Creditor budget

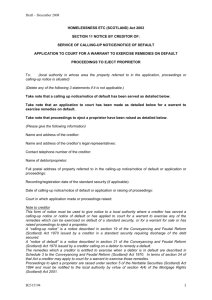

advertisement

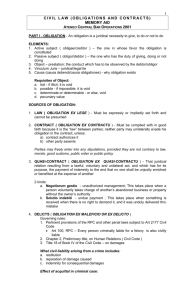

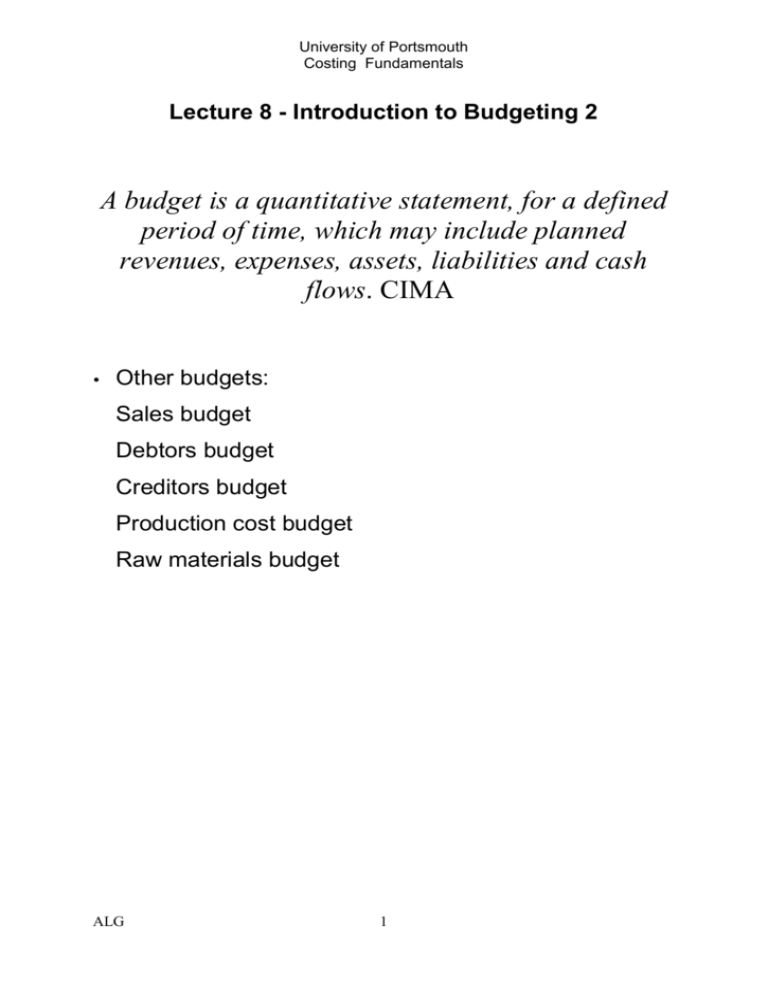

University of Portsmouth Costing Fundamentals Lecture 8 - Introduction to Budgeting 2 A budget is a quantitative statement, for a defined period of time, which may include planned revenues, expenses, assets, liabilities and cash flows. CIMA Ÿ Other budgets: Sales budget Debtors budget Creditors budget Production cost budget Raw materials budget ALG 1 University of Portsmouth Costing Fundamentals Sales budget The sales budget is derived by the sales manager who forecasts the amount of goods that will be sold in the forthcoming year. He will usually base his forecast on the current year adjusted for any known differences such as price increases. The sales budget will determine how much the production department will make. Example: Kirkwood plc has two products Alpha and Omega. It is forecast that the sales of Alpha will run at 500 units through out January to June. However Omega will start at 1000 units and rise by 100 units per month. Each Alpha sells at £35 each and Omega £50 each. Prepare a sales budget. Jan £ Alpha Omega Total sales Feb £ March April £ £ 17,500 50,000 67,500 May £ June £ Total £ 105,000 375,000 480,000 Debtors budget The debtors budget begins with the opening debtor. This is usually taken from the debtor on the closing balance sheet from the previous period. As we make sales on credit the debtor balance increases and as we receive cash payments from our customers the debtor balance decreases. Each month we calculate the closing debtor. This closing debtor will become the opening debtor for the next period. ALG 2 University of Portsmouth Costing Fundamentals Example The debtor balance on Kirkwood’s balance sheet at December 31st is £50,000. It’s customers pay one month in arrears using the sales budget prepare the debtor budget. Jan £ Opening debtor Add Credit sales Total Less cash received Closing debtor Feb £ March £ April £ May £ June £ Total £ 50,000 50,000 67,500 480,000 117,500 50,000 530,000 437,500 67,500 92,500 What will be the closing debtor on the balance sheet dated 31st June? Creditors budget The creditor budget begins with the opening creditor. This is usually taken from the creditor on the closing balance sheet from the previous period. As we make purchases on credit the creditor balance increases and as we make cash payments to our suppliers the creditor balance decreases. Each month we calculate the closing creditor. This will become the opening creditor for the next period. Example The creditor balance on Kirkwood’s balance sheet at December 31st is £10,000. It pays it’s suppliers one months in arrears, purchases are expected to be £12,000 in January and will increase by £1000 per month. Prepare the creditor budget. ALG 3 University of Portsmouth Costing Fundamentals Creditors budget Jan £ Feb £ March £ April £ May £ June £ Total £ Opening creditor 10,000 10,000 Add Credit Purchases 12,000 87,000 22,000 Total 10,000 Less cash paid 12,000 Closing creditor 97,000 80,000 17,000 Production cost budget The production budget will be linked to the sales budget. We should only manufacture up to the levels that we have forecast will sell. Both Alpha and Omega cost the same to manufacture, Direct Materials are £10 per unit, Direct Labour £12 per unit and Production overhead £5 per unit. Prepare a production cost budget Alpha (units) Omega (units) Total sales (units) Direct Materials Direct Labour Production Overhead Total cost ALG Jan £ Feb £ 500 1,000 1,500 500 1,100 1,600 March April £ £ 500 500 1,200 1,300 1,700 1,800 May £ June £ Total £ 500 1,400 1,900 500 1,500 2,000 3,000 7,500 10,500 15,000 10,500 7,500 105,000 73,500 52,500 33,000 231,000 4 University of Portsmouth Costing Fundamentals Raw materials budget The raw material budget helps to forecast how much material we need to buy. Let’s assume that the purchases in the creditors budget are all raw material we can construct a raw materials budget. The opening stock is £20,000 and the material used comes from the production budget. Construct a raw materials budget. Jan £ Opening Stock Add Material Purchases Total Less used in production Closing Stock Feb £ March £ April £ May £ June £ Total £ 20,000 17,000 14,000 11,000 8,000 5,000 20,000 12,000 13,000 14,000 15,000 16,000 17,000 87,000 32,000 15,000 30,000 28,000 16,000 17,000 26,000 18,000 24,000 19,000 22,000 20,000 107,000 105,000 17,000 14,000 11,000 8,000 5,000 2,000 2,000 Seminar Preparation 1. Knox plc has the following sales forecast for it’s two products: Beta and Gamma. The Beta will sell at 1000 units in January rising by 50 units per month. From January to March each Beta will sell at £20 the price will rise in April to £25. The Gamma will sell 2,000 units in January rising by 100 units per month. The gamma will sell at £10 each. Required: Knox’s sales budget from January to June. ALG 5 University of Portsmouth Costing Fundamentals 2. Thomas Iger has an opening creditor of £2900 (£400 October, £1200 November and £1300 December). Creditors will be paid 3 months in arrears. Credit purchases in January will be £2000 rising by £200 per month until March and then suffering a 10% decline in April after which it will remain constant. Required: Prepare Thomas Iger’s creditor budget for January to June. ALG 6 University of Portsmouth Costing Fundamentals Sales budget Kirkwood plc Jan £ Alpha Omega Total sales Feb £ March April £ £ 17,500 17,500 50,000 55,000 67,500 72,500 17,500 17,500 60,000 65,000 77,500 82,500 May £ June £ Total £ 17,500 70,000 87,500 17,500 75,000 92,500 105,000 375,000 480,000 June £ Total £ Debtors budget Opening debtor Credit sales Total Less cash received Closing debtor Jan £ Feb £ March £ April £ May £ 50,000 67,500 72,500 77,500 82,500 87,500 50,000 67,500 72,500 77,500 82,500 87,500 92,500 480,000 117,500 50,000 140,000 67,500 150,000 72,500 160,000 77,500 170,000 82,500 180,000 87,500 530,000 437,500 67,500 72,500 77,500 82,500 87,500 92,500 92,500 Feb £ March £ April £ May £ June £ Creditor budget Jan £ Total £ Opening creditor 10,000 12,000 13,000 14,000 15,000 16,000 10,000 Add Credit Purchases 12,000 13,000 14,000 15,000 16,000 17,000 87,000 22,000 Total 10,000 Less cash paid 12,000 Closing creditor 25,000 27,000 12,000 13,000 29,000 14,000 31,000 15,000 33,000 16,000 97,000 80,000 13,000 14,000 15,000 16,000 17,000 17,000 ALG 7 University of Portsmouth Costing Fundamentals Production cost budget Alpha (units) Omega (units) Total sales (units) Direct Materials Direct Labour Production Overhead Total ALG Jan £ Feb £ 500 1,000 1,500 500 1,100 1,600 March April £ £ 500 1,200 1,700 May £ 500 1,300 1,800 500 1,400 1,900 June £ Total £ 500 3,000 1,500 7,500 2,000 10,500 15,000 10,500 7,500 16,000 17,000 11,200 11,900 8,000 8,500 18,000 12,600 9,000 19,000 13,300 9,500 20,000 14,000 10,000 105,000 73,500 52,500 33,000 35,200 37,400 39,600 41,800 44,000 231,000 8