Asset management

8 October 2012

Economist Insights

Fiscal bungee

Joshua McCallum

Senior Fixed Income Economist

UBS Global Asset Management

joshua.mccallum@ubs.com

Recent ECB actions have allowed investors to switch their

focus from the Eurozone crisis to the impending US ‘fiscal

cliff’. The limited time between the election and the fiscal

cliff and the increasing polarisation of politics make it look

increasingly likely that the US will fall off the fiscal cliff in

January. Some politicians may like to go over the cliff because

they think a deal will be easier from that starting point.

In other words, there will be some fiscal loosening. In that

scenario, the US might be saved from the recession that a

full fiscal tightening would entail, but only at the expense

of a very weak first half of 2013. The second half could be

stronger, but like jumping with a bungee cord, you never

bounce back to where you would be if you had not jumped.

Now that the bond buying promises of the European

Central Bank have ‘taken the tail risk’ off the table for many

investors, concerns are turning increasingly to the fiscal cliff in

the US. If the US Congress does nothing then, as of midnight

on 31 December, the US will face around USD 600 billion of

fiscal tightening. If the US does fall off this fiscal cliff, as looks

increasingly likely, the question everyone is asking is whether

it can bounce back.

Gianluca Moretti

Fixed Income Economist

UBS Global Asset Management

gianluca.moretti@ubs.com

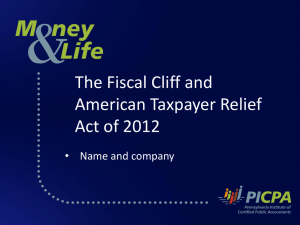

Ouch!

Estimates from the CBO of impact on US GDP of two scenarios for the

fiscal cliff (percentage points, annualised rate)

0

-1

-2

-3

The non-partisan Congressional Budget Office (CBO) has

estimated the impact on GDP of the US going over the fiscal

cliff (see chart). If the US falls off the fiscal cliff, it will slow

annualised growth by something like 5 percentage points

over 2013 as a whole and by faster than that in the first half

of the year. An alternative scenario, with more modest cuts,

sees growth slow by about 1 percentage point.

-4

Why is it now increasingly likely that the US faces gridlock?

For that, we can turn to the ‘wisdom of crowds’: at the time

of writing1, the betting website Intrade.com shows Obama

winning the forthcoming US presidential election (69%

probability), the Democrats controlling the senate (62.9%)

and the Republicans controlling the House of Representatives

(87.1%). In short, the same political gridlock that took the US

to the edge of technical default on its debt a year ago.

Source: Congressional Budget Office

1. 15:00 BST, Friday 5 October

-5

-6

-7

First half 2013

Fall off the cliff

Second half 2013

Step back from the cliff

The gridlock could turn out to be worse this time around.

The polarisation of US politics in the last couple of years now

has an opportunity to express itself in an election, so the

candidates that are elected may well be more extreme on

both sides. Many Republicans have sworn not to raise taxes,

and many Democrats have sworn not to cut spending.

Unless the economy miraculously starts growing at an

amazing speed, they cannot balance the budget without

either tax hikes or spending cuts.

While a number of headlines have reported progress being

made towards a compromise, or at least an agreement

to kick the can down the road a bit further by extending

everything for six months or so, all the progress has been

in the Senate. Ever since the troubles last year, the Senate

has not been the real problem for compromise – it is the

House that has been the stumbling block. From a practical

perspective it is hard to see how a compromise could be

reached quickly. There are only 13 days in the ‘lame duck’

session of Congress between the election and year end.

Many of the attendees will in fact have lost their seats in the

election but will not step down until January; quite possibly

some of them will not even show up for much of the session.

More crucially, many politicians may now view going over

the cliff as the best first step in reaching a deal later on. Their

logic would be that the fiscal cliff will result in immediate

tax hikes and spending cuts. Once taxes have risen, anything

that is then agreed could actually be presented as a tax cut.

Similarly, once spending has been cut, any reversal could be

presented as a spending increase. The disadvantage for the

Republicans is that the vast majority of the fiscal cliff consists

of tax increases, not spending cuts.

It is quite likely that if the US does go over the cliff the

politicians will be able to reverse at least some of the

tightening next year. Aside from the strategies that each side

may have, the fact is that the pressures from their electorates

are likely to change drastically. While plenty of activists, of

the Tea Party type or others, will quite happily call for strict

measures, history has generally proven that views change

once wallets are hit. If the US does go over the fiscal cliff,

people will feel it almost immediately. The obvious way is

through withholding taxes in the middle of the month,

but cuts to Medicare payments to doctors could cause many

of them to refuse to see Medicare patients right from the

start of January. You can expect that to cause uproar pretty

quickly. This sort of scenario will make a compromise far

more acceptable and hence far more probable.

So what if the US does have a bungee cord attached when

it goes over the cliff, and bounces back some of the way?

What would be the impact on the economy? Some officials

have actually described the fiscal cliff as being more like a

fiscal slope because the effects are felt gradually over time.

Unfortunately for this more optimistic view, households and

businesses are actually fairly forward-looking so they react

today to tax increases that are coming in the future. This is

why the CBO has estimated such a large hit to GDP in the

first half of next year.

The interesting thing is that the CBO assumes that the US

goes over the fiscal cliff and stays there. If people think that

there will be a bungee cord that pulls them back, then they

might view the cuts as being temporary. This would lessen

but not eliminate the impact.

What would definitely happen is that there would be a lot

of volatility in the growth numbers. Growth would be much

weaker in the first half of 2013 but, as long as people expect

politicians to reverse the fiscal tightening, growth may be

able to stay positive. Thereafter, any reversal would actually

constitute a fiscal stimulus in the context of GDP calculations,

and growth could actually end up being well above trend in

the second half as the bungee cord bounced the economy

back up. But remember that a bungee cord never pulls you

back up to the height that you would still be at if you had not

jumped at all.

The views expressed are as of October 2012 and are a general guide to the views of UBS Global Asset Management. This document does not replace portfolio and fundspecific materials. Commentary is at a macro or strategy level and is not with reference to any registered or other mutual fund. This document is intended for limited

distribution to the clients and associates of UBS Global Asset Management. Use or distribution by any other person is prohibited. Copying any part of this publication without

the written permission of UBS Global Asset Management is prohibited. Care has been taken to ensure the accuracy of its content but no responsibility is accepted for any rrors

or omissions herein. Please note that past performance is not a guide to the future. Potential for profit is accompanied by the possibility of loss. The value of investments and

the income from them may go down as well as up and investors may not get back the original amount invested. This document is a marketing communication. Any market or

investment views expressed are not intended to be investment research. The document has not been prepared in line with the requirements of any jurisdiction designed to promote

the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The information contained in this

document does not constitute a distribution, nor should it be considered a recommendation to purchase or sell any particular security or fund. The information and opinions

contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith. All such information and

opinions are subject to change without notice. A number of the comments in this document are based on current expectations and are considered forward-looking statements”.

Actual future results, however, may prove to be different from expectations. The opinions expressed are a reflection of UBS Global Asset Management’s best judgment at the time

this document is compiled and any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise is disclaimed. Furthermore,

these views are not intended to predict or guarantee the future performance of any individual security, asset class, markets generally, nor are they intended to predict the future

performance of any UBS Global Asset Management account, portfolio or fund.

© UBS 2012. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

22497