aspirations and settlement - Cornell University Law School

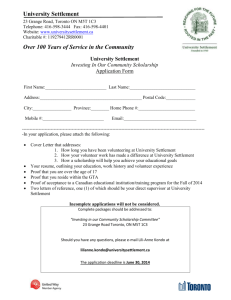

advertisement