enhancing - Public Bank

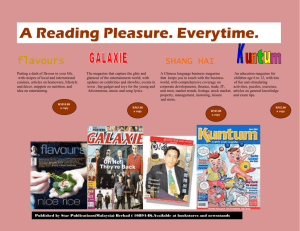

advertisement