Annual report 2011

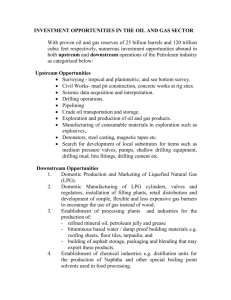

advertisement