March 3 lecture notes Definitions Economic Costs (opportunity costs

advertisement

March 3 lecture notes

Definitions

Economic Costs (opportunity costs) -payments that must be made in order to obtain and retain the

services of a resource

Explicit costs – monetary payments that a firm must make to an outsider to obtain a resource

Implicit costs – monetary income foregone by using self-owned, self-employed resources in its own

production rather than selling them to other firms

Normal Profit – payment by a firm to obtain and retain entrepreneurial ability

Profit = revenue-costs

Suppose you earned $31,000/yr as a manager at a restaurant. Then you decided to open your own

restaurant and manage it yourself. This entrepreneurial ability is worth $10,000 per year.

You invest $40,000 in savings which could otherwise earn you $1,000/yr in interest

You own a restaurant space which you previously rented at $10,000/yr. You plan to use this space.

You hire a cook for $20,000/yr and a waitress for $15,000/yr. The cost of food is $30,000/yr.

Your utility bill is $7,000/yr

Suppose that in the first year your restaurant has total sales revenue of $240,000

What is your profit?

An accountant would tally your profit as follows:

Total Revenue:

Costs:

Food

Employees

Utilities

Total explicit costs

Accounting Profit:

240,000

30,000

35,000

7,000

72,000

168,000

But when economists calculate profit, they include implicit costs. By including implicit costs, such as

foregone wages, interest, etc., you do not ‘over state’ the success of your business.

Economists Calculation:

Total Revenue:

Costs:

Food

Employees

Utilities

Total explicit costs

Foregone interest

Foregone rent

Foregone wages

Foregone

entrepreneurial

income

Total implicit costs

Economic Profit:

240,000

30,000

35,000

7,000

72,000

1,000

10,000

31,000

10,000

52,000

116,000

So we have:

Accounting Profit = Total revenue – explicit costs

Economic Profit (pure profit) = Total revenue – explicit costs – implicit costs

Economic profit will always be smaller than accounting profit.

As we discussed, firms face different time periods in which they have different abilities to adjust to market

changes. In the immediate market period, firms cannot adjust at all, and hence cannot offer greater

quantities with greater prices. In the short term, firms cannot adjust their plant size, but they can change

some resources, such as the amount of labour they use. Hence, in the short run, firms can, and are willing

to offer slightly greater quantities as price increases. In the long run, firms can vary all resources input.

They can change both plant size and the amount of labour they use. Thus, in the long run, firms can and

are willing to offer greater quantities as price increases.

Note: short run and long run periods are conceptual rather than calendar periods. The long run must be

long enough for plant size to vary. In some industries (clothing manufacturers), plant size can be varied in

very short periods (weeks). In other industries (auto manufacturers, oil refiners), plant size may take

months or years to vary.

We can take a look at each period (short run and long run) and consider the types of costs that firms face.

Later we will use these cost definitions to show how firms make decisions on how much to produce in the

short run and long run.

Short Run Production – plant size is fixed, but we can use the plant more intensively by increasing

variable inputs such as labour

TERMS:

Total Product (TP) = total quantity or total output of a good produced by the firm

Marginal Product (MP) = the extra or added product associated with adding one unit of variable

resource (labour) to the production process.

MP = change in TP/change in Labour

Average Product (AP) = the output per unit of labour input (note: this is also called labour productivity)

AP= TP/Labour

Law of Diminishing Returns (Law of diminishing marginal product) – as successive units of a

variable resource (labour) are added to a fixed resource (plant), beyond some point, the extra (marginal)

product per resource unit will decline.

Consider a hamburger shop:

Units of Variable Resource (labour)

TP

MP (per extra labour)

AP

(units of

hamburgers

produced)

0

1

0

10

2

3

4

5

6

25

45

60

70

75

15

7

8

75

70

0

10

20

15

10

5

-5

n.a.

10

12.5

15

15

14

12.50

10.71

8.75

At 0 workers, no hamburgers are produced. At 1 worker, 10 are produced. This worker has to do all the

cooking, serving and cleaning up, and therefore cannot produce much alone. At 3 workers, each can

specialize in one task, and their average product is much higher (15). At 5 workers, however, the shop is

getting crowded and the workers aren’t working as efficiently. The marginal product of the last worker is

now only 10.

These costs can be graphed, and look as follows:

TP

75

2

6

Q Labour

MP, AP

20

AP

10

2

6

Q Labour

MP

Note: TP is maximized where MP=0. This is because when the MP falls below zero, each additional unit

of labour hired actually detracts from production, therefore, production falls. Also, notice that as soon as

MP starts to fall, TP increases at a decreasing rate, and AP starts to decrease. Why? If each added unit of

labour adds a smaller amount of production, then the increment in TP should be less than before. Also,

since AP is an average, if the extra unit added is smaller than the average, the average will fall. This is

why the MP intersects the AP at the maximum of the AP.

Short Run Costs

In the short run, a firm faces several kinds of costs:

Fixed costs (FC)– costs that, in total, do not change when the firm changes output (i.e. rent)

The sum of all fixed costs is total fixed costs, TFC

Variable costs (VC)– costs that change with the level of output (i.e. payments to labour)

The sum of all variable costs is total fixed costs, TVC

Total costs (TC)– the sum of all fixed and variable costs : TC=FC+VC

Average or per unit costs are simply the costs above, divided by the number of units produced:

Average Fixed Cost (AFC) = TFC/Q

Average Variable Cost (AVC) = TVC/Q

Average Total Cost (ATC) = TC/Q = (TFC+TVC)/Q = AVC + AFC

Marginal Cost(MC) – the extra or additional cost of producing one more unit of output

MC= (change in TC)/(change in Q) = (Change in TVC)/(change in Q) {because change in TFC=0}

also

MC=(change in ATC)/(change in Q) however our trick above does not work for change in AVC,

because AFC does change

You can think of TVC as the sum of all Marginal costs

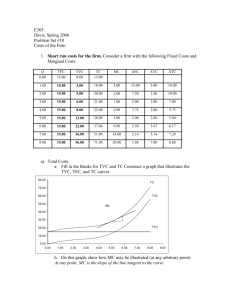

An example of these costs in chart form is below:

TP=Q TFC TVC TC

AFC

AVC

ATC

MC

0

1

100

100

0

90

100

190

n.a.

100

n.a.

90

n.a.

190

90

2

3

4

5

100

100

100

100

170

240

300

370

270

340

400

470

50

33.33

25

20

85

80

75

74

135

113.33

100

94

80

70

60

70

6

7

8

100

100

100

450

540

650

550

640

750

16.67

14.29

12.50

75

77.14

81.25

91.67

91.43

93.75

80

90

110

Graphically:

TC

$

100

TVC

TFC

0

Quantity

$

MC

ATC

AVC

AFC

Quantity

Notice that the MC curve intersects both the AVC and ATC curves at their lowest points. It does this for

the same reasons as the MP curve.

Notice also that the MC curve exhibits diminishing returns past a certain point. That is, each added unit of

labour used in production results in fewer and fewer units produced per extra unit of labour.

What causes shifts in these cost curves?

1. Changes in resource prices. Ex. The cost of labour (wages) increases, will cause VC AVC TC and

ATC to rise.

2. Technological change. Ex. A technological improvement will cause VC AVC TC and AVC to fall

Long Run Production Costs

In the long run, a firm can expand it’s plant size. As such, in the long run, the firm faces several possible

short run ATCs:

Plant size 1=small plant = short run ATC1

Plant size 2=medium size plant = ATC2

Plant size 3=large plant = ATC3

Plant size 4=very large plant = ATC4

At each of these possible sizes, the firm faces a specific ATC for the short run. However, in the long run,

the firm could change it’s plant size, so as to produce with the least possible costs.

What would it’s long run cost curve look like then? It is drawn below.

ATC

ATC1

ATC2

ATC4

ATC3

LR ATC

Quantity

The long run is made up of the bottom most parts of the short run ATC curves

Note: we have assumed that increasing plant size leads to lower average unit costs up to a certain quantity,

after which, increasing plant size leads to higher costs. Why would we think this? It isn’t because of law

of diminishing returns, rather it is due to economies and diseconomies of scale.

Economies of scale: Long run costs decrease as firms grow. (increasing returns to scale)

Economies of scale are due to: managerial specialization, labour specialization, efficient capital,

design/R&D costs and advertising. The larger the plant is, up to a certain point, the more the firm is able

to utilize its managers to their fullest capabilities, improve labour productivity through specialization, etc.

See your book for more details.

Diseconomies of scale: Long run costs increase as firms grow. (decreasing returns to scale)

Diseconomies of scale are due to: difficulties in coordination of large plant size, and worker alienation.

The larger the firm, the more difficult it is to make quick agreements on technological change, etc, and the

less likely workers are to feel a bond and integrity for the company. See your book for more details.

Constant returns to scale (CRS)-the range of output between where economies of scale and

diseconomies of scale begin. Here, a 10% increase in all inputs will cause a 10% increase in output.

Average total costs are constant in this range.

ATC

Econ.

of scale

CRS

Diseconomies

of scale

LR ATC

Quantity