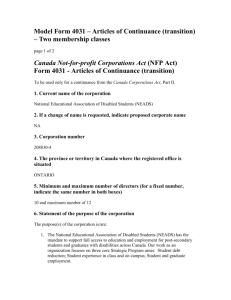

Canada Not-for-profit Corporations Act Suitcase

advertisement