CHAPTER 11 Competitive Dynamics

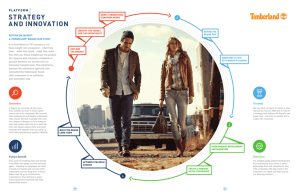

advertisement