Svetlana Saksonova Managerial Accounting for Decision

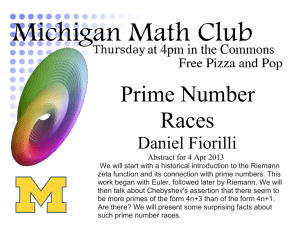

advertisement