AEF 508 - University of Ilorin

advertisement

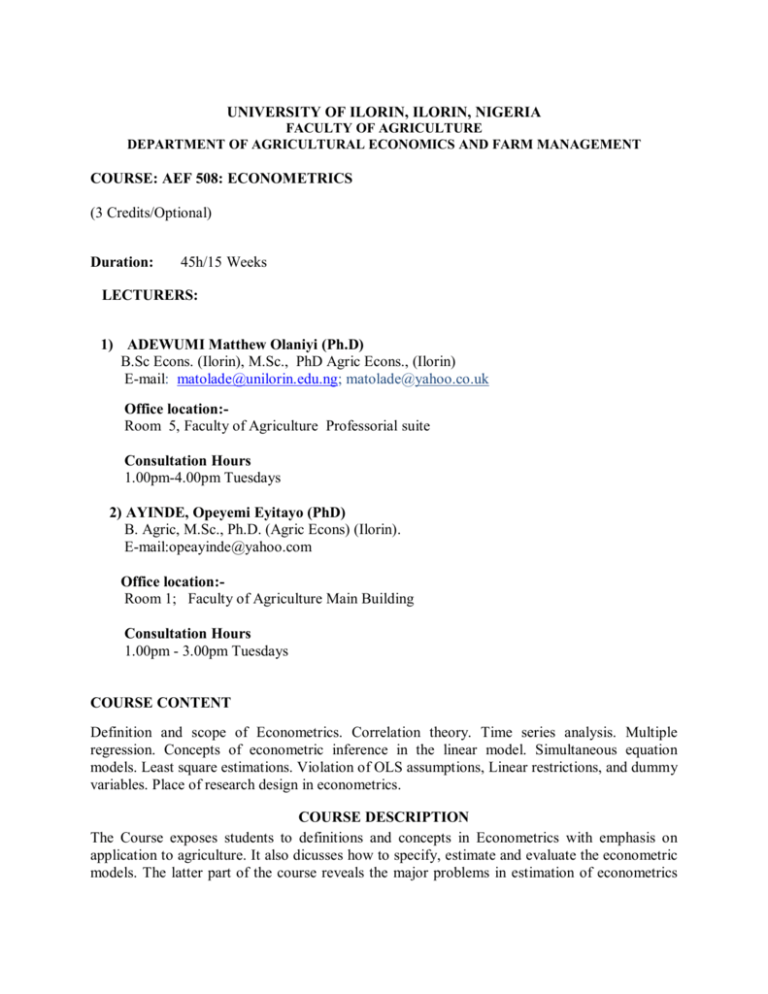

UNIVERSITY OF ILORIN, ILORIN, NIGERIA FACULTY OF AGRICULTURE DEPARTMENT OF AGRICULTURAL ECONOMICS AND FARM MANAGEMENT COURSE: AEF 508: ECONOMETRICS (3 Credits/Optional) Duration: 45h/15 Weeks LECTURERS: 1) ADEWUMI Matthew Olaniyi (Ph.D) B.Sc Econs. (Ilorin), M.Sc., PhD Agric Econs., (Ilorin) E-mail: matolade@unilorin.edu.ng; matolade@yahoo.co.uk Office location:Room 5, Faculty of Agriculture Professorial suite Consultation Hours 1.00pm-4.00pm Tuesdays 2) AYINDE, Opeyemi Eyitayo (PhD) B. Agric, M.Sc., Ph.D. (Agric Econs) (Ilorin). E-mail:opeayinde@yahoo.com Office location:Room 1; Faculty of Agriculture Main Building Consultation Hours 1.00pm - 3.00pm Tuesdays COURSE CONTENT Definition and scope of Econometrics. Correlation theory. Time series analysis. Multiple regression. Concepts of econometric inference in the linear model. Simultaneous equation models. Least square estimations. Violation of OLS assumptions, Linear restrictions, and dummy variables. Place of research design in econometrics. COURSE DESCRIPTION The Course exposes students to definitions and concepts in Econometrics with emphasis on application to agriculture. It also dicusses how to specify, estimate and evaluate the econometric models. The latter part of the course reveals the major problems in estimation of econometrics models: their causes, consequences and how solution. This is with a view to exposing the students to the major tools required for research in agricultural economics. COURSE JUSTIFICATION The ability to formulate sound policies from the results of agricultural research is one of the major global issues on agricultural development. Therefore, the practical knowledge that would be acquired from this course will enable students to be able to identify and analyze agricultural data from where necessary inferences towards addressing agricultural economics problems could be derived. The course will also be of assistance to the students in their final year project work. COURSE OBJECTIVES The broad objective of the course is to acquaint students with the integration of economics, mathematics and statistics for the purpose of providing numerical values for the parameters of economic relationships and verifying economic theories. At the end of the course, students will be able to (i) Know the meaning of economic theory, statistics, mathematical economics, and all the prerequisites of econometrics; (ii) estimate the parameters of the econometric model and test their significance; (iii) Make inferences using the estimated parameters so obtained; and (iv) Identify some of the likely problems encountered in estimation procedure (v) Course Requirement Ø This is an optional course for students in the Agricultural Economics and Farm Management Department. Registered students are expected to participate actively in all the course activities. Ø All registered students are expected to attain a minimum of 75% attendance to be able to sit for the examination. Ø Students are expected to sign up to an email account and be ready to consult the library and internet facilities for necessary reference materials. Ø Assignments must be promptly submitted as at when due and students must be punctual for the lectures. METHOD OF GRADING The grading method for this course is as shown below: Components Maximum score obtainable Continuous assessment Written test Term paper Assignment Examination Score 100% 15 % 15 % 70% COURSE DELIVERY STRATEGY Lectures run between 8:00am to 11:00am (3 Hours) every Wednesday. The course will be delivered through the face-to-face class teaching method. Students are expected to raise questions as the lecture progresses while final evaluation of the course would be conducted at the end of the course. LECTURES Weeks 1: Meaning, scope and division of Econometrics Objectives: To acquiant the students with the definition and areas of Econometrics. Sub-themes: Definition and scope of Econometrics, goals of Econometrics, division of Econometrics. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Gujarati, D. N. (1999). “Essentials of Econometrics”, 2d ed., McGraw-Hill, New York. Hill, C., William, G. And Judge, G (2001). “ Undergraduate Econometrics”, John Wiley & sons, New York. Walters, A. A. (1968). “An Introduction to Econometrics”, Macmillan, London. Practice Questions 1.What is Econometrics? 2.Why are ecometric analyses relevant to agriculture? 3.Discuss the main branches of Econometrics. Week 2: Methodology of Econometric research Objectives: To teach the students the stages involved in econometric research and how to formulate econometric models Sub-themes: The stages of econometric research – specification of the model, estimation of the model, evaluation of estimates, evaluation of the forecasting power of the estimated model, types of econometric data, desirable properties of an econometric model. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Goldberger, A. S. (1998). “ Introductory Econometrics”, Harvard University Press. Gujarati, D. N. and Sangeethe (2007). “ Basic Econometrics.” 4th edition, 1036 pp. New Delhi: Tata McGraw-Hill Publishing Company Limited. Practice Questions 1.What types of criteria would you use to evaluate the results of an estimated relationship? Which of these criteria are more important? 2. Consider the following demand function for tomato Q = b0 + b1P + u i. Interpret the coefficients b0 and b1, defining their sign. ii. How would your interpretation of the parameters of the demand function change if you knew that the demand for tomato is affected by the amount of money awarded for household meals? iii. Make a list of some important variables which have been ommitted from the above demand function and discuss how you would expect changes in these factors to ‘shift’the demand function. Week 3: Correlation theory Objectives: To introduce the students to how to measure the degree of relationships existing between economic variables. Sub-themes: A measure of linear correlation – the correlation coefficient, numerical values of the correlation coefficient, the rank correlation coefficient, partial correlation coeeficients, test of sidnificance for the sample correlation coefficient, limitations to the theory of linear correlation. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Gujarati, D. N. (1999). “Essentials of Econometrics”, 2d ed., McGraw-Hill, New York. Practice Questions 1. Would you expect positive, negative or zero linear correlation to exist between the population of values of each of the following pairs of variables? a. Number of farm households and total population, in different villages. b. Farming experience of husbands and their wives c. Hoe size and farming experience d. Years of education and farm income earned e. Total cost of production and level of output 2. The following table shows the yields in tonnes of ten agro-ecological zones of Nigeria for two crops, maize and wheat Maize 6 5 8 8 7 6 10 4 9 7 Wheat 8 7 7 10 5 8 10 6 8 6 a. Compute the correlation coefficient between the two sets of crop yield and comment on its value b. Using the above information, test the hypothesis that there is no correlation between yield of maize and wheat. Week 4: The simple linear regression model – the ordinary least square method (OLS) Objective: To educate the students on how to derive estimates of parameters of economic relationships frm statistical observations through the ordinary least square method. Sub-themes: The simple linear regression model, assumptions of the linear stochastic regression model, the distibution of the dependent variable Y, the least square criterion and the ‘normal’ equations of OLS, stimation of a function where intercept is zero, estimation of elasticities from estimated regression line. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Dielman, T. E. (1991). “Applied Regression Analysis for Business and Economics”. PWS-Kent, Boston. Draper, N. R. And H. Smith (1998). “ Applied Regression Analysis”, 3d ed., John Wiley & Sons, New York. Goldberger, A. S. (1968). “ Topics in Regression Analysis”, Macmillan, New York. Spent, P. (1969). “Models in Regression and Related Topics”, Methuen, London. Practice Questions 1. With the aid of graphs distinguish carefully between the following concepts a. The true relationship between X and Y b. The true regression line c. The estimated relationship d. The estimated regression line 2. What assumptions do we make about the random term u? Why are these assumptions necessary? 3. The following table includes the price and quantity of demanded of the product of a monopolist over a six-year period Year 2005 2006 2007 2008 2009 2010 Quantity (in thousand yards) 8 3 4 7 8 0 Price (in N per yard) 2 4 3 1 3 5 a. Estimate the demand function of the oligopolistic product, assuming this function is linear. Comment on the values of the estimated coefficients on the basis of economic theory. b. Estimate the average elasticity of demand. c. Estimate the elasticity of demand at price 4 d. Forecast the level of demand if price rise to N6. Comment on ypur forecast. Week 5: Statistical tests of significance of the estimates Objective: To teach the students how to establish criteria for judging the ‘goodness’ of the parameter estimates. Sub-themes: The test of the goodness of fit with r2, tests of significance of the parameter estimates, confidence intervals of the parameters, importance of the statistical tests of significance. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Frank, C. R., Jr. (1971). “Statistics and Econometrics”, Holt, Rinehart and Winston, New York. Practice Questions a. Compute r2 for the demand function of Practice Question Week 4 No 3 and test its statistical significance at the 5 per cent level. b. Calculate the standard error of the coefficient of the coefficients of the demand function of Practice Question Week 4 No 3. Then test the null hypothesis bi = 0 at the 5 per cent level. c. Construct a 95 per cent confidence interval for the true slope of the demand function of Practice Question Week 4 No 3. Week 6: Properties of the least squares estimates Objective: To acquiant the students with the optimal attributes for sample estimates acceptable by the statistical theory. Sub-themes: Desirable properties of estimators, Properties of the least squares estimators. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Valavanis, S. (1959). “An Introduction to Maximum-Likelihood Methods”, McGraw-Hill, New York. Practice Questions 1. Distinguish carefully between the members of each of the following pairs of preperties: a. Unbiasedness and consistency b. Consistency and asymptotic efficiency c. Efficiency and minimum variance d. Asymptotic efficiency and BLUE e. Unbiasedness and minimum MSE f. Consistency and zero MSE 2. Among the properties of unbiasedness and efficiency (or minimum variance) which would you consider more important? Why? 3 Consider the model Yt = b0 + b1Xt + ut (t = 1, 2, . . . , n) Where u satisfies the basic stochastic assumptions [U is random, E(u) = 0, E(u)2 = (homoscedacity), E(uiuj) = 0 (i = j) (serial independence)]. How would the properties of bi be affected in the following cases: a. The number of observations (n) is increased. 2 u constant b. The variance of X (dispersion of the value of X) increases c. All the X’s have the same value d. E(u)2 = 0 Week 7: Multiple linear regression Objective: To introduce the students to relationships between two explanatory variables and develop some practical rules for the derivation of the normal equations models including any number of variables. Sub-themes: Model with two explanatory variables, the general linear regression model. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Dielman, T. E. (1991). “Applied Regression Analysis for Business and Economics”. PWS-Kent, Boston. Goldberger, A. S. (1968). “ Topics in Regression Analysis”, Macmillan, New York. Spent, P. (1969). “Models in Regression and Related Topics”, Methuen, London. Draper, N. R. And H. Smith (1998). “ Applied Regression Analysis”, 3d ed., John Wiley & Sons, New York. Practice Questions The quantity supplied of a commodity X is assumed to be a linear function of the price of x and the wage rate of labour used in the production of x. The population supply equation is given as Q = b0 + b1Px + b2W + u Where Q = quantity supplied of x Px = price of x W = wage rate Using the sample data of Table 1, a. Estimate the parameters by OLS b. Test the significance of the individual coefficients at the 5 per cent level. c. What percentage of the total variation in the quantity supplied is explained by both Px and W? d. Compute the price elasticity of supply at the mean price and mean quantity. Table 1 Y=Q 20 35 30 47 60 68 76 90 100 105 130 140 125 120 135 X1 = Px 10 15 21 26 40 37 42 33 30 38 60 65 50 35 42 X2 = W 12 10 9 8 5 7 4 5 7 5 3 4 3 1 2 Week 8: Regression and analysis of variance Objectives: To make the students understand how to break down the total variance of a variable into additive components which may be attributed to various factors and the logical significance of each one of them. Sub-themes: Regression analysis and analysis of variance, comparison of regression analysis and analysis of variance, testing the overall significance of a regression, testing the improvement of fit from additional regressors, test of equality between coefficients from different samples, test of stability of regression coefficients to sample size, test of restrictions imposed on the relationship between two or more parameters. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Spent, P. (1969). “Models in Regression and Related Topics”, Methuen, London. Draper, N. R. And H. Smith (1998). “ Applied Regression Analysis”, 3d ed., John Wiley & Sons, New York. Practice Questions The saving function for the economy as a whole is given as St = b0 + b1Yt-1 + b2rt + u Where St = aggregate saving in year t Yt-1 = national income in year t – 1 rt = interest rate in year t The sample data are given in Table 1: Table 1 Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 St 20 25 25 30 33 38 35 45 43 50 55 Yt 100 110 130 140 160 170 170 200 240 250 260 rt 0.02 0.02 0.03 0.02 0.03 0.04 0.03 0.04 0.04 0.05 0.05 a. Estimate by OLS the parametrs of the saving function. b. Test the additional variation of r using the ANOVA table. c. Test the overall significance of the saving function. d. Compute the marginal propensity to consume and the marginal propensity to save e. Focast the level of saving at Yt-1 = 300 and r = 0.8. Week 9: Econometrics problems: Autocorrelation Objectives: To acquiant the students with the sources, plausibity and consequences of autocorrelation as well as the tests and solutions for the problem. Sub-themes: The assumptions of Econometrics, the assumption of independence, sources of autocorrelation, plausibity of the assumption, the first-order auto-regressive scheme, consequences of autocorrelation, solution for the case of autocorrelation, methods for estimating the autocorrelation parameters. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Gujarati, D. N. (1999). “Essentials of Econometrics”, 2d ed., McGraw-Hill, New York. Practice Questions The following table shows the quantity supplied (Y) and the price (X) of a certain commodity. The variables are measured in arbitrary units. Year 1990 1991 1992 1993 1994 1995 199 6 1997 1998 1999 2000 200 1 200 2 2003 2004 Yt 2 2 2 1 3 5 6 6 10 10 10 12 15 10 11 Xt 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 et 1.37 0.46 -0.45 -2.36 -1.27 -0.18 0.09 -1.00 2.08 1.17 0.27 1.36 3.44 -2.46 2.37 a. Estimate the supply function Yt = b0 + b1X1 + ut. b. Find the t-ratios for b0 and b1 and conduct tests of significance at 5 per cent level. c. Estimate the arc elasticity of supply. Also conduct the point elasticity at the price of 10. d. Test the overall significance of the regression, using the F statistic. e. Using the regression residuals (given in the last row of the above table), test for autocorrelation, using the Durbin-Watson d statistic. f. From your findings in (e) above can you definitely conclude that there is no autocorrelation in the residuals? Explain. Week 10: Econometric problems – Multicollinearity Objective: To educate the students on how to overcome the problem of multicollinearinearity in econometric data. Sub-themes: The assumption of non-multicollinear regressors, plausibility of the assumption, consequences of multicollinearity, tests for detecting multicollinearity, solutions for multicollinearity, multicollinearity and prediction. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Hayashi, F. (2000). “Econometrics”, Princeton University Press, Princeton N. J. Maddala, G. S. (2001). “Introduction to Econometrics”, John Wiley & Sons 3d ed., New York. Practice Questions 1. a. Consider the hypothetical observations of the Table 1, show that multicollinearity makes the coefficient of X1 unstable and increases its standard error N 1 2 3 4 5 6 7 8 Y 9 5 8 6 8 5 9 6 X1 9 4 8 7 8 4 9 7 X2 7 2 4 3 4 2 7 3 b. Is this a general result of multicollinearity? 2. Assume that the consumption behaviour of a cross-section of families is estimated by the model Yj = b0 + b1Xj + uj Where Yj = consumption expenditure of the jth family Xj = disposable income of the jth family a. We observe that two important variables are omitted: liquid assets, and size of family. b. It is known that families with small incomes have very simmilar and rigid spending habits, while high-income families have very dissimilar and flexible spending habits. c. Given (a) and (b) which assumption(s), of the linear regression model are violated? d. What are the consequences of these violations on the OLS estimate of b1 ? e. Discuss appropriate ‘corrective’ solution(s). Week 11: Econometric problems: Heteroscedasticity Objective: To explain the plausibility, consequences, the tests and the solutions for the violation of the assumption of constant distribution of the random variable over time. Sub-themes: The assumptions of randomness, zero mean, constant variance and normality of the disturbance term, plausibility of the assumption of homoscedasticity, consequences of the violation of the assumption of homoscedasticity, tests for homoscedasticitysolutions for heteroscedastic disturbances. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Gujarati, D. N. and Sangeethe (2007). “ Basic Econometrics.” 4th edition, 1036 pp. New Delhi: Tata McGraw-Hill Publishing Company Limited. Practice Questions Assume that the price of shares in the stock market is described by the following model Pj = b0 + b1Dj + b2Rj + uj (j = 1, 2, . . . , n) Where P = price of the jth firm Dj = dividend of the jth firm Rj = retained profits of the jth firm. a. If a cross-section sample of large of large and small agricultural firms is used for the estimation of this model, explain why heteroscedasticity is almost certain to exist, arising both from Dj and Rj. b. Discuss how you would proceed to explore the pattern of heteroscedasticity in this case. c. Outline the ‘corrective solution’which you would adopt, and show that this solution eliminates heteroscedasticity. Week 12: Models of simultaneous relationships Objective: To teach the students how to solve a system describing a joint dependence of variables. Sub-themes: Simultaneous dependence of economic variables, endogenous and exogenous variables, consequences of simultaneous relations, solution to the simultaneous-equation bias, structural models, reduced form models, recursive models, simultaneous equation methods. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Gujarati, D. N. and Sangeethe (2007). “ Basic Econometrics.” 4th edition, 1036 pp. New Delhi: Tata McGraw-Hill Publishing Company Limited. Gourieroux, C. (2000). “Econometrics of Qualitative Dependents Variables”, Cambridge University Press, New York. Practice Questions 1. a. What is the simultaneous equation bias? How does it arise? Illustrate your answer with an economic model of simultaneous relations. b. Can we use OLS for estimating equations belonging to a system of simultaneous relations? Why? 2. Consider the model Lt = a0 + a1Wt + a2St + u1 (1) Wt = b0 + b1Lt + b2Pt + u2 (2) Where L = the amount of labour employed Wt = the water rate S = sales P = a measure of productivity of labour a. Define the endogenous and exogenous variables b. Obtain the reduced-form coefficients of the above model; that is, the π’s of the following equations L = π10 + π11S + π12P + ν1 W = π20 + π21S + π22P + ν2 c. Show that π11 can be split into two effects: a direct effect and an indirect effect on sales (S) and employment (L). Explain the way in which S affects L indirectly. 3. Define recursiveness and explain how this property is related to the question of identification. Week 13: Identification Objective: To educate students on the identification of behavioural equations and the conditions for identification. Sub-themes: The problem of identification, implication of the identification state of a model, formal rules for identification, identifying restrictions, tests for identifying restrictions, identification and multicollinearity, identification and choice of econometric method. 1 References Gujarati, D. N. and Sangeethe (2007). “ Basic Econometrics.” 4th edition, 1036 pp. New Delhi: Tata McGraw-Hill Publishing Company Limited. Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Practice Questions 1. Given the following market model D = b0 + b1P + u S = a0 + a1P + v D=S a. Show that both equations are under-identified b. Show the effect of the inclusion of an additional variable (e.g. W = weather conditions) in the supply function, as far as the identification state of both equations is concerned. c. Under what conditions would both equations be identified? 2. Given the following macro-model of income determinetion: Ct = a0 + a1Yt + a2T + u It = b0 + b1Yt-1 + v Tt = c0 + c1Yt + W Yt = Ct + It + Gt a. Define the endogenous and exogenous variables b. Examine the identification state of the three behavioural equations c. Show that if we impose the restrictions a1 = a2, the consumption function becomes identified. Week 14: Elements of statistical theory Objective: To teach the students the basic tools for drawing statistical references. Sub-themes: Subscripts and summations, populations and samples, parameters and statistics, frequency distributions, probability distributions. 1 References Koutsoyiannis, A. (2003). “Theory of Econometrics.” 2nd edition. Pp 681. New York:PALGRAVE publishers. Gujarati, D. N. and Sangeethe (2007). “ Basic Econometrics.” 4th edition, 1036 pp. New Delhi: Tata McGraw-Hill Publishing Company Limited. Practice Questions 1. Differentiate between the following: a. Simple and double summations b. Populations and samples c. Population parameters and sample statistics d. Discrete random variable and continous random variables 2. With the aid of sketches, illustrate the shapes of probability functions you know Week 15: Revision/ Tutorial Exercises Description: Students are expected to raise questions on any difficult issue(s) taught during the preceding lecture periods.