 1 unit increase in the input variable means that the output variable increases additively. ∗ Exponential: y-values are separted by a common ratio for evenly spaced x-values. Each 1 unit increase in the input variable means that the output variable increases multiplicatively. MATH 109 EXAM 2 REVIEW Remarks About the Exam: • The exam will have some multiple choice questions (≈ 4-6 questions) AND some free response questions with multiple parts where you will have to show your work (≈ 4-6 questions) – Construct formulas for a linear function from a table, graph, or verbal description. – Give real-world interpretations of the slope in a linear function with correct units. – Recognize the impact changes in the parameters C and a can have on the graphs of exponential functions of the form y = C · ax . – State the domain and range of an exponential as well as recognize the appearance of horizontal asymptotes. – Recognize exponential functions as functions which exhibit constant percent change. – Apply discrete compound interest and/or continuous compound interest formulas: • You should be to: – Construct linear and exponential regression equations from a given set of data. This will require use of the graphing calculator. – Describe what the correlation coefficient of a regression equation tells you. – Use properties of exponents (integer or rational numbers) and radicals to simplify algebraic expressions. – Identify the initial value and growth/decay factor of an exponential function of the form y = C · ax . – State the growth/decay rate from the growth/decay factor and vice versa. r F =P 1+ n – Construct exponential equations of the form y = C · ax from a graph, table, or verbal description. nt F = P · ert n – Recognize the 1 + nr as the one-year growth factor for discrete compound interest. – Give practical interpretation of the parameters C and a in an exponential function of the form y = C · ax . n – Recognize 1 + nr − 1 as the one-year growth rate for discrete compound interest (also known as the effective annual rate). – Recognize er as the one-year growth factor for continuous compound interest. – Recognize er − 1 as the one-year growth rate for continuous compound interest (also known as the effective annual rate). – Recognize a as the one-unit of time growth/decay factor in an exponential function of the form y = C · ax . – Convert between the n-unit of time growth/decay factor and the one-unit of time growth/decay factor for an exponential function. – Recognize the differences between a linear function and exponential function from a table: 1 1. The following data show the total government debt for the US t years since 1950: 2. Simplify the following: 3 (a) (2a4 ) Year 0 5 10 15 20 25 30 35 40 45 50 3 (b) (10a2 b3 ) Debt ($ billions) 257 274 291 322 381 542 909 1818 3207 4921 5629 3 (c) − (2a2 ) 3 (d) (−2a4 ) (e) (2ab)2 − 3 (ab)2 (f) (x5 y) (x6 ) (x2 y 3 ) (g) −2x5 y 5 3 x2 y 2 4 (h) (3x2 y 5 ) (a) Fill in the table below: Regression Type Equation Correlation Coefficient (i) 3x3 y 2 5xy (j) 2a2 b3 ab2 4 3. Simplify the following expressions. Write your final answer with only positive exponents! Linear −3 (a) (−2x3 y−1 ) (x2 y −2 )0 −2 Exponential (b) (c) (−2x3 y−1 ) (x2 y −2 )−1 3x2 y −5 −1 3 4 5x y (b) Which equation bests models the US debt? Explain your answer by talking about the correlation coefficient. (d) (3x−1 z 4 ) (c) Give a practical interpretation of the slope in your linear model. (e) h i −2 −1 x−2 −y −1 (xy 2 )−1 −2 (f) (5x−2 y −3 ) (d) Give a practical interpretation of the growth factor in your exponential model. 4. Use rules of exponents to show that 1 (e) Use your exponential model to predict the current debt . 1 To see what the current debt is, you can visit the “debt clock” at www.brillig.com/debt clock 2 95 27−7 = 331 5. Simplify: (a) (b) q a2 b4 c6 √ 3 q 256x8 y 16 (d) q x45 y 25 10000z 5 5 i. 50 years ii. 100 years iii. 500 years 64x6 y 12 (c) 4 (b) How much of the original 100 grams of plutonium-238 would be left after: (c) How long does it take for plutonium-238 to decay to half its original amount? 6. In 1998, a Zone 1 parking permit cost $160. In 2008, the same permit costs $300. (d) Use the results of part (c) to construct an exponential function using the half-life. (a) Find a formula for the cost of a Zone 1 parking permit t years since 1998 assuming that the cost grows: 8. The rate of inflation is often used to describe the value of currencies over time. For example, if you buy something now for $100 and the rate of inflation is 5% a year, this means that one year from now, you’ll need $105 to buy the same item you bought a year ago. i. Linearly ii. Exponentially (b) Give a practical interpretation of the slope of your linear equation. (a) Suppose someone says the inflation rate is 0.7% a month, what is inflation per year? (c) Determine the 10-year growth factor for a Zone 1 parking permit. (b) Suppose someone says inflation is 5% a year, what is it per month? (d) Determine the 10-year growth rate for a Zone 1 parking permit. 9. During 1988, Nicaragua’s inflation rate averaged 1.3% a day. This means that, on average, prices went up by 1.3% from one day to the next. (e) Determine the annual growth rate for a Zone 1 parking permit. (f) Determine to the nearest year the time it takes for the cost of a Zone 1 parking permit to quadruple. (a) What is the monthly rate of inflation? (b) What is the annual rate of inflation? 7. Plutonium-238 is used in bombs and power plants but is dangerously radioactive. It decays very slowly into nonradioactive materials. If you started with 100 grams today, a year from now you would still have 99.2 grams left. 10. Between 1970 and 2000, the US population grew from 200 million to 280 million. Assume the population grows exponentially. (a) Determine the 30 year growth factor. (a) Construct an exponential function to describe the decay of plutonium-238 after t years. (b) Determine the 30 year growth rate. 3 (c) What is the annual growth rate? (a) Estimate the half-life of the drug. (d) Find a formula to express the population of the US t years after 1970. (b) Construct an equation for drug’s concentration based on your answer from part (a). (e) Determine to the nearest year, when the US population will reach 1 billion people. 13. Suppose $1000 is deposited into an account paying interest at a nominal rate of 8% per year. Find the balance 3 years later if the interest is compounded: 11. According to a letter published in the Ann Landers column in the Boston Globe on Friday, December 10, 1999, “When Elvis Presley died in 1977, there were 48 professional Elvis impersonators. In 1996, there were 7,328. If this rate of growth continues, by the year 2012, one person in every four will be an Elvis impersonator.” (a) Monthly (b) Weekly (c) Daily (a) What is the growth factor for the number of Elvis impersonators for the 19 years between 1977 and 1996? (d) Continuously 14. If you need $25000 six years from now what is the minimum amount of money you need to deposit into a bank account that pays 5% annual interest compounded: (b) What is the annual growth rate for Elvis impersonators from 1977 to 1996? (c) Construct an exponential function that describes the growth in Elvis impersonators since 1977. (a) Annually (d) Use your exponential function to predict how many Elvis impersonators there will be by 2012. (b) Monthly (c) Daily (e) Use the exponential model you found in the previous question to determine if one out of every four people in the US will be an Elvis impersonator. 15. You decide to invest $10000 in a college trust fund for your newborn child at 9% interest compounded continuously for 18 years. You learn of another trust fund which compounds quarterly. What nominal rate does the second trust fund need to be in order for both investments to be equally good for you? 12. The graph below shows a drug’s concentration in the body over time, starting with 100 milligrams. 4 19. Which table is linear and which is exponential? Find formulas for each table. 16. Fill in the following table assuming that the principal is $10,000 in each case. Nominal Compounded Future Value Formula Effective Rate Annual Rate 6.25% Weekly 10000 1 + 7% 4% Quarterly Daily Continuously 0.08 2 t g(t) 1 5.6 2 6.2 8 5 7 9.2 8 9.8 10 11 2t 8.5% t 1 2 5 7 8 10 f (t) 5.5 6.05 8.0526 9.7436 10.718 12.969 20. Consider the exponential functions graphed below. Assume that a, b, c, d, p, and q are constants. 17. You want to invest money for your newborn child so that she will have $50,000 for college on her 18th birthday. You have three accounts to choose from: • Account 1: Nominal rate is 9% compounded annually • Account 2: Nominal rate is 8.9% compounded quarterly • Account 3: Nominal rate is 8.5% compounded continuously Which account do you choose? Justify your answer with the effective annual rate! 18. The graph of an exponential function, f (x), is shown below: (a) Which of these constants could be between 0 and 1? (b) Which two of these constants are definitely equal? (c) Which constant(s) is/are responsible for y → 0 as x → ∞? Find a formula for f (x). 5 (d) −8a12 21. Consider the graphs of three exponential functions as shown below: (e) a2 b2 (f) x13 y 4 (g) −8x9 y 9 (h) 81x8 y 20 (i) 9 4 x 25 4 4 (j) 16a b 3 y 3. (a) − 8x 9 (c) x4 4 5 xy 9 3 (a) Which function has the largest decay factor? (d) 9z 8 x2 (b) Which function has the smallest decay factor? (e) (c) Which function has the largest decay rate? (f) y2 − xy x 1 4 6 xy 25 (b) (d) Which function has the smallest decay rate? 5 4. 95 27−7 ANSWERS 5. (a) 1. (a) Linear: y = 104.94x − 937, r = 0.872296 ; Exponential: y = 150.01(1.072508)x , r = 0.959479 = (32 ) (33 )−7 = 310 3−21 = 310 · 321 = 331 ab2 c3 2 4 (b) 4x y (c) 4x2 y4 (d) x9 y 5 10z (b) Exponential function ; correlation coefficient is higher. (c) Each year, US debt increases by 7.25% 6. (a) See below (d) $8,700 billion (That’s 8,700,000,000,000 or 8.7 trillion ; if you visit the debt clock website, the debt is actually more than 1 trillion higher than this prediction.) i. C = 14t + 160 t ii. C = 160 (1.875) 10 2. (a) 8a12 (b) Each year permit cost increases by $14. 6 9 (b) 1000a b (c) 1.875 6 (c) −8a (d) 87.5% every decade 6 (e) 6.5% every year (b) Q(t) = 100 t (f) In the year 2020. 2 13. (a) $1270.24 7. (a) A = 100(0.992)t (b) $1271.02 (b) See below: (c) $1271.22 i. 66.92 grams ii. 44.79 grams iii. 1.80 grams (d) $1271.25 14. (a) $18655.38 (c) 86.3 years (d) A = 100 1 2 (b) $18532 1 2 t 86.3 (c) $18520.84 15. 9.1% 8. (a) 8.7% (b) 0.407% 16. See below: Nominal Compounded Rate 9. (a) 47.3% (b) 11054% 6.25% 10. (a) 1.4 (b) 40% 8% (c) 1.12% (d) P = 200(1.0112) Weekly Semi-annually 8.24% t 7% 4% (e) By the year 2113 11. (a) 152.6667 Daily Continuously 52t 0.0625 52 2t 0.08 10000 1 + 2 4t 10000 1 + 0.0824 4 365t 0.07 10000 1 + 365 0.04t 10000 1 + 10000e 6.44% 8.16% 8.5% 7.25% 4.08% 17. Choose account 2. It has the highest effective annual rate. (b) 30% (c) f (t) = 48(1.3029) Quarterly Future Value Formula Effective Annual Rate 18. f (x) = 625(0.8)x t 19. g(t) = 0.6t + 6.2 ; f (t) = 5(1.1)t (d) 505741 (e) US Pop = 320 million ; Impersonator = population is an impersonator. 505741 320000000 20. (a) b, a, c, p ≈ 0.16% of (b) c, a 12. (a) 2 units of time (c) b 7 21. (a) f (t) (b) h(t) (c) h(t) (d) f (t) 8