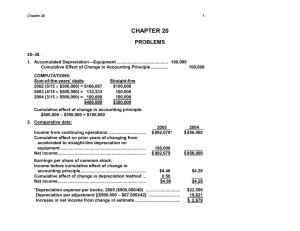

Chapter 20 - ucsc.edu) and Media Services

advertisement