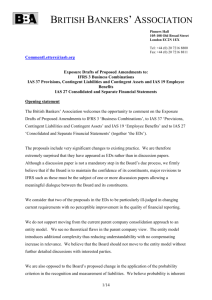

SB-FRS 103 Business Combinations

advertisement