Syllabus - Matthew Hoelle Home

advertisement

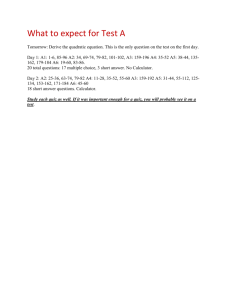

Macroeconomics Economics 515 Fri 3:45-5:15, 5:30-7:00 Sat 12:15-1:45, 2:00-3:30 May, June 2014 Rawls 2058 Purdue University Krannert School of Management Department of Economics Co-Professor Co-Professor Matthew Hoelle E-mail: Office: mhoelle@purdue.edu KCTR 226 Kevin Mumford E-mail: Office: mumford@purdue.edu Rawls 4026 Prerequisites None (though intuition from previous coursework in Microeconomics might be useful) Course description The course will cover both quantitative macroeconomics and macroeconomic policymaking. The first provides students with the understanding about how macroeconomic data is collected and analyzed. The second provides students with examples of the current models used by economists to make policy recommendations. The goals of policymakers include (among other things): growth, employment, and distributional equity. In order to achieve these goals, policymakers must understand how the policies, combined with other institutional features present in the economy, affect the macroeconomic variables. This requires a theory about how the decisions of consumers and firms are affected by prices and policy, and how market prices respond to shocks. For this reason, the course focuses on macroeconomic models that are micro-founded, meaning that decisions are made at the household and firm level by households and firms that solve constrained optimization problems. This course covers models useful in explaining the recent global financial crisis of 20072008. Learning outcomes Analyze macroeconomic data. Understand the mechanisms in the economy using macroeconomic models that are micro-founded. From predictions about the causes of the recent global financial crisis and the potential causes of future crises. 1 Course websites The Katalyst site will contain (i) all course files, (ii) 1 course quiz, (iii) course grades, and (iv) a link to the Sharepoint site. The Sharepoint site will contain (i) all course files (organized chronologically) and (ii) all course videos. A previous version of the syllabus listed the course text as Economics: A Survey (Barron, Blanchard, and Lynch). We will not use this text in this course. The text is a useful reference for some of the topics that will be covered. However, all material for this course will be provided on the course websites. Course structure The courses consists of 3 sessions, taking place in 2-day windows on three different weekends. May 23, 24 Taught by Kevin Mumford Topics: 1. Macroeconomic accounting a. national accounts b. savings and wealth c. interest rates d. government debt 2. Macroeconomic models a. productivity, output, and employment b. consumption, savings, and investment c. Solow growth model Materials: May 23 slides, May 24 slides, Interim Exam (2013 course) June 6, 7 Prepared by Matthew Hoelle, taught by a computer Quiz 1: 30 minute quiz beginning at 3:45 pm on June 6 Online material on Macroeconomic Accounting 1. Product markets a. Background b. Measurement example c. Data analysis 2. Price indices: Data analysis 3. Labor markets: Data analysis 4. Bond markets a. Background b. Measurement example 2 c. Data analysis 5. Stock markets: Data analysis Homework 1 will contain 2 questions from Product markets (1 on measurement and 1 on data analysis), 1 question from Price indices (on data analysis), 1 question from labor markets (on data analysis), 2 questions from Bond markets (1 on measurement and 1 on data analysis), and 1 question from Stock markets (1 on data analysis). Materials: Quiz 1 (available in Katalyst), Homework 1 questions, Macroeconomic Accounting notes, online videos (available in Sharepoint, 3 on Product markets, 1 on Price indices, 1 on Labor markets, 3 on Bond markets, and 1 on Stock markets) June 20, 21 Taught by Matthew Hoelle Homework 1: Due by 3:45 PM on June 20 Lecture 1: Real Business Cycle Models Lecture 2: New Keynesian Models Lecture 3: Leverage Cycle Models Lecture 4: Challenges and Future Crises Quiz 2: 30 minute quiz beginning at 3:00 pm on June 21 Materials: Real Business Cycle Models slides, New Keynesian Models slides, Leverage Cycle Models slides Methodology The course will be based on a series of lectures and online videos. The course material is reinforced by: 1) Quiz 1 Quiz 1 will take place at the beginning of the session on June 6 (the session begins at 3:45 pm). Quiz 1 will be a multiple-choice examination containing 10 questions. Students are permitted 30 minutes to complete the quiz. Questions will be similar to (i) the 10 questions from the Multiple Choice section of the 2013 Interim Exam, (ii) Question 1 from the Short Answer section of the 2013 Interim Exam, and (iii) Questions 2, 3, and 5 (no demand curve graph for Question 5) from the Problems section of the 2013 Interim Exam. 3 2) Homework 1 The questions from Homework 1 can be answered by watching the videos assigned for the classes on June 6, 7. Students are encouraged to work in their assigned study groups, but each individual must submit his/her own homework solutions. Homework 1 must be submitted at the beginning of the session on June 20 (the session begins at 3:45 pm). Homework 1 will contain 2 questions from Product markets (1 on measurement and 1 on data analysis), 1 question from Price indices (on data analysis), 1 question from labor markets (on data analysis), 2 questions from Bond markets (1 on measurement and 1 on data analysis), and 1 question from Stock markets (1 on data analysis). 3) Quiz 2 Quiz 2 will take place at the end of the session on June 21 (the session ends at 3:30 pm). Quiz 2 will be a multiple-choice examination containing 10 questions. Students are permitted 30 minutes to complete the quiz. The questions will cover the material presented on June 20, 21. The presentation slides will be made available. Assessment Quiz 1 Homework 1 Quiz 2 1/3 1/3 1/3 NB: Given the online nature of the classes on June 6, 7 (Quiz 1 is an online quiz and the material to complete Homework 1 will only be available online), please let me know if you have a work or personal conflict with the meeting times on these dates. If such a conflict exists, you will be permitted to complete the work online. The huge advantage of completing Homework 1 on campus on June 6, 7 is that individuals are permitted to work with their assigned study groups to answer the questions. 4