DATA COLLECTION TOOL (DCT) TRAINING

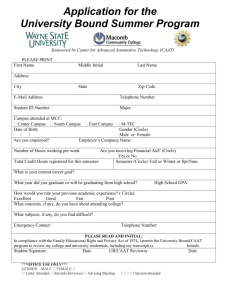

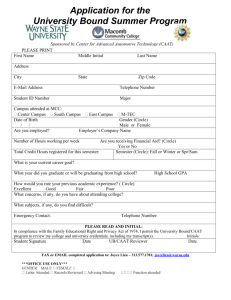

advertisement

2013 Data Collection Tool Workshop Feb 4, 2014 1 2 Today’s Agenda Time Agenda Item Speaker 10:00 Introduction & What’s New! Irene Dailide 10:05 DCT Walkthrough – Collection of 2013 Data Nicole Lewis 10:50 Importing of Data and Live DCT Demo Mike Miller Nicole Lewis 11:15 DCT Reconciliation of Contributions Process Dominik Golonka 11:30 Wrap up Irene Dailide 2013 DCT Introduction Irene Dailide What’s New! Member Annual Statement delivery Pilot Timeframes to be set for data validation and annual statement print production 2013 DCT Training Nicole Lewis Access to the DCT DCT released February 4, 2014 DCT Start Up package User name Temporary password 2013 DCT Guidelines 2013 Service spreadsheet DCT Reporting 2013 Data You will be provided with a 2013 Service spreadsheet which will need to be completed checked and returned to CAAT for processing pensionable service. To be sent separate from the DCT What the Plan provides on the DCT Basic information for each person on the database during the year Information on termination, retirement, death and LTD events during the year by individual Updated Leaves of Absences Pre-loaded Service for full-time members What the Employer enters on the DCT Pensionable earnings, contributions for active periods Breaks for leaves Pension Adjustment If the member bought back service for 2013, the PA must include the deemed earnings and service purchased Log On Homepage Changing your Password Year: 2008 2013 Last run:(01/02/2014 2:31:23 PM) Changing your Password Year: 2013 Homepage Year: 2013 Last run:(01/02/2014 2:31:23 PM) Homepage: Header Year: 2013 Last run:(01/02/2014 2:31:23 PM) Homepage: Instruction Guide for Administrators Year: 2013 Homepage: Data Problems Year: 2013 Last run:(16/02/2014 2:31:23 PM) Homepage: Member Data Summary Year: 2013 Last run:(01/02/2014 2:31:23 PM) Tool Bar: Member Data Year: 2013 Last run:(01/02/2014 2:31:23 PM) Reports Year: 2013 Last run:(01/02/2014 2:31:23 PM) Reports: Error Reports Year: 2013 Last run:(01/02/2014 2:31:23 PM) Tool Bar: Help Year: 2013 Last run:(01/02/2014 2:31:23 PM) Timeout Member Data: View/Edit Data Year: 2013 Last run:(01/02/2014 2:31:23 PM) Edit/View Data: Search Year: 2013 Edit/View Data: Search Year: 2009 Year: 2013 EDIT/VIEW DATA: Search Year: 2013 Year: 2009 Edit/View Data: Search Edit/View Data: Add New Member Year: 2009 Year: 2013 Edit/View Data: Add New Member Year: 2010 2013 Edit/View Data: Add New Member Year: 2013 Update screen: Personal Year: 2013 Update screen: Basic Year: 2013 YMPE for 2013 is: $51,100 Contributions and PA Checking your Calculations Earnings and Pre-loaded Pensionable Service Basic Screen: Contributions (CAAT/RCA) PA/Comments Year: 2013 YMPE for 2013 is: $51,100 Basic Screen: Comments Year: 2013 YMPE for 2013 is: $51,100 Basic Screen: Checking your calculations Year: 2013 YMPE for 2013 is: $51,100 Basic Screen: Earnings and Credited Service Year: 2013 YMPE for 2013 is: $51,100 Basic Screen: Earnings and Credited Service Year: 2013 YMPE for 2013 is: $51,100 Member Status: Effective Date Year: 2013 Member Status: Description Year: 2013 Member Status: Previous Status vs Reported Year Status Year: 2013 Member Status: Pregnancy/Parental Leave Year: 2013 04/08/2013 01/12/2013 Member Status: Return to Work Year: 2013 01/12/2012 2008 01/06/2013 Member Status: Reduced Workload Year: 2013 2008 01/06/2013 80 2009 01/09/2013 Process overview Pensionable Service Process The CAAT Plan will Provide the partially pre-loaded pensionable service spreadsheet You will be required to Verify and complete service for all members Send the service spreadsheet to CAAT via S-Doc DCT Process CAAT Plan releases DCT Feb 4, 2014 You will Import data to the DCT Run Validations and make changes Update Pensionable Service Spreadsheet Once reconciled – Send data to CAAT Importing the .csv file Mike Miller Flags Live demo Nicole Lewis Flags: Errors/ Warnings Year: 2013 Demo site How to send data to CAAT Year: 2013 Last run:(01/02/2014 2:31:23 PM) 999999999 Collins, Jim How to send data to CAAT Year: 2013 999999999Collins, Jim How to send data to CAAT Year: 2013 999999999 Collins, Jim How to send data to CAAT Year: 2013 999999999 Collins, Jim How to send data to CAAT Year: 2013 Last run:(01/02/2014 2:31:23 PM) 999999999 Collins, Jim 59 DCT Questions All general and DCT inquiries should be forwarded directly to your designated Employer Services Pension Analyst. 416.673.9000, or toll free 1.866.350.2228 CAAT and RCA Contributions Reconciliation Dominik Golonka 61 Initial reconciliation of contribution remittances Each year the DCT file is released to the employers by Client Services 62 Initial reconciliation of contribution remittances Finance Department provides 2 Excel worksheets (via S-Doc) showing all contributions remitted for both CAAT and RCA Plans. 63 Initial reconciliation of contribution remittances The first worksheet contains two different documents: 1. Summary of 2013 Pension Contributions 2. Other Than Current Contributions (a listing of purchases by member). The second worksheet shows the RCA Plan Summary only. Please check the information and confirm it’s accurate. 64 CAAT Excel worksheets Summary of 2013 Pension Contributions SUMMARY OF 2013 PENSION CONTRIBUTIONS CAAT Pension Plan Pension Contributions - 2013 Lewis College Account January Total Current Contributions: $10,120,362.80 February March April 388,198.40 388,198.40 254,004.53 254,004.53 378,904.49 378,904.49 270.22 270.22 270.22 270.22 270.22 270.22 270.22 270.22 June Current Current Pre-enrollment Pre-enrollment Pregnancy/Parental leave Pregnancy/Parental leave Unpaid leave of absence Vested Prior (Optional) Non-Vested Prior Transfer in Strike period purchase Deferred 50% Return 1110-1 1110-2 1115-1 1115-2 1120-1 1120-2 1130-1 1135-1 1140-1 1145-1 1150-1 1157-1 EE er EE er EE er EE EE EE EE EE EE For previous years For previous years 1160-1 1160-2 EE er 240.00 - Open 1170-1 EE - Total Non-current Service 254,000.00 254,000.00 May 170,588.83 100,000.00 100,000.00 1,200.00 2,750.00 270.22 270.22 1,010.00 255.00 123.50 811.17 - 569,825.39 569,825.39 1,550.00 July August 422,491.95 422,491.95 497,585.58 497,585.58 September October 445,530.44 445,530.44 488,519.52 488,519.52 November 734,197.37 734,197.37 December 526,923.73 526,923.73 10,731.82 10,731.82 1,561.26 Total 5,060,181.40 5,060,181.40 2,750.00 2,750.00 12,082.92 12,082.92 1,010.00 255.00 123.50 170,588.83 811.17 1,801.26 - 508,540.44 776,937.24 508,549.50 928,938.25 206,930.11 1,141,200.78 540.44 540.44 540.44 171,129.27 6,930.11 1,550.00 844,983.90 - 1,018,196.06 23,024.90 891,060.88 - 977,039.04 - 1,468,394.74 - 1,053,847.46 - 10,324,618.40 204,255.60 65 CAAT Excel worksheets Other Than Current Contributions VESTED PRIOR (PREVIOUSLY CALLED OPTIONAL) CAAT PENSION PLAN OTHER THAN CURRENT SERVICE CONTRIBUTIONS 2013 PRE-ENROLMENT MONTH May May June NAME Calculator, M Quipu, R Calculator, M MONTH NAME May Wampum, H PRINCIPAL 255.00 255.00 EMPLOYEE EMPLOYER 1,200.00 1,550.00 1,550.00 1,200.00 - NON-VESTED PRIOR (PREVIOUSLY CALLED PRIOR) MONTH NAME 2,750.00 2,750.00 May Abacus, J PRINCIPAL 123.50 123.50 PREGNANCY/PARENTAL LEAVE MONTH January February March March April April May May August NAME Lizak, R Smith, J Excel, G Calculus, R Frankowski, K Quinoa, L Rybak, K Red, M April, D EMPLOYEE EMPLOYER 270.22 270.22 140.00 130.22 125.00 145.22 200.00 70.22 10,731.82 270.22 270.22 140.00 130.22 125.00 145.22 200.00 70.22 10,731.82 12,082.92 12,082.92 May NAME Down, H MONTH NAME May Access, C EMPLOYEE 811.17 811.17 FOR PREVIOUS YEARS MONTH May August NAME 120-2012 Annual Reconciliation Woods, A (2003-04 Current EE+er+interest) AMOUNT 240.00 1,561.26 1,801.26 LEAVE OF ABSENCE MONTH STRIKE PERIOD PURCHASE (WORK STOPPAGE) AMOUNT 1,010.00 1,010.00 66 RCA Excel worksheet RCA Plan Summary SUMMARY OF 2013 PENSION CONTRIBUTIONS CAAT SUPPLEMENTARY PLAN (RCA) Pension Contributions - 2013 Lewis College Account Current Current Pregnancy/Parental leave Pregnancy/Parental leave 1110-1 1110-2 1120-1 1120-2 EE er EE er Prior years 1160-1 EE Total Current Contributions Total Current Contributions for RCA January February March April 5,425.62 16,276.86 5,207.91 15,623.73 4,710.39 14,131.17 5,804.48 17,413.44 May 10,000.00 30,000.00 June July 10,754.34 32,263.02 19,093.36 57,280.08 August 11,572.92 34,718.76 September 7,809.59 23,428.77 October November December 7,370.70 22,112.10 10,962.54 32,887.62 8,168.15 22,504.45 425,520.00 Total 106,880.00 318,640.00 - 21,702.48 20,831.64 18,841.56 23,217.92 40,000.00 43,017.36 76,373.44 46,291.68 31,238.36 29,482.80 43,850.16 30,672.60 425,520.00 21,702.48 20,831.64 18,841.56 23,217.92 40,000.00 43,017.36 76,373.44 46,291.68 31,238.36 29,482.80 43,850.16 30,672.60 425,520.00 67 Initial reconciliation of contribution remittances Employer verification Cash sent by the employer or member during the year agrees with CAAT Plan’s records Names and types of service are accurately recorded 68 Initial reconciliation of contribution remittances Employer verification – Confirmation Please confirm accuracy with email: “I agree with the CAAT and RCA 2013 DCT Reconciliation Remittance spreadsheets” (do not attach spreadsheets) 69 Annual reconciliation From Pension Analyst: A Schedule of Adjustments reconciling contributions from the original DCT submissions made by the college to the final reconciled totals (from Pension Operations) A copy of the final Summary Data Report that shows all membership data after adjustments have been entered 70 Annual reconciliation From Finance: CAAT Annual Statement of Contributions RCA Annual Statement of Contributions 71 ANNUAL STATEMENT OF CONTRIBUTIONS FOR THE YEAR 2013 Annual reconciliation Employer Information CAAT Annual Statement of Contributions Lewis College James Sisko 99 Northern Ave P.O. Box 009 Toronto, Ontario M5D 3H 7 FINAL STATEMENT ISSUED: GROUP NUMBER June 29, 2014 5 REGULAR CONTRIBUTIONS MEMBER 'Annual Reporting of Contributions' Initial Submission: EMPLOYER TOTAL 5,059,002.25 5,059,002.25 10,118,004.50 560.05 560.05 1,120.10 'Annual Reporting of Contributions' RECONCILED TOTAL: 5,059,562.30 5,059,562.30 10,119,124.60 TOTAL CONTRIBUTIONS REMITTED: 5,060,181.40 5,060,181.40 10,120,362.80 Adjustments as per following page(s): BALANCE DUE TO EMPLOYER $1,238.20 For inquiries relating to the annual reconciliation process, please contact your Pension Analyst at 416.673.9000. For inquiries relating to contribution remittances, please contact Dominik Golonka at 416.673.9044. Colleges of Applied Arts and Technology Pension Plan 250 Yonge Street, Suite 2900, P.O. Box 40 Toronto ON M5B 2L7 Tel 416.673.9000 Fax 416.673.9029 72 EFT Payments Send payment together with invoice Send invoice by Fax: CIBC Mellon Fax: 416-643-5418 Attention: IPA Team OR Send invoice by Email: B1K@cibcmellon.com 73 Mailing cheques CIBC Mellon 320 Bay Street P.O. Box 1 Toronto, ON M5H 4A6 Attention: IPA Team Cheques should be payable to: CAAT Pension Plan c/o CIBC Mellon or CAAT Supplementary Plan c/o CIBC Mellon 74 CAAT- DCT balance due to college Please claim the balance owing against your next monthly remittance by showing a credit on the CAAT Contribution Remittance Summary form 014-A under ‘Credits Employer’ and reducing the total remittance amount. The regular monthly contribution remittance amounts should remain unaffected. Example on next slide 75 Current service contributions must be remitted monthly and received by the custodian no later than the 5th business day of the month following the month for which the contributions were made. Contributions Remittance Summary 1. Employer Identification Name of Employer Lewis Group No. 5 Prepared by James Sisko Name Telephone (including area code) and Extension Jsisko@Lewis.on.ca Email 416-505-1234 2. Contributions For the Month/Year: Form of Payment 2014 Year EFT (Electronic Funds Transfer) Payment Date (YYYYMMDD) Payment Received Date July Month 20140731 (for custodian use only) Total Payment Amount $ 998,761.80 Comments (limited to 30 characters) Contributions Type CIBC Mellon Code Amount Current Service - Employee $ 500,000.00 Current Service - Employer $ 500,000.00 Pregnancy/Parental - Employee Pregnancy/Parental - Employer Credits - Employee Credits - Employer $ (1,238.20) 2013 DCT Reconciliation Credit CAAT Pension Plan 250 Yonge Street, Suite 2900 P.O. Box 40, Toronto ON M5B 2L7 Tel 416.673.9000 / 1.866.350.2228 Fax 416.673.9029 Form 014-A (10/13) 76 RCA – DCT balance due to college Please claim the balance owing against your next monthly remittance by showing a credit on the RCA Contribution Remittance Summary form 020-A under ‘Credits Employer’ and reducing the total remittance amount. The regular monthly contribution remittance amounts should remain unaffected. Example on next slide Current service contributions must be remitted monthly and received by the custodian no later RCA than the 5th business day of the month following the month for which the contributions were made. CAAT Supplementary Plan Contributions Remittance Summary 1. Employer Identification Name of Employer Lewis Group No. 5 Prepared by James Sisko Name Telephone (including area code) and Extension 2. Jsisko@lewis.on.ca Email 416-505-1234 Contributions For the Month/Year: Form of Payment 2014 Year EFT (Electronic Funds Transfer) Payment Date (YYYYMMDD) Payment Received Date July Month 20130731 (for custodian use only) Total Payment Amount $ 31,929.50 Comments (limited to 30 characters) Contributions Type CIBC Mellon Code Amount Current Service - Employee $ 8,000.00 Current Service - Employer $ 24,000.00 RCA Fee (December only) Pregnancy/Parental - Employee Pregnancy/Parental - Employer Credits - Employee Credits - Employer $ (70.50) 2013 DCT Reconciliation Credit CAAT Pension Plan 250 Yonge Street, Suite 2900 P.O. Box 40, Toronto ON M5B 2L7 Tel 416.673.9000 / 1.866.350.2228 Fax 416.673.9029 Form 020-A (11/13) 79 Questions? Bozena Glinska Manager, Finance 416.673.9016 bglinska@caatpension.on.ca Dominik Golonka Pension Accounting Analyst 416.673.9044 dgolonka@caatpension.on.ca 80 Thank you for participating! The DCT will be released today S-DOC email with DCT starter package Service spreadsheet separate from DCT Forward service spreadsheet to your Pension Analyst at CAAT via S-Doc Please check your email for a feedback survey and send us your comments. Congratulations!