24.10.2012 STRATEGY

RESEARCH DEPARTMENT

Russia and the US elections: function follows form

;

Erik De Poy

+7 (495) 983 18 00 ext. 54440

Erik.DePoy@gazprombank.ru

Ivan Sinelnikov

+7 (495) 983 18 00 ext. 54074

Ivan.Sinelnikov@gazprombank.ru

Alexander Nazarov

+7 (495) 980 43 81

Alexander.Nazarov@gazprombank.ru

Andrey Klapko

+7 (495) 983 18 00 ext. 21401

Andrey.Klapko@gazprombank.ru

The outcome of the US general elections in two weeks could have an important

impact on the Russian market as we head into 2013. Investors are seeking

answers to two key questions: 1) will the perception of Russia investment risk be

harmed in the event of a Romney victory; and 2) will there be an external shock

to growth in Russia triggered by the US fiscal cliff? While the answer to the first

question has gotten most of the media attention so far, we believe the second

may ultimately be more significant for the Russian market next year.

A focus thus far on the presidential race… Russia investors so far have mainly

focused on the outcome of the US presidential race, with a Romney victory seen

as an unfavorable outcome that leads to a more assertive stance toward Russia,

precipitating an increase in the country risk premium. The re-election of Obama,

on the other hand, is generally seen as net neutral for the country’s investment

case. Arguably, the worst case for investors would be a repeat of the vote

recount and uncertainty that followed the disputed US election in 2000.

… but the composition of Congress may be more important. The identity of who

occupies the White House in 2013 will undoubtedly establish the tone of

bilateral relations between the US and Russia going forward. But while the

President is typically a key figure in helping shape the US budgetary agenda, the

shape of the next Congress may have a more pronounced impact on the

Russian market heading into 2013 as a result of the looming budget cuts and tax

increases, popularly known as the fiscal cliff.

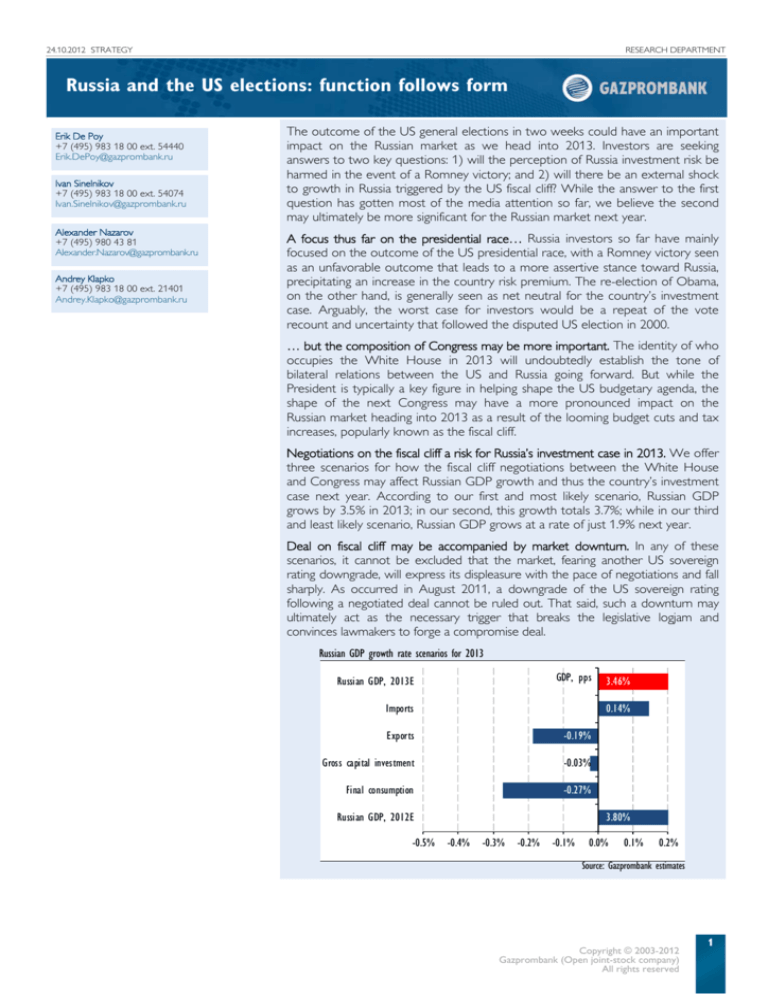

Negotiations on the fiscal cliff a risk for Russia’s investment case in 2013. We offer

three scenarios for how the fiscal cliff negotiations between the White House

and Congress may affect Russian GDP growth and thus the country’s investment

case next year. According to our first and most likely scenario, Russian GDP

grows by 3.5% in 2013; in our second, this growth totals 3.7%; while in our third

and least likely scenario, Russian GDP grows at a rate of just 1.9% next year.

Deal on fiscal cliff may be accompanied by market downturn. In any of these

scenarios, it cannot be excluded that the market, fearing another US sovereign

rating downgrade, will express its displeasure with the pace of negotiations and fall

sharply. As occurred in August 2011, a downgrade of the US sovereign rating

following a negotiated deal cannot be ruled out. That said, such a downturn may

ultimately act as the necessary trigger that breaks the legislative logjam and

convinces lawmakers to forge a compromise deal.

Russian GDP growth rate scenarios for 2013

GDP, pps

Russian GDP, 2013E

Imports

0.14%

Exports

-0.19%

Gross capital investment

-0.03%

Final consumption

-0.27%

Russian GDP, 2012E

-0.5%

3.46%

3.80%

-0.4%

-0.3%

-0.2%

-0.1%

0.0%

0.1%

0.2%

Source: Gazprombank estimates

Copyright © 2003-2012

Gazprombank (Open joint-stock company)

All rights reserved

1

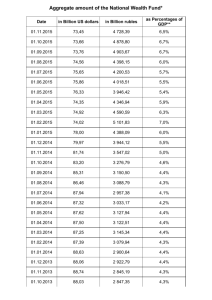

24/10/2012

Research Department

+7 (495) 287 6318

What does the US presidential election imply for Russia?

Early voting for the 2012 US presidential election has begun, and First Lady Michelle

Obama has cast her vote. Thus far, most Russia investors have focused on the

outcome of the presidential race, which will undoubtedly be important for bilateral

relations in the coming years. With the third and final debate now over, the odds of

Obama being re-elected as measured by prediction market Intrade.com currently stand

at around 54%, with Romney given about a 46% chance of victory. The latest Gallup

daily tracking poll of likely voters, however, suggests that Romney has a seven-point

lead over Obama. The accuracy of these polls aside, it seems clear that uncertainty

regarding the outcome is likely to linger right up until election day on November 6.

In terms of policy stance, Governor Mitt Romney has attempted to distance himself

from President Barack Obama in the foreign policy realm by being the most

outspoken and assertive regarding US policy toward Russia. Among other things, he

has publicly referred to Russia as the “number one geopolitical foe” of the US, and

his campaign website indicates his pledge to “reset the reset” and “discourage

aggressive behavior on the part of Russia”, for example by reviewing

implementation of the START arms control treaty.

The cynical view of the US political process is that Romney’s statements are driven

more by a desire to appease elements within his party and electorate while

differentiating himself from Obama than any real conviction to revive Cold War

tensions. According to this view, Romney will likely temper his public statements

after entering office and a period of accommodation will ensue. Russia was not a

major topic of discussion during the third presidential debate devoted to foreign

policy, although Romney did say the following: “Russia does continue to battle us in

the UN time and time again. I have clear eyes on this. I’m not going to wear rosecolored glasses when it comes to Russia, or Mr. Putin. And I'm certainly not going

to say to him, 'I'll give you more flexibility after the election'”.

An argument can be made that the market would be satisfied with either candidate as

long as the election does not repeat the disputed vote recount and Supreme Court

decision following the 2000 election between George W. Bush and Al Gore. Taken at

face value, however, a Romney administration would potentially be most concerning

for Russia investors, and a knee-jerk negative reaction in the Russian equity market

(albeit temporary) cannot be excluded in the days immediately following his election.

What about the Congressional elections?

While the outcome of the presidential election will undoubtedly be important for the

tone of US-Russia bilateral relations going forward, we think the form of the next

Congress may ultimately be more important for how it functions. After all, it is the

Congress that shapes fiscal policy and will have to approve any deal to address the

grave fiscal issues facing the US government in the form of the so-called ‘fiscal cliff’.

What is the fiscal cliff?

Among other items, the fiscal cliff comprises more than $400 bln in tax increases

and $200 bln in spending cuts in fiscal years 2012-13 stemming from last year’s

compromise deal reached by the US budgetary supercommittee. In total this equals

roughly 4% of nominal US GDP and, on an annualized basis (i.e. including the

effects in calendar years 2012-13), the permanent fiscal tightening would amount to

more than $800 bln (5.1% of GDP).

The US Congressional Budget Office (CBO) believes that in the worst case

involving the full impact of the fiscal cliff, a failure to reach a deal could potentially

reduce the US GDP growth rate by up to 3.9 pp in 2013, with the economy

contracting 1.3% in the first half and expanding 2.3% in the second. The rating

agency Fitch believes this outcome could cut the emerging markets growth rate in

half. Russia would hardly be immune to such a global downturn, particularly if oil

demand destruction were to ensue, as occurred in 2008-09.

2

Russia and the US elections: function follows form

24/10/2012

Research Department

+7 (495) 287 6318

Impact globally

Estimates vary regarding the impact that falling off the fiscal cliff would have on the

US and global economies. At the APEC summit in Vladivostok on September 9,

IMF Managing Director Christine Lagarde said that the fiscal cliff was one of “three

key risks” for the global economy in 2013, the other two being the Eurozone crisis

and medium-term public financing. The IMF forecasts 2.1% GDP growth in the US

in 2013 (and 3.6% for the world), but these figures are subject to downward

revision should US fiscal policy be tightened.

According to Fitch, the fiscal cliff represents the most significant near-term threat to

world economic recovery. The rating agency estimates that the fiscal cliff would

reduce US GDP growth in 2013 by 2.0 pps, from 2.3% to just 0.3%. In terms of

major consequences for the global economy, as domestic demand fell US imports

would drop faster than exports. The resulting improving trade balance would need

to be matched by deterioration in trading partners' balances, causing growth to

slow. Fitch estimates that such a shock would slash the world GDP growth rate in

half, from their current estimate of 2.6% to just 1.3%.

We believe the knock-on effects globally could trigger “risk-off” sentiment and lead

to dollar appreciation, which in turn would weigh on oil and other export

commodity prices – a direct risk to the Russian economy and financial markets.

Impact on Russia

Although the US accounts for just 3% of Russia’s direct foreign trade, the knock-on

effects globally from an economic shock totaling 5% of US GDP could be severe.

Finished goods exporters like China and Japan would be the first group of countries

to be affected, likely in 1H13, followed by commodity exporters like Russia and

Australia in 2H13 and into 2014. Although baseline GDP growth would resume, it

would likely do so at lower trend rates.

The IMF believes that the CIS region would not be immune to the impact from a

global downturn through potentially sharp falls in commodity prices. Further

destabilization in the Eurozone would also be felt in Russia since Europe is now its

largest trading partner outside the CIS. For Russia, the IMF sees 3.75% real GDP

growth in 2013, led by domestic demand and supported by expansionary fiscal

policy and sustainable credit growth. This compares with our slightly more

optimistic base-line expectations (assuming no fiscal cliff) of 3.8-4.0% GDP growth

and decelerating credit growth.

Impact on equity markets

Historically, the impact from US elections on the Russian market has varied

considerably, with no clear trend seen in RTS index performance in November of

election years. Moreover, the infrequency of elections since 1996 (the first data

point we have to work with, as the RTS Index only began to be calculated in

September 1995) would make any potential correlation statistically insignificant.

RTS Index performance during US election months: no clear trend

Year*

Change, %

1996

5.2

1998

15.9

2000

-27.0

2002

1.0

2004

-8.2

2006

8.2

2008

-21.3

2010

2.1

*bold indicates general election year

Source: RTS-MICEX, Gazprombank estimates

The situation is similar with regard to US elections and the US stock market. Since 1900,

the average return for the Dow Jones Industrial Average when a Democrat has occupied

3

Russia and the US elections: function follows form

24/10/2012

Research Department

+7 (495) 287 6318

the White House has been about 8.5%, compared with around 6.0% for Republican

administrations. After accounting for market volatility, the figures are essentially even. It is

also largely inconclusive whether a divided government is better or worse for the

markets: although the Dow has tended to perform a bit better when one party controls

both the White House and Congress, the figures are statistically insignificant.

The conclusion therefore is that what matters most for the market is effective

policy-making. This view will soon be put to the test as investors turn their

attention from who will occupy the seats of US government to how they intend to

address the looming fiscal crisis.

Our expectations

Fiscal cliff implies three scenarios for Russian GDP growth in 2013. We currently

forecast baseline (i.e. assuming no fiscal cliff) GDP growth in Russia of 3.8-4.0% in

2013 (our official forecast for 2012 is 3.8%), but may review our estimates based

on the outcome of three scenarios involving the fiscal cliff negotiations between the

White House and Congress.

In any of these scenarios, it cannot be excluded that the market, fearing another US

sovereign rating downgrade, will express its displeasure with the pace of

negotiations and fall sharply. That said, such a downturn may ultimately act as the

necessary trigger that breaks the legislative logjam and convinces lawmakers to

forge a compromise deal.

Downgrade of US rating cannot be ruled out. As occurred in August 2011, a

downgrade of the US sovereign rating following a negotiated deal cannot be ruled out.

While Fitch and Moody’s have yet to downgrade the US, in the press release

accompanying its downgrade of the US long-term sovereign rating last year, which

occurred just five days after the US debt ceiling was raised, S&P noted that its outlook

on the long-term rating is negative and that it “could lower the long-term rating to 'AA'

within the next two years if we see that less reduction in spending than agreed to,

higher interest rates, or new fiscal pressures during the period result in a higher general

government debt trajectory than we currently assume in our base case.” It should be

noted that as of October 19, the US national debt totaled $16.196 trln, compared with

the current debt ceiling of $16.394 trln, which at current spending rates meaning that

the ceiling would likely be breached in less than two months.

First scenario (Let’s make a deal). Our first, most likely scenario involves the

reaching of a compromise deal to address the fiscal cliff, either prior to or soon

after the January 1 legislative deadline, that involves a mix of relatively moderate tax

increases and spending cuts. This deal would prevent a US recession but

nonetheless result in a minor shock to the global economy. Russian GDP growth

would come in at 3.5%, down 0.3-0.5 pps from our baseline GDP growth estimate.

Russian GDP growth in 2013 based on first scenario

GDP, pps

Russian GDP, 2013E

Imports

0.14%

Exports

-0.19%

Gross capital investment

-0.03%

Final consumption

-0.27%

Russian GDP, 2012E

-0.5%

3.46%

3.80%

-0.4%

-0.3%

-0.2%

-0.1%

0.0%

0.1%

0.2%

Source: Gazprombank estimates

4

Russia and the US elections: function follows form

24/10/2012

Research Department

+7 (495) 287 6318

Second scenario (Kick the can). Our second, less likely scenario is a classic ‘kick the

can’ decision by which the main fiscal and taxation issues are delayed until

mid-2013 with the aim of striking a more comprehensive deal at some point. In this

case, the US economy would absorb a moderate shock but recession would be

avoided, while the effects on the global economy would be limited but still tangible.

Russian GDP growth would come in at a slightly better 3.7%, down 0.1-0.3 pps

from our baseline GDP growth estimate. It should be noted that the market is

currently pricing in such an outcome.

Russian GDP growth in 2013 based on second scenario

GDP, pps

Russian GDP, 2013E

3.67%

Imports

0.06%

Exports

-0.05%

Gross capital investment

-0.01%

Final consumption

-0.14%

Russian GDP, 2012E

3.80%

-0.50% -0.40% -0.30% -0.20% -0.10% 0.00% 0.10% 0.20%

Source: Gazprombank estimates

Third scenario (Over the cliff). According to our third and least likely scenario, the fiscal

cliff is not avoided and not swiftly followed by tax cuts to restore the status quo ante.

Political deadlock ensues and the economy bears the full brunt of fiscal contraction.

Forecasts for US and global GDP growth are slashed, precipitating a plunge in stock

markets and corporate earnings estimates. In this worst case, we would consider cutting

our Russian GDP growth forecast for 2013 all the way down to 1.6%.

Russian GDP growth in 2013 based on third scenario

GDP, pps

Russian GDP, 2013E

Imports

0.49%

Exports

-0.78%

Gross capital investment

-0.13%

Final consumption

-1.50%

Russian GDP, 2012E

-1.50%

1.89%

3.80%

-1.00%

-0.50%

0.00%

0.50%

Source: Gazprombank estimates

Divided government scenarios

We have assigned probabilities to each of our three scenarios depending on the

outcome of the presidential and congressional elections, with the first scenario

being the most likely and the third the least.

In general, a divided government (whereby one party controls the White House

and the other controls one or both houses of Congress) would lessen the

likelihood of our first scenario and heighten the odds of either of our other two

outcomes occurring. We see the greatest probability (25%) of a worst-case

scenario should Obama be re-elected and the Republicans take control of both

5

Russia and the US elections: function follows form

24/10/2012

Research Department

+7 (495) 287 6318

houses of Congress. We assign the smallest odds (10%) of a worst-case outcome

for Russian GDP growth to a scenario that sees Romney take the White House

and his party control both houses of Congress.

Another factor worth considering is how the lame-duck congress may behave.

Congress is back in session one week after the November 6 election day, with

December 14 being the last scheduled day for it to be in session. However, should

a deal not be in place by that time, the sitting president has the authority to call on

lawmakers to continue working toward a deal.

It should be noted that the fiscal cliff provisions only come into force on January 2,

i.e. Congressional lawmakers have all of New Year's Day to continue last-minute

negotiations, if it comes to that. They would also have all of January 2 to reach a

deal before the term of the 112th Congress officially ends at midnight.

Electoral and fiscal cliff timeline

Source: CBO

Generally speaking, how the Republicans fare in the new Congress will play a key role

in determining how willing they are to cooperate with the Democrats and proceed

with constructive fiscal talks. The relative strength of the Tea Party faction within the

Republicans may play a key role in the course of fiscal cliff negotiations, as its members

are adamant that spending cuts be introduced no matter what the short-term cost.

Fiscal cliff scenarios: no major changes in political landscape expected

Political configuration

Intrade odds*

Scenario probabilities

President Senate

House

Let's make a deal Kick the can Over the cliff

Obama

R

R

2.5%

50%

25%

25%

Obama

D

R

49.1%

70%

15%

15%

Obama

D

D

2.1%

75%

20%

5%

Obama

R

D

0.1%

70%

15%

15%

R

R

26.0%

80%

10%

10%

Romney

Romney

R

D

0.2%

60%

20%

20%

Romney

D

D

0.1%

50%

25%

25%

Romney

D

R

19.0%

60%

20%

20%

* data as of October 24

Source: www.intrade.com, Gazprombank estimates

Other potential issues post the election

Aside from bilateral relations and the issues posed by the fiscal cliff, the US

elections will have implications for several other issues that could impact Russia in

the medium to longer term.

Federal Reserve. Romney has stated that he would not reappoint Ben Bernanke as

Federal Reserve Chairman after his term expires in January 2014. The prospect of a

lame-duck Fed Chairman and the related uncertainty about future US monetary

policy (in particular the prospect of higher long-term rates in a shift away from

current low-rates policy) could heighten risk aversion, particularly with regard to

investment in high-beta, cyclical emerging markets like Russia. If Obama were to be

re-elected, however, the expectation is that current Fed policy would remain

essentially unchanged, notwithstanding reports that Bernanke may be considering

leaving the Fed after his current term expires.

6

Russia and the US elections: function follows form

24/10/2012

Research Department

+7 (495) 287 6318

Sovereign rating downgrade. A downgrade of the US Sovereign rating by one of

the major rating agencies cannot be excluded in any of our three scenarios, but

particularly in the event of the second or third scenarios. To remind, it was the

impasse in debt ceiling negotiations that precipitated S&P’s initial downgrade of the

US rating in August 2011.

Jackson-Vanik amendment. A more confrontational stance by a Romney

administration could complicate recent efforts to abolish the Jackson-Vanik

amendment. Alternatively, a victory by Obama would heighten expectations that

the amendment would be repealed relatively soon, particularly given Russia’s entry

to the WTO and the inconsistencies related to the law.

Military/Iran/Middle East. Of the two candidates, Romney is seen as more hawkish

with regard to action aimed at preventing Iran from possessing a nuclear weapon.

Israel has said that Iran will cross the “red line” as soon as spring 2013. Hence, his

victory could trigger speculation about a more aggressive US policy stance with

regard to Iran and other parts of the Middle East, arms control and renewed

military spending (or at least protection for the defense sector in the event of

budget cuts). Heightened defense spending by foreign governments in response to

a US military buildup cannot be ruled out.

Energy policy. Regardless of the outcome of the elections, the US will continue its

efforts to develop domestic hydrocarbon reserves (shale gas in particular).

Although this is a longer-term issue for the global energy market, Romney says he

will seek to accelerate this process (e.g. offshore drilling) compared to Obama,

whom he believes is beholden to the environmental lobby. A more confrontational

relationship with Russia could also affect the chances of bilateral cooperation in

natural resources development, e.g. in the Arctic.

Global policy response. Dollar weakness precipitated by a failure to slow the rate of

increase in the US budget deficit could encourage foreign central banks, especially

those in emerging markets, to limit appreciation of their currencies in a bid to

maintain export competitiveness.

7

Russia and the US elections: function follows form

Research Department

+7 (495) 287 6318

Gazprombank

HQ: 16/1 Nametkina St., Moscow 117420, Russia

(Office: 63 Novocheremushkinskaya St.)

Research Department

Alexey Demkin, CFA

Acting Head of Research

+7 (495) 980 43 10

Alexey.Demkin@gazprombank.ru

Equity Research

Equity Strategy

Erik DePoy

+7 (495) 983 18 00 ext. 54440

Andrey Klapko

Alexander Nazarov

Fixed Income Research

Banking

Oil & Gas

Andrey Klapko

Ivan Khromushin

+7 (495) 983 18 00 ext. 21401

+7 (495) 980 43 89

Alexander Nazarov

Alexey Demkin, CFA

Head of FI

+7 (495) 980 43 10

Alexey.Demkin@gazprombank.ru

+7 (495) 980 43 81

Metals & Mining

Macroeconomics

Transport & Industrial

Natalia Sheveleva

Ivan Sinelnikov

Aleksei Astapov

Strategy

Ivan Sinelnikov

+7 (495) 983 18 00, ext. 21448

+7 (495) 983 18 00 ext. 54074

+7 (495) 428 49 33

+7 (495) 983 18 00 ext. 54074

Sergei Kanin

+7 (495) 988 24 06

Chemicals

Utilities

Telecoms, Media & IT

Credit research

Aleksei Astapov

Dmitry Kotlyarov

Anna Kurbatova

Yakov Yakovlev

+7 (495) 428 49 33

+7 (495) 913 78 26

+7 (495) 913 78 85

Market and equity technical analysis

Consumer & Retail

Vladimir Kravchuk

Vitaly Baikin

+7 (495) 983 18 00 ext. 21479

Production team

+7 (495) 983 18 00 ext. 21417

+7 (495) 983 18 00 ext. 54072

Mike Sidеlеv

Tatyana Andrievskaya

+7 (495) 983 18 00, ext. 54084

+7 (495) 287 62 78

Equity product department

Debt product department

Konstantin Shapsharov

Managing Director, Head of Department

Pavel Isaev

Head of DPD

+7 (495) 983 18 11

Konstantin.Shapsharov@gazprombank.ru

+ 7 (495) 980 41 34

Pavel.Isaev@gazprombank.ru

Equity Sales & Trading

Sales

Maria Bratchikova

+7 (495) 988 24 03

Artyom Spasskiy

+7 (495) 989 91 20

Svetlana Golodinkina

+7 (495) 988 23 75

+7 (495) 988 24 92

Yury Tulinov

Trading

Debt capital markets

Fixed Income Sales & Trading

Alexander Pitaleff,

Head of equity trading

Igor Eshkov

Head of DCM, ED

Andrei Mironov

Head of FI S&T, ED

+7 (495) 988 24 10

+ 7 (495) 913 74 44

+7 (495) 428 23 66

Denis Voynikonis

Sales

Vera Yaryshkina

+7 (495) 983 74 19

Artyom Belobrov

+7 (495) 988 24 11

Ilya Remizov

+7 (495) 983 18 80

Dmitry Kuznetsov

+7 (495) ) 428 49 80

Equity Capital Markets

Trading

Alex Semenov, CFA

Head of ECM

Elena Kapitsa

+7 (495) 988 23 73

+7 (495) 980 41 82

Sebastien de Prinsac

+7 (495) 989 91 28

Roberto Pezzimenti

+7 (495) 989 91 27

Dmitriy Ryabchuk

+7 (495) 719 17 74

+7 (495) 989 91 34

Electronic trading department

Gazprombank Invest (MENA) S.A.L.

Gazprombank’s building, Dbayeh, Lebanon

Maxim Maletin

Head of Electronic trading

+7 (495) 983 18 59

broker@gazprombank.ru

Hrant Balozian

Head of Investment Banking

Rawad Hakme

Head of Capital Markets

Racha Saadeh

Capital Markets Associate

+961 4 403888, ext. 121

h.balozian@gpbi.net

+961 4 403888, ext. 123

r.hakme@gpbi.net

+961 4 403888, ext. 122

r.saadeh@gpbi.net

Copyright © 2003-2012. Gazprombank (Open Joint Stock Company). All rights reserved

This report has been prepared by the analysts of Gazprombank (Open Joint – stock Company) (hereinafter – GPB (OJSC)) and is based on information obtained from public sources believed to

be reliable, but is not guaranteed as being accurate. With exception of information directly pertaining to GPB (OJSC), the latter accepts no liability for accuracy and completeness of information

herein. All opinions and judgments herein represent analysts’ personal opinion regarding events and situations described and analyzed in this report. They should not be regarded as the GPB

(OJSC) position and are subject to change without notice, also in connection with new corporate or market events appearing. GPB (OJSC) is not under any obligation to update, amend this

report or notify anyone on it. Financial instruments mentioned herein may be unsuitable for certain categories of investors. The report shall not be the only basis for investment decision.

Investors shall make investment decisions at their own discretion, inviting independent consultants, if necessary, for their specific interests and objectives. Authors accept no liability whatsoever

for any actions arising out of the use of this report.

Information contained herein or in appendices hereto is not to be construed as solicitation, or an offer to buy or sell any securities or advertisement, unless otherwise directly stated herein or

in appendices hereto.