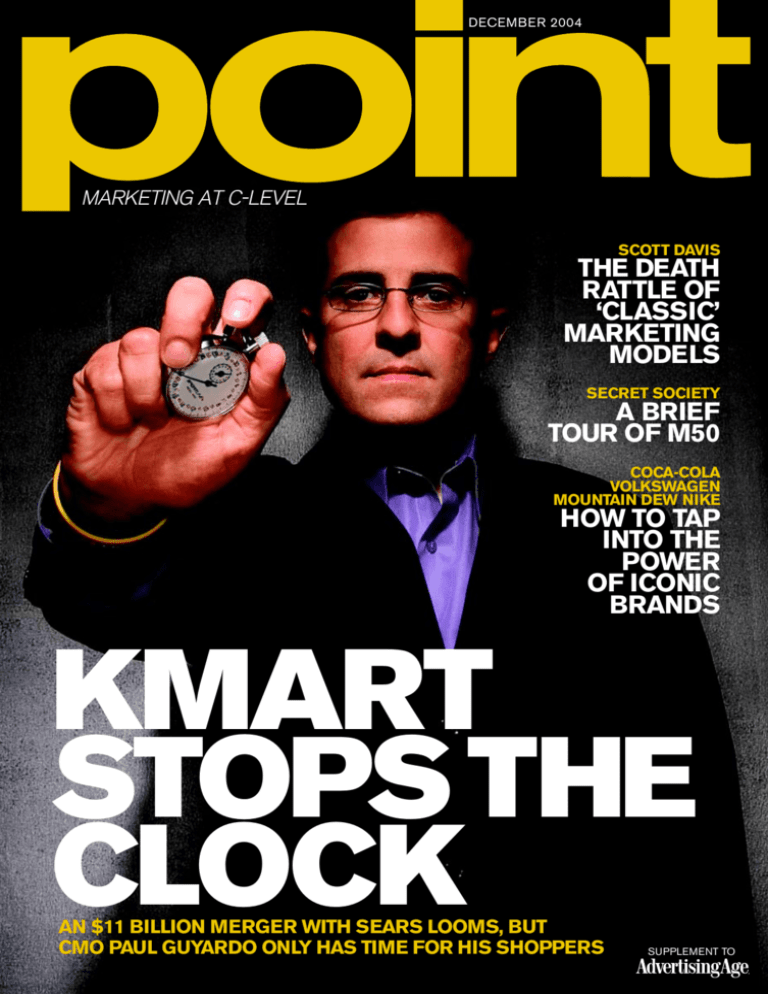

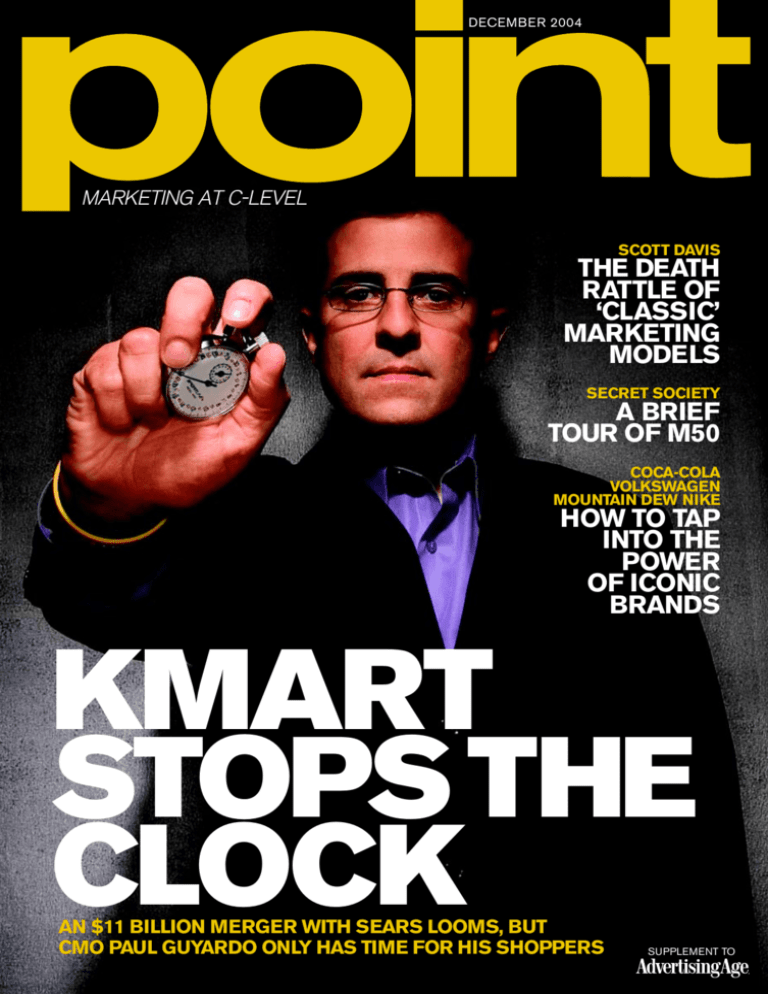

DECEMBER 2004

MARKETING AT C-LEVEL

SCOTT DAVIS

THE DEATH

RATTLE OF

‘CLASSIC’

MARKETING

MODELS

SECRET SOCIETY

A BRIEF

TOUR OF M50

COCA-COLA

VOLKSWAGEN

MOUNTAIN DEW NIKE

HOW TO TAP

INTO THE

POWER

OF ICONIC

BRANDS

KMART

STOPS THE

CLOCK

AN $11 BILLION MERGER WITH SEARS LOOMS, BUT

CMO PAUL GUYARDO ONLY HAS TIME FOR HIS SHOPPERS

SUPPLEMENT TO

future of

information

SUMMIT

’05

January 13, 2005 The New York Athletic Club NYC

Next

Generation

Strategies to Employ

a Single Customer Definition

for Improved Multi-Channel Marketing

This Summit is designed for chief marketing executives,

business intelligence managers, CIO’s and strategic planners

to learn how companies are creating a single customer

definition to link internal and external business information

assets to better target and track customers across key

channels… from mass media to direct marketing.

Don’t miss this opportunity to hear from senior executives

at major companies as they share insight and knowledge

gained from data integration initiatives.

LEARN HOW FORWARD-THINKING COMPANIES ARE

EMPLOYING A SINGLE CUSTOMER DEFINITION TO:

REGISTER NOW!

www.smrb.com/summit

or call (212) 598-5498

Hosted by Simmons Market Research Bureau

in partnership with Advertising Age

KEYNOTE SPEAKER

Barry Schwartz, author of

“The Paradox of Choice: Why More is Less”

Professor of Sociology, Swarthmore College

Consumers are paralyzed by the bewildering array

of choices in the marketplace. Professor Schwartz

has written extensively about the dilemma of

choice and the difficulty consumers face in the

decision making process. At the Summit, Barry will

speak to the ways people respond to choice and

how advertisers and marketers can better target

their products and offerings to their customers.

LUNCHEON GUEST SPEAKER

Grant J. Schneider,

Vice President, Brand Strategy & Development

TIME INC. WOMEN’S GROUP

“Seven New Rules of the Road:

Understanding Today’s Woman”

Hear from additional

presenters including:

PROCTER & GAMBLE

• Effectively attract new prospects

• Strengthen relationships among current customers

• Leverage existing business information

resources to learn more about customers

STARZ! ENTERTAINMENT GROUP

UNIVERSAL McCANN

TELEMUNDO

• Link mass media strategies with direct marketing plans

without violating privacy laws and policies

ADVERTISING AGE

• Track ROI using existing in-market performance tools

LYLE ANDERSON COMPANIES

In partnership with:

Please visit

www.smrb.com/summit

to view complete agenda

and Summit details

DECEMBER

2004

FEATURES

5

Kmart Stops

The Clock

By Sarah Mahoney

FROM THE EDITOR

“The first thing that impressed me about Paul Guyardo is his energy,”

says Sarah Mahoney, freelance writer and the author of “Kmart on the

Clock”, (page 5). “As the chief marketing officer for an established

brand, he’s working at the most sophisticated level of business. But

Kmart is no ordinary company. It’s bounced out of bankruptcy and now

finds itself on the verge of a major merger. And, as the senior marketing

officer, Paul has all the challenges of a start-up.

“His job demands a delicate balance of long-term perspective with

turn-on-a-dime immediacy,” Mahoney continues. “And energy is a

Precourt

requisite for that assignment. So are intelligence and enthusiasm.

Guyardo seems to have it all.”

This second issue of Point comes to you with many of the same dynamics. We’re an extension

of one of the most venerated brands in publishing. But we’re also a start-up, learning more about

our readers and their information needs with every issue. When we find something that works,

we’re going to stick with it. If we dare call anyone a regular in this evolving Point universe, it would

be Scott Davis. His monthly “CMO Agenda” column (page 4) once again goes right for the

marketing jugular—those “classic” brands that have not yet discovered that the world (and, most

particularly, their target audience) has left them in the dust. Not everyone agrees with Davis, a

managing partner of Prophet. Indeed, his column is Issue #1 already has generated some lively

exchanges—comments that you’ll see next issue (remember: there’s a good bit of start-up in the

Point mission) when we introduce our Letters column. If you’d like to take part in the

discussion—or have any other observations, please feel free to contact us at point@adage.com.

And we encourage you to join in the discussion. As we learn in the M50 story in our “Pointers”

section, c-level marketers stand to learn a lot when they share information. In fact, some are willing

to spend $50,000 for the privilege. It’s our mission to provide the same kind of

strategic-management service—at a much lower cost.

POINT MAGAZINE

Editor in chief: Rance Crain; VP-publishing/editorial director: David S. Klein; VP-publisher: Jill Manee

EDITORIAL

Editorial Director: Scott Donaton; Executive Editor: Jonah Bloom

Editor: Geoffrey Precourt; Design: Jesper Goransson

Contributors: Brooke Capps, Scott Davis, Thom Forbes, Sarah Mahoney, Paul Hyde, Randall Rothenberg

Art director: Donna M. Lappetito; Photo/art editor: Susan McCoy; Production editor: Lisa Fain; Copy editors: Sheila Dougherty, Ken Wheaton

ADVERTISING/CIRCULATION

General manager, sales and marketing: Vanessa Reed; Advertising director: Jeff Burch, 212-210-0280;

General manager, online: Allison Price Arden; Circulation director: Philip Scarano III; Subscriber services: 888-288-5900

BOARD OF ADVISERS

Michael Boylson, chief marketing officer, J.C. Penney Co.; Ian Beavis, senior VP-marketing and promotions, Mitsubishi Motors North America;

John Costello, exec VP-marketing and merchandising, and chief marketing officer, Home Depot; Paul Guyardo, senior VP-chief marketing officer, Kmart;

Allison Johnson, senior VP-corporate marketing, Hewlett-Packard Co.; Jim McDowell, VP-marketing, BMW of North America;

James D. Speros, chief marketing officer, U.S., Ernst & Young; Joseph V. Tripodi, chief marketing officer, Allstate Insurance Corp.

For Paul Guyardo, Kmart

CMO, so much depends

on timing. Even though

the Sears merger is just

months away, he has his

eye on another clock:

His focus is on the store,

where he figures he has

just 20 minutes to grab

his shopper’s attention

9

The Power of

Cultural Activism

By Douglas B. Holt

Iconic brands tell stories

that address the

particular desires of their

target constituencies.

What marketers can learn

from their success

DEPARTMENTS

2

POINTERS

Marketing’s most

secretive—and most

powerful—members-only

group. Selling through the

five senses. Capturing the

wisdom of crowds

4

THE CMO AGENDA

By Scott Davis

Listen closely for the

death rattle of classic

marketing models

12

END POINT

What our holiday shopping

habits tell us about our

national psyche

Cover photo by Darryl Estrine

POINT DECEMBER 2004

1

THOUGHT, TALK & SPECULATION

CoreBrand

Value Index

The latest CoreBrand

Equity IndexTM is 1.05,

up 0.01 from last month.

The Index measures the equity value

of a portfolio of 10 blue-chip corporate

brands to track trends in corporate

brand value. Index value of 1.00 based

on Aug. 2, 2004 portfolio value.

Sector Report:

Energy

Performance of top

10 valued brands in

Energy sector.

(Scale is $1 million

in brand equity.)

‘SECRET’ MARKETING SOCIETY

PROVIDES FORUM FOR IDEA SWAP

Marketing thought leaders have long mused that

the industry needs a way for senior managers to

share knowledge and ideas. To that end, a new (and

somewhat secret) society of the informed gathered

for the first time in Manhattan.

Inspired by such executive clubs as the

Corporate Executive Board and Spencer Stuart’s

G100 club, Marketing 50 (or M50) is the Skull and

Bones of the marketing set. The group is a subset of

World 50, an organization that runs a dozen

executive clubs for such disciplines as international

finance, technology and human resources. Rick

Smith, a former Spencer Stuart consultant from

Atlanta, started the member-driven groups as

havens for discussions.

I grew up in Africa, and one of the

first things I realized was that

predators have small ears.”

—Ted McConnell, manager,

Information Technology Research Organization,

Procter & Gamble Co., on whether big companies

are good at listening to consumers

‘‘

Source: CoreBrand

2

DECEMBER 2004 POINT

“It’s not a secret group, it’s a group of secrets,”

said Mr. Smith, while declining to comment

further. Elaine Stock, a former McKinsey & Co.

senior partner, is M50’s managing director.

Membership is by invitation, with one executive

from each industry category. A $50,000 annual fee

buys: two to three formal summits in London and

New York; a series of informal dinners; and online

tools; access to proprietary content from such

advisers as WPP Group’s Kantar Group, VML,

Omnicom Group, Accenture and Goldman Sachs.

Allstate’s Joe Tripodi, General Motors’ C.J.

Fraleigh, Charles Schwab’s Jody Bilney, Kodak’s

Carl Gustin and ESPN’s Lee Ann Daly are said to

be members.

MARTIN LINDSTROM MODELS

FIFTH-DIMENSIONAL MARKETING

Martin Lindstrom was hired by the R&D

department of Lego Co. when he was six. At 18, the

young Dane sold his first ad agency (complete with a

handful of national clients). By his late 20s, he had

been COO of LookSmart—British Telecom’s

Internet search engine—as well as CEO of BBDO

Interactive Europe/Asia Pacific.

Now, at 32, Lindstrom is a brand-thinker on a

world stage, with a plethora of papers and books to

his name, not to mention a host of Fortune 500

consultancies.

Early next year, Free Press will publish “Brand

Sense,” Lindstrom’s latest book. As the name

suggests, the work aims to revolutionize branding by

showing marketers how to leverage all five senses.

Lindstrom plans to put on a series of symposia—

scheduled in at least 16 countries—to tell marketers

exactly what he’s talking about. To demonstrate the

validity of his theory, Lindstrom recently told an

Australian audience how Kellogg’s uses audio-

By Kate

MacArthur

By Jonah

Bloom

testing to upgrade the sound quality of its cereal’s

crunchiness and how several automakers have

created new-car smells for their latest models.

According to Lindstrom, 72% of our emotions

are based on what we smell, not what we see or hear.

Consequently, he believes, 40% of the world’s

Fortune 500 companies will have a sensory

branding strategy in place by the end of 2005.

‘‘

One of the contributions I was able

to make … was to start asking

people, ‘I hate this thing—does anybody

like it? No. Then why are we doing it?’ ”

—Robert A. Lutz, GM vice chair/

head of product development, discussing

corporate culture in The New York Times.

Q&A

DAN McLINDEN

How can the Open Source Decision Methodology™ (OSDM) provide

managers with insight they can’t get from other research?

When managers need information the typical response is “conduct a survey” or “hold a focus group” or

“let’s organize an off-site.” But what a manager really needs is the wisdom to make the right decision.

OSDM provides the best ideas of many individuals in response to a complex issue, and integrates these

multiple and diverse ideas in an actionable plan.

What are some of the brand-positioning – or realignment – lessons you’ve

learned from tapping into collective wisdom?

A large financial-services organization with multiple retail locations throughout the country was investing in

significant organizational and technology changes that would affect customer service. Instead of working

from a narrow vision, management used OSDM to listen to the customer-facing work force about their

needs and expectations.

Two lessons emerged. First, the management debriefing led to a real “aha” experience. Opportunities

emerged that no one anticipated; potential problems were identified that no one had contemplated. Second,

rather than creating a program that was driven solely by management or consultants, the new systems and

processes included a new and better understanding of the customers and the work force as well as the

insights of the other stakeholders. In other words, a single picture of the outcome was built with diverse

input from multiple perspectives.

How would a brand manager use OSDM?

Imagine a stable product in a changing market. How do you increase sales? Ask the right people to provide

their best ideas in response to the following: “To leverage our brand into new channels requires that we …”

Take all of those ideas and ask these same people to organize this insight into key themes. Behind the scenes

OSDM uses sophisticated mathematical algorithms to take that individual input and paint an actual picture of

the collective wisdom that shows the detailed ideas organized into key themes and the perspectives on value

(i.e., importance, criticality, market opportunity). These answer the question of “what must be done?”

How do you identify the most useful kinds of “crowds” as information sources?

We look for a diverse group of people with an informed perspective on the business challenge.

A new-product project, for example, can start by getting input from the designers, manufacturers, sellers and

buyers, and building it into a single integrated picture.

How does this differ from broad-based survey?

The “your comments” section often at the end of a survey implies the not-so-subtle message, “Now that we

have asked what we think is important, you can add your thoughts.” Why not start by focusing on what you

need to hear, and what the respondents know and want to tell you? With OSDM, individual participants tell

you what they know about a subject, which is totally different from the premise of a survey.

How do you measure the efficacy of OSDM?

By getting the right input. Rather than focusing on who can make the meeting and provide input, OSDM

focuses on who ought to participate and allows people to take part regardless of location, time zone or

schedule. Efficacy is also about being enlightened. Rather than asking people what you want to know,

OSDM lets the right people tell you what they want to, without preconceived ideas and beliefs. ■

DARRYL ESTRINE

Dr. Dan McLinden leads the Open

Source Decision Methodology™

practice at Rogen International,

where he solves client’s

problems by tapping into

their stakeholders.

POWER OF

COLLECTIVE

WISDOM

“Collective intelligence”

has caught the attention

of business managers

as a counterintuitive

way of determining

customer needs. In

“The Wisdom of Crowds,”

James Surowiecki,

business columnist

for The New Yorker,

reminds us of the

mechanics of

“Who Wants to Be a

Millionaire”: Stumped

contestants can

answer a multiplechoice question, call

an “expert” or poll the

studio audience.

“Everything we think

we know about

intelligence suggests

that the smart individual

would offer the most

help,” Surowiecki writes.

“And, in fact, the ‘experts’

did OK, offering the

right answer—under

pressure—almost 65%

of the time. But they

paled in comparison

to the audiences.

Those random crowds

of people with nothing

better to do on a

weekday afternoon

than sit in a TV studio

picked the right answer

91% of the time.”

While collective

wisdom has a rich

academic heritage,

it’s a relatively new

business tool. Rogen

International, a 36year-old New Yorkbased management

consultancy, is tapping

into the theory of

collective wisdom

with a practice it calls

“Open Source Decision

Methodology.”

Contact

DMcLinden@rogen.com

POINT DECEMBER 2004

3

BY SCOTT DAVIS

TOMORROW’S CMOs: ESCHEW

YESTERDAY’S MARKETING MODELS

’’

Scott Davis is

a managing

partner of Prophet

(prophet.com), a

consultancy specializing

in the integration of

brand, business and

marketing strategies.

Davis has written several

best-selling books on

brand topics.

Contact:

sdavis@prophet.com

4

DECEMBER 2004 POINT

downloads and its opening of Red Lounge teenhangout centers.

You also see it in Starbucks’ move to mix more

than just mochas with its pilot Hear Music media

bars that allow patrons to listen to music, create

custom mixes and burn their own CDs. It shows

once again that the coffeehouse giant is as much

about the experience as it is about the brew.

Too many, however, struggle to find ways to

compete and re-establish their relevance—all the

while watching their margins decline as they fail to

break out of the old marketing

paradigms. They continue on

the noble yet dated search for

the message du jour—such as

KFC’s oxymoronic attempt to

jump on the low-carb

bandwagon—or for the silverbullet fixes to deeper problems.

Swiss Air’s failure to bring to

life a promising message of

“Attention to Detail” stemmed

from a culture that couldn’t

follow through.

For others, it’s been too

little, too late, like Geoffrey: A

Toys ’R’ Us Experience stores.

Toys ’R’ Us once had the

muscle to pull this concept off,

but today has been out-WalMarted and is now considering

the sale of its toy operations.

Ultimately, it’s about

creating relevance and meaning in a highly

fragmented and commoditized world.

It’s about knowing how your most profitable

customers think and act.

It’s about ensuring that the totality of your brand

and marketing delivers the experience for them.

It’s about effective partnering with operations,

technology, merchandising, billing and the call

center to truly go beyond the traditional marketing

model.

You may call it “taking a risk” to throw out your

old Marketing 101 textbook.

I call it “survival” and the opportunity to write a

new bestseller. ■

TOBY MORISON

‘‘

This new model

is less about

messaging and

more about

understanding

your profitable

segments of

customers in

order to design

the experiences

that are right

for them.

That sound you’re hearing is the death rattle of an

aging icon taking its last breath after a long and

honored run: the “classic” marketing model as

epitomized by consumer-package-goods

companies.

If there was any doubt that this model—based

around one-size-fits-all advertising and

promotional efforts—is no longer able to move the

masses, consider how some of the biggest brands are

shifting away.

Dell lets other manufacturers fight for retail

shelf space (and eat its dust)

while it markets and sells

more computers and

consumer-electronic

equipment on dell.com.

McDonald’s now assigns

just a third of its marketing

budget to TV, compared to

two-thirds five years ago.

A more powerful model

for marketing has been

emerging in recent years,

and it’s shaking up the way

traditional marketing

departments are organized

and how Madison Avenue

markets itself.

Forged by the service

sector’s experientialmarketing approach, this

new model is all about

establishing and maintaining

a sustainable relationship with, and loyalty from,

customers at every nuanced point of interaction. It’s

less about the messaging and more about

understanding your profitable segments of

customers in order to design the experiences that

are right for them, not necessarily everyone.

While few could state, for example, what Tide’s

advertising message is today, loyal Tide customers

can easily talk about Tide’s Fabric Care Network

Web site that shares tips and tactics going far

beyond detergent usage.

It’s why Coca-Cola Co. reinforces its lifestyle

connections through such vehicles as a Web site

featuring “fantasy” Nascar racing teams and music

COVERSTORY

KMART

ON THE

CLOCK

PAUL GUYARDO HAS ONE EYE ON HIS SHOPPERS,

ONE ON THE MARCH TO MERGER WITH SEARS

By Sarah Mahoney

For Paul Guyardo, Kmart CMO, the clock is always

running. There are the usual retail benchmarks—

back-to-school sales and the make-or-break holiday

season. And then there are the demands, just 18

months after emerging from bankruptcy, of proving

the company is on track: The month-to-month

pressure to improve same-store sales, and the

closely-watched quarterly results.

Then there’s the newest clock, the one that

started ticking last month when the Troy, Michiganbased chain announced its $11-billion merger with

Sears, forming the third-biggest retailer in the U.S.

“It’s a win-win for both companies,” Guyardo

says. “For Sears, it’s location, location, location—

we’ll help them pursue their off-mall strategy in a

major way. And Kmart gets even more great

proprietary brands—Craftsman, Lands’ End,

DieHard, Kenmore. We have to create reasons for

people to drive past a Wal-mart, past a Target, and

come to Kmart—proprietary brands are key.”

At press time, it’s still not clear how each store

will be branded when Sears Holdings—the new

parent company—begins formal operation,

presumably in March. At the time of the November

announcement, the company said it would keep

both brand names, but that several hundred Kmart

stores would likely be converted into off-the-mall

Sears Grand stores, accelerating a new one-stopshopping concept where Sears offers foods as well

as apparel and home appliances.

Kmart Chairman Edward Lampert, the

billionaire investor who was the largest shareholder

of each company prior to the merger, will be

chairmanof the new company; Sears CEO Alan

Lacy will be vice chairman and CEO; Aylwin Lewis,

hired as Kmart president-CEO a month before the

merger announcement, will be president of Sears

Holdings and CEO of Kmart and Sears Retail.

Until March, Sears and Kmart marketing efforts

are set to continue running on separate tracks.

Guyardo, Lampert’s hand-picked choice for the

Kmart CMO post, will continue in that position.

And Janine Bousquette, executive VP-chief

customer and marketing officer, will continue to

oversee Sears’ branding efforts.

CONTINUED ON PAGE 6

‘‘

Everything

is about

marketing.

Even how your

bathrooms

look is part

of marketing.

’’

About the author

Sarah Mahoney,

a contributing editor

to More and Parents,

often writes about

marketing. She lives

in Durham, Maine.

POINT DECEMBER 2004

5

COVERSTORY

‘‘

Our customer

will come in with

her list, and say,

‘I’ve got 20

minutes to get

all this stuff in

my cart.’ If

the store is

organized so

well, the signs

are so clear,

everything is in

stock, and the

associates are

helpful, maybe

she’ll get all that

done in 10

minutes.

’’

6

DECEMBER 2004 POINT

CONTINUED FROM PAGE 5

For Guyardo, that’s an alarm clock that will not

ring for a few months. The clock that ticks the loudest

right now is the same one that he’s been listening to

most attentively since he joined the company 10

months ago—it’s the one that starts ticking the minute

a customer walks into her local Kmart.

His idea of retail Nirvana? “Our customer will

come in with her list, and say, ‘I’ve got 20 minutes

to get all this stuff in my cart.’ If the store is

organized so well, the signs are so clear, everything

is in stock, and the associates are helpful, maybe

she’ll get all that done in 10 minutes.

“Then, if we’ve done our job, this customer will

be gracious, and give me that extra 10 minutes. The

impulse items she puts in her basket are my reward.”

But there’s a nightmare version as well: “If she

can’t find what she needs or if she is disappointed

with the quality of what she sees—she’ll just leave,”

says Guyardo, who spent eight years at Home

Shopping Network before joining Kmart Holding

Corp.’s turn-around team. “And then I’ve lost her.”

Holding her attention isn’t easy, and “my focus

can’t be anywhere else but on the consumer,” he

says. “We’re trying to move mountains here.”

The struggle is creating a marketing identity that

falls between cheesy (a niche currently dominated by

Wal-Mart Stores) and chic (a spot already taken by

the trendy Target Corp.). The secret, Guyardo is

convinced, is strengthening and revitalizing Kmart’s

proprietary brands, including Martha Stewart

Everyday, Route 66 and Jaclyn Smith for Women—

and the merger with Sears can only help.

But it’s clear that Guyardo’s clock-watching has

paid off: The company credited improvements in

advertising and promotion when it recently posted

third-quarter profits of fiscal 2004 of $553 million,

compared to a net loss of $23 million in the yearearlier period. (Same-store sales declined again for

the quarter, but the company said it was encouraged

by a 1.9% gain in same-store sales in October—the

first gain in six months.)

Whichever name prevails (the betting, of course,

is on Sears), Guyardo is still intent on transmitting a

constant and consistent message: “Our customer

needs to know that our stores and our brands stand

for high quality and good value.” For Guyardo,

marketing is the sum of every last detail of the

shopping experience. “Everything is about

marketing,” he says. “Even how your bathrooms

look is part of marketing.”

Of course, translating that message for a brand

that means many things to many people is

complicated. A trip to Kmart might find teens

shopping for trendy jean jackets just two racks away

from an octogenarian ooh-la-la-ing over markeddown jack-o’-lantern sweatshirts, or a young mom

stocking up on stunning new Martha Stewart

holiday ornaments, even while cracking wise about

Martha’s Christmas in the slammer.

It doesn’t help that Kmart has burned so many

shoppers in the past. Over the years, former Kmart

customers have become “unforgiving,” says Gary

Ruffing, a retail analyst with BBK, Southfield,

Mich. “She’s a reliable mom, and Kmart has not

been reliable, in terms of quality and value. Once

you let her down, it hard to get a second chance.”

But don’t expect Guyardo to come up with a

single-word mantra on how to get back in her good

graces. “It’s so easy for people to believe there’s a

DARRYL ESTRINE

silver bullet in this business,” says Jon Gieselman,

VP-advertising and public relations, who also

worked for Guyardo at Home Shopping Network.

“Paul often says that Kmart is like a car—many

different pieces have to work together. Is the

merchandise right? The people, pricing, location,

lighting, flooring? Are the carts lined up neatly

when people walk in? There’s no one thing we need

to do better, there’s hundreds of things,” says

Gieselman. “And we have to do them all well.”

Guyardo’s initial focus was on apparel,

marketing the contemporary new look Lisa Schultz,

Kmart’s chief creative officer, and John Goodman,

chief apparel officer, have given Kmart’s existing

product lines. (Before joining Kmart, both Schultz

and Goodman spent more than decade at the Gap.)

These revamped lines bode well for Sears Holdings:

“In the year following the bankruptcy, Kmart was

able to bring in a lot of talented people—like Paul,

like Lisa,” says Ruffing, “and now the merger will

allow it to reposition itself out of the discount

industry. With Sears’ respected brands and Kmart’s

talent and expertise in consumables and health and

beauty, it can become a whole new kind of megastore—a kind of Home Depot without wood.”

Also key to Kmart’s marketing strategy are the

working relationships Guyardo has built with

outsiders, including the WB Network, E! and

Telemundo. Such deals have given the company

market traction it might never have gotten on its

own. Take the WB, a juggernaut in communicating

Paul Guyardo

November 8, 2004

The bad news: The Sears

merger may mean a new

management team.

The good news: Guyardo

enjoys the passion and

excitement of a

turnaround situation.

CONTINUED ON PAGE 8

POINT DECEMBER 2004

7

COVERSTORY

BUILDING

A BETTER

CMO

For Paul Guyardo,

the classical training

of package-goods

marketing was ideal

preparation for his current

job as Kmart’s chief

marketing officer.

First

marketing job:

Tracy-Locke/BBDO,

Dallas: “They had me

work behind the counter at

a Taco Bell in Fort Worth

for a week—wearing that

uniform, making the tacos.

A few months later, a

friend told me I’d been

spotted. ‘He may be telling

you he works on the Taco

Bell account, but I saw him

behind the counter,’ an

acquaintance said to him.

‘That poor guy is working

at Taco Bell.’”

Best basic

training:

Brand management

at Johnson & Johnson:

“You have to work with

the people in R&D, the

people in sales, the people

in advertising,” he says.

“When you’re in charge

of P&L, it forces you

to thinks beyond

your own little world.”

Most eye-opening

experience:

Home Shopping

Network: “I got to work

with the great mind of

Barry Diller, and learn

that there are many ways

to talk to a customer—

through a catalog,

through TV, through

hsn.com. … It was a

whole way to understand

multichannel marketing.”

8

DECEMBER 2004 POINT

CONTINUED FROM PAGE 7

with the all-important 12-to-24 crowd. Kmart

already was a significant advertiser, but Guyardo had

a bigger idea: If the WB would pony up actors from

its hit shows, including “7th Heaven” and “Reba,”

Kmart would feature them in an extensive

advertising campaign.

The deal with Kmart was “one of the riskier

choices we’ve made, with one of the greatest

returns,” says Suzanne Kolb, exec VP-marketing for

the WB. “I’m not sure dressing our stars up in

clothes from Kmart would have been anyone’s first

instinct, but Paul had such a vision, and assured us

that the process would be collaborative. Nineteen

stars participated, and not one that we asked said

no,” she says. “We all love the way the ads came out.

For the WB, it was great exposure—our media

budget can only go so far.”

If the deal gave WB programming vital

exposure, the campaign, created by Grey

Advertising, gave Kmart a level of hipness it

wouldn’t have found on its own. “When we run

those ads in In Style, it helps our marketing message

break through the clutter,” says Guyardo. “There is

an element of borrowed equity. It has a nice halo

effect, and it elevates our brand.”

Similarly, Kmart is using its licensing agreement

with Latin songbird Thalia Sodi to reach out to the

fast-growing Hispanic market. But Thalia, who

started on Mexican soap operas and is married to

music honcho Tommy Mottola, lends Kmart

marketing sizzle that cuts across all demographics:

What woman can’t occasionally go for something

low-cut, see-through or at least leather trimmed?

And Kmart continues to be nothing but

enthusiastic about the performance of Martha

Stewart Everyday, recently extending its licensing

agreement through 2009. (Analysts estimate that

MSE products account for about $1.2 billion of its

annual sales, which were $23.3 billion in 2003.)

FINDING THE CUSTOMER

WHERE SHE LIVES

“The majority of our business is done with people

who live within three to five miles of their nearest

Kmart,” says Gieselman. So while the vast majority

of the chains’ marketing efforts are national, local

media—circulars, radio, outdoor and direct mail—

have become more important. “We have monthly

post-mortems on our Sunday circular performance,

looking at how well each item did relative to

expectations, but also what other items made it in

the way to the market basket. If they came in for the

advertised Coke special, what else did they buy?

And what else did they buy if they came in for the

battery special?”

If Guyardo sounds exceedingly hands-on, he is.

Considering how many ads, promotions, marketing

plans and research initiatives come through

Guyardo’s office, “I’m astonished at the level of

detail he can stay on top of,” says Gieselman. When

it came time to shoot the Jaclyn Smith print ads,

Guyardo flew out to the California set, where rock

photographer Matthew Rolston was shooting

Smith for the print campaign. “Paul felt we weren’t

pushing the envelope,” Gieselman says. “He was

right.” The resulting ads make Smith—now 57, and

still best known for her role in Charlie’s Angels—

look downright … vixenly.

Building his team at Kmart has been a

challenge—a downscale retailer with a recent

bankruptcy located on the outskirts of Detroit isn’t

exactly a recruiter’s dream. (The new company will

be based in suburban Chicago, but will continue to

maintain a significant presence in Troy.)

“But there’s a special person who is attracted to

turnarounds. You have to come to work incredibly

motivated. And it all starts with me. … You have this

whole organization looking to you, and you have to

have the kind of passion and enthusiasm that can rub

off on other people,” Guyardo says. But most of all,

he says, he’s been building a team—and a plan—

built on “tremendous respect for the customer, and

who she really is,” says Guyardo, who remains

understandably coy about the demographic specifics

of his target market. “You can’t develop plans for

who you want the customer to be.”

Or where you want the customer to be, and the

merger fully reflects that reality: “Right now, Sears

is where the customers aren’t,” says Ruffing.

Still, plenty of observers aren’t sure Kmart and

Sears can rescue each other. “Sears has been

struggling for years to solve its merchandising

problems, very unsuccessfully,” says Ulysses Yannas,

a retail analyst with Buckman, Buckman & Reid, in

Red Bank, N.J. “So now you’ve got two companies

trying to straighten themselves out—it’s a

monumental task.”

Ruffing, however, is optimistic: “It won’t be easy,

but there’s not a lot of risk. The company’s realestate holdings are invaluable,” he says. “The

merger has the potential to make Kmart something

more than the third wheel in the discount world,

and Sears something more than a struggling, lowertier department store. Why not give this a shot, and

create a brand new arena, with the best products

from both companies?” ■

STRATEGICINSIGHT

THE

POWER OF

CULTURAL

ACTIVISM

HOW LARGER-THAN-LIFE ICONIC BRANDS

LEARN TO SPEAK WITH DRAMATIC AUTHORITY.

By Douglas B. Holt

The concept of “cultural activism” begins with the understanding that certain powerful brands—

including Coca-Cola, Volkswagen, Nike and Mountain Dew—have developed into brand icons that

are cultural forces in society. In this excerpt from “How Brands Become Icons” (Harvard Business

School Press, 2004), Douglas B. Holt discusses how certain brands develop a reputation for “telling

a story that addresses the identity desires of a particular constituency.”

The single most debilitating mistake that managers

can make in regard to the long-term health of an

identity brand is to develop a strategy so abstract that

it yanks the brand out of its social and cultural

context. Product design and benefits are the platform

on which myths are built. A wide variety of myths can

be built atop any product-benefit platform, and most

of them are worth little to consumers.

What, then, is a strategy for an identity brand?

Cultural-brand strategy must identify the most

valuable type of myth for the brand to perform at a

particular historical juncture, and then provide

specific direction to creative partners on how to

compose the myth. Drawing from the cultural

knowledge described above, a cultural-branding

strategy should include the following components:

Target the most appropriate myth market.

With knowledge of the country’s most important

existing and emerging myth markets and the brand’s

cultural and political authority, managers look for

the best fit. The most opportune myth market is the

one that the brand has the most authority to

address. Mountain Dew’s equity made the slacker

myth market a perfect choice, while the indie myth

market was a natural fit for Volkswagen given its

cultural and political authority.

Compose the identity myth. Managers

CONTINUED ON PAGE 10

About the author

Douglas B. Holt is the

L’Oréal Professor of

Marketing at the Saïd

Business School,

University of Oxford. His

research applies a sociocultural lens to key issues

in branding, advertising,

and consumption. Holt

also has been a professor

at the Harvard Business

School (2000-2004)

and a brand manager

at Clorox Co. and Dole

Packaged Foods.

POINT DECEMBER 2004

9

DAN PAGE

‘‘

Too often,

the job of the

brand manager

is reduced

to adjective

selection—the

management

of meaningless

abstractions.

’’

10

DECEMBER 2004 POINT

CONTINUED FROM PAGE 9

shouldn’t usurp the role of their creatives, but they

must give specific direction on creative content if

they are to play a significant strategic role. The first

step in composing the myth is to prepare a myth

treatment: a synopsis of the myth that describes the

identity anxieties the myth should address and the

way in which the myth will resolve these anxieties.

Next, managers must describe the populist world

in which the myth will be located, and the strategy

for the brand to develop an authentic voice within

this world. To maintain legitimacy, the executions

of the myth must aim in part at the insiders who

control the populist world that the brand inhabits.

Brands win this authenticity with performances

that express the brand’s populist world literacy and

its fidelity to the world’s values. Finally, managers

need to work with their creative partners to

develop the brand’s charismatic aesthetic, namely,

an original communication code that is organic to

the populist world.

Extend the identity myth. When a brand

performs the right myth targeted at the right myth

market, consumers jump on board, using the

product to sate their identity desires. They come to

depend on the brand as an icon and remain fiercely

loyal, but only as long as the brand keeps the myth

fresh and historically relevant. Once established,

myths must evolve creatively and also weave in new

popular culture in order to remain vital.

Reinvent the identity myth. Even the most

compelling identity myths will eventually falter,

not because competitors attack, but because

societal changes drain their value. The seemingly

rock-solid value of a brand’s myth in one year can

come unglued the next. Socioeconomic and

ideological shifts reconfigure the identity desires of

the nation’s citizens, sending them searching for

new myths. These cultural disruptions create

extraordinary opportunities for innovative new

identity brands while also presenting treacherous

hazards for incumbents.

Even the most successful brands routinely

struggle to understand the cultural disruptions that

send their brands into tailspins. Witness

Volkswagen’s two-decade-long struggle to regain

its iconic stature and Budweiser’s dead-end

experiments that stalled the brand for most of the

1990s. Other brands, like Miller, Levi’s and

Cadillac, have yet to recover.

BRAND MANAGER

AS COMPOSER

Brand managers must act as composers of the

brand’s myth. Too often, the job of the brand

manager is reduced to adjective selection—the

management of meaningless abstractions. As

cultural activists, managers treat their brands as a

medium—no different than a novel or a film—to

deliver provocative creative materials that respond

to society’s new cultural needs. While they must

leave the actual construction of the myth and its

charismatic voicing to creative talent, managers

STRATEGICINSIGHT

must become directly involved in the composition

of the myth, or else they give away the strategic

direction of the brand.

Marketing organizations are today dominated

by spreadsheets, income statements, reams of

market data and feasibility reports. The rationality

and pragmatism of the everyday business of

marketing smothers cultural activism. Moreover,

the breeding ground for brand managers—M.B.A.

programs in business schools—conscientiously

socializes managers into a psycho-economic

worldview that runs directly counter to the cultural

point of view needed for identity brands. Many

business schools marginalize social issues as the

domain of not-for-profit ventures and treat the

texts of the culture industries superficially, if at all.

Most M.B.A.s leave their programs without even a

rudimentary ability to evaluate an ad from a

cultural perspective.

Iconic brands have broken out of this rationalized

mind-set to make contact with the nation’s culture.

They are exceptions to the rule, led by the intuitions

of ad agency creatives and the occasional marketing

iconoclast. Because companies have not nurtured a

cultural perspective and the talent that goes with it,

the primary architects of iconic brands have been

copywriters and art directors. Not surprisingly, the

members of the brand team with the greatest

cultural competencies take the lead. As a result,

cultural strategies have evolved haphazardly by the

chance engagement of talented creatives, rather than

through the consistent deployment of a brand

strategy.

For brand owners that seek to build iconic

brands, the challenge is to develop a cultural activist

organization: a company organized around

developing identity myths that address emerging

contradictions in society; a company organized to

collaborate with creative partners to perform myths

that have the charisma and authenticity necessary to

attract followers; a company that is organized to

understand society and culture, not just consumers;

and a company that is staffed with managers who

have ability and training in these areas.

Mind-share branding is today slipping out of

favor even among its most loyal stalwarts. And

commingling brands with culture seems to be in.

Procter & Gamble, Coca-Cola Co. and Unilever all

have made significant gestures of late to move in

new directions, often mentioning Hollywood as the

most likely destination.

In a speech to the Publicity Club of London,

Niall Fitzgerald, then chairman of Unilever,

proclaimed that the “interrupt and repeat” model of

advertising is in decline, and so marketers can no

longer push “messages and memorability into the

skulls of the audience.” In place of mind share,

Fitzgerald sees advertising moving into the space

occupied by other culture-industry products, such

as film: “Today we should conceive and evaluate our

brand communication as though it were content—

because today, in effect, that is what it is. We are in

the branded-content business.”

Fitzgerald is certainly right. Marketing

companies can no longer ignore that consumers

have become tremendously cynical about

advertising and can now act on this cynicism with

technologies like TiVo, which allows them to edit

out ad exposures. Instead, advertising is looking

more and more like entertainment. Madison Avenue

and Hollywood are becoming incestuous partners.

But how should companies, long enamored by

mind share, proceed? Fitzgerald seems to suggest

that branded content is a new-to-the-world

proposition. But, as this book makes clear, the most

successful identity brands have long focused on

delivering branded content, at least since the

beginning of the TV age in the mid-1950s. The

extraordinary successes of Marlboro and

Volkswagen in the 1960s; Coke and McDonald’s in

the 1970s; Nike, Budweiser and Absolut in the

1980s; and Mountain Dew and Snapple in the 1990s

were all the result of branded content. So managers

interested in new branding models would do well to

glean some lessons from their predecessors rather

than try to reinvent the wheel.

Fitzgerald’s provocations beg the question: What

branded content? If brands merely deliver

entertainment like most culture-industry products,

they will be handicapped from the start. We live in a

world oversaturated with cultural content, which is

delivered not just by the traditional culture industries

(film, TV, magazines, books and so on) but also

increasingly by video games and the Internet. How

can a 30-second ad compete with a film or rock

concert in terms of entertainment value? Or,

alternatively, why would customers seek out a film

when the plot is stilted by commercial sponsorship?

The greatest opportunity for brands today is to

deliver not entertainment, but rather myths that

their customers can use to manage the exigencies of

a world that increasingly threatens their identities.

To do so, companies would do well to follow the

lead of the most successful brands of the past halfcentury rather than throw their marketing budgets

at Hollywood. Brands become cultural icons by

performing myths that address society’s most

vexing contradictions. ■

‘‘

The breeding

ground for brand

managers—

M.B.A. programs

in business

schools—

conscientiously

socializes

managers

into a psychoeconomic

worldview that

runs directly

counter to the

cultural point

of view needed

for identity

brands.

’’

Reprinted by permission

of Harvard Business

School Press. Excerpted

from Chapter 9 of “How

Brands Become Icons” by

Douglas B. Holt.

Copyright 2004

Harvard Business School

Publishing Corp.; all rights

reserved.

POINT DECEMBER 2004

11

WE ARE WHAT WE SPEND

Over a few months, the American people spend more

than most governments do in a year. And our shopping

reveals much about our national psyche.

“In today’s consumer-driven society, satisfying consumer

needs has less do with the practical meeting of physical

needs and everything to do with gratifying desires based

upon emotions. The act of consuming, rather than the

item being consumed, satisfies the need.”

—Pamela Danziger, “Why People Buy Things

They Don’t Need: Understanding and Predicting

Consumer Behavior,” Dearborn Trade, 2004.

$608

Average individual gift investment in 2004

(4% increase over last year).

$219 billion

Total U.S. 2004 holiday-gift expenditure.

$96 billion

Amount spent on electronics gear

in 2003. Women accounted for

$55 billion (yes, more than men).

89

Percentage of electronicspurchase decisions

involving women.

27.7%

U.S. homes with

a digital camera

at the end of 2003.

End of 2002:

19.6%. Women

are the primary

users of digital

cameras.

12

DECEMBER 2004 POINT

$22.12

Average amount consumers will spend

on co-workers this holiday season.

Families: $406.52. Friends: $71.29.

$1.8 billion

U.S. sales for fur and fur-trimmed

apparel and accessories last year, a record

amount and a 7.5% increase from 2002.

$13.2 billion

Amount U.S. shoppers will spend

online this holiday season. The figure,

which represents 20% growth, is less

than the 31% 2003 increase.

$116.87

The amount men plan to spend

on themselves this holiday

season—almost twice as much

as women ($65.88).

$16.10

Average amount

consumers will

spend on flowers

this holiday season.

Decorations: $35.91;

greeting cards and

postage: $25.22;

candy and food:

$83.77.

OCTOBER 18, 2004

ADAGE.COM

CRAIN’S INTERNATIONAL NEWSPAPER OF MARKETING | U.S. $3.99, CANADA $ 5.00, U.K. £3.95

LATE NEWS

BK ties Subservient Chicken

effort to Fox Sunday lineup

[MIAMI] Burger King Corp. has ordered a

new Subservient Chicken campaign built

around Fox TV’s new season of Sunday

night programming, according to

executives close to the marketer. The

effort backs the launch of a salad as the

third item in its TenderCrisp chicken

platform and includes print ads, in-store

displays and a sweepstakes. Ads include

a teaser to look for the chicken on the

Sunday programs, which begin Nov. 7.

WPP Group’s MindShare, New York,

handled the media as an upfront deal.

MDC Partners-backed Crispin, Porter &

Bogusky, Miami, handled creative

THE IPOD Lowe’s, Tyson

■ TOO HOT FOR TV?

ABC’s

ECONOMY divorce

‘Housewives’

By BETH SNYDER BULIK

t’s the white, white world of the iPod economy, an exploding

universe in which marketers such as Hewlett-Packard, Kate Spade, Bose and

BMW are tapping into Apple’s portable music player to boost their own sales

and brand equity.

Apple last week wowed investors by announcing a 44% year-on-year increase

in profit to $106 million on revenue of $2.35 billion, up an impressive 37%. A

344% increase in sales of iPods, and a 600% increase in sales from Apple’s iTunes

music program, fueled the results.

See IPODon Page 37

But the iPod itself is just the beating heart of a growing

I

Others clamor for ratings hit,

fueling 100% hike in ad price

By CLAIRE ATKINSON

abc’s “desperate housewives” is fast becoming the

hottest show on TV, but it’s too hot for some advertisers to

handle.

The network is doubling ad prices for the series even as

some marketers pull out because of its racy plot lines.

Lowe’s Home Improvement and Tyson Foods pulled ads

out of the show because of content concerns.

Their moves underscore the growing conflict for advertisers as they strive to be in cutting-edge content that attracts a lucrative demographic at the risk of angering watchdog groups over issues of taste or decency.

Advertising Age’s Age Madison & Vine newsletter reported that S.C. Johnson pulled its sponsorship from the

cross-dressing reality show “He’s a Lady” just days before

Ford non-traditional

efforts rise to 20%

See ‘HOUSEWIVES’on Page 38

[DEARBORN, MICH.] Ford Motor Co.’s Ford

Division has increased its spending in

non-traditional marketing to 20% of its

total marketing budget this year from

just 2% a decade ago, said Steve Lyons,

president of the division. He said it could

go as high as a third in the near future. A

prime example, the redone 2005

Mustang will be integrated into several

broadcast network TV shows and

backed by a 60-second spot arriving in

theaters Nov. 1. That spot, from WPP

Group’s J. Walter Thompson, Detroit,

shows late actor Steve McQueen

recreating his Frank Bullitt movie role.

The late actor also appeared in a Ford

Puma spot in Europe from WPP’s Y&R.

Marketing primed

for a hiring spree

Freeze thaws at Fortune 500 firms

By JAMES B. ARNDORFER

fortune 500 companies appear ready to bolster their marketing departments in 2005 after years of keeping a lid on

headcount.

More than half the respondents in a new survey by

staffing firm CPRi said they plan to add staff in their marketing departments next year. The disciplines slated for the

biggest increases are several tied to return on investment:

project management, data analysis and market research,

along with brand marketing.

The study, and similar reports from recruiting and

training companies, are a strong indication that marketers,

which slashed staff before and after Sept. 11, 2001, are now

more comfortable with the direction the economy is going.

It also underscores how marketers are trying to keep up

See CPRIon Page 38

Hip-hop help

Hot blogs

Unilever convenes panel of

urban trendsetters, asks for

advice on Axe

PAGE 16

Boosted by presidential race,

top sites command

top dollar for ads PAGE 34

0

NEWSPAPER

71486 01024

1

42

See LATE NEWSon Page 2

LO

U BE

AC

H

[DULLES, VA.] America Online is launching a

national TV campaign for its dial-up

Netscape service, pitting it against rival

NetZero. Both services cost $9.95 a

JOE ZEFF

America Online rolls

Netscape dial-up spots

Publishes: March 28, 2005

Closes: March 7, 2005

Celebrate

the

top

75

advertising

moments

in

our

75th

anniversary

issue

© 2004 Crain Communications Inc

To advertise in the 75th Anniversary issue or to learn about other special

anniversary opportunities, please contact your sales representative or

Jeff Burch, Advertising Director, at 212-210-0280 or jburch@crain.com.

May we direct your attention to the original search engine?

47% of U.S. on-line consumers use Internet Yellow Pages.*

Truly trackable. Totally measurable.Virtually omnipresent.Yellow Pages has been delivering comprehensive

local search results for more than 100 years. Last year, 1.2 billion searches were conducted in

Internet Yellow Pages, and 66% resulted in new customers for businesses.** That's why Yellow Pages in print,

on-line or wireless is a fundamental component of every successful national marketing plan.

So, plan accordingly and never underestimate the power of the Yellow Pages.

I t p ay s . We ’l l p rove i t .

Call 1-866-88BUYYP (882-8997)

L og o n t o w w w. b u y ye l l ow. c o m

*Forrester 2004 Benchmark Study. **KN/SRI 2004 Industry Usage Study.