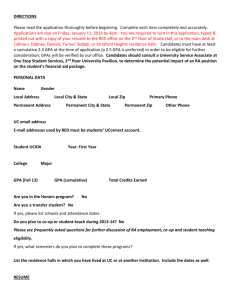

- Maurice Turnor Gardner

advertisement

Page1 Private Client Business 2014 How to do the splits: Finance Act 2013 - improved flexibility for leavers and arrivers? Emma-Jane Weider* Fiona Poole* Claire Roberts* Subject: Tax Keywords: Capital gains tax; Income tax; Residence; Split years Legislation: Finance Act 2013 (c.29) *P.C.B. 236 A quirk of English tax law is that, in the absence of specific rules, an individual is either UK tax resident or non-UK tax resident for an entire tax year. This article considers the benefits and difficulties of relying on split year treatment to mitigate the rigours of the UK tax system for individuals arriving in or leaving the UK part way through a tax year. In particular, it considers the difficulties for non-UK domiciliaries who become UK tax resident without having established a pot of clean capital and who wish to rely on split year treatment to do this. UK tax residence The Finance Act 2013 (FA 2013) saw the introduction, for the first time, of a comprehensive statutory definition of residence for most UK tax purposes1 with effect from April 6, 2013. In accordance with the law that applied prior to this date, the FA 2013 requires residence to be determined for a year of assessment as a whole and an individual is either UK resident or non-UK resident for a full tax year and at all times in that tax year. On its own, this rule can lead to harsh results where an individual arrives in, or leaves, the UK part way through a tax year: such an individual may still be subject to UK tax for the entire year. More nuanced rules are therefore required to address this position. *P.C.B. 237 The position pre-April 6, 2013: concessionary treatment only Prior to April 6, 2013, three extra-statutory concessions were potentially available to individuals coming to or leaving the UK part way through a tax year: (a) Extra-Statutory Concession A11, together with the accompanying spouse/civil partner Concession A78, in relation to certain income only; and (b) Extra-Statutory Concession D2, in relation to capital gains. However, given the inherent uncertainty in relation to their application (being based on administrative discretion rather than the strict letter of the law) and the difficulties of obtaining a remedy should HMRC fail to apply the concession, many advisors were loath to advise clients to rely on these concessions. As Scott L.J. observed in Absolom v Talbot 2 "[t]he fact that such extra-legal concessions have to be made to avoid unjust hardships is conclusive that there is something wrong with the legislation". Page2 The position from April 6, 2013: statutory rules The legal position has been addressed with effect from April 6, 2013. Provided certain conditions are met, FA 2013 Sch.45 Pt 3 provides for a tax year to be split into two parts if an individual either leaves the UK to live or work abroad or comes from abroad to live or work in the UK: • a UK part during which the individual is charged to tax as a UK resident; and • an overseas part during which, for certain defined tax purposes, an individual is charged to tax as a non-UK resident. It is important to note that the rules have no impact on whether someone is or is not in fact resident under the statutory residence test. The impact of this will be made clear later in this article. The cases There are three circumstances in which an individual leaving the UK can split the tax year into a UK and an overseas part3: Case 1: they lose UK residence by virtue of commencing full-time work abroad; Case 2: they are the spouse or partner accompanying someone leaving the UK to take up full-time work abroad; or Case 3: they cease to have a home in the UK. There are five further circumstances in which an individual arriving in the UK can split the tax year into UK and overseas parts: Case 4: during the year, there comes a day when their only home or homes is or are in the United Kingdom; Case 5: they become resident by starting full-time work in the UK; Case 6: they return to the UK following a period of full-time work abroad; Case 7: they are the spouse or partner of someone returning to the UK following a period of full-time work abroad; or Case 8: they acquire a home in the UK for the first time. *P.C.B. 238 Page3 The purpose of this article is not to consider the detailed conditions that apply to each case (although it is important to ensure each condition is met on a case by case basis) but rather to flag some of the more interesting points that arise in practice. Residence before and after the split year The conditions for each Case include requirements in relation to the tax years before and after the split year. For example, Case 6 only applies when the individual has been a UK tax resident in one of the previous four tax years and was non-resident under the full-time work abroad automatic overseas test4 in the previous tax year. Whilst Cases 4, 5, 6, 7 and 8 require the individual to be resident in the following tax year, under Case 8 only, the following year must be a full year of residence rather than a split year. An individual who wishes to rely on split year treatment needs to be aware of the limitations that this can impose. Priority between Cases It is of course possible that an individual could fall within more than one Case. The legislation therefore includes rules to determine which Case has priority over another5. This means it is important to ensure that an individual does not jeopardise their tax planning by inadvertently ending the overseas part through satisfying the criteria for a Case that would take priority over another more favourable Case. Broadly speaking, the impact of the rules is that the Case which would result in the shortest overseas part has priority. There are two separate priority rules: one governs priority as between split year Cases 1–3. The other governs priority as between split year Cases 4–8. Where the individual is leaving the UK and is within two or all of Cases 1–3 then: (a) Case 1 has priority over Case 2 and Case 3; and (b) Case 2 has priority over Case 3. Where the individual is arriving in the UK and is within two or more of Cases 4–8, priority will be determined in accordance with the following table6: First case applying Second case applying Case taking priority Case 5 Case 6 Case with earlier split year date. Case 7 (but not Case 6) Case 5 Case with earlier split year date. Two or all of Cases 4, 5 and 8 Case or Cases with the only (or the earlier) split year date (but not Cases 6 or 7) HMRC have confirmed their view that these priority rules mean that it is not possible to split the tax year more than once7. Modified day count requirements In order to determine whether split year treatment applies, specific rules are used to determine the pro-rata amount of days that it is permissible for an individual to spend (and in some cases, work) in Page4 the UK in *P.C.B. 239 the overseas part of the year. Many individuals who wish to rely on split year treatment will therefore need to carefully monitor their presence in the UK. For Cases 4, 5 and 8, the individual must not meet a modified version of the "sufficient ties test" for the part of the tax year before the day on which they start to have a home in the UK (Cases 4 and 8) or meet the full time work in the UK test (Case 5). For Cases that involve full-time work abroad (Cases 1, 2, 6 and 7) there is also a limit on the number of days that the individual can spend in the UK and can work in the UK. Starting to have a "home" in the UK Although the concept of a "home" is critical to the statutory residence test, this subjective term is not defined in the legislation and we can only therefore rely on HMRC’s guidance and, in due course, judicial interpretation. As set out in Annex A to HMRC’s guidance note on the statutory residence test (RDR3), HMRC "consider that a person’s home is a place that a reasonable onlooker with knowledge of the material facts would regard as that person’s home." When considering Case 4 and Case 8, a difficult question may arise in relation to the point at which a taxpayer starts to have a home in the UK. For example, consider an individual who takes a lease on an apartment in London before the date they actually move to the UK: it is possible that this could start being a home before they actually move to the UK. In these circumstances, HMRC notes in RDR3 that: "Your home starts to be your home as soon as: • "it is capable of being used as your home, for example, you have taken ownership of it, even if it is temporarily unavailable because of renovation • you actually use it as your home." If the first point above is satisfied, but in fact you never actually use it as your home, then it will not be your home. In these circumstances, an individual who wishes to rely on split year treatment and extend the overseas part of the year beyond the date on which they acquired their UK property should be advised (if possible) not to visit the property or move any of their belongings into the property until their planning is complete. Starting full-time work in the UK As anyone who has had the pleasure of applying the third automatic UK test will appreciate,8 it is very easy for an individual to become tax resident in the tax year before the year in which they actually start full-time work in the UK simply by spending a day working in the UK in the previous tax year. The reason is that this day could, when looked at retrospectively, form part of the 365 day period used for the purpose of assessing full-time work in the UK. In order to avoid this trap, it may be necessary for an individual to ensure that there has been a "significant break" from UK work. The effect of splitting a tax year As noted above, an individual is either UK resident or non-UK resident at all times in the tax year. However, by splitting a tax year the effect of this rule is relaxed in accordance with the special charging rules of FA 2013. Part 2 of Sch.45 introduces amendments to particular charging provisions in the Income Tax Acts so that income arising in the overseas part of a split year is treated, for these purposes, as arising to a Page5 non-UK *P.C.B. 240 resident. The statutory amendments mean that split year treatment will apply to the following sources of income9: • certain employment income under the Income Tax (Earnings and Pensions) Act 2003 (ITEPA); • foreign pension income under Pt 9 ITEPA; • trading income under Pt 2 of the Income Tax (Trading and Other Income) Act 2005 (ITTOIA); • income from an overseas property business under Pt 3 ITTOIA; • savings and investment income under Pt 4 ITTOIA; • miscellaneous income under Pt 5 ITTOIA; • relevant foreign income charged on the remittance basis under s.832 ITTOIA. In any case it is imperative to check whether a particular source of income is protected by split year treatment. The list of legislative amendments in FA 2013 provides a handy checklist for this purpose. The Taxation of Chargeable Gains Act 1992 is similarly amended so that an individual is not chargeable to CGT in respect of any chargeable gains accruing in the overseas part of the year.10 Rather unfortunately, the amendments originally introduced by FA 2013 meant that gains arising in the overseas part of a year to a remittance basis user but remitted in the UK part of that year, or in a subsequent period of UK residence, would be charged to tax. This anomaly sparked a debate between practitioners in relation to whether, as was believed, this was simply a deficiency in the drafting or whether it reflected a deliberate policy decision. Fortunately, the Government admitted that this was in fact a mistake. The legislation has now been amended by the FA 2014 (retrospective to April 6, 2013) so that the charging of gains on the remittance basis excludes gains arising in the overseas part of a split year. Transfer of assets abroad: a nasty trap Of particular concern for practitioners advising clients with offshore structures is the failure to extend split year treatment to income treated as arising to UK resident individuals under the Transfer of Assets Abroad (TOAB) legislation.11 The result is that whilst UK resident individuals may not be taxable on actual income received during the overseas part of a tax year, they will still be subject to income tax on income that is treated as arising to them during that period under the TOAB provisions. The significance of this cannot be overstated where individuals coming to the UK are dependent on offshore structures to fund their lifestyle (or indeed any UK business interests). For example, whilst an income distribution from a trust in the overseas part (prima facie taxable as miscellaneous income) would be protected by split year treatment, the TOAB provisions may still result in a UK tax charge if there is available income in the structure. In such a case, careful consideration will need to be given Page6 to whether or not the motive defence12 will be available. Limitations of split year treatment As split year treatment has no impact on whether someone is or is not in fact resident for a particular tax year, there are many examples of areas in which the full rigours of the UK tax system continue to apply. The following are some of the main issues that may be encountered in practice. *P.C.B. 241 Double taxation agreements Split year treatment will not affect whether an individual is regarded as UK resident for the purposes of any double taxation agreement. Deemed domicile and the remittance basis charge For the purposes of the 17 year residence rule for IHT purposes,13 the legislation makes clear that "residence" has its normal income tax meaning. Split years will therefore count as full years of residence for these purposes. The same is true of the 12 year residence test and the seven year test for the remittance basis charge.14 Disregarded income The limitation on a non-resident’s UK liabilities under s.811 of the Income Tax Act 2007 will not be relevant in the overseas part. This could have far-reaching consequences, including for offshore trustees where an individual beneficiary is coming to the UK for the first time. If that trust holds UK investments then, whilst there are no UK resident beneficiaries, the trustees’ tax liability on "disregarded income" will be limited. However, this limit will cease to apply as soon as there is a UK resident beneficiary of the trust15 and the trustees will be subject to UK tax without the benefit of this limit for the whole tax year, regardless of whether or not the relevant beneficiary is entitled to split year treatment. Personal representatives and trustees Split year treatment applies to an individual’s personal tax situation. It is not relevant to an individual’s role as a personal representative. It applies in a limited way to individuals acting as trustee of a settlement in determining the trustees’ residence status.16 Where an individual is entitled to split year treatment, but has only been a trustee of the settlement in the overseas part of the split year, then for the purposes of the trustee residence tests, the individual trustee can be treated as if they were not resident for the year. The effect is that the trustees of a settlement will not become UK resident in a situation where one of the trustees is eligible for split year treatment and only acts as a trustee of the trust during the overseas part of that split year. Individuals must therefore be careful not to confuse their personal tax position with the tax position of any structures of which they are trustee. Conclusion Many people coming to, or leaving, the UK may not appreciate that their UK tax liabilities are not governed by their actual dates of arrival or departure and, unless properly advised, will not plan accordingly. Non-UK domiciliaries seeking to establish a pot of clean capital using distributions from offshore structures must be very careful where this planning is done in the overseas part of a split year as they may find themselves on the wrong side of the anti-avoidance rules that are not relaxed by split year treatment. Emma-Jane Weider Page7 Partner Maurice Turnor Gardner LLP Fiona Poole* Senior Associate (CTA) Maurice Turnor Gardner LLP Claire Roberts* Associate Maurice Turnor Gardner LLP P.C.B. 2014, 5, 236-241 *. Emma-Jane Weider is a Partner at Maurice Turnor Gardner LLP. One of her specialisms is advising non-domiciled clients on UK tax and estate planning matters, particularly when they are planning their arrival to (or departure from) the UK. Tel: (0)20 7786 8716; email: emma-jane.weider@mtgllp.com; Fiona Poole is a Senior Associate at Maurice Turnor Gardner LLP who specialises in complex tax-efficient structuring of clients’ personal and business assets in multiple jurisdictions and international trust issues for high net worth individuals. Tel: (0)20 7786 8737; email: fiona.poole@mtgllp.com; Claire Roberts is an Associate at Maurice Turnor Gardner LLP. Claire advises trustees, banks and high net worth individuals on tax and trust planning and in particular on international wealth planning structures. Tel: (0)20 7786 8727; email: claire.roberts@mtgllp.com. 1. The Finance Act 2013 (FA 2013) Sch.45 para.1 confirms that the rules apply for the purposes of income tax, capital gains tax, inheritance tax and corporation tax. 2. Absolom v Talbot [1943] 1 All E.R. 589. 3. FA 2013 Sch.45 Pt 3. 4. FA 2013 Sch.45 para.14. 5. FA 2013 Sch.45 paras 54 and 55. 6. See RDR3, para.5.7. 7. Expatriate Forum meeting July 2013, see www.hmrc.gov.uk/consultations/joint-forum-expat-tax.htm [Accessed August 7, 2014]. 8. FA 2013 Sch.45 para.9. 9. See FA 2013 Sch.45 paras 57 –91. 10. See FA 2013 Sch.45 paras 92 –101. 11. Income Tax Act 2007 Ch.2 Pt 13. 12. Income Tax Act 2007 ss.737 and 739. 13. Inheritance Tax Act 1984 s.267. 14. Income Tax Act 2007 s.809H. 15. Income Tax Act 2007 s.812. 16. Taxation of Chargeable Gains Act 1992 s.69 and Income Tax Act 2007 s.475. © 2014 Sweet & Maxwell and its Contributors