Guide to Form VA-4 Virginia State Income Tax Withholding

advertisement

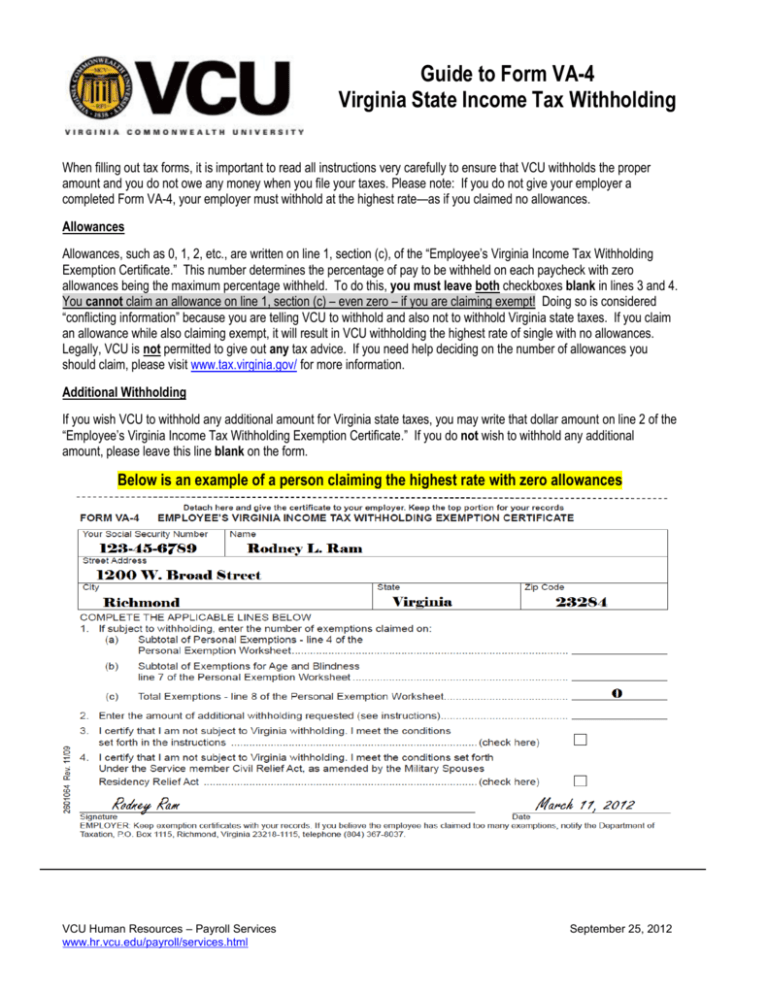

Guide to Form VA-4 Virginia State Income Tax Withholding When filling out tax forms, it is important to read all instructions very carefully to ensure that VCU withholds the proper amount and you do not owe any money when you file your taxes. Please note: If you do not give your employer a completed Form VA-4, your employer must withhold at the highest rate—as if you claimed no allowances. Allowances Allowances, such as 0, 1, 2, etc., are written on line 1, section (c), of the “Employee’s Virginia Income Tax Withholding Exemption Certificate.” This number determines the percentage of pay to be withheld on each paycheck with zero allowances being the maximum percentage withheld. To do this, you must leave both checkboxes blank in lines 3 and 4. You cannot claim an allowance on line 1, section (c) – even zero – if you are claiming exempt! Doing so is considered “conflicting information” because you are telling VCU to withhold and also not to withhold Virginia state taxes. If you claim an allowance while also claiming exempt, it will result in VCU withholding the highest rate of single with no allowances. Legally, VCU is not permitted to give out any tax advice. If you need help deciding on the number of allowances you should claim, please visit www.tax.virginia.gov/ for more information. Additional Withholding If you wish VCU to withhold any additional amount for Virginia state taxes, you may write that dollar amount on line 2 of the “Employee’s Virginia Income Tax Withholding Exemption Certificate.” If you do not wish to withhold any additional amount, please leave this line blank on the form. Below is an example of a person claiming the highest rate with zero allowances VCU Human Resources – Payroll Services www.hr.vcu.edu/payroll/services.html September 25, 2012 Claiming Exempt If you wish to claim exempt from Virginia state taxes and you meet one or both conditions explained on form VA-4 (lines 3 and/or 4), you must leave line 1, section (c), completely blank. You cannot claim an allowance in line 1, section (c) – even zero – if you are claiming exempt! Doing so is considered “conflicting information” because you are telling VCU to withhold and also not to withhold Virginia state taxes. If you claim an allowance while also claiming exempt, it will result in VCU withholding the highest rate of zero allowances. There are two different ways to claim exempt for Virginia state taxes. Please be sure to carefully read lines 3 AND 4 if you wish to claim exempt. Legally, VCU is not permitted to give out any tax advice. If you need help with deciding the number of allowances you should claim, please visit www.tax.virginia.gov/ for more information. Below is an example of a person claiming EXEMPT on Form VA-4 Below is an example of a MILITARY exemption on Form VA-4 VCU Human Resources – Payroll Services www.hr.vcu.edu/payroll/services.html 2 September 25, 2012 NOTE: Please be sure to review your form before turning it in to your department or VCU Human Resources. We cannot accept incomplete forms (i.e., missing the full social security number or a signature). If you submit an incomplete form, your withholding will be set at the highest rate and you will be required to submit a completed form to VCU Human Resources, regardless of the number of allowances you wish to claim. VCU Human Resources – Payroll Services www.hr.vcu.edu/payroll/services.html 3 September 25, 2012